Bitcoin’s trading times have surpassed those of the modern US fiat stock market since the Nixon shock, but claims that Bitcoin would outpace the entire history of US stock trading or fiat worldwide would be premature. Closer examination reveals a more nuanced picture of the market’s longevity and trading activity.

The crypto community was recently abuzz over a statistic that highlighted how Bitcoin had amassed more trading hours than the fiat stock market after a analysis by Cory Bates.

Bates identifies how Bitcoin trading has now surpassed the fiat stock market, but it is important to remember that this does not represent the entire history of the US stock market. Yet it may be so derived from that Bitcoin trading predates fiat trading in the US. However, it is not older than fiat worldwide.

The earliest known use of fiat money occurred in China during the Song Dynasty (960–1279 CE). The government issued paper money that was not backed by physical commodities such as gold or silver. This currency was initially backed by government credits and was widely accepted for trade and tax purposes.

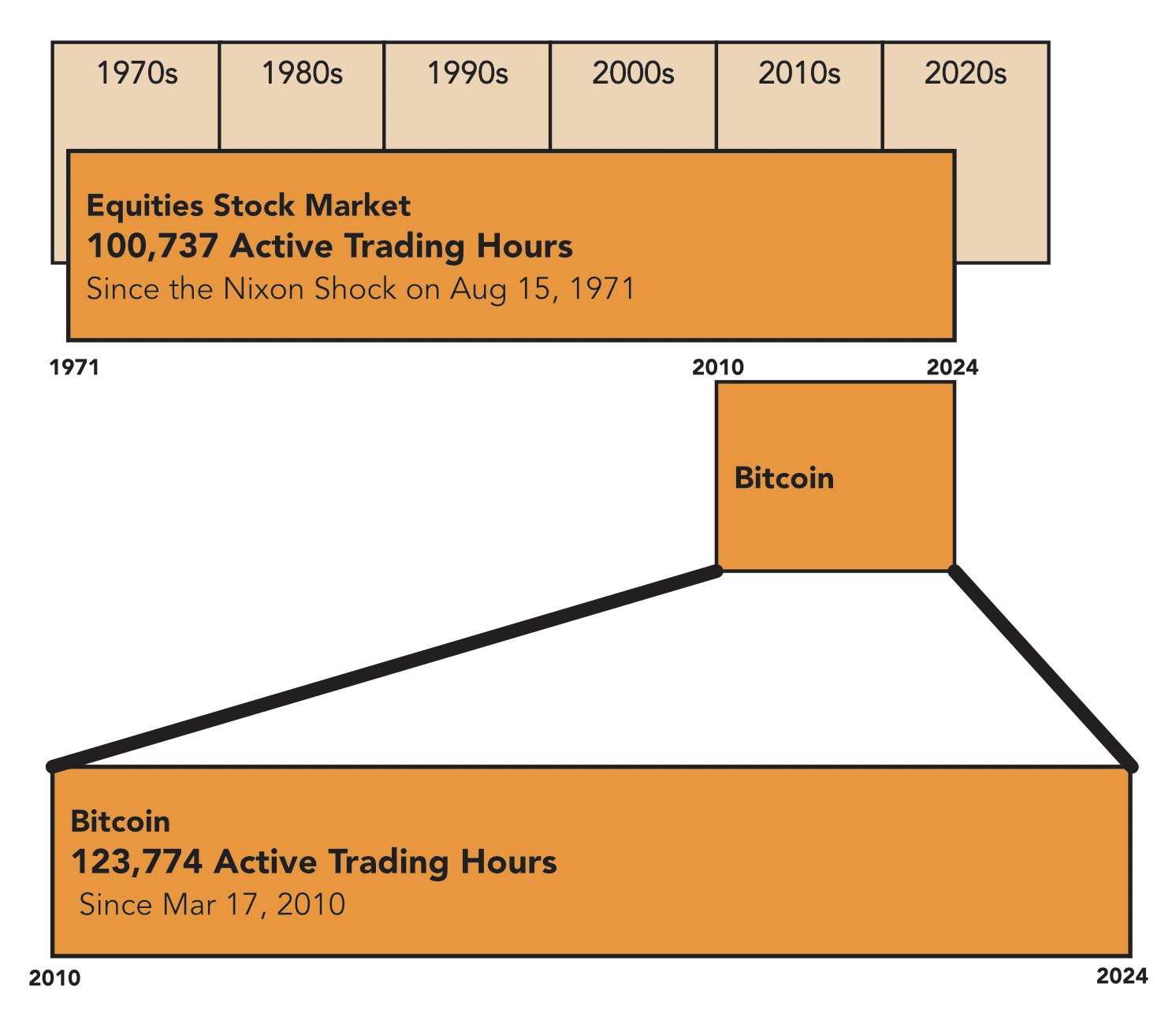

Bitcoin trading hours vs US fiat stock market

Launched in 2009, Bitcoin has amassed 123,774 active trading hours since the first recorded transaction on March 17, 2010. This surpasses the 100,737 hours recorded by the US stock markets since August 15, 1971 – the date of the Nixon shock, which marked a significant shift in the global financial systems through the abolition of the gold standard.

However, the history of the US stock market goes far beyond 1971. Founded in 1792, the New York Stock Exchange has a legacy spanning more than two centuries. If we consider this whole history, the picture changes dramatically.

Calculations based on the NYSE’s founding date reveal approximately 380,509 active trading hours through September 6, 2024. This figure dwarfs Bitcoin’s current holdings, despite the digital asset’s 24/7 trading schedule.

Bitcoin’s 24-hour availability gives it a significant advantage in accumulating trading hours. The traditional stock market operates on a more limited schedule, typically 6.5 hours a day, five days a week, excluding holidays.

Given Bitcoin’s continued trading, projections indicate that it will take until approximately April 15, 2053 for the digital asset to actually surpass the total trading hours in the entire history of the U.S. stock market. This assumes that both markets continue to operate on their current schedule without significant disruptions.

However, it is critical to note that trading hours alone do not fully reflect market depth, liquidity, or overall economic impact. The US stock market remains a cornerstone of global finance, with a depth and breadth of listed companies and trading volume that Bitcoin has yet to match.

While Bitcoin has made remarkable progress in its short existence, the full weight of the U.S. stock market’s centuries-long history remains a formidable benchmark.

A complete history of fiat money trading

Bitcoin’s journey, while rapid, still has decades to go before it can truly claim to have outlasted the cumulative trading hours of the fabled US stock markets. Further, in assessing the claim that it has also surpassed fiat, so have the forex markets available Since 1971, 24 hours a day on weekdays.

Estimating total trading hours for fiat currencies worldwide poses a unique challenge due to the staggered historical adoption of fiat systems. Although fiat money has been used in some form since ancient China, modern trading times only became consistent in the 20th century, especially after the transition from the gold standard following the Nixon shock in 1971.

Before 1971, global trading hours were localized, irregular, and varied from region to region. Even as fiat systems became more common, there was no unified global trading market and exchanges operated with limited hours. However, after 1971, the rise of the foreign exchange market (forex) became a more reliable measure for calculating trading hours.

Today, modern forex trading operates approximately 120 hours per week (24 hours a day, five days a week). Using this as a basis, it can be estimated that approximately 6,240 hours of fiat trading have taken place per year since 1971. Over the 53 years from 1971 to 2024, that would amount to roughly 330,720 trading hours for fiat in modern global markets.

In summary, although Bitcoin has surpassed the post-1971 US fiat stock market in terms of trading hours, the cumulative trading hours of global fiat trading have been significantly higher since the inception of organized global forex markets.

Thus, Bitcoin has not surpassed the total global trading times of fiat currencies – neither in terms of modern forex trading nor when considering the deep history of fiat money worldwide. But unless the major forex markets are also open on weekends, Bitcoin could theoretically eventually catch up. However, some brokers allow limited weekend trading on the most popular forex pairs.