- XRP offers a good buying opportunity between risk and reward.

- Sentiment is bearish and traders may need to quickly cut their losses if price trends move in the opposite direction.

Ripple [XRP] continued to trade within the short-term range. The bears tried to push prices down and seem to have succeeded at the time of writing, but the bulls have nothing to worry about.

A deviation below the range lows sets the market up for a near-term reversal, and come Monday, swing traders may want to lean bullishly on the range lows.

Do the indicators support a turnaround?

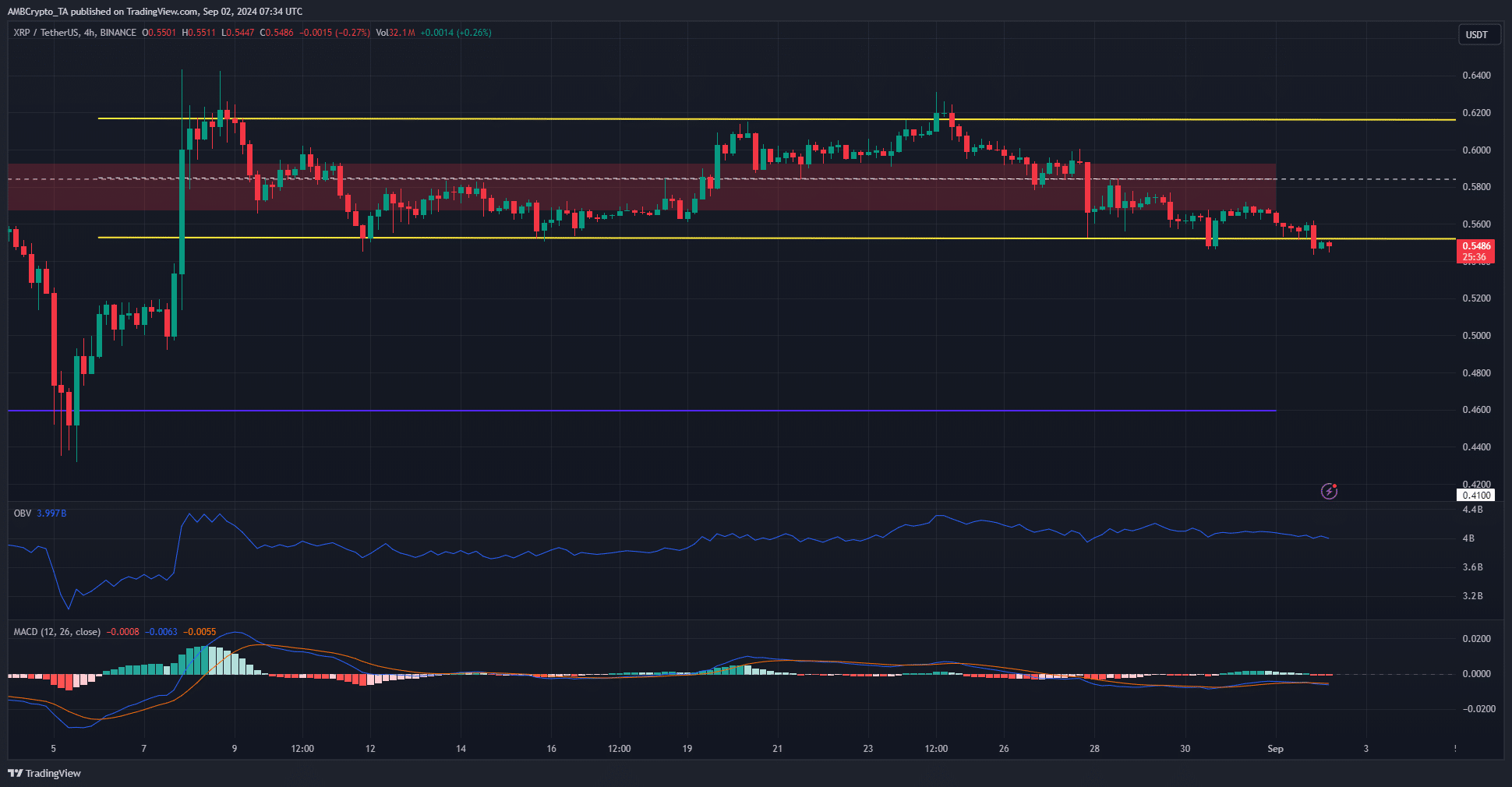

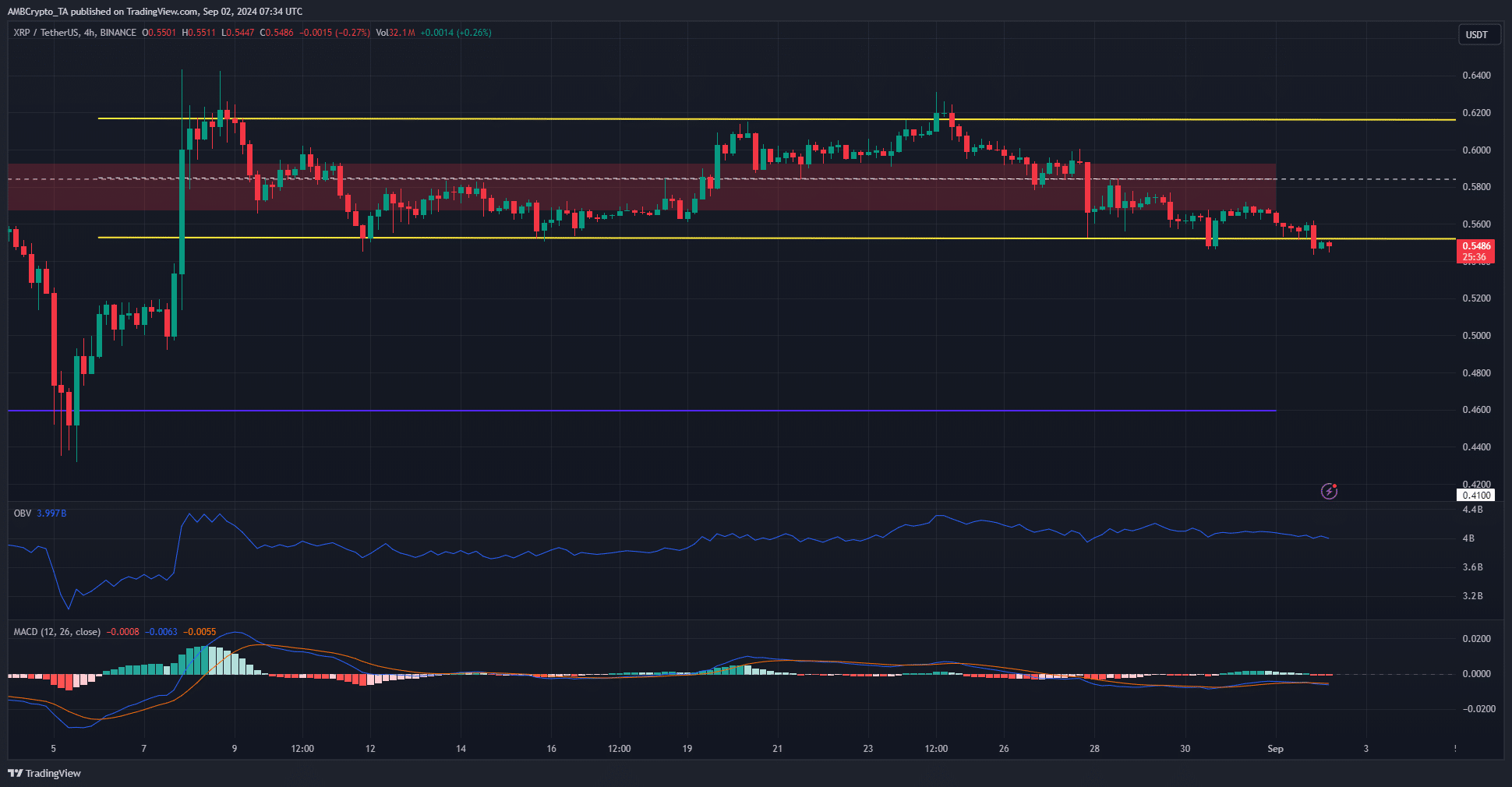

Source: XRP/USDT on TradingView

The OBV on the 4-hour chart has been flat for the past eight days. During this period, XRP fell by 13.5%. OBV’s behavior was encouraging as the steady price decline was not accompanied by overwhelming sales.

Instead, a return to the range lows presented a buying opportunity. Meanwhile, the MACD showed momentum was somewhat bearish, reflecting last week’s trading.

The reward risk for short-term bulls is high and invalidation is imminent. More cautious bulls may want to wait until the New York trading session begins and the associated volatility spike has leveled off before entering the market.

Assessing the sentiment behind XRP

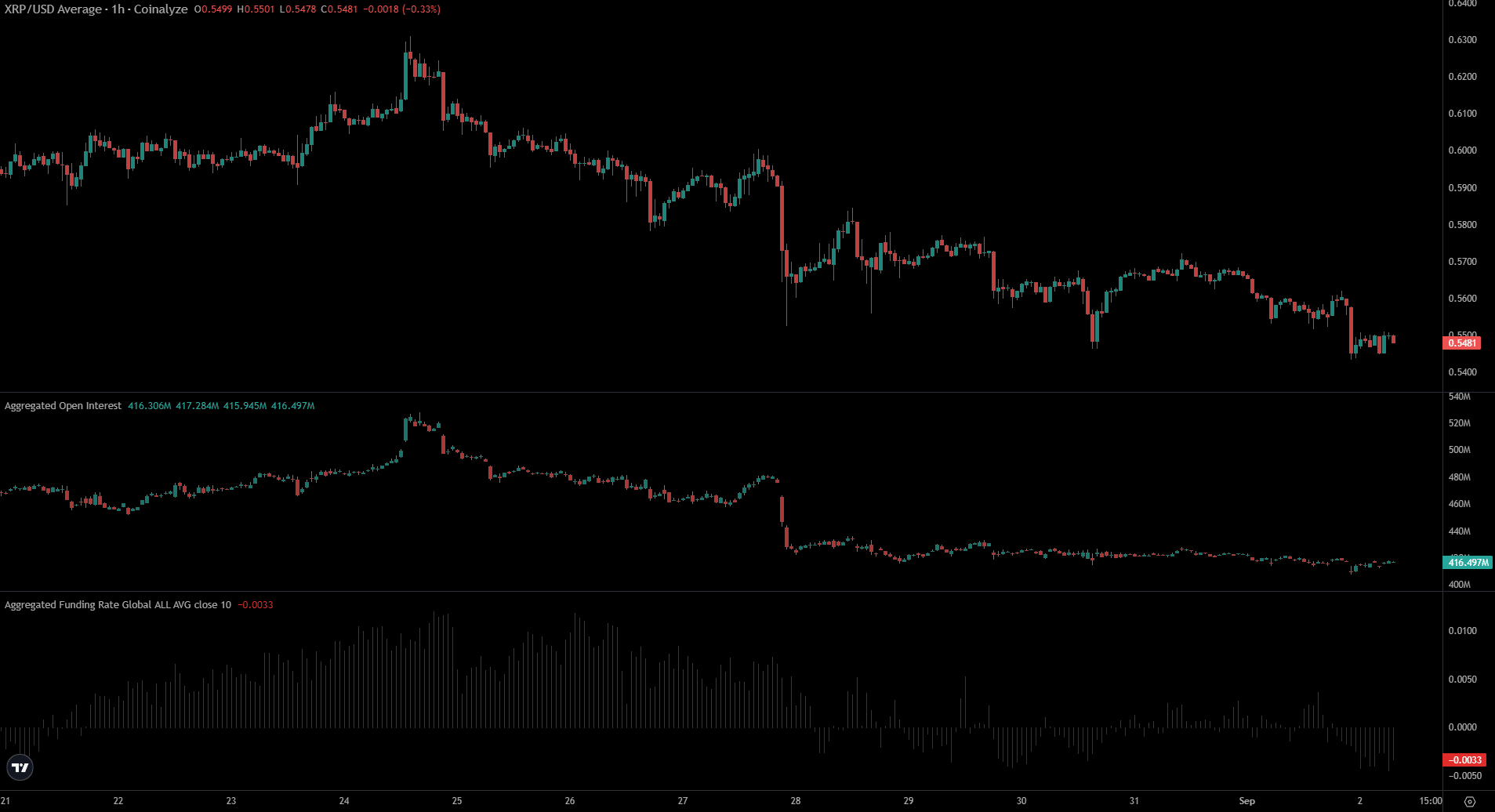

The financing interest rate was negative and the open interest rate refused to rise higher. Both indicators meant futures traders were reluctant to go long, preferring to sell or stay on the sidelines.

Read Ripple’s [XRP] Price forecast 2024-25

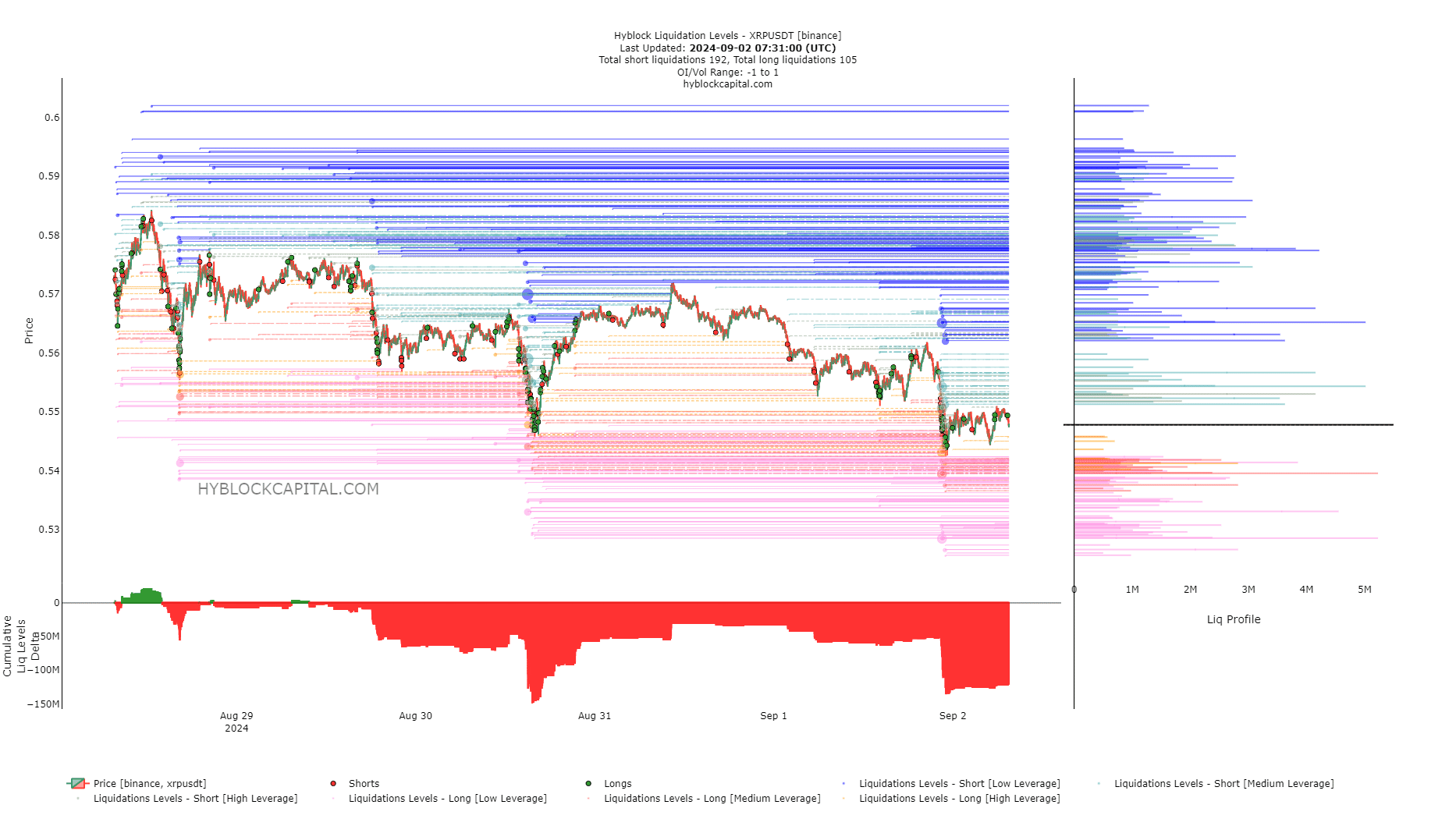

This bearish sentiment was reflected in the data on liquidation levels. The cumulative delta of liquid levels was negative and almost reached the August 30 level. XRP then managed to bounce 4.7% off the range lows.

It’s likely a similar scenario is playing out, but traders should be careful. Bitcoin [BTC] could decide to drop towards or below the $56,000 mark, pulling the altcoin market with it.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer