- Dofwifhat experienced strong downward momentum almost collapsing to $1.

- However, things have changed in the past 24 hours as WIF rose 22%.

Over the past month, the crypto markets have seen bigger swings. The increase in volatility peaked on July 5, when the market nearly collapsed.

During the market dip, Bitcoin hit a two-month low of $49,577. With the drop, all altcoins suffered, resulting in a $1 billion liquidation and a $300 billion drop in the Crypto market.

So a dog hat [WIF]like other altcoins and meme coins, fell significantly and continued a month-long decline.

WIF gains after weeks of decline

Over the past week, WIF has experienced a significant decline, which has continued during the recent market crash. However, by a turn of events, dog hat has reported huge gains on the daily charts.

At the time of writing, WIF was trading at $1.7, having risen 22% in the last 24 hours. This increase comes after the memecoin experienced strong downward momentum.

Thus, on the daily charts, WIF shows strong upward activity that would continue and complete the recovery.

Is WIF safe from the fear of a $1 drop?

Despite the gains on the daily charts, WIF still remains bearish. Over the past seven days, WIF is down 26.34%, with trading volume on the daily charts down 37%.

As previously reported by AMBCryto, dogwifhat’s decline caused analysts to fear a further decline below $1. However, the recent rise on the daily charts has the market believing that the upward momentum, if maintained, could drive prices further higher.

According to AMBCrypto’s analysis, despite the gains on the daily charts, WIF experienced a strong bearish trend. Looking at the Directional Movement Index, the downward trend is strong, with the negative index at 28 being higher than the positive index at 17.

Source: Tradingview

Moreover, the Aroon line further proves that the downtrend is strong as the Aroon at 85.71% sits above the Aroon Up line at 21.43%.

Source: Tradingview

The RVGI also showed that the downtrend of the WIF remains below zero at -0.4355, and below the signal line at -0.4339.

Source: Santiment

Looking further, our analysis of Santiment data shows that open interest per exchange has fallen over the past week. Open interest per exchange has fallen from a high of $146.7 million to $109.1 million at the time of writing.

However, over the past 24 hours there has been an increase in the outstanding WIF interest per exchange. The decline indicates that investors are closing their positions without opening new ones.

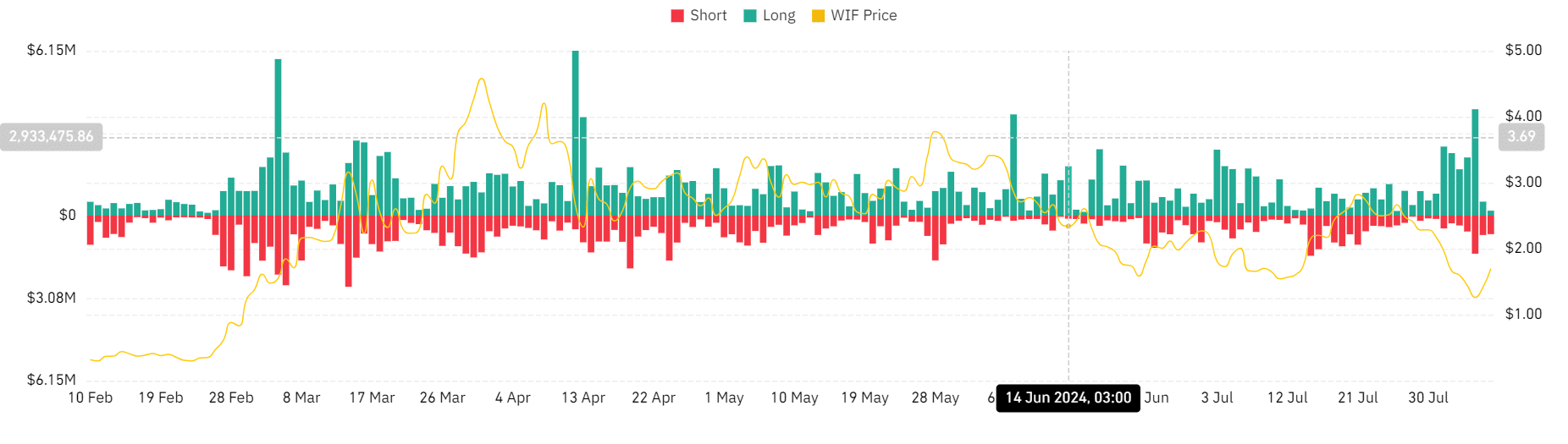

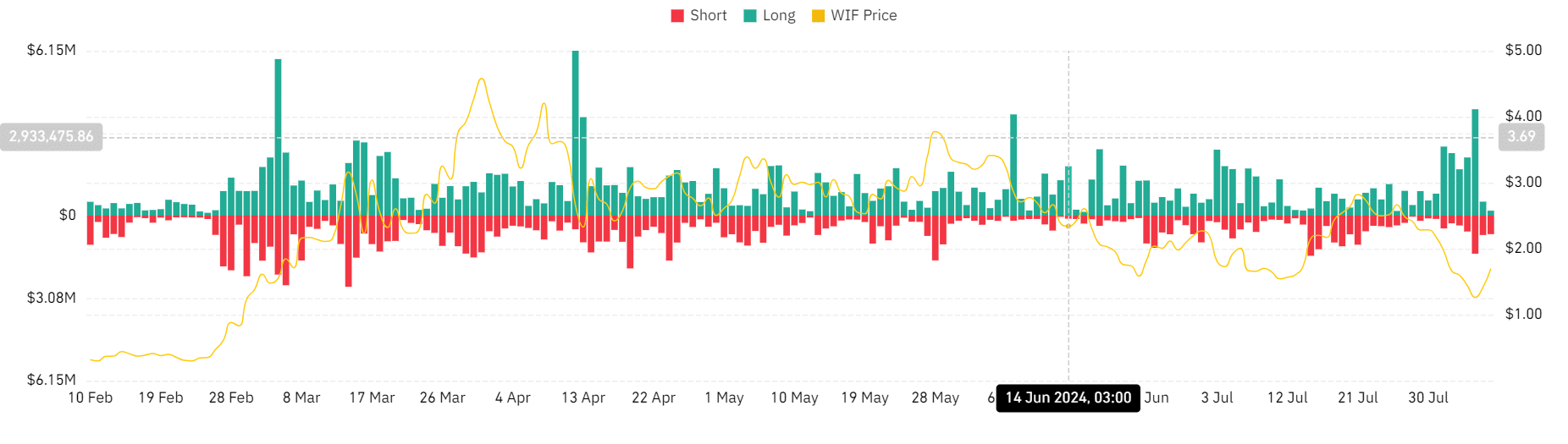

Source: Coinglass

Finally, Coinglass data shows that WIF has experienced higher liquidation of long positions over the past seven days.

Realistic or not, here is the market cap of WIF in terms of BTC

The gains on the daily charts show that liquidation of short positions increased, while long positions remained significantly low.

Therefore, if gains on the daily charts hold, WIF will look to reach a significant resistance level around $2.3. However, if general market sentiment holds, dogwifhat is not out of danger of falling to $1.05.