- Solana has regained dominance over its rivals, allowing SOL to make short-term profits.

- However, reaching a new ATH may take a little more time.

Defying the market odds, hope for Bitcoin [BTC] to hit $100,000 in one bull run seems to have faltered. Even with President Trump’s support, caution is taking over the market.

Still, the lack of a pullback suggests the bears aren’t winning yet.

This environment has opened the door for altcoins to shine, breaking psychological barriers and outperforming Bitcoin with gains that have doubled the pace.

Unlike the previous cycle, which featured Solana [SOL] can reap the most benefits, the rivals are in the spotlight this time, with Cardano [ADA] post higher highs.

While Bitcoin struggles to break the $93,000 resistance, altcoins appear poised for near-term gains.

However, for a parabolic run, BTC must overcome this resistance to restore investor confidence in the market. Meanwhile, Solana faces other challenges that, if not resolved, could hinder her pursuit of a new all-time record.

There are two possible routes ahead for Solana

The past 24 hours have been crucial for Solana, who broke away from a five-day consolidation with a 9% jump in one day and was trading at $238 at the time of writing.

This level was last seen in the same month three years ago, during the cycle where SOL reached its ATH of $260.

This breakout comes at a time when Bitcoin is engaged in a tug-of-war to overcome the $91,000 resistance. Meanwhile, XRP has stolen the spotlight on the daily charts.

While Solana stagnated, XRP soared, gaining over 70% and breaking the $1 barrier.

Together, these factors create a bullish outlook for Solana. The reasoning is simple: Over the past five days, Solana’s consolidation has been driven by investors shifting their focus to XRP.

However, XRP’s recent 7% drop to baseline signals the exit of weak hands. This presented an opportunity for the Solana bulls to take advantage, which previous analysis shows they are already doing.

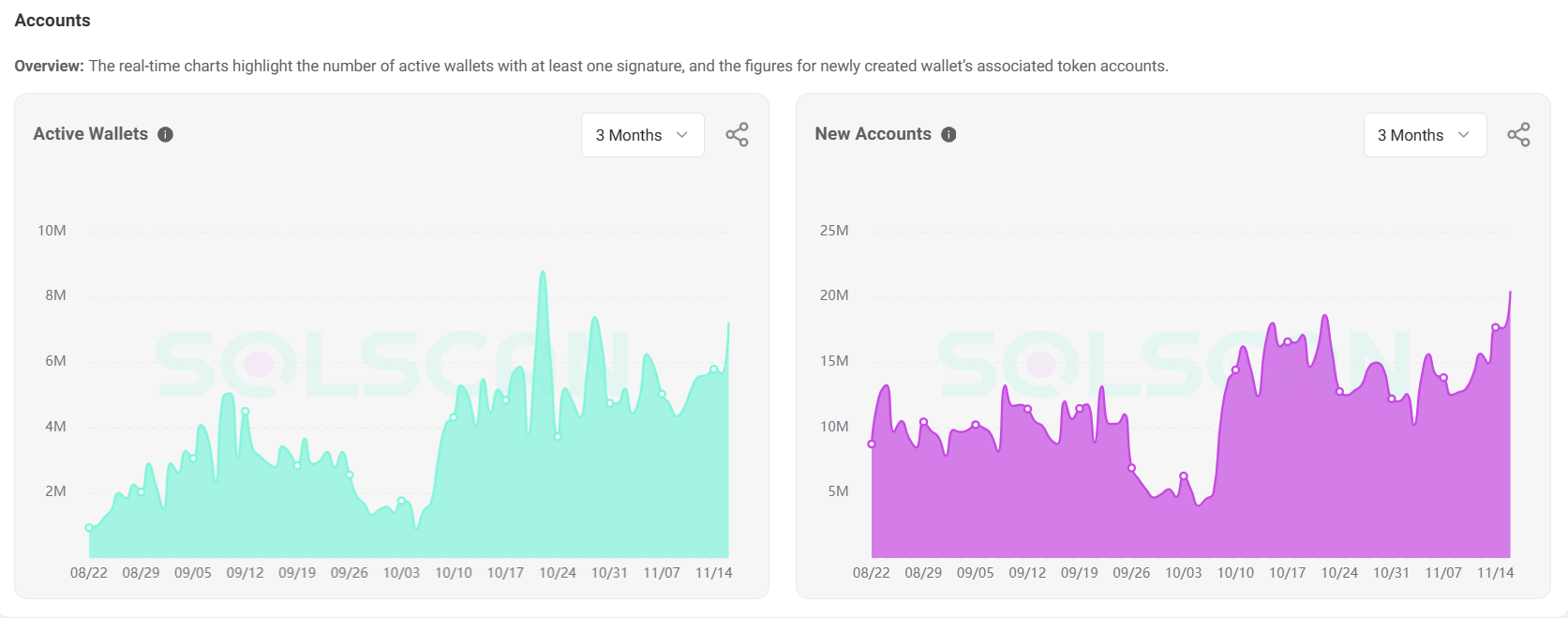

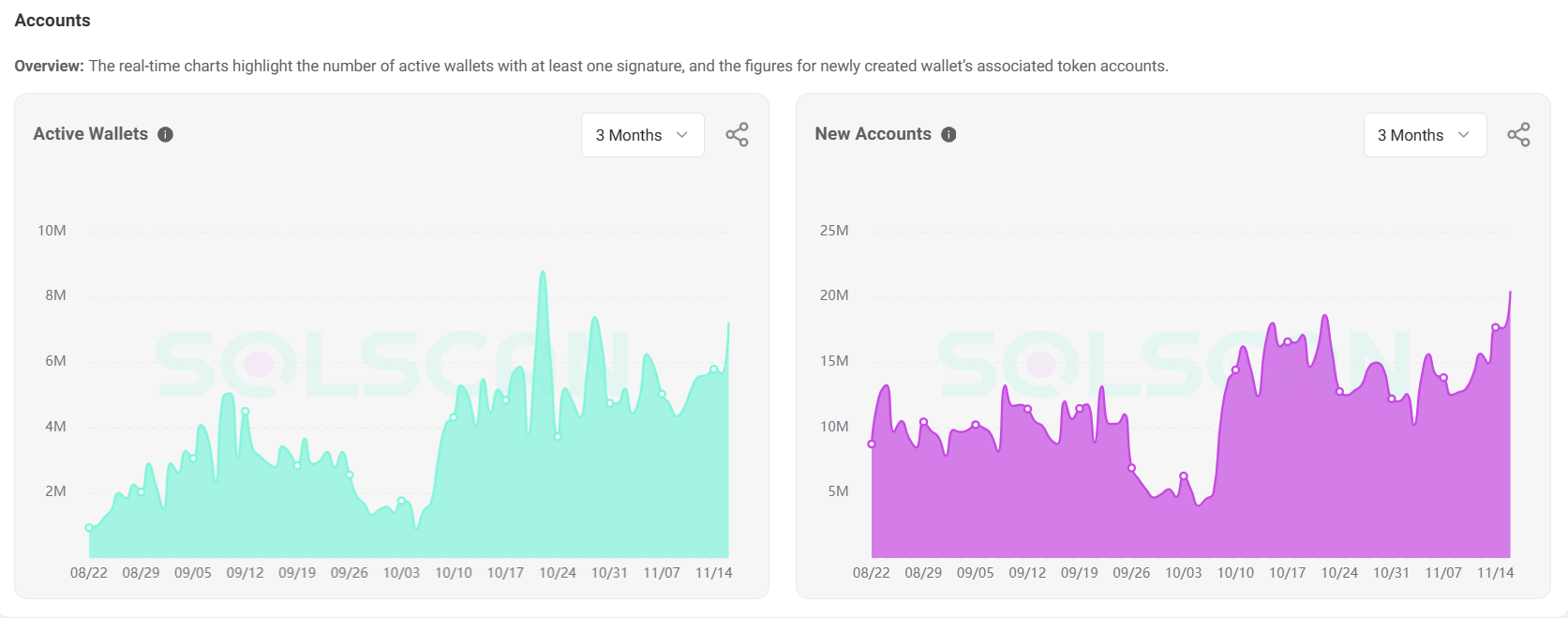

Notably, the increase in the number of newly created wallets on the Solana network is approximately 30.77%, up from 15.6 million to 20.4 million in just five days.

This increase reflected growing interest, largely fueled by FOMO anticipation because an outbreak becomes more intense.

Source: SolScan

As a result, Solana looks poised for a short-term rise to around $248. However, given the extreme market volatility, the rally could be limited to this target.

The next step could be a correction before reaching a new ATH or waiting for an underlying catalyst.

History suggests that SOL may have to wait longer

While the aforementioned benchmark may not seem too optimistic given the bullish on-chain data, the overall market sentiment should not be overlooked.

The RSI is in an overbought state, with 81% of price movements over the past two weeks being bullish, indicating overheating. To prevent weak hands from disappearing, the focus now shifts to the fundamentals.

Psychologically, investors are at a crossroads regarding Bitcoin’s long-term potential, awaiting a major catalyst to push its value above $93,000.

The consolidation below $91,000 suggests that bulls are consistently defying bearish pressure on several metrics.

While altcoins benefit from this momentum, parabolic rallies have historically often been driven by Bitcoin itself.

So unless stakeholders identify the Bitcoin market’s next low, the top altcoins may have to wait before breaking through the psychological level.

Read Solana’s [SOL] Price forecast 2024–2025

In short, despite newcomers having a ‘long’ view of Solana, it may not be enough to break the $260 mark. For a repeat of the 2021 cycle, bulls must first break Bitcoin’s resistance at $93,000.

This could lead to a rally, with another dip around $95,000, potentially paving the way for Solana to reach $260. For that to happen, investors must continue to choose SOL over other altcoins.