Berachain is everywhere! On x, in your DMS, and probably at the moment in your dreams. Although it sounds similar, it is not about the Berenmarkt (your portfolio is safe – for now). Berachain is a Layer-1 blockchain that runs on a unique proof-of-liquidity (Pol) model. This model ensures that capital remains active in the ecosystem instead of being inactive as in proof-of-stake (POS) chains. This quick guide deals with what you need to know in 2025.

What is Berachain?

Berachain is a low-1 blockchain built using the Cosmos SDK. It has an EVM identical environment and a proof-of-liquidity (Pol) consensus mechanism.

Note: This setup ensures that Ethereum-based Dapps can migrate without problems, while liquidity providers play a central role in securing the network.

Berachain is built on the Cosmos SDK. This means that the platform benefits from a modular structure for simple upgrades and optimisations.

Berachain Homepage: Berachain

Why Cosmos SDK is important?

Most block chains are rigid; As soon as they are built, they are difficult to change. Berachain, on the other hand, is able to exchange components if necessary, thanks to Cosmos SDK. Think of it as a modular house; If you want to upgrade the kitchen, you don’t have to break the entire house.

How does Berachain work?

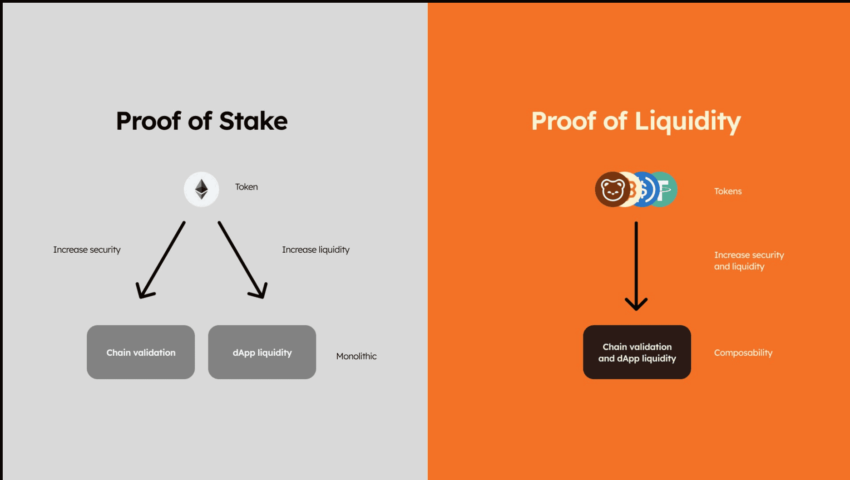

Berachain is on proof-of-liquidity (Pol), a mechanism in which Validators liquidity rather than just lock tokens to secure the network.

What is Proof-of-Liquidity (Pol)?

Proof-of-Liquuidity (Pol) is the unique consensus mechanism of Berachain, where Validators protect the network by using liquidity provider (LP) tokens instead of locking native tokens.

This ensures that liquidity remains active in Defi instead of being removed from the circulation.

Pos vs. Pol: Blog

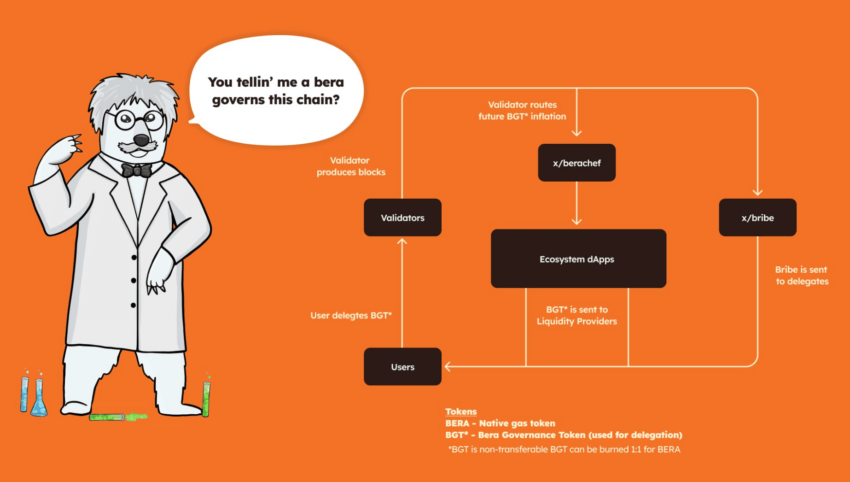

Here is a quick overview of how that works:

- Users deposit assets (eg Bera, USDC, Honing) into liquidity pools and receive LP -Tokens that represent their share.

- Users stuck LP -Tokens in reward safes to earn BGT (Berachain Governance token) as an incentive.

- Validators need BGT to steer emissions, which means that they have to attract BGT delegations from users to get influence.

- Protocols want more liquidity, so they offer incentives to validators to lead BGT emissions to their liquidity pools.

- Users follow the highest BGT emissions and ensure that the liquidity moves efficiently over the ecosystem.

- BGT can be burned to Mint Bera, which guarantees a self -sufficient token stream.

Berachain Validator Flow: Berachain Blog

What is being built on Berachain?

The Berachain Minet went live on 6 February 2025. The ecosystem already includes 80+ projects in different domains. Here are a few remarkable elements:

Defi -Platforms

- Bex (Berachain Exchange): Bex is the indigenous decentralized exchange of Berachain (Dex), which facilitates safe token waps. BEX has the widest possible series of Defi options: liquidity pools, yield of agriculture and low transaction costs.

- Apiarist Finance: A Defi platform that offers yield of yield, deployment and credit services, which use the high transactions speeds of Berachain and low costs to offer efficient financial activities.

- Honeypot Finance: A Defi-hub run by the community with a unique flywheel model that produces double stimuli.

Gaming

- Boein: A Berachain-Native Blockchain game with $ Bera prices and fun gameplay.

- Honey Jar: An unofficial community-driven project that combines NFTs with gaming, centered around the Bong Bears theme.

Socialfi

- Berally: A platform in which the intersection of social media and decentralized financing within the Berachain ecosystem investigates.

NFTs

- Bera Monks: A cultural NFT project that combines art, tradition and community with unique hand-drawn characters.

- Bao Bao: An NFT collection that offers exclusive NFTs, events, play-to-earn options and DAO benefits.

Berachain -tokenomics

Berachain runs on a three-linked system, in which each token plays a clear but mutually interconnected role.

$ Bera (gas & utility token)

- Powers all network transactions (gas costs).

- Used as a basic trade in Berachain Defi protocols.

- Earned by validators as part of Block Production Rewards.

$ Bgt (governance token)

- Only earned by offering liquidity in Berachain Dapps.

- It cannot be transferred, but can be burned to Mint Bera (which gives liquidity providers an output).

- Used to vote on management decisions, managing protocol emissions and stimuli.

$ Honey (Liquidity Stips & Stablecoin)

- It can be beaten by turning off the collateral.

- Used as the most important stable exchange medium in the Berachain ecosystem.

- Supported by reserve activa to maintain price stability.

Together, these three tokens create a balanced economic flywheel, so that network security, liquidity determination and governance are all provided.

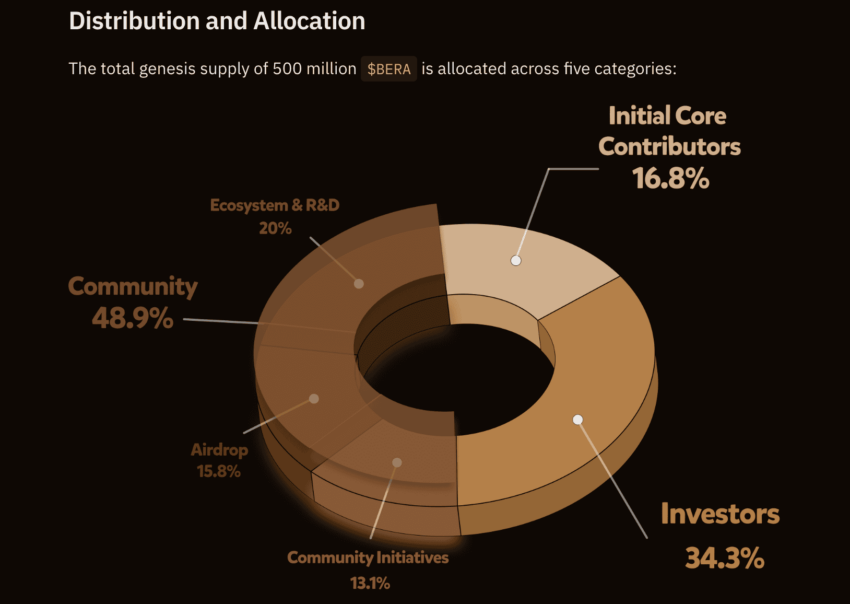

While Berachain works with three tokens, the primary focus of Tokenomics discussions revolves around $ Bera because it is the fixed delivery activa (500 million Bera at Genesis). Moreover, Bera is the most important token used for transactions, deployment and protocol rewards. And finally, it is directly influenced by the burning of BGT, which influences its circulating supply.

Berachain -Tokenomics: Berachain Docs

At Genesis, 500 million Bera -Tokens were assigned as follows:

After a one -year cliff, 1/6th of the assigned tokens becomes liquid. The remaining 5/6th vest will be linear for the next 24 months.

Berachain versus other layer-1 block chains

Berachain offers a capital efficient alternative by keeping liquidity active, in contrast to traditional POS models. Here is a fast table to help you find the differences:

Can Berachain change the L1 game?

Berachain redefines how low-1’s deal with liquidity, governance and safety. Instead of locking tokens, the capital keeps moving. Instead of passively expanding, the active participation rewards. Realistic, the Ethereum will not replace. However, it can force other L1s to reconsider their liquidity models. While they are early days, as proof-of-liquidity scales, the blockchain with bear theme could set a new standard for Laag-1’s.