- Recent data revealed a sharp increase in chain net flows, putting SUI ahead of other prominent Layer 1 blockchains.

- Several key indicators and metrics contributed to the rally’s upward trend.

Although Sui [SUI] saw a decline of 4.85% over the past week, but is starting to recover, with a modest gain of 0.69% in the past 24 hours.

TIts recovery is contributing to an impressive monthly growth rate of 77.91%, indicating a strong upward trajectory.

On-chain metrics and market sentiment both pointed to continued momentum. According to AMBCrypto’s analysis, these positive indicators suggested that the altcoin’s rally could continue further if current trends continue.

SUI advances with net flow of $23.8 million

SUI has included an impressive net flow of $23.8 million in the last 24 hours, according to Artemis data.

This puts the coin ahead of major blockchains like Arbitrum [ARB]Solana [SOL]Bitcoin [BTC]and optimism [OP]indicating a strong increase in market activity and investor confidence.

A chain net flow of $23.8 million represents the net balance of funds moving into or out of SUI during this period. It is calculated by subtracting the outflow from the inflow.

A positive net flow, as seen here, often indicates bullish sentiment, indicating growing demand for SUI’s ecosystem and the potential for price appreciation.

Source:

SUI recently announced a partnership with Franklin Templeton, a trillion-dollar asset management firm.

This collaboration is expected to strengthen the currency’s ecosystem by encouraging further development and attracting institutional interest.

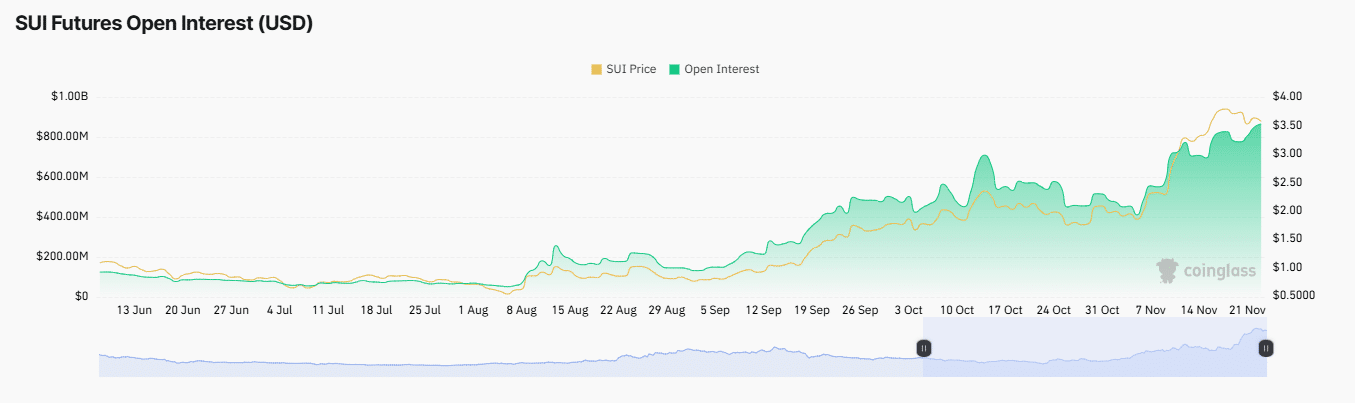

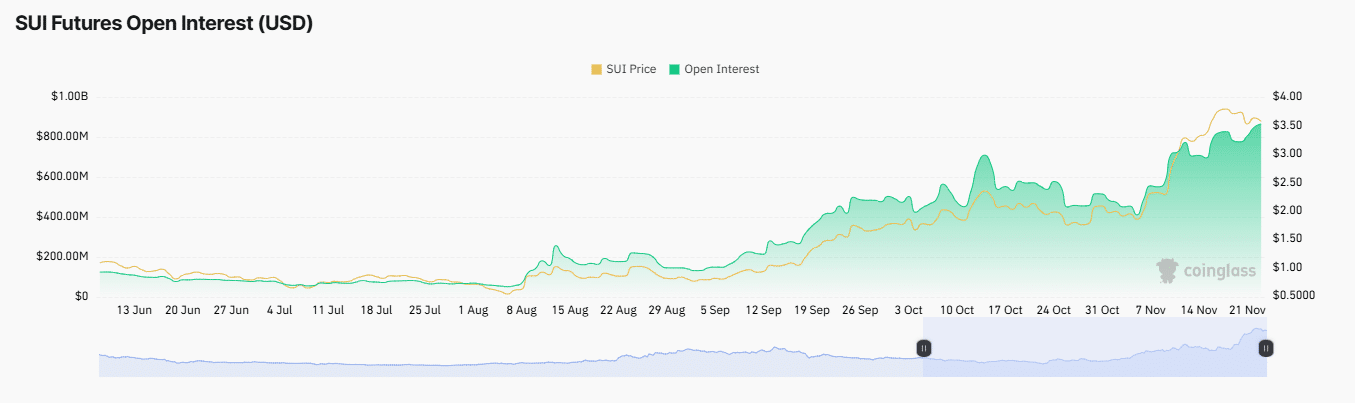

Open Interest reaches record highs

SUI has reached the highest level of Open interest (OI) yet it rose to $858.43 million at the time of writing.

This milestone signals a surge in demand for the asset, indicating increased trading activity and growing interest in the derivatives market.

OI measures the total number of unsettled derivative contracts and provides insight into market sentiment and demand.

A high OI, such as SUI’s 3.56% increase, often indicates greater market participation and investor confidence in the asset’s future performance.

Source: Coinglass

Meanwhile, the coin has recorded a negative Exchange Netflow of $8.23 million over the past 24 hours.

This means that more SUI has been withdrawn from crypto exchanges than deposited, reducing the circulating supply on trading platforms.

The trend is generally seen as positive and indicates a shift towards long-term investing rather than selling pressure.

With less SUI on the exchanges, demand could rise further, potentially creating upward price momentum.

A short pause before SUI’s next move

The coin’s expected rebound may take longer as the Long-to-Short ratio at the time of writing was below one, at 0.9227.

This indicates that there are more short positions than long positions, potentially limiting upside momentum.

Read Sui’s [SUI] Price forecast 2024–2025

This indicated bearish sentiment among derivatives traders, with more contracts betting on a price decline. Such a condition can cause temporary downward pressure or slow a rally, as in SUI.

However, if broader market sentiment remains bullish, the alt could still gain strength and spark a rally, especially if key indicators align to support positive price action.