It is widely accepted that Bitcoin ETF applications have been the main driver of Bitcoin’s return to April 2022 levels above $40,000. The proposition is simple: with a new layer of institutional legitimacy, the capital pool for Bitcoin inflows would expand.

From hedge funds and commodity trading advisors (CTAs) to mutual funds and pension funds, institutional investors have easy access to diversifying their portfolios. And they would do that because Bitcoin is an anti-depreciation asset.

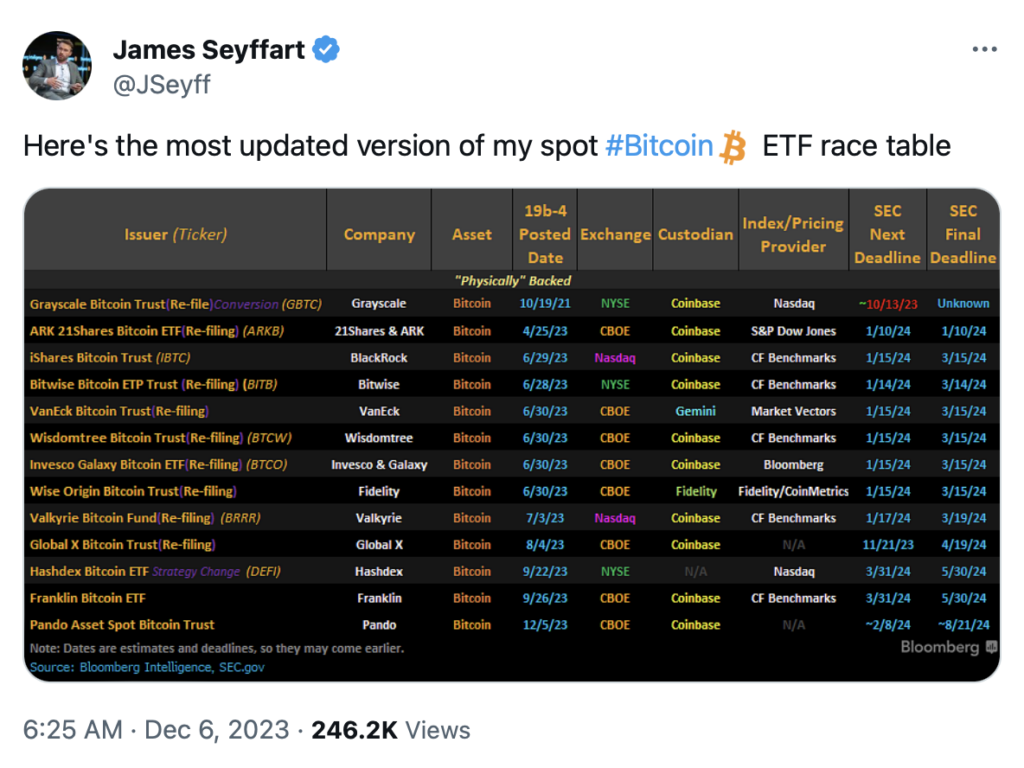

Not only against the perpetually depreciating fiat currencies, but also against gold, which is not so limited. In contrast, Bitcoin is not only limited to 21 million, but its digital nature is also secured by the most powerful computer network in the world. So far, 13 applicants have maneuvered to serve as institutional Bitcoin gateways.

According to Matthew Sigel, VanEck’s head of digital asset research, SEC approvals in the first half of 2024 will likely raise “more than $2.4 billion” to boost Bitcoin’s price. Following the SEC’s lawsuit against Grayscale Investment over its Bitcoin trust to ETF conversion, Bitcoin ETF approvals are now seen as a virtual certainty.

Most recently, SEC Chairman Gary Gensler met with Grayscale representatives alongside seven other Bitcoin ETF applicants. Later, Gensler confirmed in a CNBC interview that the path to Bitcoin ETFs is a matter of figuring out the technical details.

“We had denied some of these applications in the past, but the courts here in the District of Columbia have reconsidered that. And so we are looking at this again based on those court decisions.”

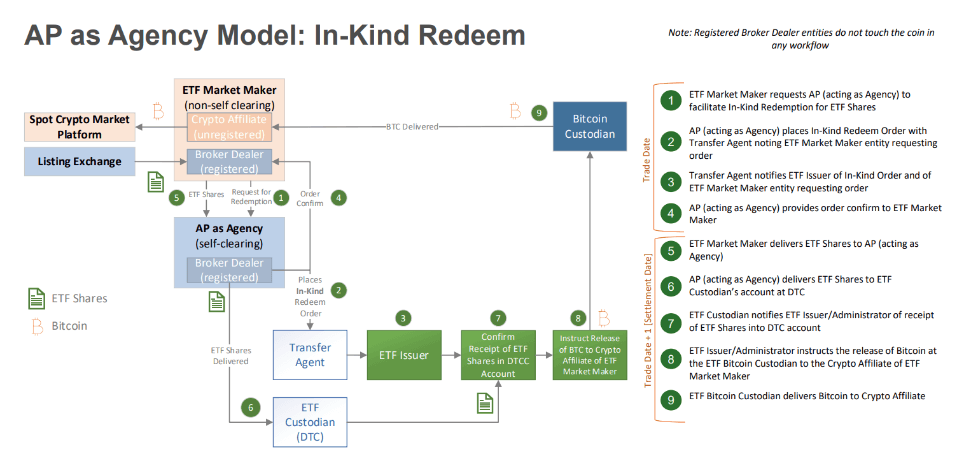

The most telling indicator in that direction is that BlackRock, the world’s largest asset manager, has integrated Wall Street-friendly rules. In that context, banks could participate as authorized participants (APs) in the exposure to Bitcoin ETFs. This is also notable considering that Gary Gensler himself is a former Goldman Sachs banker.

What would the Bitcoin ETF landscape look like given this likely horizon?

The role and concerns of custodians in Bitcoin ETFs

Of the 13 Bitcoin ETF applicants, Coinbase is the custodian of BTC for 10. This dominance is not surprising. BlackRock partnered with Coinbase in August 2022 to connect BlackRock’s Aladdin system to Coinbase Prime for institutional investors.

Additionally, Coinbase has built cozy relationships with government agencies, from ICE and DHS to the Secret Service, to provide blockchain analytics software. At the same time, the largest US crypto exchange tracks information requests from law enforcement agencies and agencies in annual transparency reports.

As a preferred choice, Coinbase would serve the dual role of crypto exchange and ETF custodian. This took Coinbase (COIN) stock to new highs this year, preparing it to close out 2023 with a +357% gain. On the other hand, the same SEC that regulates Coinbase as a publicly traded company sued Coinbase in June 2023 for operating as an unregistered exchange, broker, and clearing agency.

According to Mike Belshe, CEO of BitGo, this could cause friction on the path to approval of Bitcoin ETFs. In particular, Belshe sees Coinbase’s merger of trading and custody services as problematic:

“There are many risks associated with setting up Coinbase that we don’t understand. There is a strong possibility that the SEC will refuse to approve applications until these services are completely separated.”

Previously, the SEC’s oft-cited reasoning behind the Bitcoin ETF’s denial revolved around market manipulation. For example, as a receiver of BTC flows, Coinbase could execute ETF orders just before the ETF order execution to take advantage of the price difference.

The SEC has urged strict trading controls and market surveillance to prevent possible market manipulation. This is in addition to the existing surveillance sharing partnership between Coinbase and Cboe Global Markets.

Suffice to say, it is in the best interest of Coinbase and its COIN shareholders not to erode the integrity of BTC’s custody. Of greater importance is how Bitcoin redemptions will be accomplished.

Reimbursements in kind versus cash: analysis of the options

The Bitcoin ETF concept revolves around BTC exposure while avoiding the potential pitfalls of BTC self-custody. After all, it is estimated that up to 20% of the Bitcoin supply is lost forever due to forgotten initials, phishing, and other self-governance weaknesses.

Once that more centralized BTC exposure is achieved, how might investors redeem that exposure? In addition to market surveillance, this has been the focus of the SEC, with refunds broken down into:

- Reimbursements in kind: While existing Grayscale (GTBC) shares are not directly exchangeable for Bitcoin but rely on the secondary market, Bitcoin ETFs would change that. The above Authorized Participants (APs) would be able to exchange BTC ETF shares for a corresponding BTC amount.

This is the preferred approach of most Bitcoin ETF applicants, given its common use in traditional stock/bond ETFs. This approach would also benefit the market as it minimizes the risk of price manipulation by avoiding the need for large-scale BTC sales. Instead, APs can gradually sell their bitcoins without flooding the market to artificially suppress the price.

- Cash repayments: This approach is reductionist by default and provides a more direct BTC-to-fiat pipeline when APs exchange ETF shares for cash.

Since the SEC is part of the USG’s fiat system, the watchdog agency prefers it. Cash refunds would close the redemption life cycle by keeping the capital in TradFi instead of exploring BTC custody.

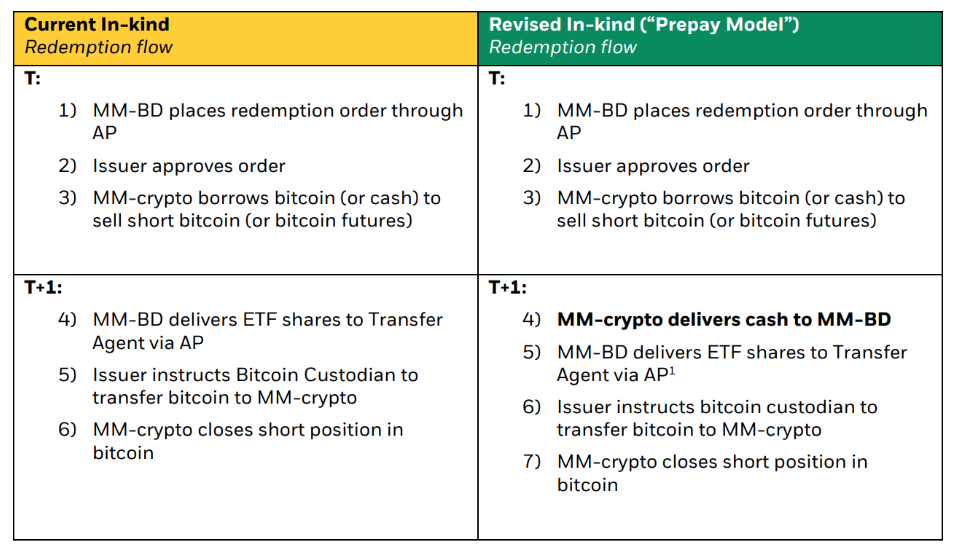

The November 28 memorandum between the SEC and BlackRock shows that the approach has not yet been determined. BlackRock has revised its in-kind redemption model, following the SEC’s concerns about market maker (MM) risk. In the new model, there would be an additional step between the MM and the market maker’s registered broker/dealer (MM-BD).

Unlike the in-cash model, the revised in-kind model would eliminate the need to pre-finance sales transactions. This means that ETF issuers do not need to sell assets/raise funds to meet AP redemption requests. Despite the complexity, this would not impact free cash flow without leverage.

Furthermore, market makers would assume the risk of executing redemptions, rather than this risk falling on the APs. With lower transaction costs and a better defense against market manipulation, BlackRock’s preferential in-kind redemptions appear to be gaining ground.

Another major asset manager, Fidelity Investments, also prefers an in-kind model, as noted in the December 7 memorandum.

It will then be up to the SEC to determine the post-Bitcoin ETF landscape.

Market implications and investor perspectives

In the short term, following the approval of the Bitcoin ETF, the VanEck analyst estimates an inflow of $2.4 billion. VanEck predicts a larger capital pool of $40.4 billion within the first two years.

In the first year, Galaxy researcher Alex Thorn sees over $14 billion in capital accumulation, which could push the BTC price to $47,000.

However, some analysts are more optimistic. The Bitwise research team predicts that Bitcoin ETFs will not only be “the most successful ETF launch of all time,” but that Bitcoin will trade above the new all-time high of $80,000 by 2024.

If the SEC continues its anti-crypto tradition, it could pick out a few details that would act as a deterrent. For example, a high redemption threshold would discourage APs from creating BTC ETF shares in the first place, as the initial cost of purchasing a large amount of bitcoins would be perceived as too burdensome and risky.

An example of this is that existing gold ETF redemptions, treated as ordinary income, incur a 20% capital gains tax in the long term. On the other hand, cash redemptions would only trigger a taxable event when Bitcoin is sold.

If the SEC approves in-cash models for some filers, investors would have more incentive to redeem ETF shares in cash instead. This in turn could lead to greater potential for price manipulation.

All told, the SEC has plenty of wiggle room to put major downward pressure on Bitcoin’s price, despite its stated goal of investor protection.

Conclusion

2024 is poised to be the trifecta year for Bitcoin. With the influx of Bitcoin ETFs, the market also expects the fourth Bitcoin halving and the Fed’s intervention in interest rate cuts. In the meantime, the dollar will continue to erode even under the best-case scenario of 2% annual inflation.

The latter two factors could even overshadow Bitcoin ETFs regardless of whether the SEC opts for in-kind redemptions or more downside cash redemptions. In either case, Bitcoin is about to cross a new legitimacy milestone. This in itself is sure to please Bitcoin holders for years to come.