- Litecoin network activity declined as the number of transactions decreased.

- The price of LTC fell sharply last week and market indicators were bearish.

Litecoin [LTC] recently completed its third halving on August 2, 2023, cutting miner rewards by half. In its latest tweet, the blockchain revealed that its mining sector has experienced tremendous growth, with one key metric almost hitting a new all-time high.

How many Worth 1,10,100 LTCs today

However, a closer look at Litecoin’s network stats revealed a different picture. Moreover, the halving also had no immediate positive impact on the price of the coin as the chart remained red.

Will Litecoin Grow After Halving?

Litecoin posted a tweet on August 6 highlighting the growth of its mining sector. According to the tweet, the blockchain’s mining difficulty had touted a new all-time high of 27.05 million as the hashrate approached its ATH.

Litecoin’s Hashrate is currently on the verge of hitting a new all-time high. Currently at 933.2 TH/s, struggling to just touch another ATH. $LTC is stronger than ever!

Despite what you may read in the ‘press’. pic.twitter.com/0hEgED09kd

— Litecoin (@litecoin) August 6, 2023

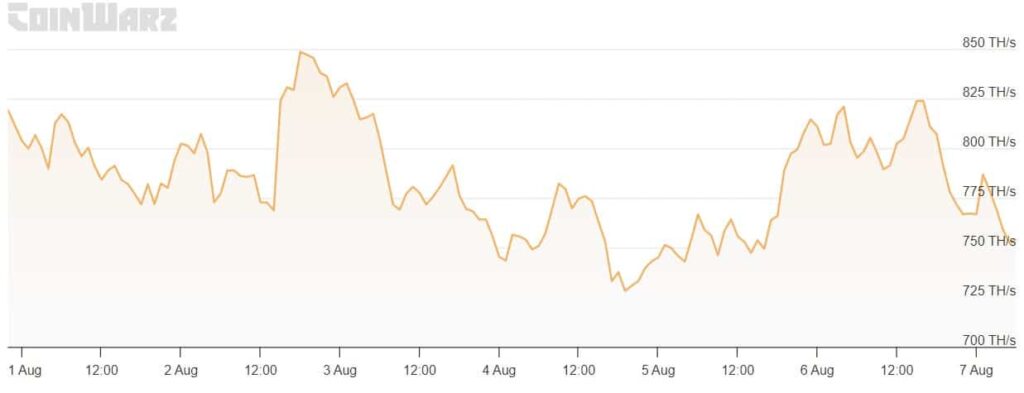

But a check of mining stats suggested that the blockchain’s key metrics actually declined after the halving event. Coinwarz’s chart revealed that after peaking on August 2, LTC‘s hashrate started to decrease. At the time of writing, Litecoin had a hash rate of 754.29 TH/s.

Source: Coinwarz

Not only that, but another key miner statistic was in a downward trend for several weeks. Glassnode’s chart indicated that Litecion’s miner fee was falling. The statistic started falling in May 2023 and at the time of writing the value was 10.5 LTCwhich was a negative signal.

Aside from mining stats, blockchain network activity has also followed the same declining trend. From Bit info chartsThe number of Litecoin transactions has dropped significantly in recent months.

Source: Glassnode

This may exacerbate the situation for Litecoin

If the aforementioned stats weren’t enough, the coin’s performance on the price front was more of a concern. According to CoinMarketCap, LTC fell more than 11% in the past seven days. At the time of writing, it was trading at $82.43 with a market cap of over $6 billion.

The falling price development may cause a further decrease in the hashrate of the blockchain. LTC miners’ rewards have already been halved and if the price of the coins continues to fall, miners may choose to leave the blockchain to seek more profitable options.

Realistic or not, here it is LTC market cap in BTC‘s conditions

A look at LTC’s daily chart helped to better understand if LTC’s price action could turn bullish. The Exponential Moving Average (EMA) ribbon showed a bearish crossover. Litecoin’s Chaikin Money Flow (CMF) registered a downtick, which was bearish.

Additionally, LTCThe Relative Strength Index (RSI) was also well below the neutral mark, increasing the likelihood of a sustained downtrend.

Source: TradingView