The crypto market has experienced several swings, but the resilience of specific sectors within this domain remains attractive. Recently, despite a noticeable dip in the broader crypto market, an area appears to be about to peak, demonstrating the potential and adaptability within the crypto ecosystem, according to a report.

Liquid staking, an industry that enables rewards for token pledges to support blockchain operations, is showing signs of resurgence. This resurgence is happening despite an overarching downturn in crypto assets.

Recover in the midst of the crypto crisis

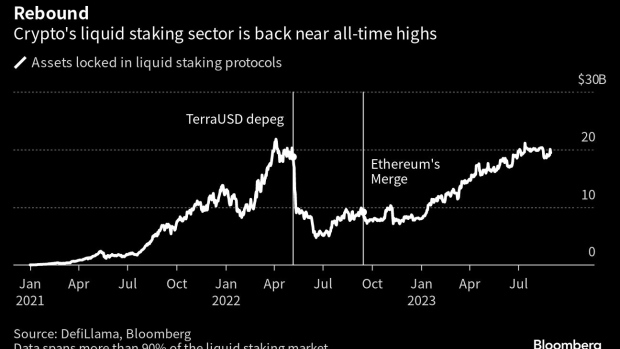

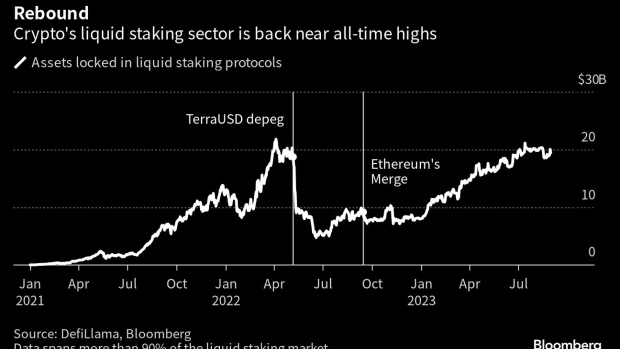

According to BloombergAccording to data from DefiLlama, there has been an approximately 292% increase in assets tied up in liquid staking services, reaching a monumental $20 billion from its June 2022 low. This increase is all the more significant given the broader crypto decline in that period.

Bloomberg noted a re-establishment of liquid strike position as “the titan of decentralized finance (DeFi).” Thanks to blockchain-based automated software, this crypto framework enables individuals to trade, borrow and lend without intermediaries.

Notably, liquid staking, once the crown jewel among DeFi applications, has overtaken lending. Protocols specialized in liquid staking, such as Lido and Rocket Pool, peaked in April of the previous year.

They amassed assets of just over $21 billion. However, this momentum was disrupted by the destabilization of TerraUSD, which led to a massive $2 trillion setback in the crypto market.

Despite the gloomy undertones in the crypto sector, where major tokens and a majority of DeFi services have yet to recover from the blows of 2021 and 2022, liquid staking stands out, showing a comeback, as shown in the chart below .

Global regulatory attitude to strike

Liquid staking plays a vital role, especially in the Ethereum blockchain. It provides a mechanism through which users can wager their tokens and receive a liquid token in return that represents their wagered amount.

This process allows users to participate in securing the network while preserving liquidity. Simply put, they can earn staking rewards without tying up their assets, ensuring flexibility and maximizing potential profit.

Kunal Goel, a research analyst at Messari, likens these services to “the on-chain equivalent of government bonds.” The analyst explains that while these are not risk-free, they exude a relatively lower risk profile and have so far remained unaffected by any hacks or exploits.

This resurgence of liquid staking has not gone unnoticed and is juxtaposed with regulatory decisions related to crypto worldwide. For example, the US has intensified its regulatory lens on the crypto sector, especially in terms of staking products.

Such measures gave rise to important players such as Crack And Bitstamp to stop them regional outlet products. DACM co-founder Richard Galvin commented:

The regulators’ crackdown on staking products offered by centralized exchanges has certainly contributed to liquid staking.

Featured Image from iStock, Chart from TradingView