- XRP and ETH are in a tight race to attract capital from Bitcoin as market sentiment turns cautious.

- XRP has the potential to develop its own asset class, separate from BTC, by 2025.

Once again, the crypto market’s resilience is being tested as the FOMC ends 2024 with a “speculative” twist. The third and final rate cut of the year – also the third in just four months – led to a sharp sell-off in Bitcoin [BTC]. A long red candlestick erased five days of gains, pushing BTC’s price below the critical $100,000 mark.

But this may be just the beginning. The Fed”carefullyTrump’s stance hinted that Trump’s conservative policies could lead to higher inflation in the coming months.

Investors did not take the news well. As the market fell, some altcoins took double-digit hits, but the top coins held firm, indicating a strong rebound is likely.

Here’s the interesting part: when it came to riding the “Trump pump,” Ripple [XRP] emerged as the big winner. Does this give XRP an edge in the battle against Bitcoin and Ethereum?

The game has started!

Right now, XRP is experiencing a wave of sell-offs across multiple companies statistics. Clearly, XRP has not been immune to the market turmoil. In fact, the $3 mark is moving further and further out of reach, with XRP currently priced at $2.30 (at the time of writing).

But all is not lost. December started off strong for So distributing XRP tokens seemed like a smart move.

On the other hand, Ethereum’s daily chart shows even more volatility, with sharp declines quickly followed by impressive rebounds.

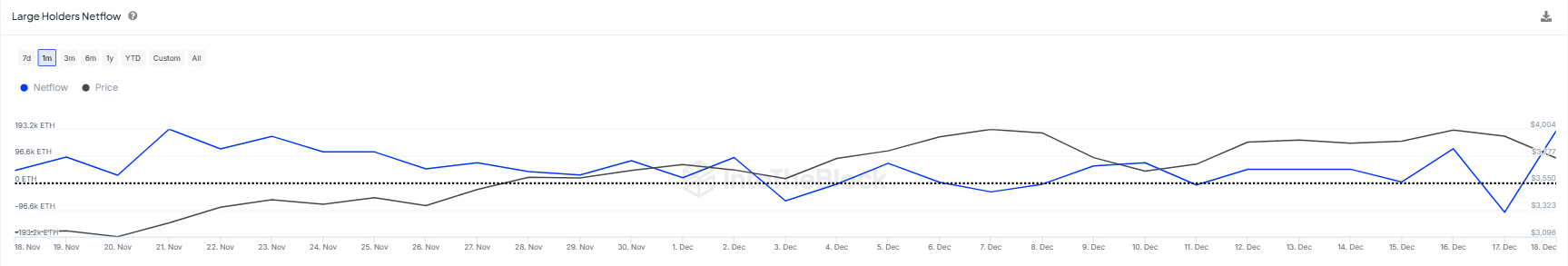

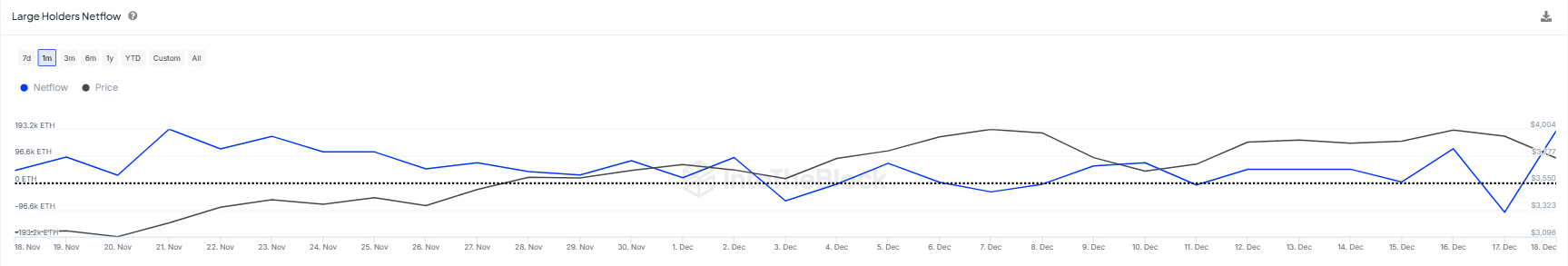

From mid-November to mid-December, each “dip” seemed strategically timed, followed by a strong recovery. This suggests that any increase in ETH supply was quickly met with aggressive response accumulation.

Now, both XRP and ETH are racing fiercely to break the key resistance levels. The competition is tight. But the winner will be the one who can stay strong amid uncertainty, backed by solid fundamentals. So which one will break first – $3 for XRP or $4K for Ethereum? Or will Bitcoin steal the spotlight instead?

XRP or ETH, whose “dip” should you dig?

The past 24 hours have rocked the crypto market, with a mix of factors coming together to cause a volatile chain reaction. Small, private investors in particular are the hardest hit.

In this climate, it is clear that FOMO may not return in the coming days. Instead, investors are rushing to adjust their portfolios, hoping to break even on their losses. It seems the burden now falls on the big players with deep pockets.

Here’s where things get interesting: the recent dip has brought both XRP and ETH close to a critical support level. If the big players start accumulating at this price point, we may see the beginning of a local bottom. This could trigger a recovery, which could inspire confidence among smaller investors.

When it comes to ETH, whales have shown significantly more strategy than XRP. They have taken advantage of these dips by picking up ETH at a discount before cashing out at a premium once the $4,000 mark is in sight.

Source: IntoTheBlock

Now, with whales By accumulating ETH again, it is likely that the price will next test $3.9K, but caution is advised.

However, attention shifts to Bitcoin, which has recently seen a strong upward move, recovering $101,000 – a bullish signal for the market.

Still, the recent Bitcoin crash has given altcoins an excellent opportunity to shine. It seems unlikely that we will see a retail surge for BTC in the near future, despite whales and institutions benefiting from the dip.

So as ETH continues to struggle with its endless loop, XRP has multiple factors supporting its growth: historical performance, whale support, the SEC developments, and the RLUSD stablecoin initiative.

Read Ripple [XRP] Price forecast 2024-2025

As a result, XRP’s potential to create a separate asset class from BTC by 2025 is a unique advantage – something Ethereum has failed to achieve since its inception.

Should XRP succeed, it could be in a prime position to benefit from Bitcoin’s volatility in the coming year.