- Bitcoin has risen more than 5% in the past three days.

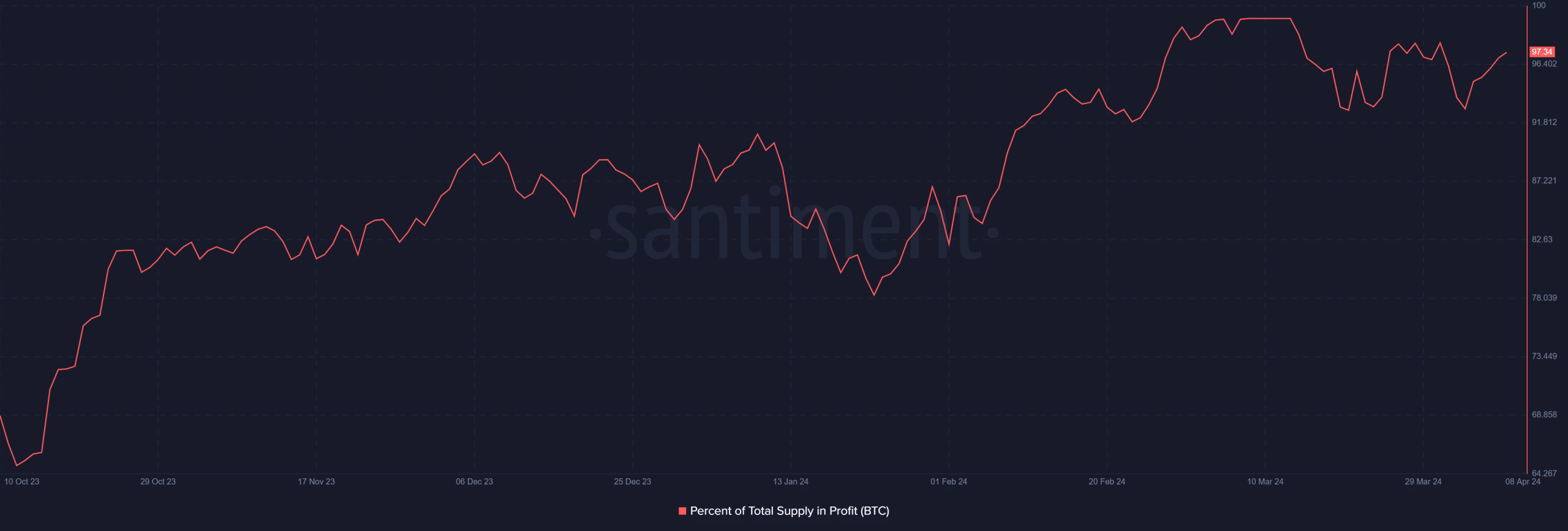

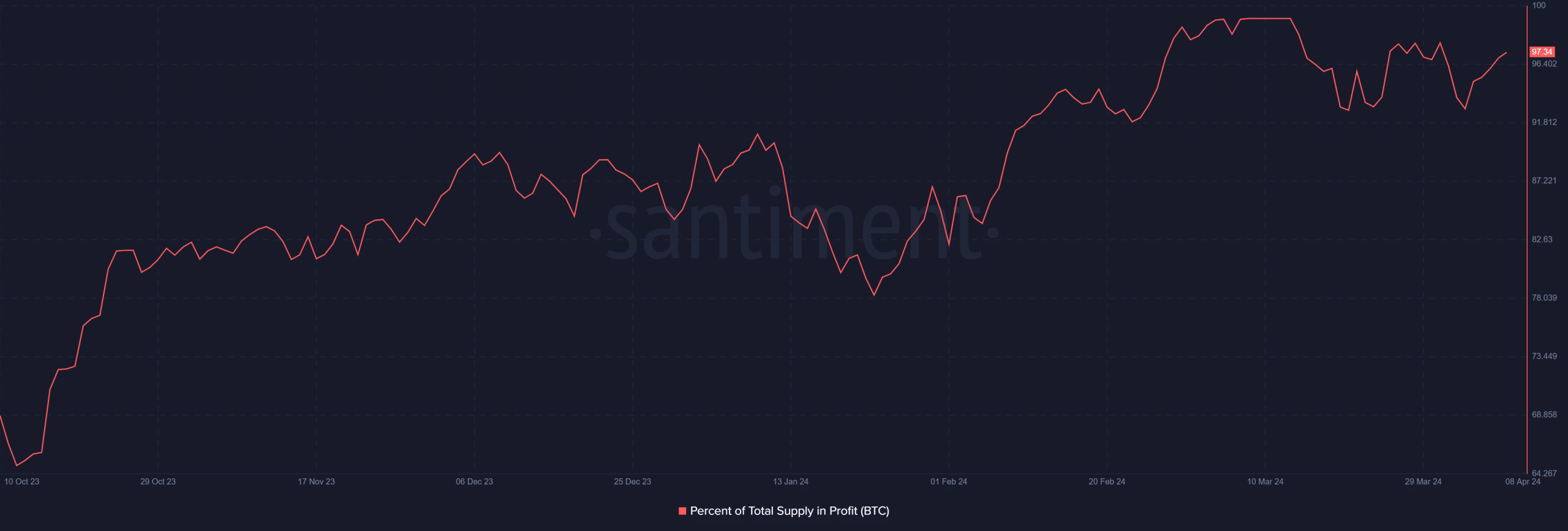

- BTC’s profit offer was now over 97%.

Bitcoin [BTC] showed glimpses of recovery in the past two days. However, the price has started a more important upward trend in recent hours.

This remarkable price increase has led to a significant increase in the volume of short liquidations, coinciding with a continued increase in the percentage of BTC supply in profits.

Bitcoin retests old ATH

Bitcoin has reignited optimism among holders, with an impressive gain of over 4% at the time of writing.

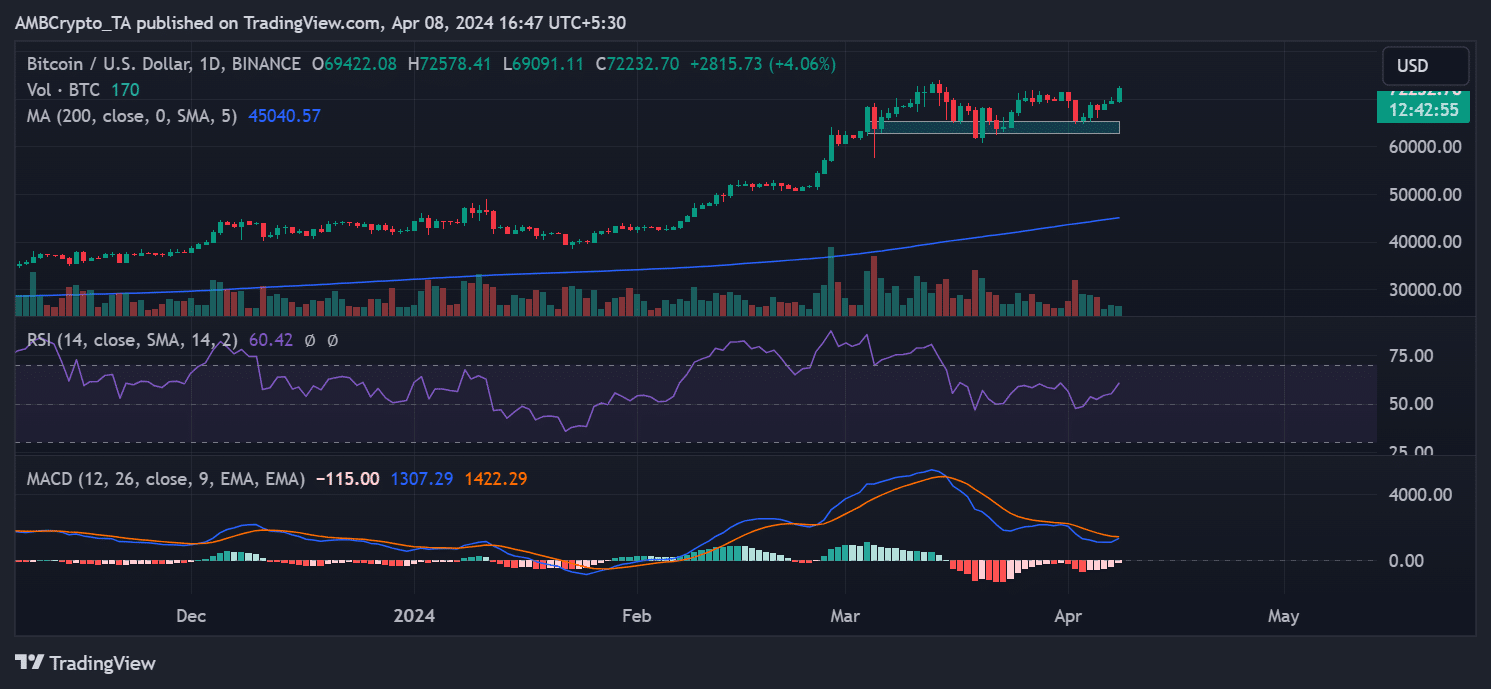

AMBCrypto’s analysis of daily price trends showed Bitcoin trading at over $72,000, reflecting an increase of over 4%. This marked a consecutive increase over the past three days, totaling more than 5%.

Notably, this current price trend brought Bitcoin closest to its all-time high of over $73,000.

Source: TradingView

Further analysis indicated that BTC support is around the $65,000 and $62,000 price zone, with resistance around $71,000.

With the current price trend breaking through resistance, a continued uptrend could signal a new price peak.

Furthermore, AMBCrypto’s analysis of Bitcoin’s Relative Strength Index (RSI) revealed that it has remained above the neutral line since crossing it in February.

However, price declines have brought the fund close to the neutral line, weakening the upward trend. The recent price surge has pushed the RSI above 60, indicating the growing strength of the current bull run.

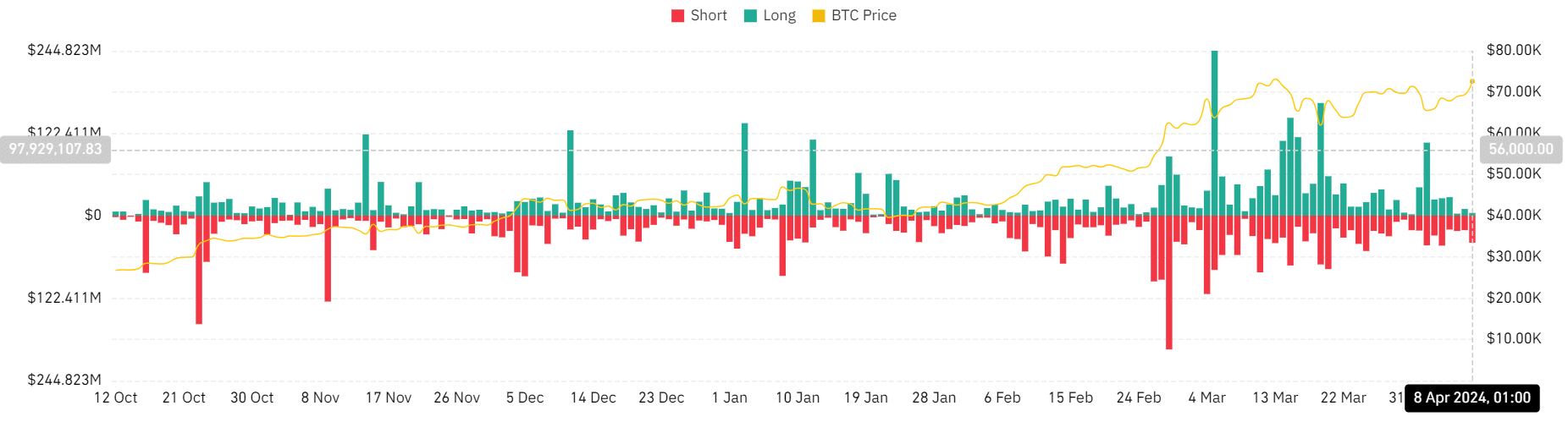

Short liquidation increases with price

Bitcoin’s price rise has led to a significant number of short liquidations. Analysis of the liquidation chart on Mint glass showed that at the time of writing, short liquidation volume exceeded $40 million.

In contrast, the long liquidation volume was approximately $4 million. This was the highest short liquidation recorded in the last four days and the highest liquidation observed in the last three days.

Source: Coinglass

If the price continues to rise, further growth in short liquidation volume is possible before the current trading day closes.

Is your portfolio green? Check out the BTC profit calculator

Bitcoin sees an increase in supply in profits

Between April 3 and the time of writing, almost 1 million Bitcoins have ended up in a profitable position.

The percentage of BTC supply in earnings showed that the number of BTC supply in earnings was about 18.3 million on April 3, after a sharp decline.

However, from then on the number recovered and at this time it exceeded 19.1 million. This represents an increase from about 93% to over 97% of the BTC supply in profit at the moment.

Source: Santiment