Key learning points

- A Layer-2 (L2) protocol is a secondary framework built on top of an existing, more secure blockchain network to make it more accessible.

- They improve transaction efficiency by removing the process from the main chain and are very similar to the SWIFT messaging network in TradFi.

- Investors can invest in the tokens of these Layer-2 projects, which they can hold or stake to identify long-term winners.

Table of contents

- What are layer 2s?

- Why are layer 2s important?

- Layer 2s vs. SWIFT

- Top layer-2 blockchains

- Where are Layer-2 Blockchains used?

- Investor Outlook for Layer-2s

- Takeaway for investors

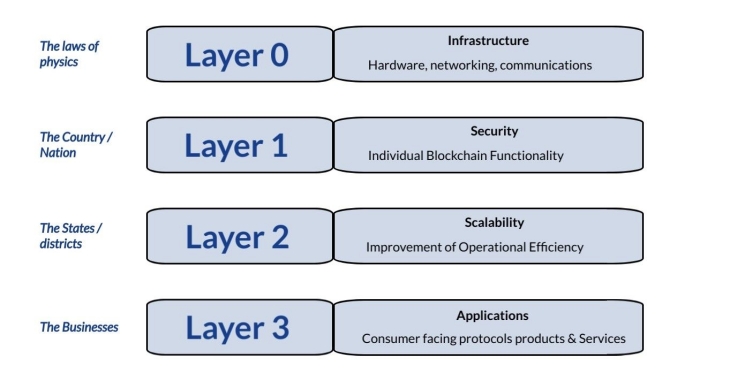

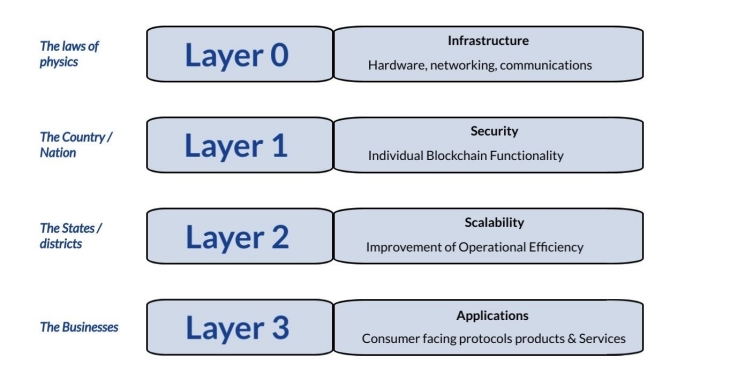

Although we often think of blockchain as a unique technology, it is layers of technology that work together.

Layers are not ideal. Once we reach a higher level, in most cases we compensate for a lack of scalability with the underlying chain. They are a hacker.

In this guide, we’ll explain what Layer-2s are and how investors can think about the ultimate winners of the Layer-2 race, so you can invest in today’s tokens that have the best chance of winning in the long term.

What are Layer-2s?

Blockchain technology consists of 4 layers:

- Low-0 (L0) includes the Internet and the hardware needed to connect and communicate over networks.

- Layer-1 (L1) refers to the primary blockchain network, such as Bitcoin or Ethereum, focused on recording transactions, forming consensus, and maintaining security.

- Layer-2 (L2) focuses on scaling these solutions

- Low-3 (L3) focuses on hosting applications to promote adoption.

Layer-2 refers to a set of technology solutions built on top of layer 1 to reduce bottlenecks (i.e., to make the underlying blockchain work faster and cheaper).

They rely on the L1 blockchain for security and data availability and typically consist of two parts: data packets and a protocol layer. While data packets represent the encoded and decoded bits of information, the protocol layer focuses on transferring data from one network segment to another.

While Layer-1 provides the foundation for decentralized finance, Layer-2 blockchain solutions are built to improve scalability and compatibility with third-party applications.

For example, Ethereum is a popular Layer-1, but it does not scale well. So Layer-2 solutions like Arbitrum, Optimism and Base are built to make Ethereum run faster and cheaper.

Why are layer 2s important?

As the number of blockchain users grows, so do their scalability issues. Layer-2 blockchains address these challenges by taking transactions off the main chain and processing them separately. Layer 2 networks typically provide:

- Lower costs: Layer-2 protocols bundle off-chain transactions into a single Layer-1 transaction, reducing data load on the mainnet while maintaining the benefits of security and decentralization.

- More utility: By enabling higher transaction throughput, Layer-2 projects can improve the user experience while focusing on real-world scope and usability.

Imagine if you had to send money abroad in the early 20th century. You would have to use gold or silver money to purchase a bank check that would be honored abroad. You can send a bank check to the person you want to send money to.

When SWIFT was invented in 1973, the money transfer process was slow, dependent on individual carriers and prone to delays and losses.

SWIFT stands for The Society for Worldwide Interbank Financial Telecommunication and is the leading messaging network for international payments. To date, SWIFT remains the standard for international money transfers and works by sending crucial information about the transaction from one bank to another, including the name of the sender, the recipient, the transaction amount and the exchange rates.

Layer-2 blockchains work similarly to SWIFT. They build and improve the existing infrastructure to ease the process of sending money. SWIFT represents a scenario where one Layer-2 blockchain becomes the primary solution for scalability – we will all use a single messaging system to communicate with the leading network.

That said, key points also distinguish Layer-2 from SWIFT. Layer-2 solutions are decentralized, meaning no central authority oversees their transactions. SWIFT is a centralized system operated by a consortium of banks.

Due to the involvement of multiple intermediaries and TradFi’s rigorous processes, SWIFT transactions take longer to settle than their blockchain counterparts.

Top layer-2 blockchains

Each type of Layer-2 solves a different pain point. Depending on the requirements of a blockchain or a user, one Layer-2 solution may be better than another.

- State Channels: A state channel is a blockchain second-tier solution that allows participants to conduct unlimited off-chain private transactions. This is ideal for situations that require frequent, bi-directional transactions, such as in-game microtransactions and livestream donations.

- Optimistic mergers: To process transactions faster, Layer-2 solutions can merge multiple off-chain transactions into a single transaction, assume them to be valid by default, and only perform calculations in the event of a dispute. This is how optimistic rollups work and are perfect for DApps and DeFi platforms.

- ZK rollups: Zero-knowledge rollups create more secure blockchains than optimistic rollups by compressing transaction data, validating the transactions off-chain, and sending this information to the main chain. Like optimistic rollups, this type of Layer-2 is perfect for dapps and DeFi platforms and offers improved privacy and efficiency.

- Plasma: Plasma chains provide the highest level of security among Layer-2 types and create a series of child chains as secondary chains that help the main blockchain with verifications, connected by smart contracts that allow the main chain to guide the child chains.

- Side chains: Sidechains are independent blockchains that run parallel to the main blockchain. It is perfect for applications that require customizable features and independent management from the main chain, while still allowing base layer operations to be resolved.

Where are Layer-2 Blockchains used?

Because Layer-2 protocols extend the capabilities and scalability of a central blockchain network, they allow these projects to support (and disrupt) industries much more easily. Some of these industries include:

DeFi

Improving transaction speed is critical for DeFi, especially in trading, where on-time execution is the difference between profit and loss. For example, Loopring uses ZK-Rollups to enable fast transactions and transfers for their merchants.

Dapps

With batch processing and improved interoperability, dapps could process more transactions across many applications. Polygon is a Layer-2 scaling solution that allows dapps to function on various blockchain platforms without sacrificing performance.

Micropayments

Because a Layer-2 solution reduces average transaction costs, micropayments come at much lower costs for users. Gaming ecosystems and livestreamers can use this feature for monetization or pay-per-use models.

Investor Outlook for Layer-2s

The history of technology may give us some clues as to how the Layer-2 race will play out.

Typically, a new technology sees an explosion of new competitors (search engines, social media sites, etc.), which gradually converge into a few scenarios:

-

Monopoly: You have one dominant solution that takes over most of the market because it becomes too difficult to use anything else. (Think Google in the search results.)

In this scenario, one large Layer-2 will dominate each of the primary Layer-1 blockchains. (And there can only be one primary Layer-1 blockchain.) In this scenario, the current winners would be Ethereum (ETH) and Polygon (MATIC), so investors would adjust their bets accordingly.

-

Oligopoly: You have two or three dominant solutions that effectively crowd out the rest of the market (think Apple and Windows or iPhone and Android).

A few Layer-2s could survive in this scenario, each offering significantly different developer benefits. For investors, the Layer-1 bet would likely still be Ethereum (ETH), but the Layer-2 bets would be too early to tell.

-

Disruptive technology: Sometimes the fundamental technology changes or is disruptive. (Disk drives, CD-ROMs, digital music stores, etc.).

No Layer-2 could win in this scenario, because Layer-1s figure out a way to become more scalable without them. Ethereum (ETH) would be the most important long-term investment in this case.

For the time being, Layer-2 solutions add value. But it will likely be a winner-takes-all or a winner-takes-most outcome. Unless, of course, Layer-1s improve significantly, making Layer-2s worthless.

Takeaway for investors

For investors, Layer-2 solutions offer both opportunities and challenges.

An intelligent investor should examine the various features of each Layer-2 solution, but more importantly, its market traction. Do they attract real users – not just investors hoping for the airdrop, but real users using them and real developers building on them?

These are the early days for Layer-2s. In the future they will consolidate or become redundant. Quality Layer-1s like Ethereum are still likely the safer investment for most investors.

Subscribe to Bitcoin Market Journal to stay up to date on all layers of blockchain investing.