- Galaxy Digital buys $23.4 million worth of BTC.

- Through institutional investments, Bitwise is expanding into the European market.

Year-round, business Bitcoin [BTC] holders have been on a buying spree. Since the launch of BTC spot ETFs and a price spike to an all-time high, companies have sought to further accumulate the king coin.

In recent developments, Galaxy Digital purchased 400 BTC.

Galaxy Digital buys $23.4 million worth of BTC

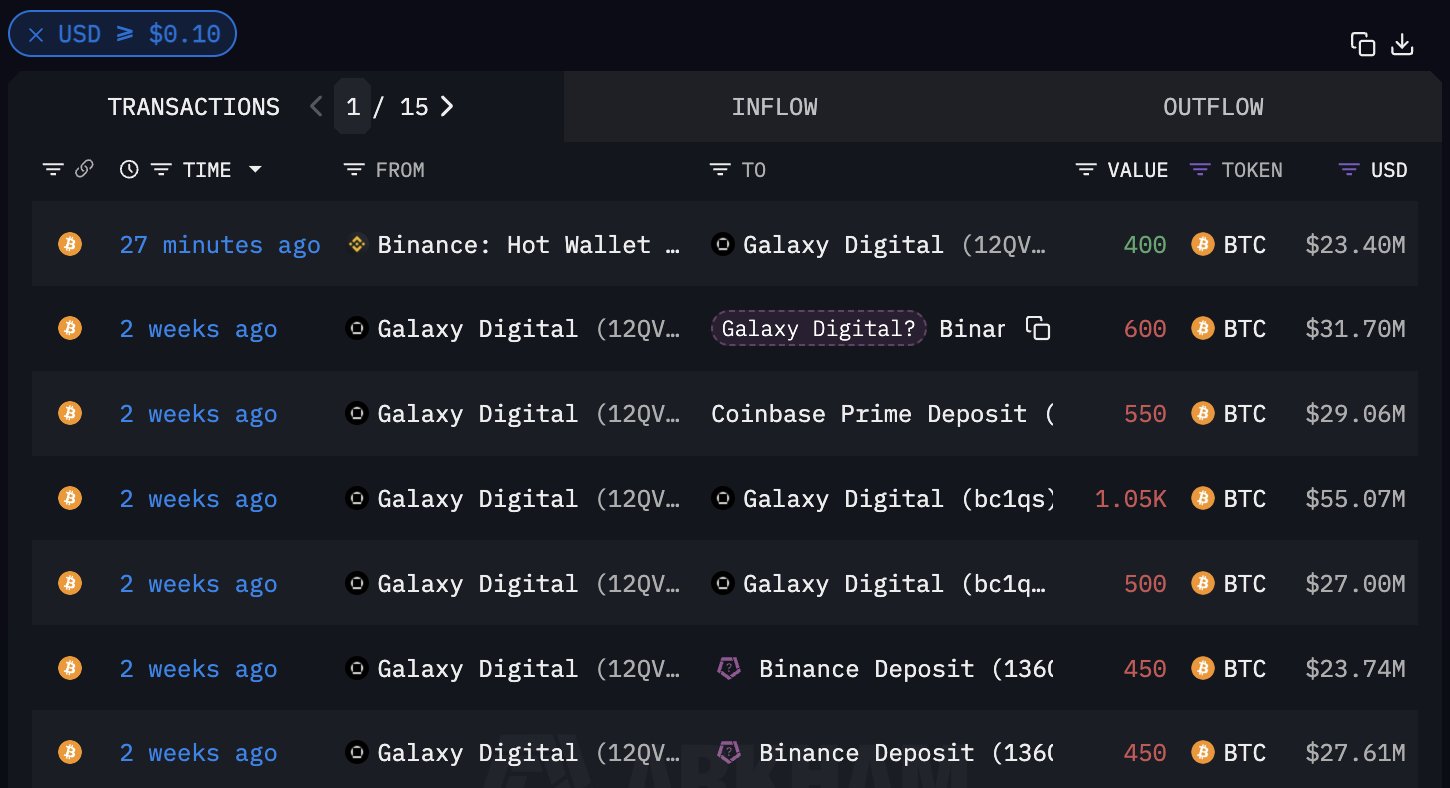

According to a report from Arkham Intelligence, the asset manager’s wallet, 12QVsf, received 400 BTC from Binance.

Based on market rates, the purchase was worth $23.4 million. The transaction was reported by On-chain analyst ai_9684xtpa via the X page and note that,

“Galaxy Digital (@galaxyhq) supposedly increased its holdings by 400 BTC, worth $23.4 million, half an hour ago.”

Source:

The recent purchase signals a shift by the company in its investment strategy, especially when the crypto market is experiencing extreme volatility.

Galaxy Digital’s BTC strategy

Galaxy Digital’s move to strengthen its positions follows a period of selling. According to On-chain’s analyst report, the company has recently achieved major sales. Via X, ai_9684xtpa reported that,

“The agency withdrew a total of 6,950 BTC from #Binance between 07.27 and 08.02, worth up to $464 million and an average price of $66,776. Then, in the week of 08.03 to 08.06, another 2050 coins (approximately 112 million dollars) were charged to the exchange. If they were sold, they would lose $24.78 million.”

Galaxy Digital has a unique approach to Bitcoin because it generates revenue without taking advantage of favorable market conditions. The company’s approach to BTC is broadly dynamic as it sells and then buys.

The company employs an acquisition and redistribution strategy for its Bitcoin holding. Therefore, the recent acquisition shows the company’s confidence in the long-term value of the crypto.

What does it mean for BTC?

Galaxy Digital’s latest move reflects broader market sentiment from institutions. Institutional investors have increased their investments in Bitcoin.

As previously reported by AMBCrypto, BTC holdings such as Marathon, Microstrategy, and Metaplanet have all turned to accumulation. Therefore, institutions are betting on the future value of BTC with increased buying activity, causing BTC prices to rise further.

Bitwise expands in Europe with ETC Group

The recent purchase of Galaxy Digital follows the general market interest in the crypto market among large companies. Bitwise has taken a huge step by expanding its activities within the European market.

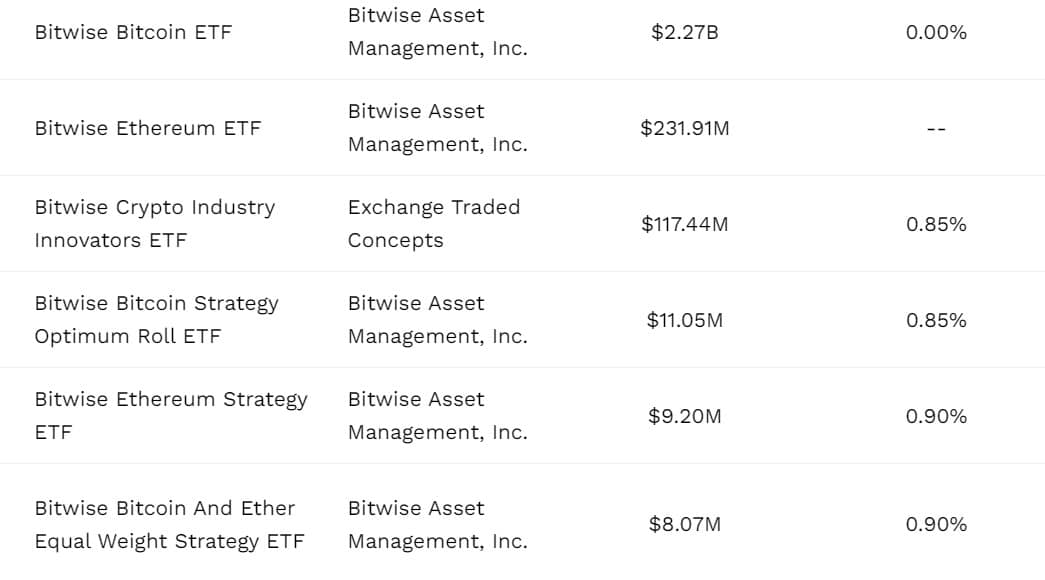

San Francisco-based asset manager Bitwise has announced the purchase of ETC Group, a London-based crypto ETP issuer. ETC Group is a major crypto asset manager with over $1 billion in assets under management.

Therefore, the purchase marks Bitwise’s expansion into Europe, adding 9 European-listed Crypto ETPs to its suite of ETPs.

Source: ETFs.com