Ethereum (ETH), the world’s second largest cryptocurrency per market capitalization, is at a crucial level, indicating a make-or-break situation for the Altcoin. This prediction is based on the current price promotion of ETH in the four -hour period.

Ethereum (ETH) Technical analysis and upcoming level

According to the technical analysis of experts, ETH seems to be an increasing triangular pattern on the four -hour period, but is currently confronted with resistance by the falling trend line and seems to fall at the level of support of the pattern.

Based on the recent price promotion, if ETH does not have the $ 2,680 level and closes a four-hour candle below $ 2,670, there is a strong possibility that it could fall by 4.5% to the $ 2,560 level in to reach in the coming days.

Together with the Beararish Outlook, ETH is currently trading under the 200-day exponential advancing average (EMA) on the daily period, indicating that it is active in a downward trend and this Bearis trend can continue.

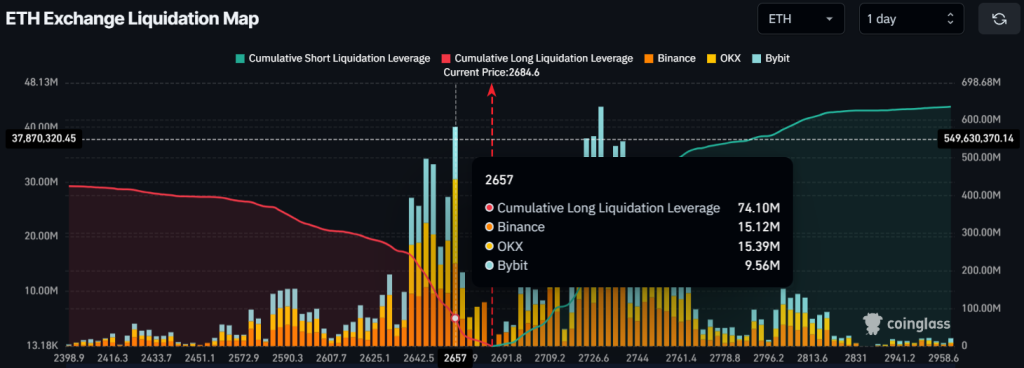

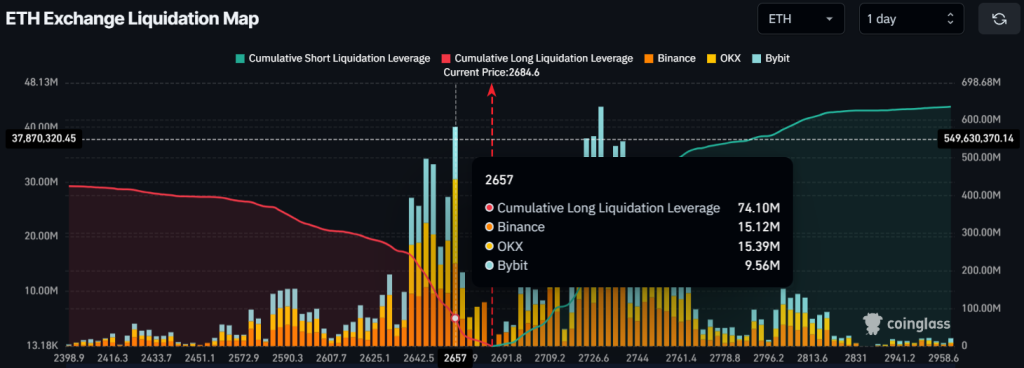

Ether liquidation risk

With the Bearish Outlook, intraday traders for $ 74 million in long positions are on the point of liquidation. Facts Show that a considerable value of $ 72 million in long positions was opened when traders delivered too much at the level of $ 2,657. This enormous amount of ETH will be liquidated if the price falls below this overlap level.

Conversely, traders who are held long positions, overlap at the level of $ 2,730, with $ 275 million in long positions with a risk of liquidation if the price falls further.

Current price momentum

ETH is currently being traded near the level of $ 2,685 and has experienced a modest fall of 0.55% in the last 24 hours. In the same period, however, trade volume fell by 9%, indicating a lower participation of traders and investors.