- More traders have taken short positions in BNB

- At the time of writing, BNB had fallen more than 2% in the past 24 hours

Binance Coin (BNB) has also been affected in recent weeks by the recent decline in the broader cryptocurrency market. However, despite this downturn, BNB has managed to maintain a significant market capitalization.

In terms of market value, it has stayed ahead of many other assets. And yet, trading activity for BNB is subdued, as evidenced by its low funding rate.

Binance retains the top spot

At the time of writing, Binance Coin (BNB) had a market cap of approximately $75.8 billion, making it the third largest cryptocurrency after Bitcoin and Ethereum, excluding Tether USDT. This is especially notable given the broader market decline over the past seven days.

In fact, according to CoinMarketCapthe top ten cryptocurrencies, including BNB, have all recorded significant declines over the past week, with each asset down more than 5%. And yet BNB was able to maintain its position in the charts.

A look at the price charts

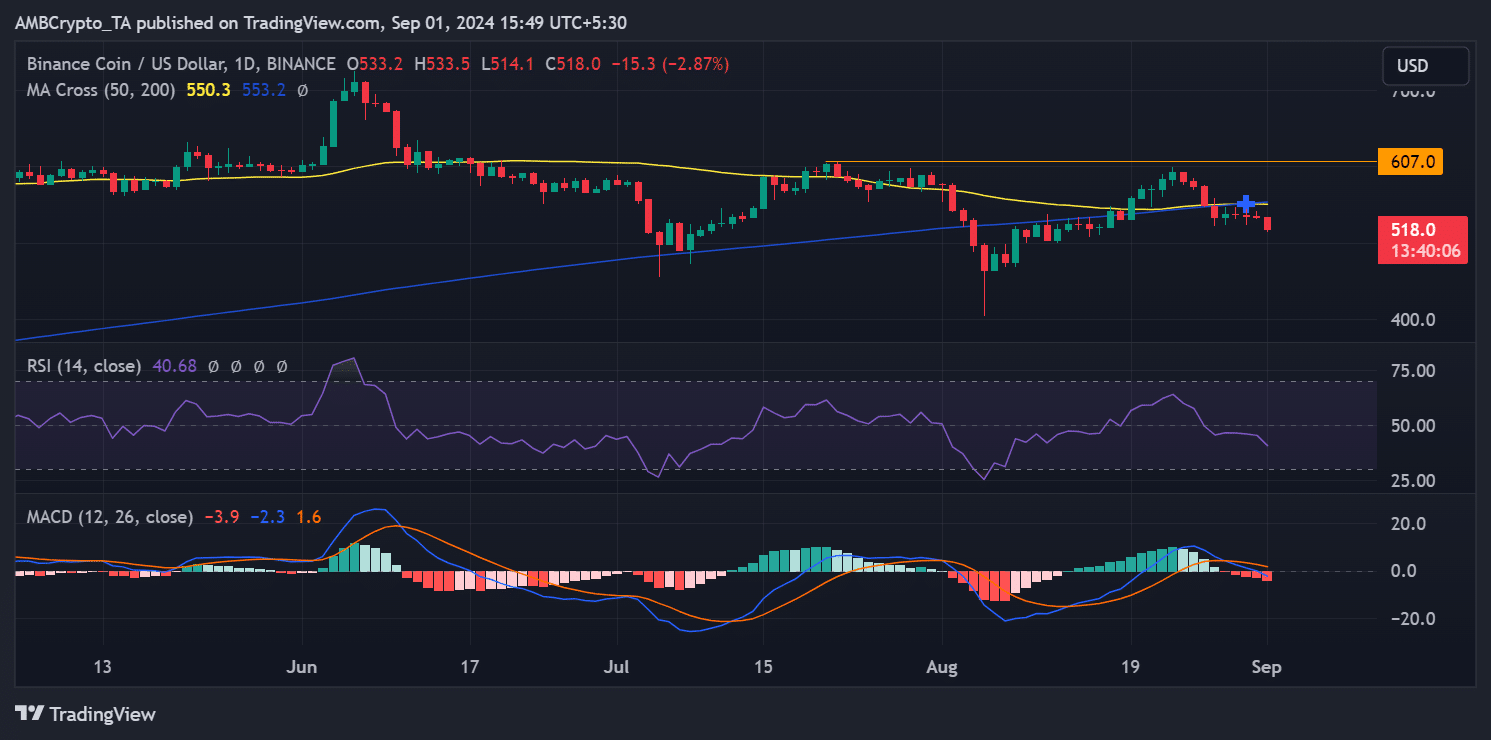

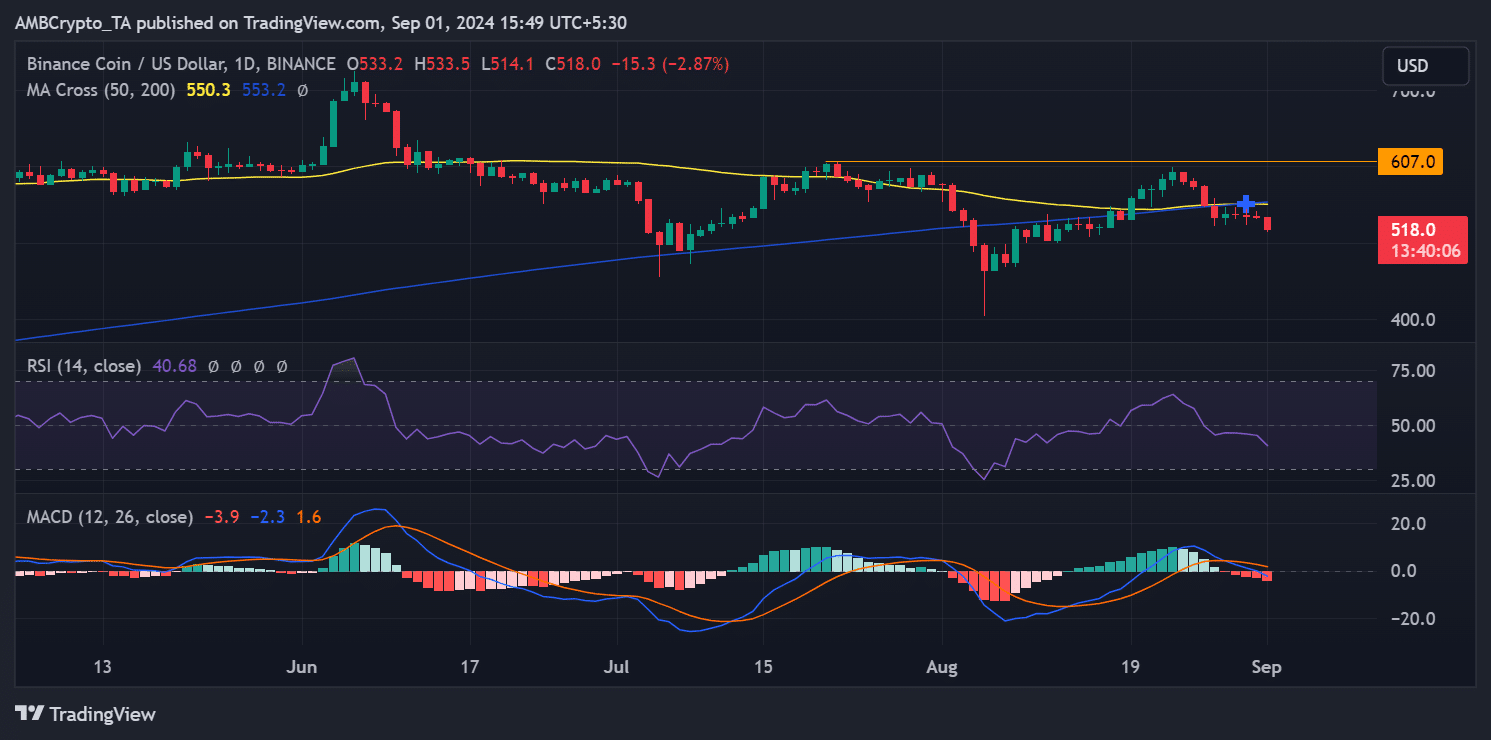

The daily chart of Binance Coin (BNB) recently showed a death cross. It is a bearish signal that occurs when a short-term moving average moves below a long-term moving average.

However, at the time of writing, this death cross had not yet been fully pronounced. It first appeared on August 30, when the price of BNB fell to around $535, after a decline of 0.24%.

Source: TradingView

Since this death cross first took shape, the price of BNB has continued to decline. At the time of writing, the stock was trading at around $517, after an additional decline of almost 3%.

The moving averages, which now act as resistance levels, appeared to be around $550. On the contrary, a more significant resistance zone can be found between USD 590 and USD 600.

Further analysis using the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators supported the bearish outlook for BNB.

The RSI indicated that BNB is trending towards oversold territory, reinforcing the altcoin’s downward momentum. Meanwhile, the MACD’s positioning and behavior appeared consistent with a bear trend – a sign that bearish pressure on BNB could continue.

Sellers take charge of subdued trading

Finally, an analysis of Binance Coin’s (BNB) financing rate revealed that trading activity has been relatively subdued in recent weeks, with only a few notable spikes. At the time of writing, the coverage ratio had fallen slightly below zero to approximately -0.0020%.

– Read Binance (BNB) price forecast 2024-25

Here, a negative funding rate indicates that sellers dominate the limited trading volume. In other words, more and more traders have taken short positions, expecting BNB’s price to continue to fall.

The trend of negative funding rates generally indicates bearish sentiment in the market as traders expect further price declines. By extension, they are willing to pay to maintain their short positions.