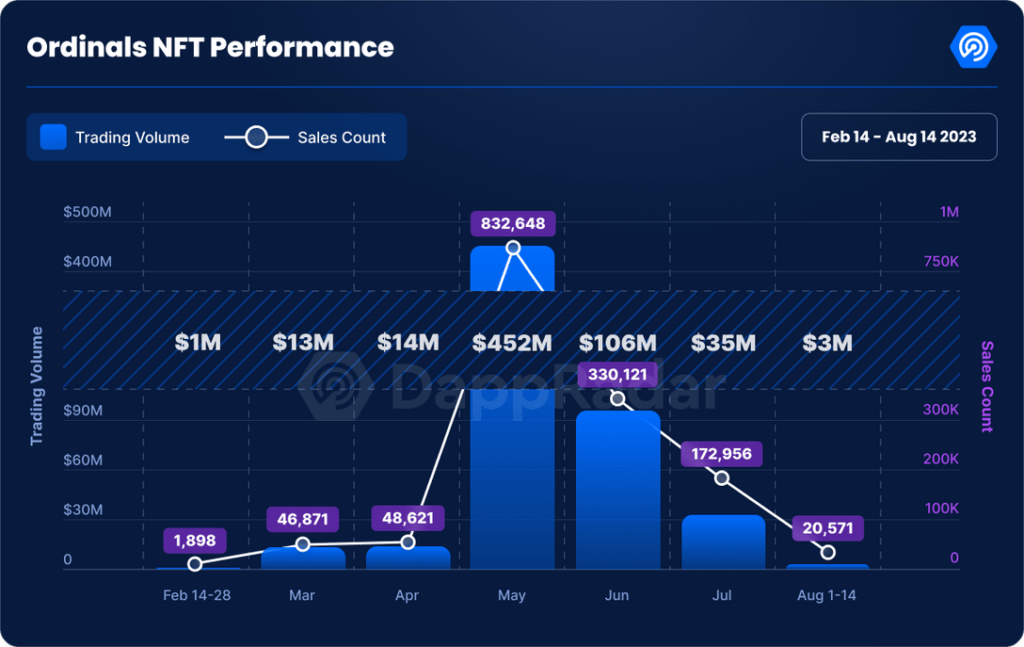

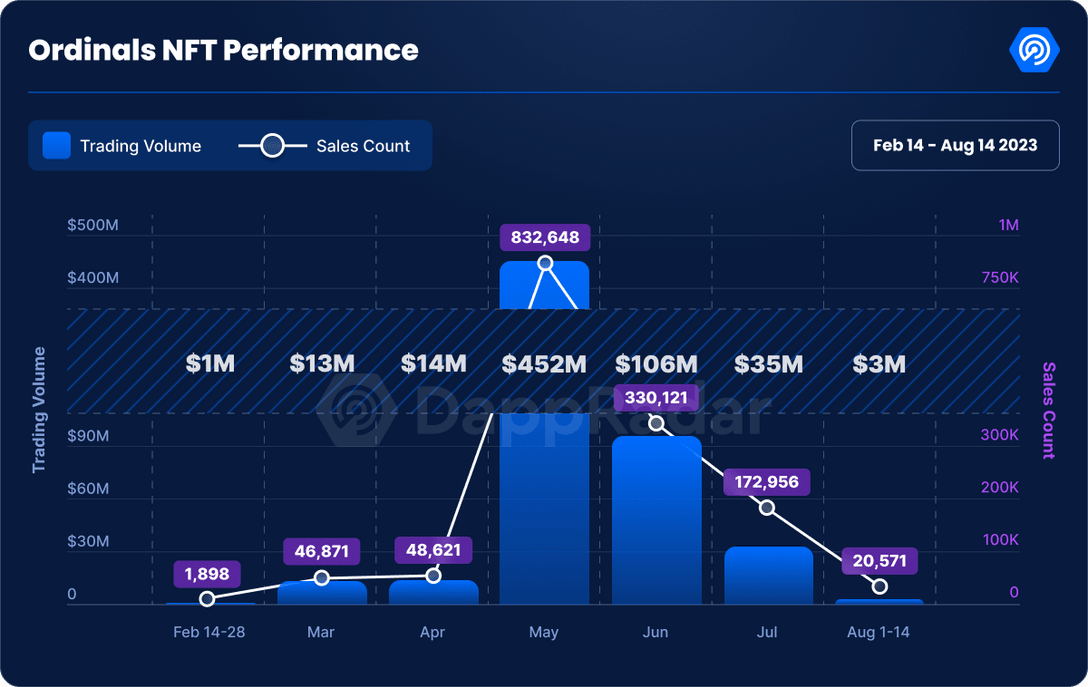

The buzz surrounding Bitcoin’s jump into the NFT world via Ordinals can be fleeting. A Dappradar study reveals that trading moves and sales for Bitcoin Ordinals have dropped by as much as 97% since their peak in May 2023. This downturn reflects a broader slowdown in the NFT sector. However, the slump in Bitcoin Ordinals is much more pronounced than in established networks like Ethereum.

Bitcoin NFTs Face Crossroads: Ordinal Sales Decline Highlights Market Volatility and the Quest for Tangible Utility

After soaring to record levels this spring, the nascent market for Bitcoin-focused NFTs has a catch. In June and July, Bitcoin Ordinals reported a sharp decline in both sales and transactions, diving 97% and 98% from their peak in May. Dappradar’s analysis indicates that trading in Ordinals fell from $452 million in May to just $3 million in early August.

There has also been a sharp drop in active participants in the Bitcoin NFT arena. The number of unique active Bitcoin wallet addresses dropped 90% from February to mid-August, from 79,261 to a paltry 6,708. While Ethereum and Polygon have seen declines in active traders, their reductions of 22% and 60% in the same time frame seem trivial compared to Bitcoin’s dramatic downturn.

Chart via Dappradar’s latest report on Bitcoin Ordinals.

Dappradar states that this withdrawal may be a sign of waning excitement and confidence in Bitcoin NFTs prospects. Unlike their Ethereum and Polygon counterparts, Bitcoin’s NFT sphere is primarily dominated by profile photo collections, which generally have limited utility. Given the broader and more diverse offerings of Ethereum and Polygon, Bitcoin’s narrow NFT specialization could accelerate its descent.

“As you can see from Dappradar’s NFT Collection Ranking, most of the collections on Bitcoin are still in their early stages and still lack the innovation that the NFT space is experiencing – in terms of interoperability, dynamics and usability,” states the report.

Dappradar’s report says the coming months will be defining moments for Bitcoin NFTs. It further notes how there is a debate within the community: some are advocating for Bitcoin to retain its “digital gold” persona, suggesting that Ethereum is playing the “digital oil” role, powering Web3 innovations.

The declining activity in Ordinals trading suggests that the Bitcoin community may not be as enthusiastic about NFTs as initially thought. However, Dapprader notes that it may be premature to dismiss Bitcoin’s potential role in the dynamic NFT arena.

The researchers further conclude by saying that the meteoric rise and subsequent fall of Bitcoin Ordinals highlight the volatile nature of the NFT market. For those tempted to ride the wave of the latest trend, the dip in Ordinals serves as a stark reminder of how fleeting speculative excitement can be.

While Bitcoin NFTs have great theoretical potential, sheer hype may not be enough to keep the market frenzy alive. Dappradar researchers suggest to ensure that Ordinals’ setback is seen as a lesson rather than a final blow, it is imperative that developers focus on advancing tangible utility, allowing Bitcoin NFTs to truly deliver on their promise.

The Dappradar report can be read in its entirety here.