- Bitcoin’s price surge has pushed spot market trading volume to a multi-year high

- The market has also seen an influx of new investors this year

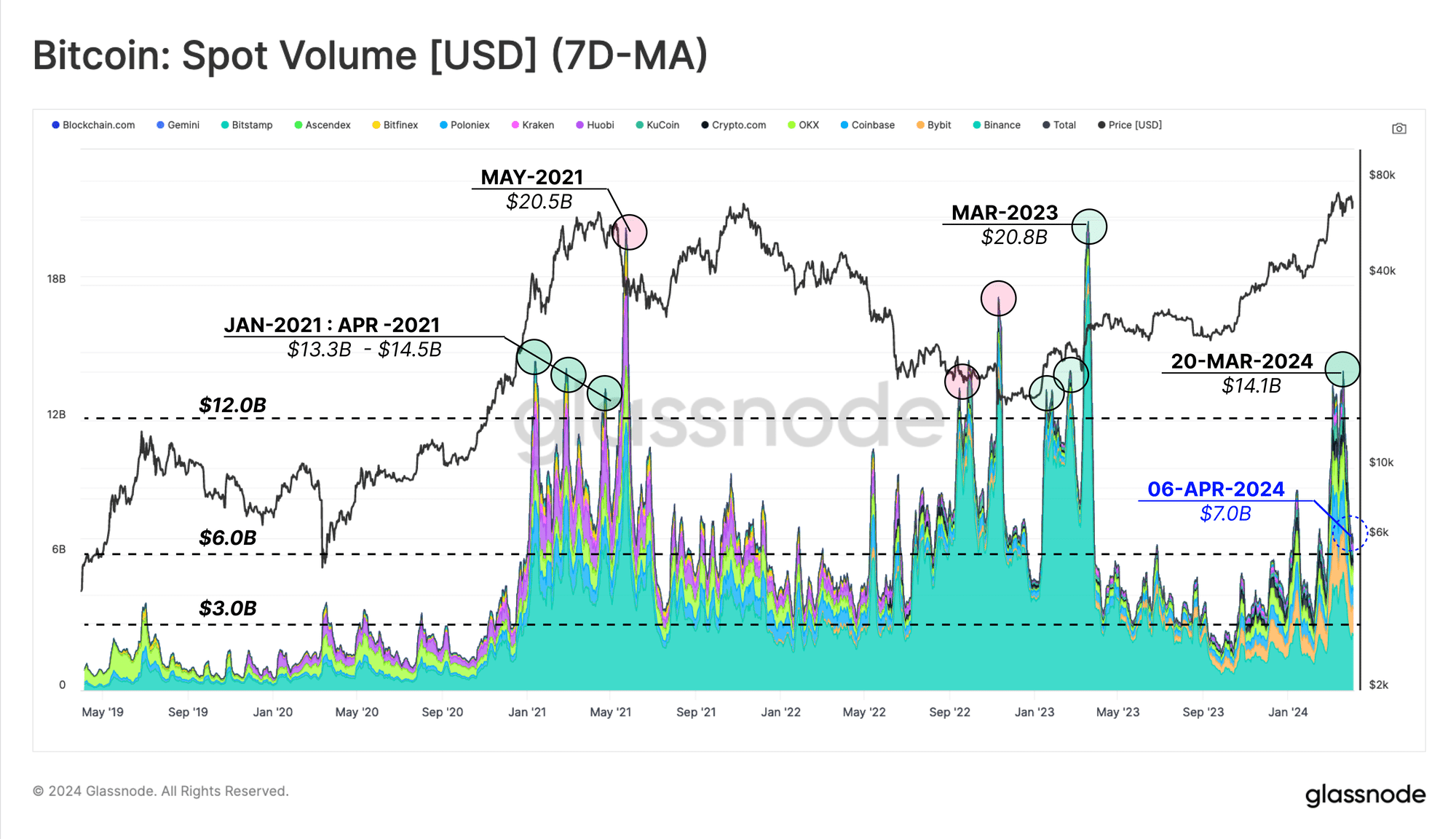

Bitcoins [BTC] The price rally, which started in October 2023, has pushed spot market trading volume to the highs of the 2020-2021 bull market, according to a Glassnode report.

According to the on-chain data provider, the recent headwinds faced by BTC’s price have led to a slight pullback, with the coin’s daily spot trading volume currently standing at around $7 billion.

Source: Glassnode

Glassnode assessed the coin’s spot trading volume by comparing the 180-day moving average (slow) and the 30-day moving average (fast). This comparison showed that since the start of the market rally in October 2023, the BTC market “has seen faster average trades significantly higher than slower ones.”

The on-chain data provider added that this indicates the coin’s growth this year is “supported by strong demand in spot markets.”

Furthermore, the rise in BTC’s price, in addition to the increase in the coin’s spot trading volume, has resulted in an increase in the flow of coins in and out of cryptocurrency exchanges. Glassnode said:

“The monthly average of total alternating flows (inflows plus outflows) currently stands at $8.19 billion per day, significantly higher than the 2020-2021 bull market peak,”

Increase in new demand

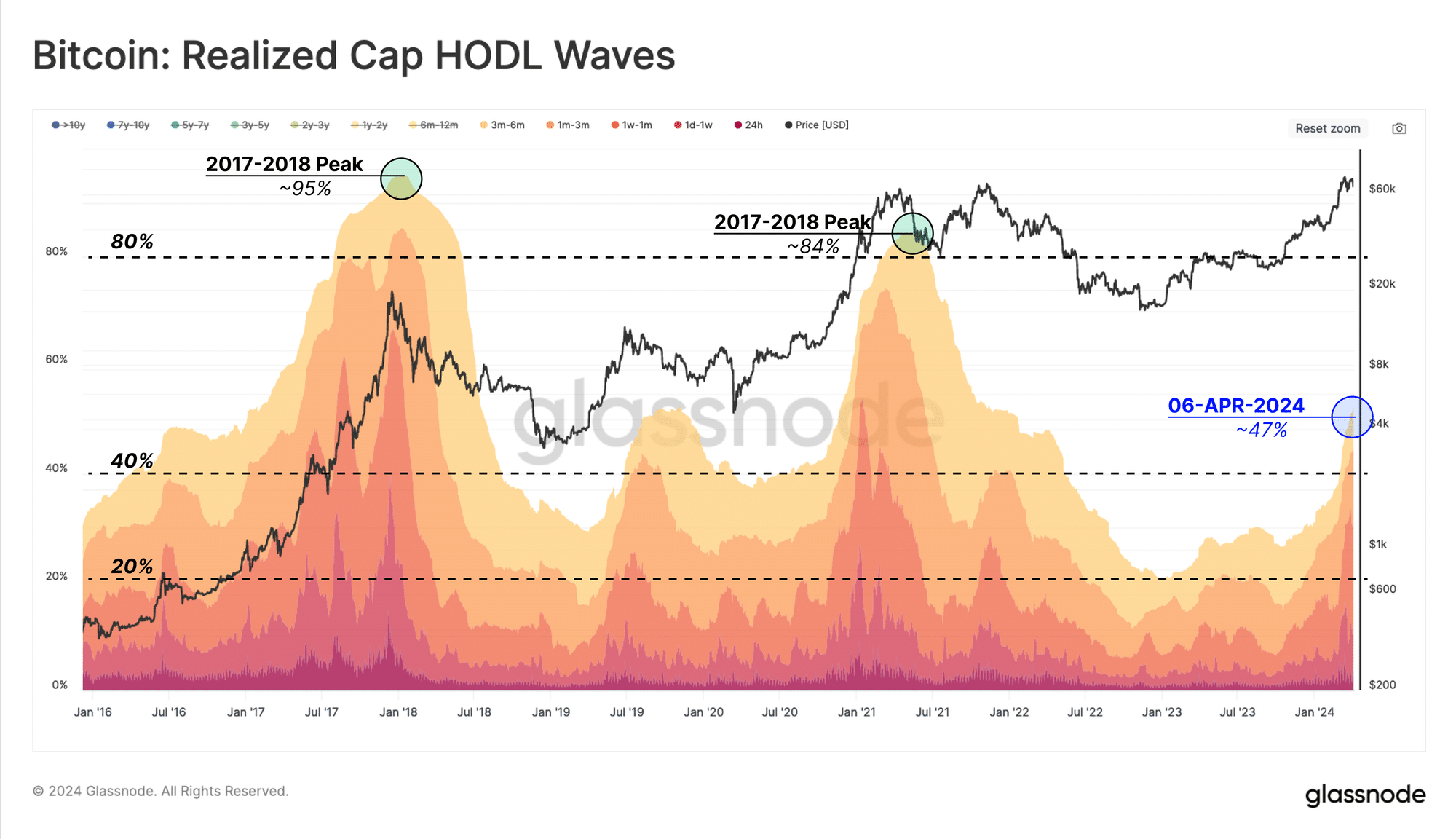

The ongoing rally has also led to a spike in the number of new investors holding BTC. As long-term holders distribute their long-held coins for profits, they are being snapped up by new investors who plan to take advantage of the market rally.

Glassnode reviewed BTC’s Realized Cap HODL Waves and found that there has been an increase in the “share of wealth held by coins less than six months old.”

Over the past year, the supply of BTC to addresses under six months has grown significantly. The same had a figure of 47% at the time of writing.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2024-25

According to Glassnode it is

“This suggests that the capital held within the Bitcoin holder base is roughly balanced between long-term holders and new demand.”

Finally, it is worth pointing out that Glassnode also claimed that it is critical to pay attention to the behavior of these new investors as “their share of capital increases.”

This is because this cohort of BTC holders tends to be more price sensitive than long-term holders (LTHs). They have their coins easily accessible and ready to be sold as soon as the price of BTC drops below their cost basis.