- Bitcoin is down more than 25% in the last four days.

- Liquidation volume rose to the highest level since April.

In the last 24 hours Bitcoin [BTC] has experienced a significant decline and has fallen below the $60,000 price range. Given the current trend and market volatility, could we see a further drop to the $40,000 price range?

Bitcoin drops 9% in 24 hours

AMBCrypto’s analysis of Bitcoin’s price trend revealed a significant downturn in the past 24 hours, with a decline of more than 9%.

Bitcoin was trading at around $52,900, with the decline hovering between 8% and 9% within this period.

Using the price range tool, it was clear that Bitcoin has experienced a substantial drop in value of over 24% since the start of the big decline around August 2.

Bitcoin to $49,000

Using the Fibonacci retracement indicator to analyze Bitcoin’s price trend provided valuable insights into potential future moves.

Notably, if the price of BTC manages to stay above the 23.6% retracement level, it could rise to test higher Fibonacci levels.

The chart showed that it could specifically test the 38.2% level at around $56,847.56 or even the 50% level at around $59,127.13.

Conversely, if the downtrend continues, the next critical support, according to the Fibonacci retracement analysis, would be at the 0% level, around $49,467.88.

Moreover, the analysis of the Relative Strength Index (RSI) showed that the price was in the oversold area. Normally, this could indicate an impending price reversal or rebound, as buyers may view this as an optimal point to enter the market.

However, it is crucial to note that during strong downtrends, the RSI can remain in the oversold zone for extended periods.

Source: TradingView

Furthermore, the Moving Average Convergence Divergence (MACD), another momentum indicator, is showing bearish momentum.

This suggests that the downtrend could continue in the short term, especially considering that the price is already below the Fibonacci level of 23.6%.

Given these factors – the bearish MACD, the oversold RSI, and Bitcoin’s positioning against the key Fibonacci levels – the short-term outlook for Bitcoin appears bearish.

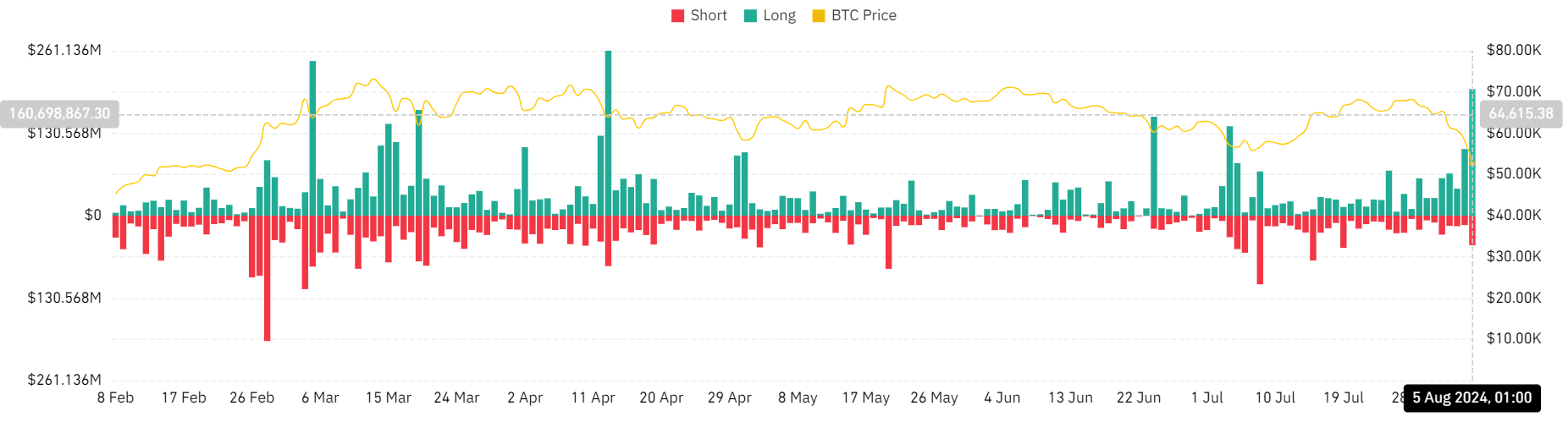

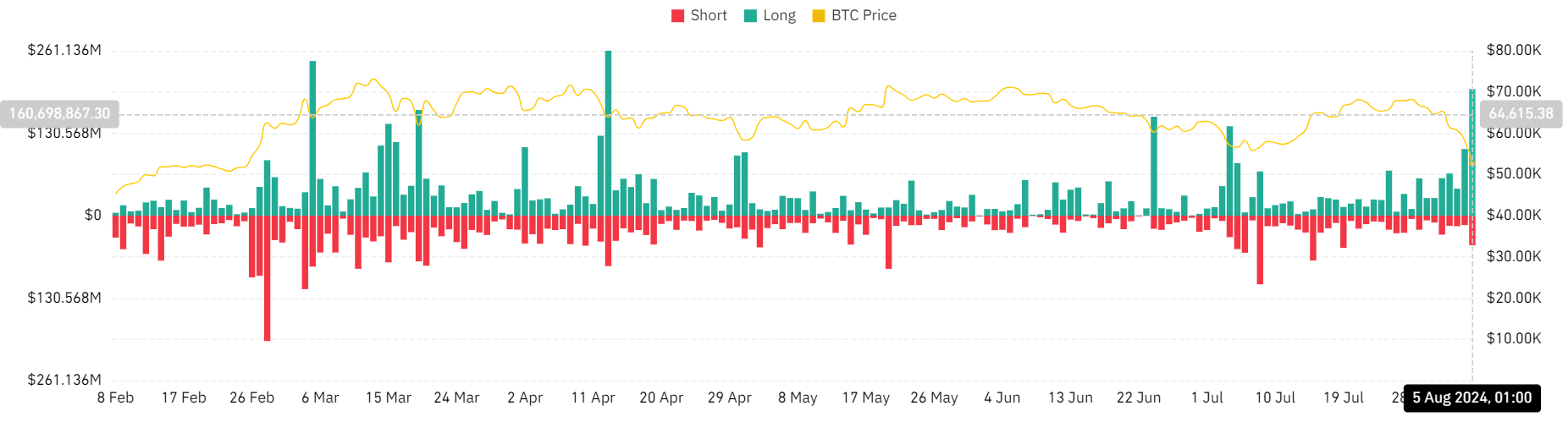

Liquidation reaches highest point in months

The analysis of Bitcoin liquidation volume on Mint glass indicated a significant spike, the highest since April.

At the close of trading on August 4, BTC’s total liquidation volume exceeded $246 million.

A closer look at these figures revealed that most of the liquidations were long positions, totaling more than $200 million. By comparison, short liquidations accounted for more than $46 million.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

This substantial increase in liquidation volume, especially in long positions, was in response to the sharp price movement that caught many traders off guard.

This likely led to stop-loss orders or liquidation of leveraged positions. The occurrence of prolonged liquidations indicates that many traders were bullish or optimistic about the price of BTC, anticipating upward moves that did not materialize as expected.