- BTC’s rally comes as foreign exchange reserves continue to decline.

- The sentiment suggests that BTC could fall further until it finds a critical point for a recovery.

Bitcoin [BTC] The market performance is not what you would expect after a significant rebound last month, which took the market to a new all-time high with an increase of 33.14%.

Currently the 24-hour profit is minimal: 0.78%. While this indicates more buying activity than selling, the upward movement is far from guaranteed, AMBCrypto reports.

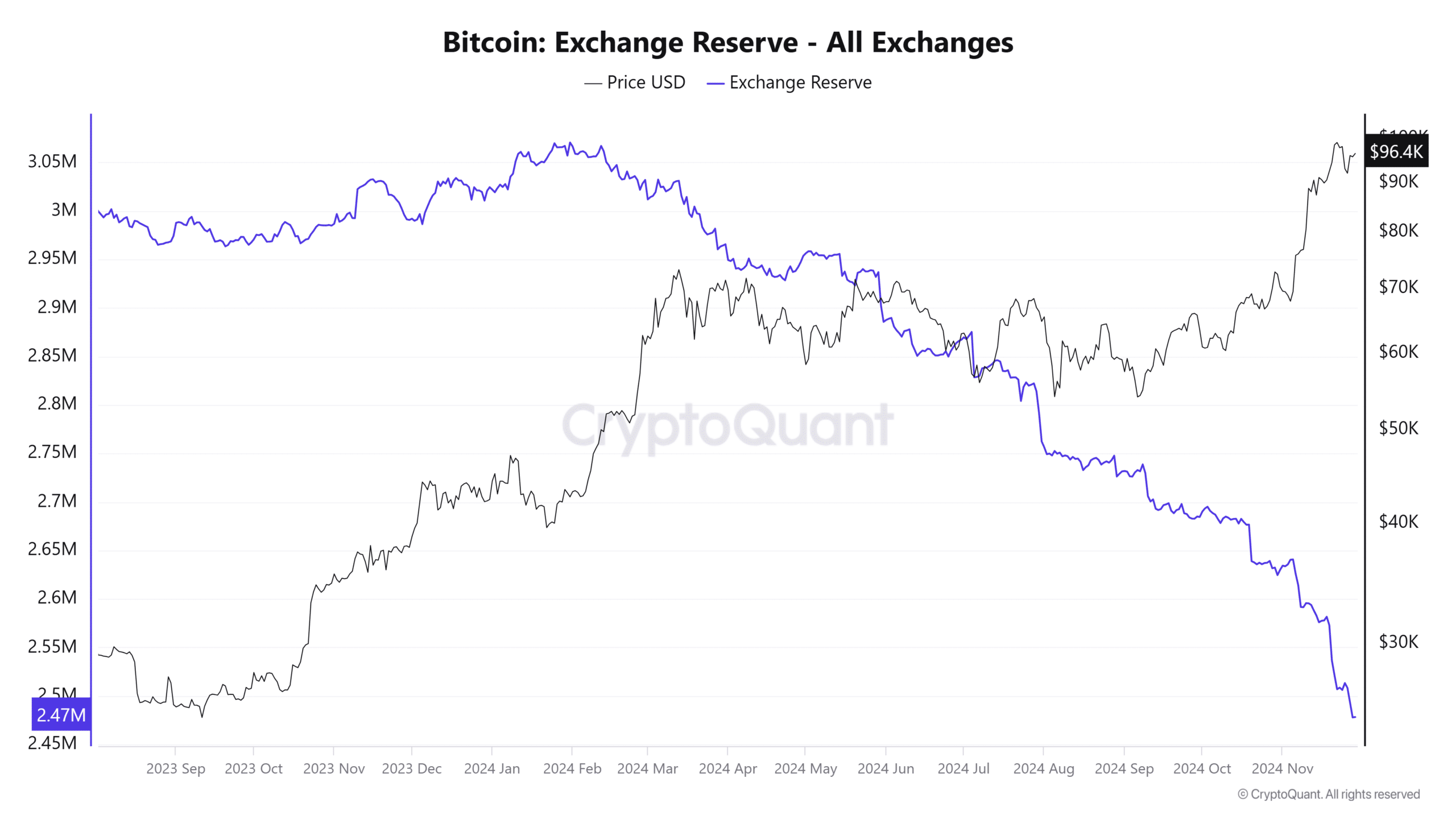

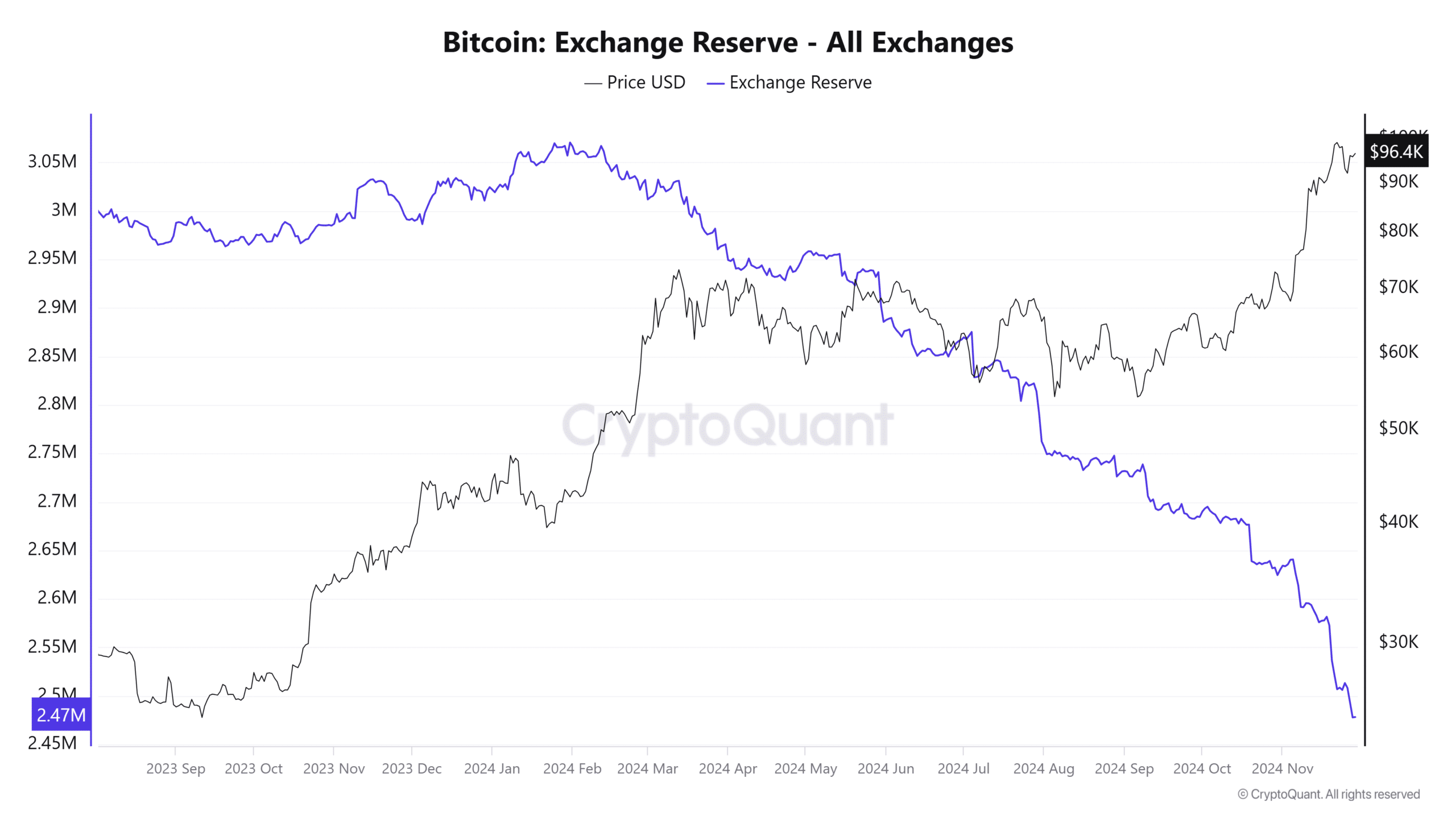

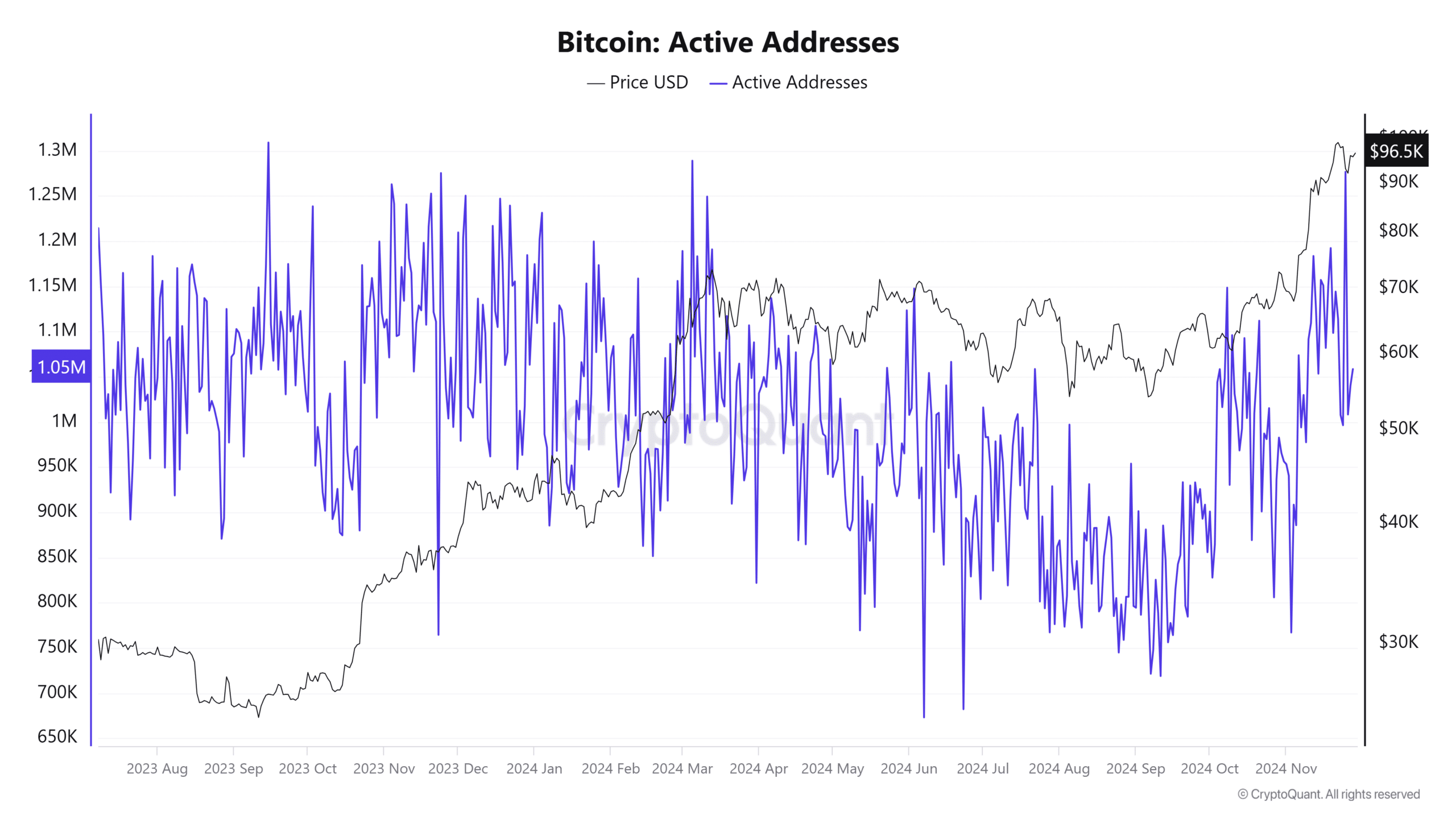

The BTC supply on exchanges continues to decline

Data from CryptoQuant reports a continued decline in Bitcoin availability on cryptocurrency exchanges. The Exchange Reserve is down 0.61% in the past 24 hours and 1.53% in the past week.

Source: Cryptoquant

A drop in Exchange Reserve typically indicates a reduced circulating supply of BTC on exchanges, a factor that often supports price increases due to scarcity.

This decline has played a role in BTC’s recent gains on the daily chart. However, the sustainability of this rally remains uncertain, with AMBCrypto outlining the key factors to watch.

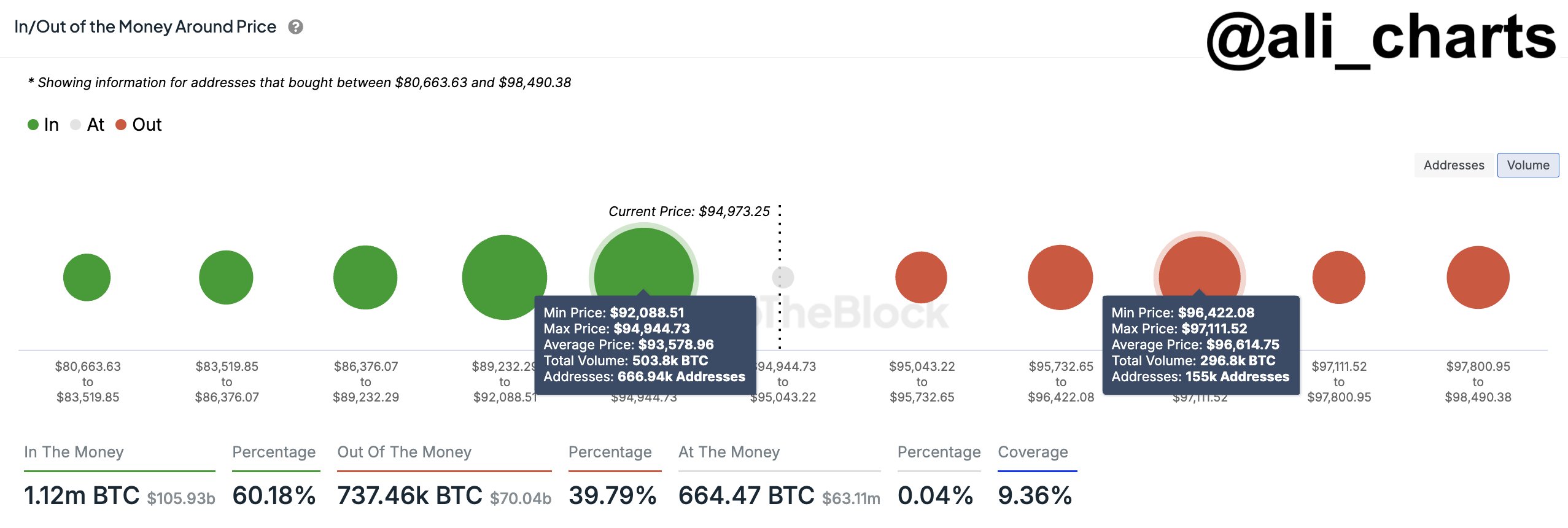

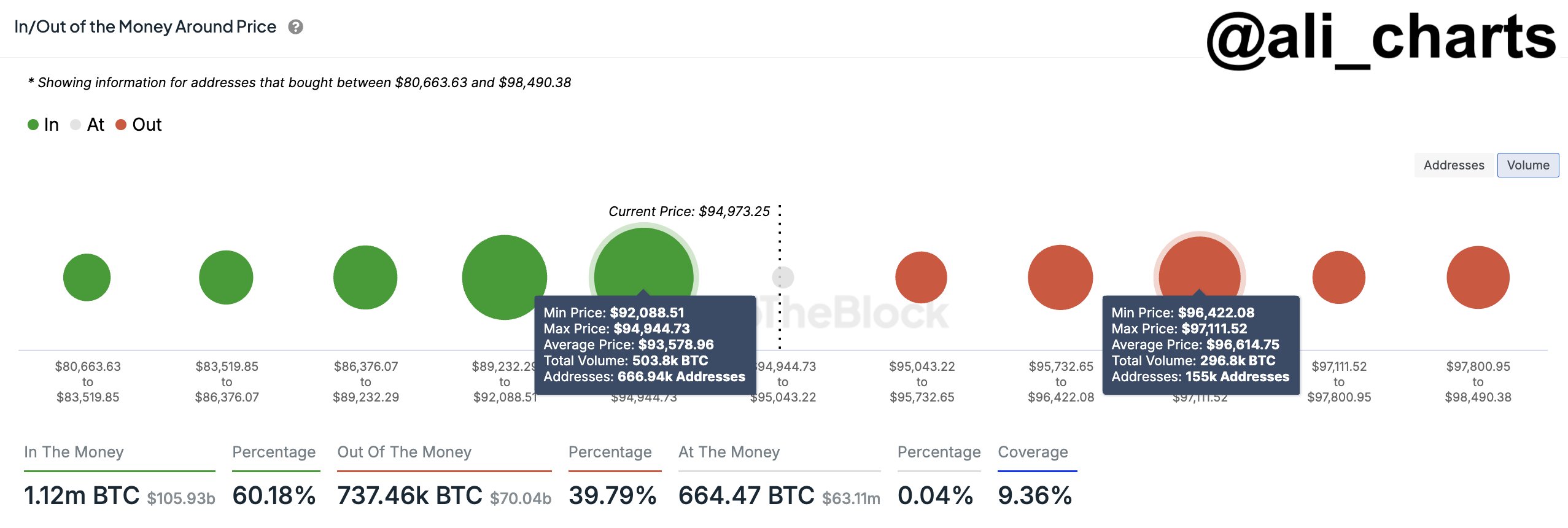

Selling pressure increases as BTC reaches the supply area

According to According to analyst Ali, BTC is at a critical juncture as it has entered a supply zone at $96,614.75. There is significant selling pressure here, with sell orders totaling 296.8K BTC.

If BTC faces a decline, Ali emphasized the importance of the next key demand zone at $93,578.96, where buy orders for 503.8K BTC from 666.94 addresses are concentrated.

He stated:

“Remaining above this support level is a must to prevent these holders from selling.”

While the stronger buying orders at this level suggest this could hold, the outcome depends on the intensity of selling pressure.

Source:

AMBCrypto also noticed a warning sign, with a sharp increase in BTC inflows to exchanges – 2,678 BTC moved in the last 24 hours – further raising the possibility of a price drop.

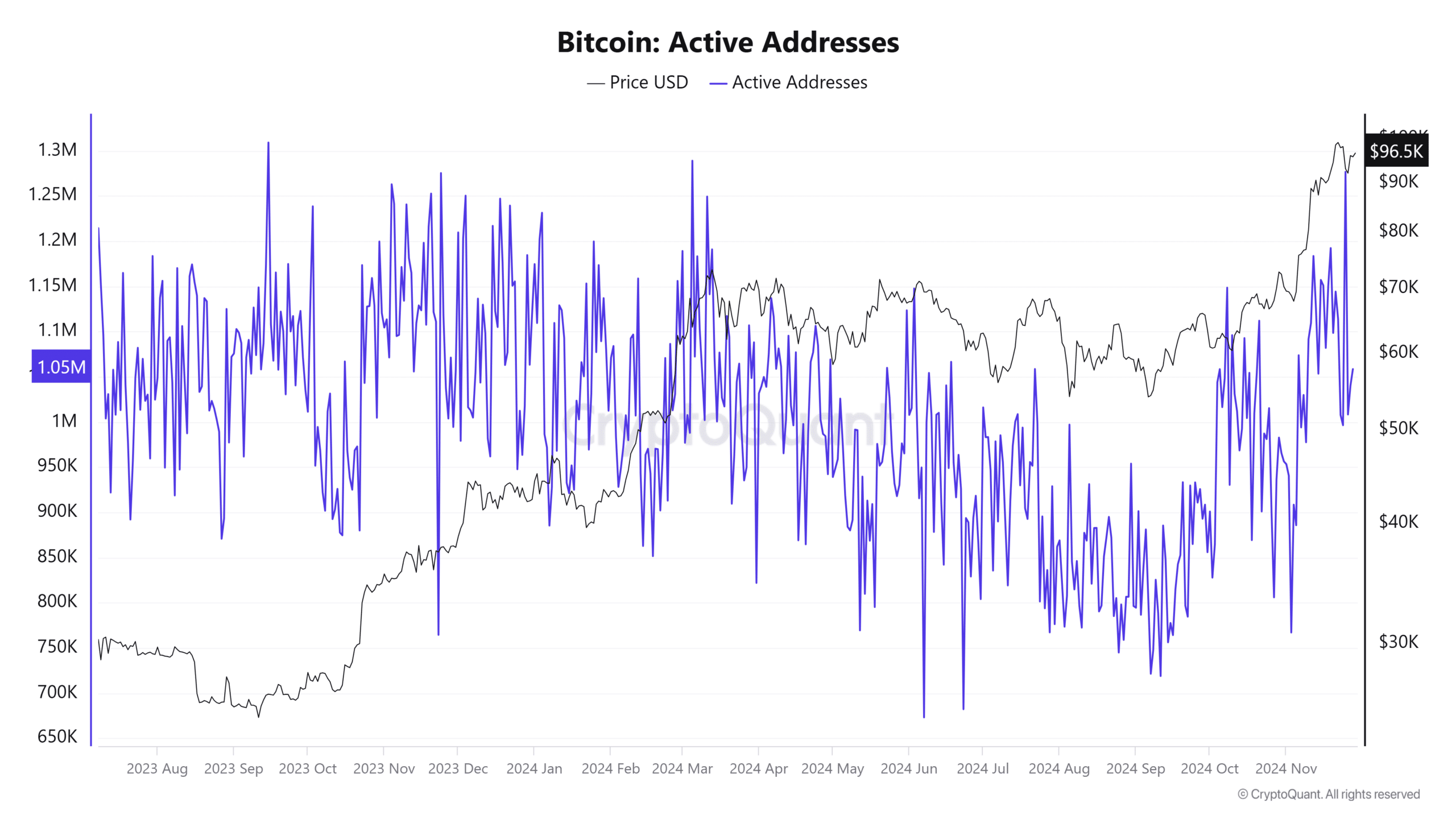

Retail participation is declining

Retail investors, who play an important role in asset price movements, are showing signs of declining interest as the number of active addresses has dropped significantly by 35.03%.

Read Bitcoin’s [BTC] Price forecast 2024–2025

A drop in the number of active addresses typically means reduced buying activity, which could contribute to a potential price drop for BTC, possibly towards the aforementioned demand zone.

Source: Cryptoquant

If the demand zone maintains current buy order volume and address activity, a price reversal from that level remains possible.