- Liquidations of Bitcoin shorts worth more than $2.5 billion were reportedly behind the slight recovery.

- BTC is expected to be more volatile towards the end of the week as sentiment improves.

Bitcoin [BTC] was again above $60,000, while sentiment improved slightly. Liquidations of leveraged short positions may have had something to do with the somewhat bullish outcome.

Bitcoin and crypto market sentiment was extremely fearful over the weekend, but there has been some recovery over the past three days.

The latest data from the fear and greed index indicated a gradual recovery, with the index standing at 30 as of press time.

Source: alternative.me

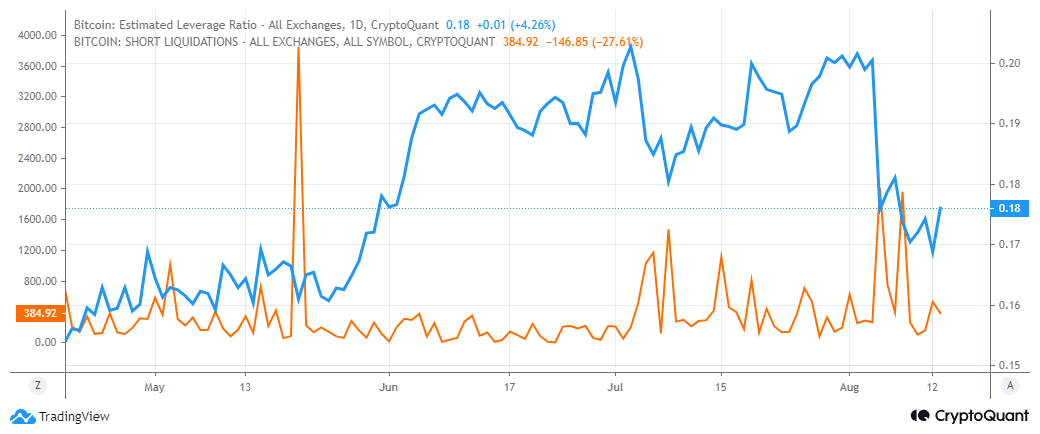

Bitcoin’s bullish momentum may also have been fueled by the liquidation of leveraged short positions. Recent data suggested that there was more than $2.5 billion in leveraged short positions recently liquidated.

This created some buying pressure.

Data from CryptoQuant’s on-chain chain showed that Bitcoin recorded a 231% increase in shorts liquidations on August 12. Demand for leverage briefly dropped to a two-month low before an uptrend emerged.

Source: CryptoQuant

After evaluating Bitcoin’s heatmap, we found that there were 81.5 million net longs on Binance between $60,852 and $60,880.

This, combined with the sharp increase in the estimated leverage ratio, as well as improving sentiment, indicated a gradual shift towards bullish optimism.

Is Bitcoin heading for more volatility?

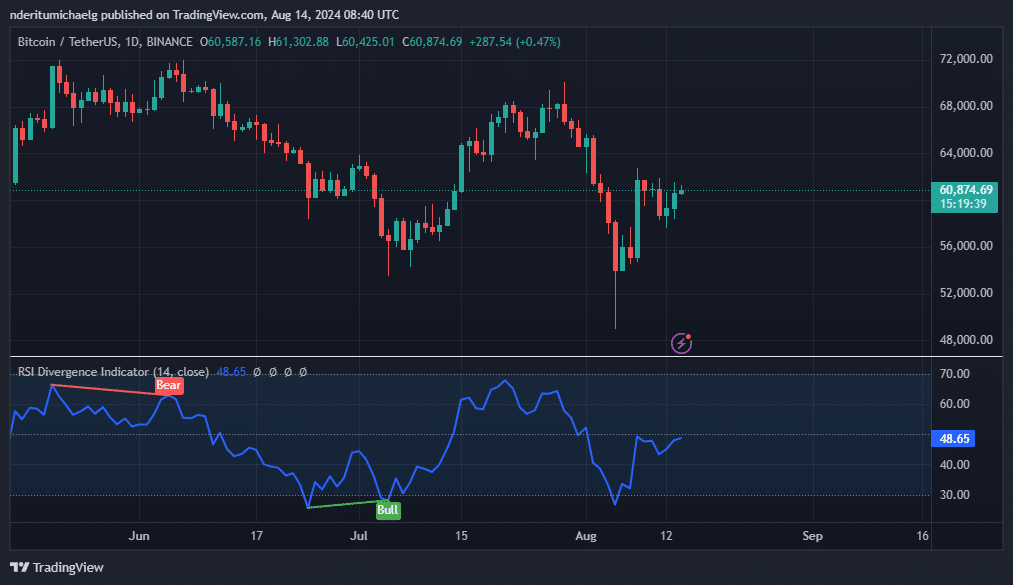

Bitcoin had a price tag of $60,890 at the time of writing. A higher push will see it retest the $61,700 level, where it has been facing resistance and low demand lately.

Unsurprisingly, this price range also coincided with the 50% RSI level. This would explain why short positions near this level were rising in anticipation of more downside.

Source: TradingView

A cocktail of low demand and short liquidations has kept prices in a narrow range in recent days. However, there may also be a third reason.

The market tends to experience low activity ahead of important economic data. Followed by an increase in activity in response to the data release.

The market has been looking forward to several economic figures this week. This includes producer price data (PPI), which was released yesterday.

CPI data coming out today could lead to more volatility and possibly a strong change in direction beyond the current range.

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin’s current level underlines the uncertainty in the market. The rise in leverage shorts signals growing bearish expectations.

On the other hand, market sentiment seemed to improve in recent days. This indicates a significant probability of a rally beyond current resistance.