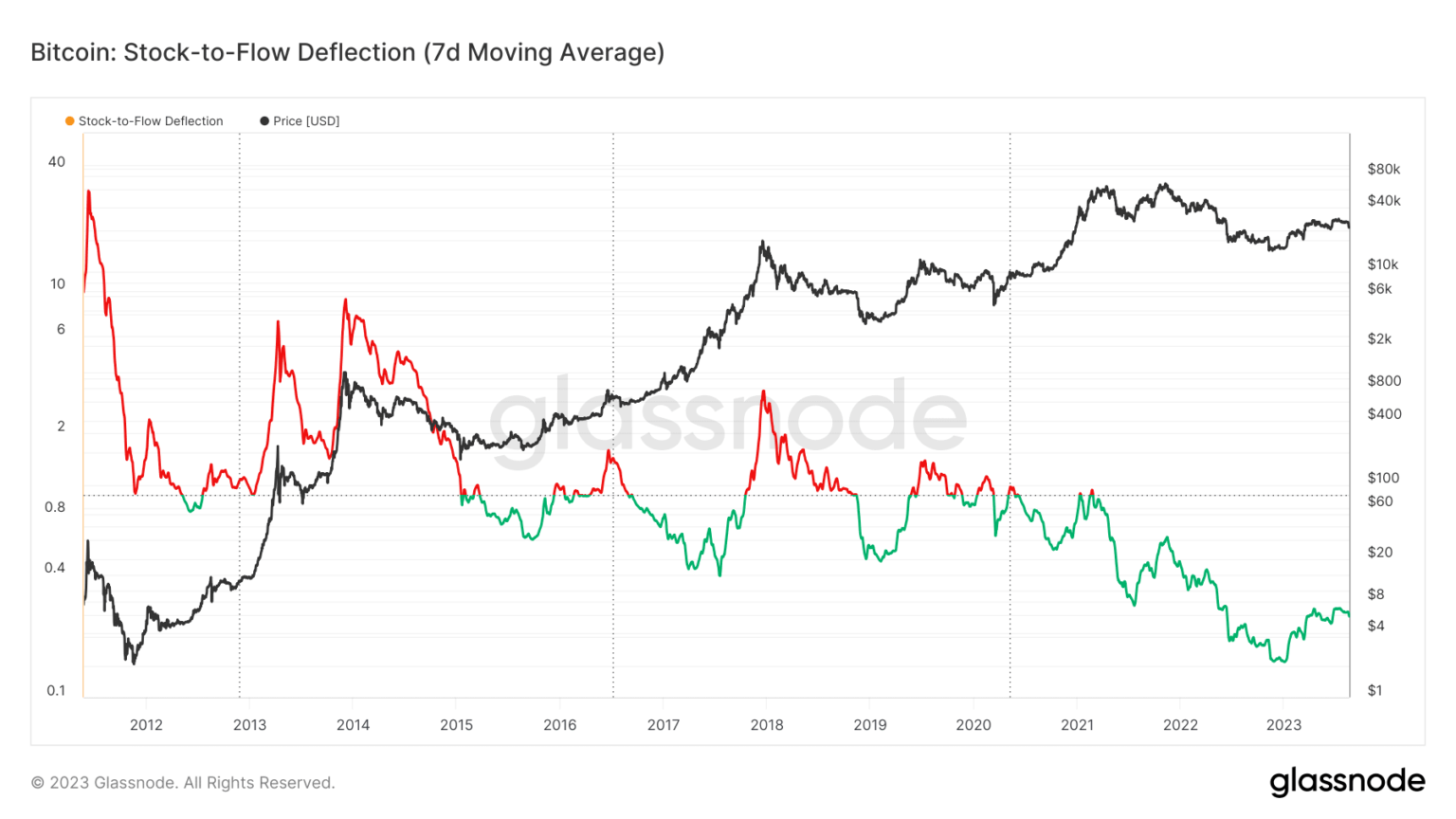

- According to the stock-to-flow deflection, Bitcoin was undervalued relative to its scarcity.

- Long-term holders had access to 75% of Bitcoin’s circulating supply.

The impact of Bitcoin [BTC] long-term scarcity of value is one of the most discussed and analyzed topics within the crypto community. Over the years, experts have developed various models that provide insight into the relationship between the two and help investors make informed decisions.

Is your wallet green? Check out the BTC Profit Calculator

According to a recent post from on-chain analytics company GlasnodeBTC’s stock-to-flow (S/F) deflection dropped to a 1-month low, suggesting more room for bull cycles in the near future.

Source: Glassnode

The scarcity of Bitcoin to increase its value

In layman’s terms, the S/F deflection determines whether an asset is overvalued or undervalued relative to its scarcity. In the current situation, the deflection was less than 1 and, as indicated above, deeper into the green undervalued area.

The S/F deflection is derived by dividing Bitcoin’s price by one of its most popular models, the S/F ratio. Created by the anonymous analyst PlanB, the S/F ratio compares the current supply of Bitcoin to the number of new Bitcoins mined each year.

The story underlying this model is that the value of an asset is directly proportional to its scarcity. The higher the ratio, the scarcer the asset becomes and the higher the price.

The model argues that the halving events that occur approximately every four years – when the number of new coins is halved – directly affect Bitcoin’s price. Glassnode data has further proven this. Note how the price of BTC remained subdued in the days leading up to the halving. However, upon completion, it exploded to new highs.

Source: Glassnode

At the time of writing, BTC was only worth about 0.2 of what it should ideally be according to the S/F model. With the next halving event scheduled for April 2024, there was a chance BTC could reach its full potential.

How much are 1,10,100 BTC worth today?

Diamond hands strike

The halving-induced bullish outlook spurred long-term Bitcoin (LTH) holders to stock up for the big day. At the time of writing, seasoned investors of the king coin accounted for 75% of all tokens in circulation.

Source: Glassnode

BTC crept back above $26,000 on August 19, as the stormy week drew to a close. It changed hands $26,108 at time of writing, per CoinMarketCap.