- Bitcoin formed a smaller range within the range.

- Bullish conviction has weakened significantly and selling pressure could soon dominate.

Bitcoin [BTC] continued to trade between $73k and $60.7k, forming a range.

In a previous analysis, AMBCrypto had reported that bulls will need to defend the $64.5k support zone to break above the $66k resistance.

This didn’t happen, instead we saw a rejection at $67k and a move to $62.8k. This development occurred at a time when whale activity and ETF inflows were declining.

Therefore, an argument for continued consolidation was valid in the short term.

The bigger picture metrics that fueled BTC’s growth have declined

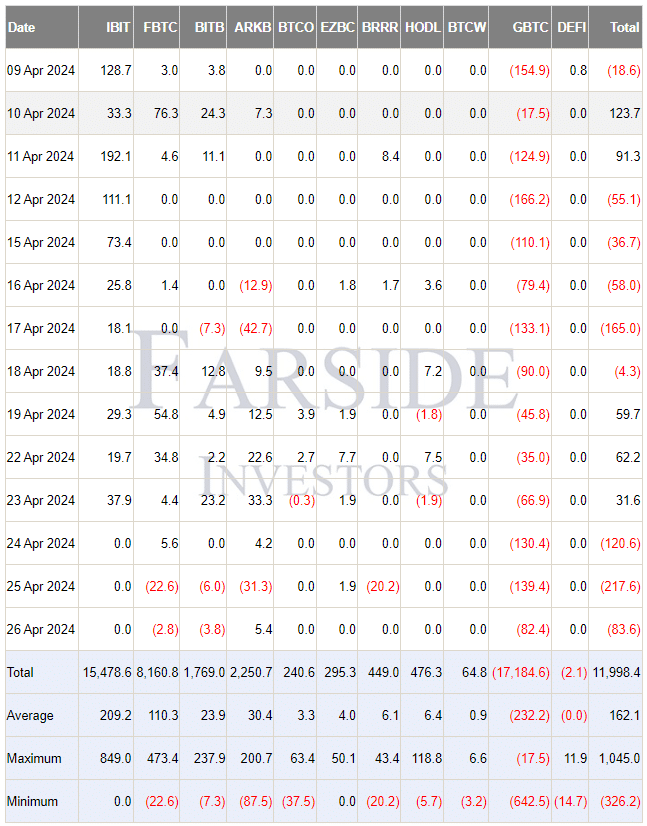

In a message on X (formerly Twitter), crypto analyst Whale panda noted that Bitcoin ETF flows were negative for the third consecutive day on Friday, April 26.

Blackrock’s ETF IBIT saw a third day of no inflows after receiving its largest inflows earlier this month.

A lack of demand is visible here. Only Grayscale Bitcoin ETF (GBTC) saw consistent outflows, but some others like ARKB joined it on April 25.

This reflected the lack of bullish conviction following the halving.

Crypto analyst Ali Martinez delivered another interesting factor in the conversation. The number of whale transactions has fallen since mid-March.

Bitcoin price also lost its bullish momentum in higher time frame over the past month.

What do the futures markets reveal about Bitcoin market sentiment?

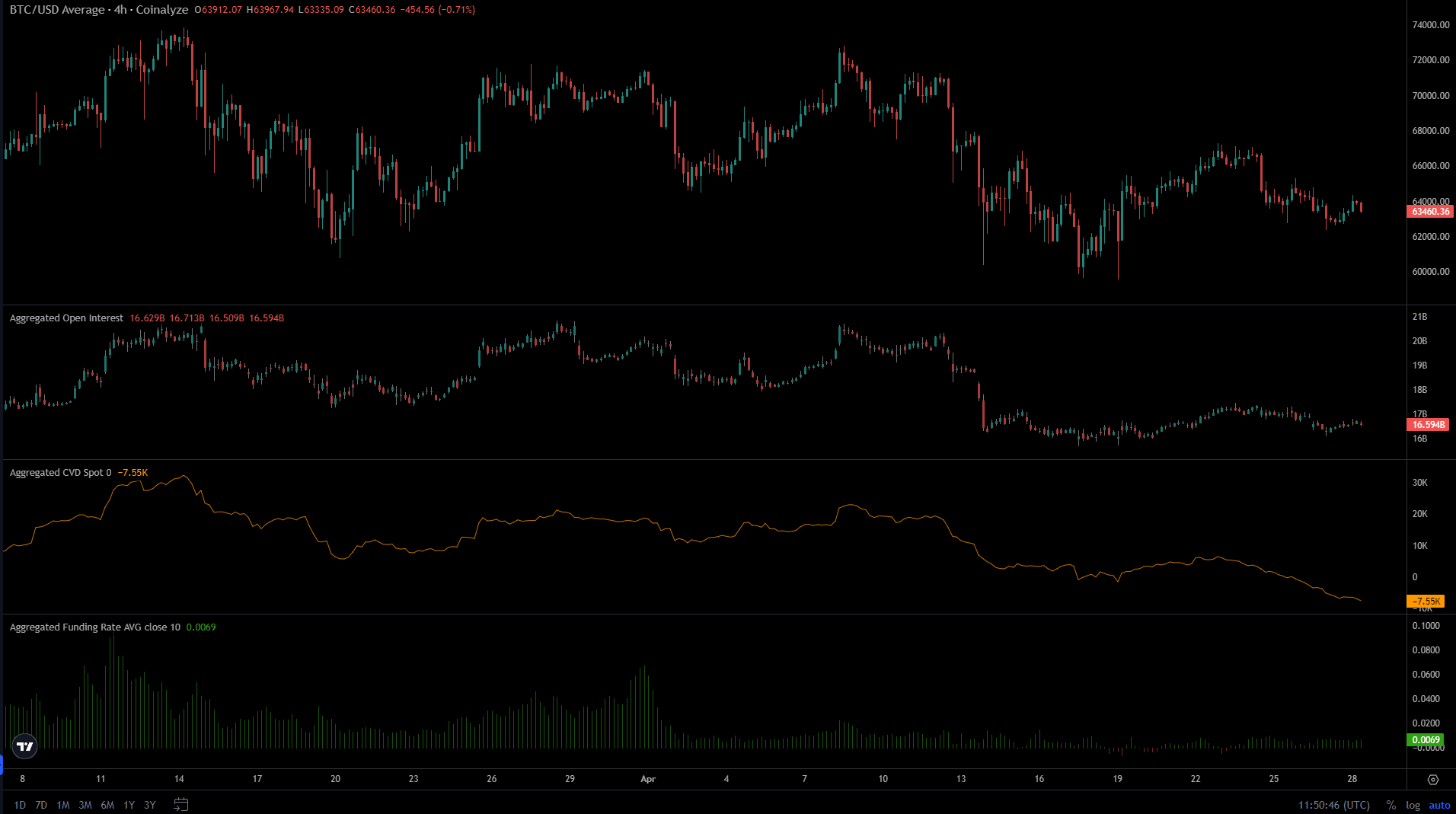

Open interest in Bitcoin has been declining since April 10. This came along with the price drop below $70,000, which took BTC to $60,000, highlighting the bearish sentiment. Speculators were unwilling to go long.

The financing rate, which had been very positive in March, was only slightly above zero in April, once again demonstrating the hesitation of speculators.

The CVD spot climbed higher from March 20 to April 10. This meant that there were buyers in the spot market at the time, giving the price a reason to try to rise above $70,000.

The past three weeks have been a relentless downward trend. Therefore, it was likely that we would see the BTC trend going down, or staying within a range.

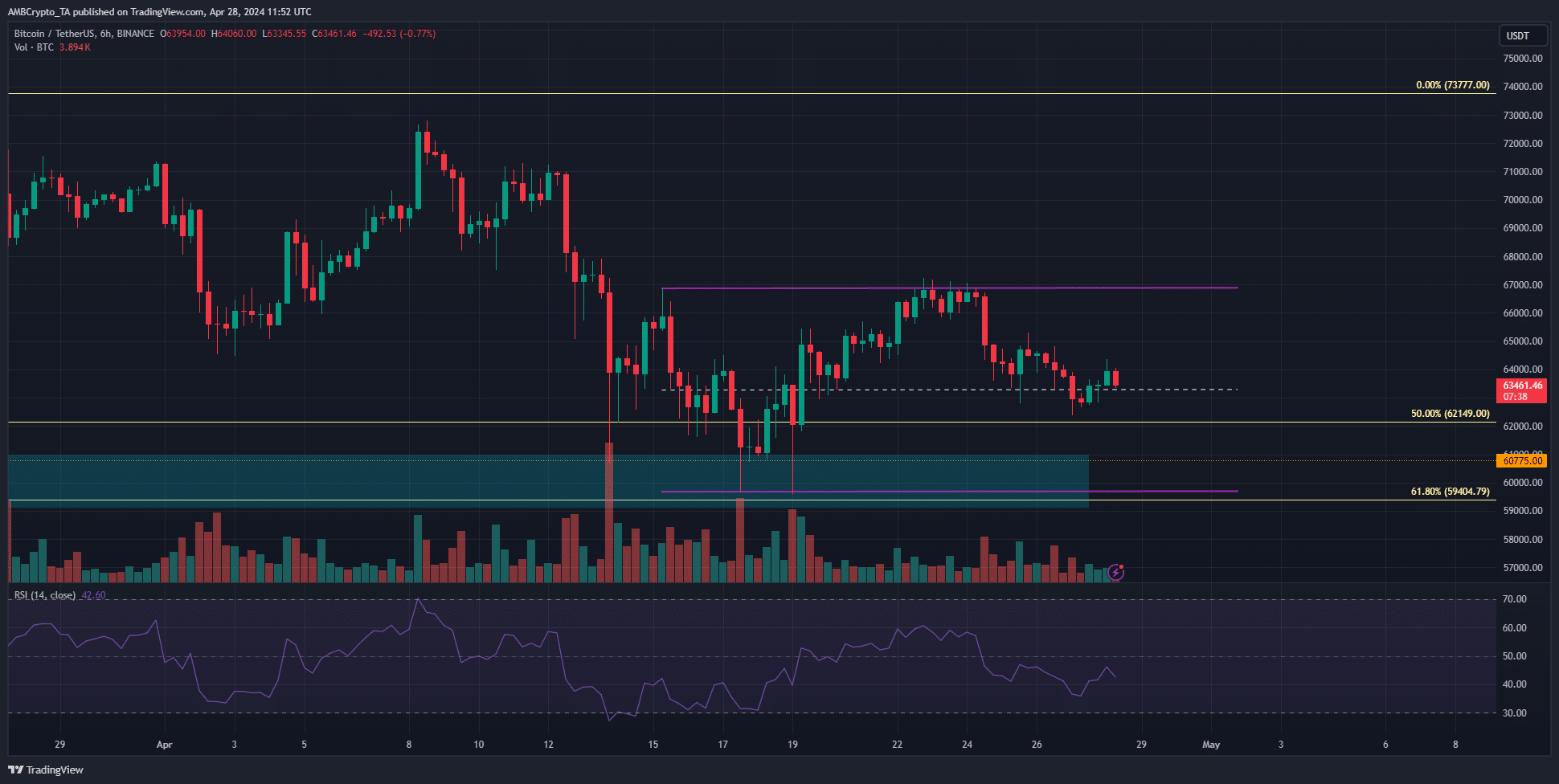

Source: BTC/USDT on TradingView

A short-term range between $66.9k and $59.7k (purple) was observed. This was at the lower end of the $60k-$73k range that BTC was already trading within.

Is your portfolio green? Check out the BTC profit calculator

The $63.3k midpoint was breached this weekend, and we could see another drop to $60k later this week.

The RSI on the 6-hour chart was below the neutral 50, indicating bearish momentum. Combined with the lack of demand, it seemed likely that another recession would be upon us soon.