Bitcoin (BTC), the largest cryptocurrency by market cap, has suffered a pullback in its recent gains after failing to consolidate above the $27,000 level. With no positive macro news that could push BTC past the upper resistance lines, industry experts are looking for chart analysis that suggests BTC may be on the verge of a major move towards $20,000.

This potentially lower price point could serve as a new higher low on Bitcoin’s 1-week chart, reminiscent of its 2019 stretch before the halving.

Bitcoin graph flashes red

Crypto analyst Rekt Capital recently shared a chart on X (formerly Twitter) outlining Bitcoin’s potential downward trajectory. According to Rekt Capital’s analysis, Bitcoin could reach the $20,000 mark again, setting a new higher low on the 1-week chart, mirroring the price movement seen in 2019 before the halving.

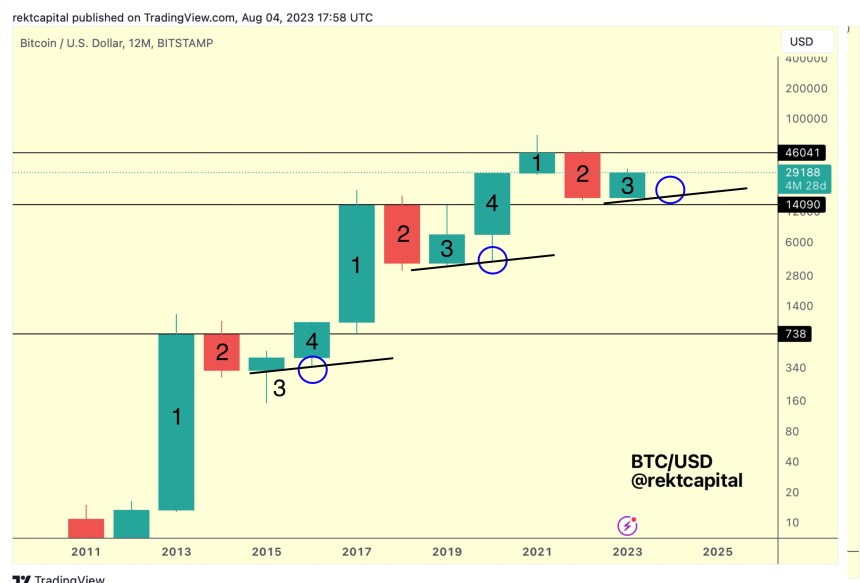

Rekt Capital highlights the significance of a new visit to the Macro Higher Low in the current cycle, which could occur in early 2024, coinciding with the half-year. In the four-year cycle, this would mean that the downside wick of Candle 4 would form a Macro Higher Low relative to Candle 3, as seen in another chart shared by Rekt below.

While some argue that another drop to the Macro Higher Low is unlikely due to the COVID-19 crash in March 2020 as a black swan event, says Rekt Capital emphasizes that the magnitude of a possible coming decline could vary significantly.

The COVID-19 crash resulted in a 72% drop from the 2019 local high to the higher low of March 2020. However, if the 2023 local high were around $31,000, it would only take a 37% drop to reach the higher low again.

While a repeat of the -72% crash is unlikely, Rekt Capital suggests Bitcoin could follow -37% without the need for another black swan.

With Bitcoin still 210 days away from the April 2024 halving, Rekt Capital is paralleling the 2019 cycle where BTC had a relief rally before hitting another lower high.

Bitcoin everywhere seems to be experiencing a similar relief rally. Rekt Capital suggests that Bitcoin may not need a drastic crash or other black swan event in the coming months to reach its Macro Higher Low in this cycle, but rather a retracement of around 27% from current prices.

Currently, the largest cryptocurrency on the market is trading at $26,600. Despite a retracement below the $27,000 level, Bitcoin has made a slight gain of 0.7% within 24 hours.

As highlighted by Rekt Capital, it remains uncertain whether Bitcoin will follow the path observed in 2019. What is clear, however, is that the BTC market is showing signs of stagnation, with a potential price breakout looming on either side.

Featured image from iStock, chart from TradingView.com