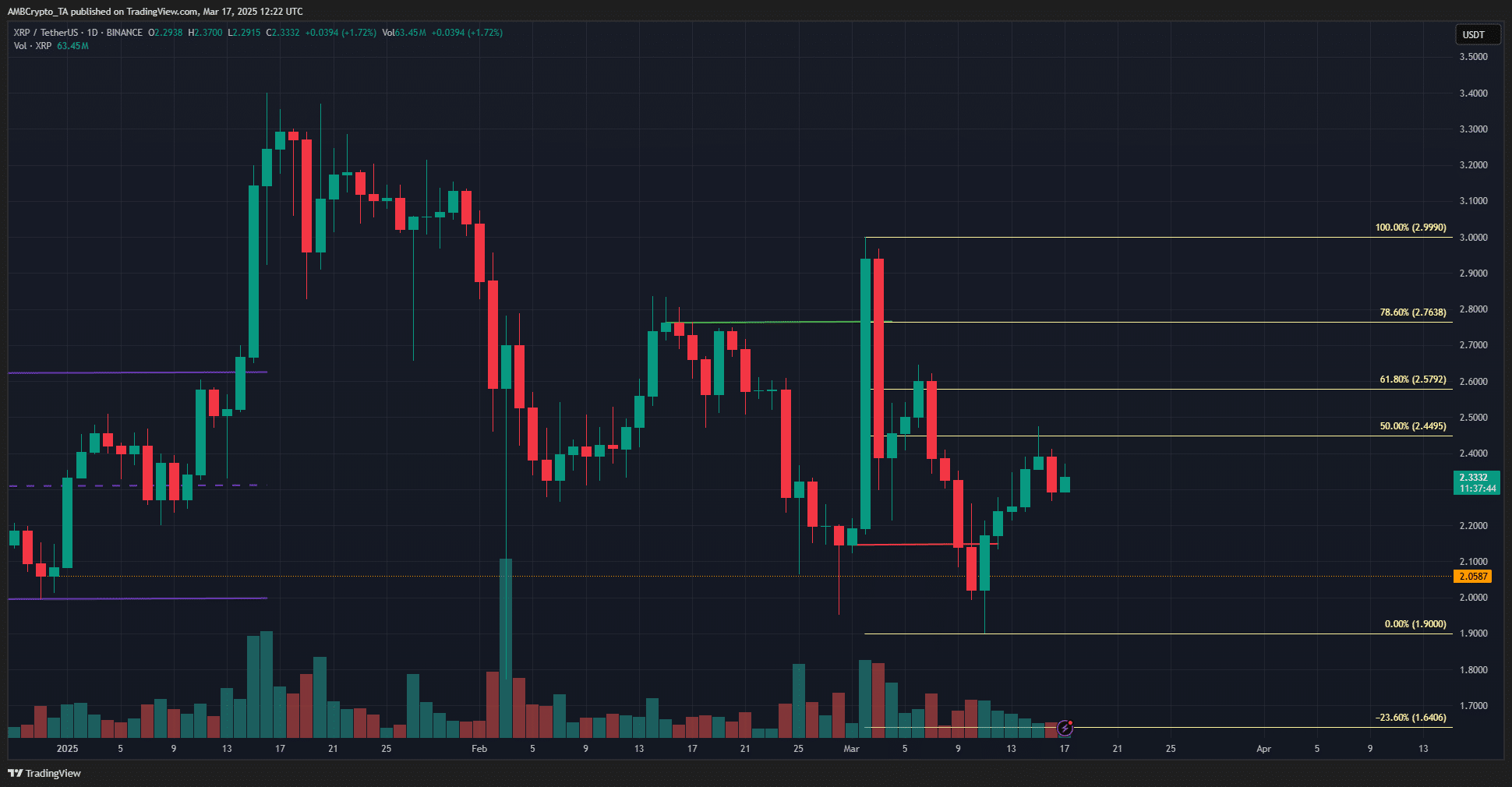

- Despite considerable profits since November, the daily graph revealed a bearish price structure

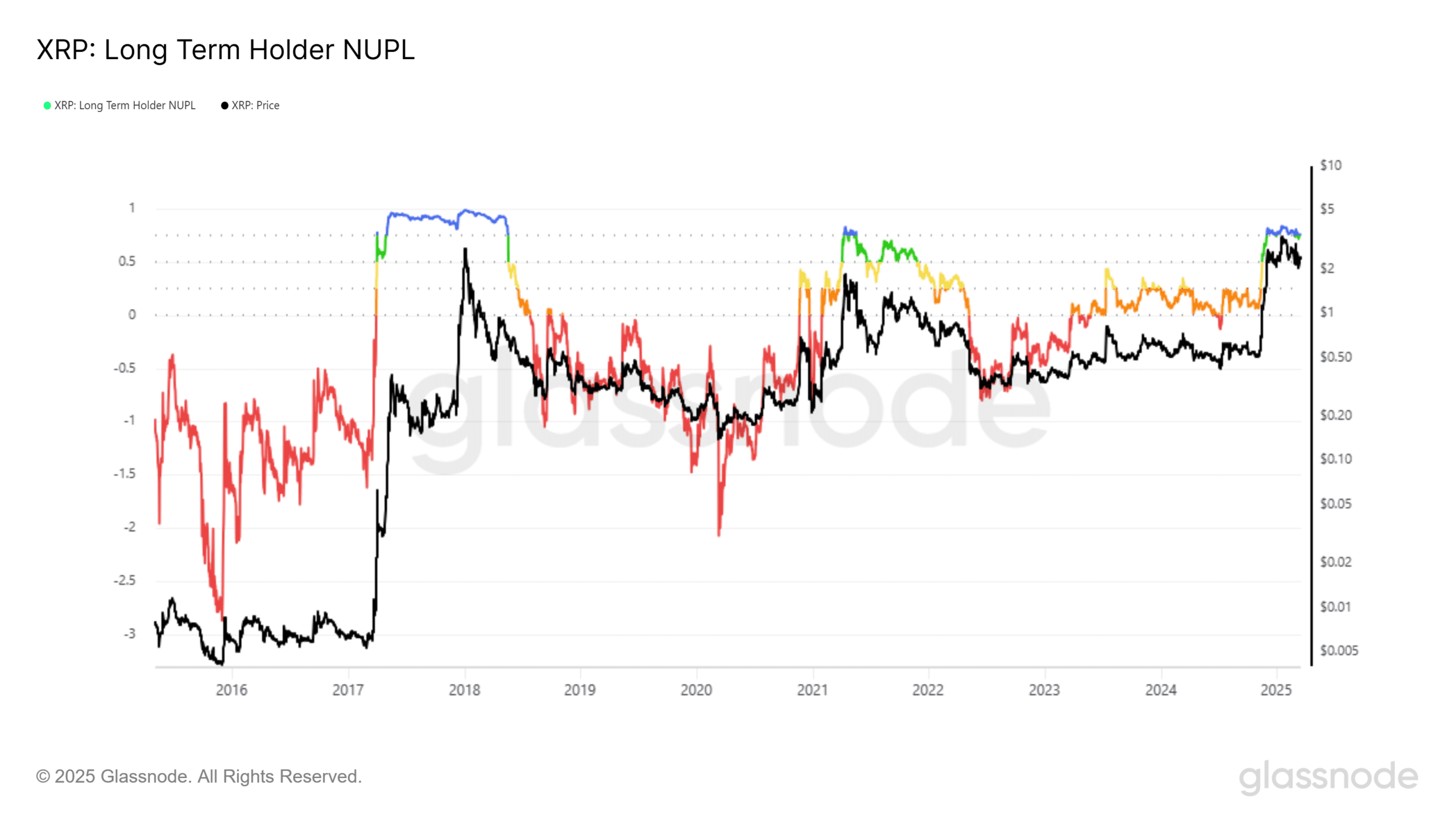

- Long-term holder of non-realized profit/loss statistics revealed agreements with the Cyclustop 2021

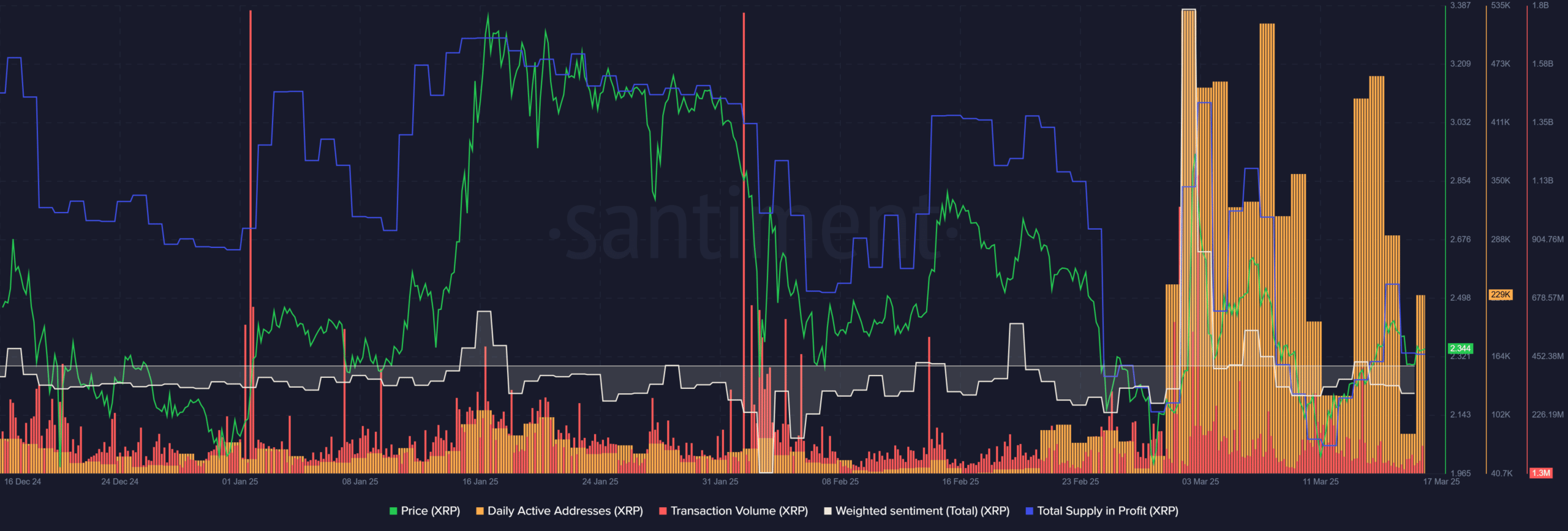

The signals on the chain behind the strong XRP win in the past six months have been mixed so far. The profit was high, as expected, but the sentiment behind the token was negative.

In fact, the net non -realized profit/loss revealed agreements with April 2021 and this can be creepy for the bulls.

Source: XRP/USDT on TradingView

The 1-day price promotion of the Altcoin showed a bearish structure on the daily graph. This shift, marked in red, took place a week ago when XRP slipped below the level of $ 2.19. Since the $ 1.9 decrease, the Altcoin has returned to test the $ 2.45 level as a resistance.

This level happened to be the retracement level of 50% of the relocation from $ 2.99 to $ 1.9. The rejection for $ 2.45 in the weekend emphasized the bearish. Therefore, although XRP has risen 370% since the US presidential election, sellers have prevailed.

High network activity increases the moral of the XRP investors

Santiment data underline some positivity for investors. The total profit for profit has fallen in addition to the price since January. However, it was still considerably higher than levels where it had been in October and November 2024.

The weighted sentiment, which follows the involvement of social media with regard to XRP, was negative. It has been negative in the last three months, with only a few peaks of positive involvement.

The daily active addresses shot Skywards in March. Although the figures have been withdrawn somewhat, it was much higher than in recent months. The transaction volumetrends remained comparable to the previous three months.

While the statistics of santiment showed the rise in activities in the chain and the potential demand, the Net Unfeerecreized win loss (LTH NUPL) emphasized in the long term euphoria/greed on the market. In recent months, the metric floats just above the 0.75 level.

Here the NUPL measures the difference between non -realized profits and non -realized losses with holders whose tokens are at least 155 days old. Positive values imply that investors are on average profitable. A value of 0.75 meant that 75% of market capitalization was in profit.

In the summer of 2021 the metric rose above 0.75 and the Cycle Top for XRP marked. In 2017, the metric rose by more than 0.9 and stayed there for weeks. At the time, however, it was also a much younger property.

XRP may have already made its cycle top. Investors must partially want to cash in on their participations in the event that the market starts to run and maintain a downward trend for the next two years.