- Solana had bearish structure and momentum on the 1-day time frame

- A recovery would require sustained buying pressure, but that is not there yet

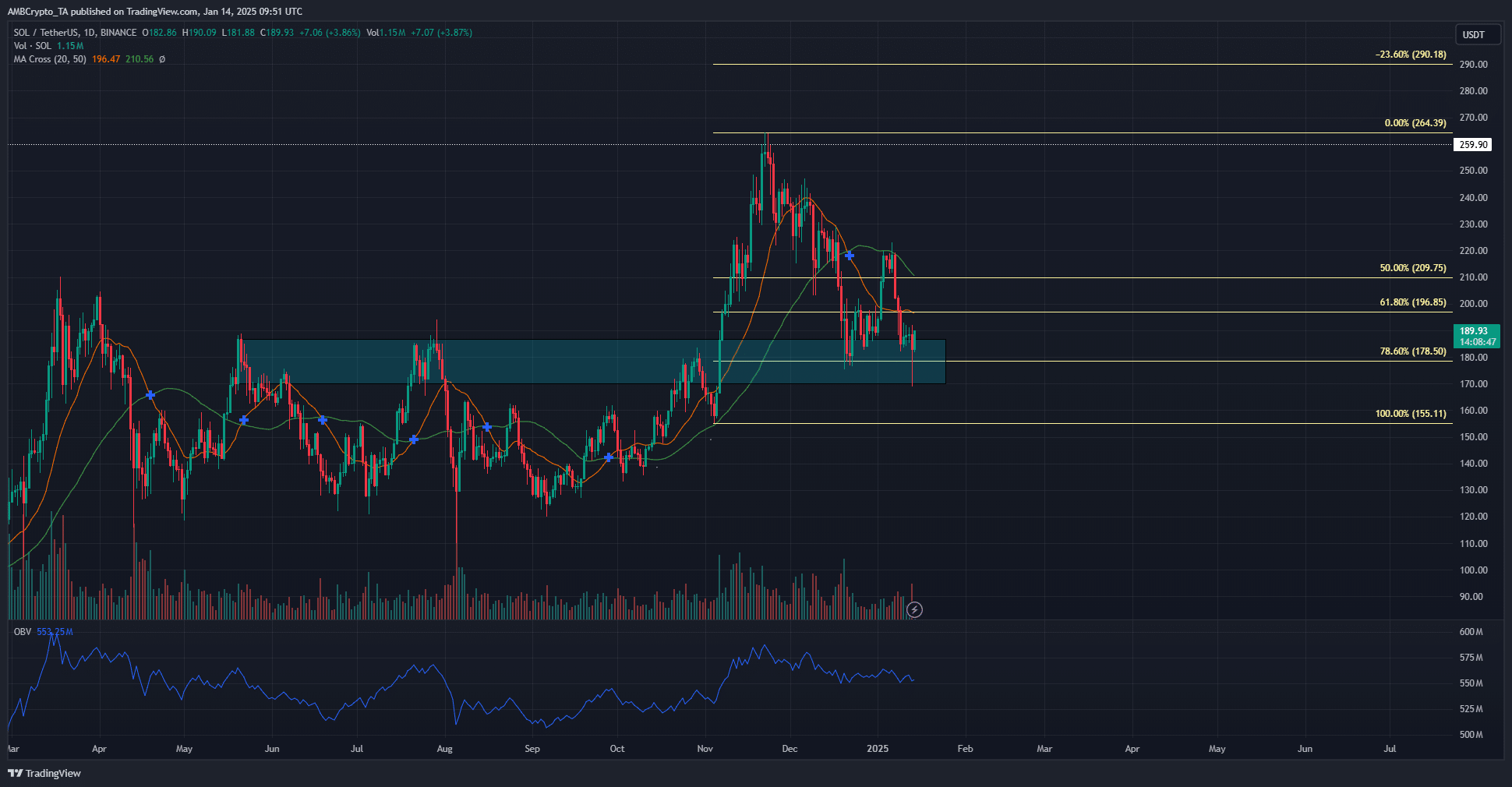

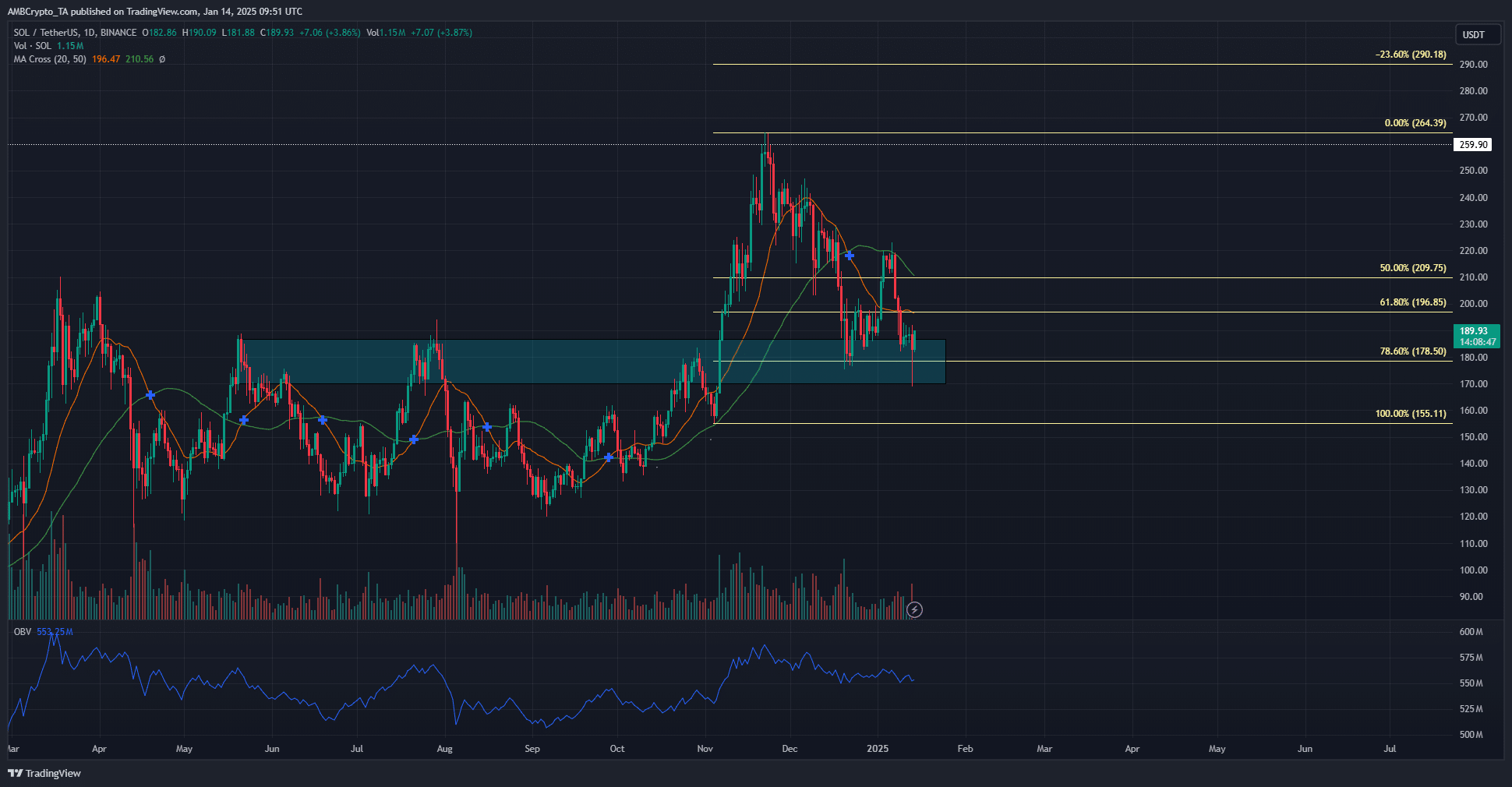

Solana [SOL] has been in a retracement phase for the past six weeks after being rejected above the $260 level. There seemed to be strong social volume around the item, but the declining number of active addresses was a concern. Pumpfun even made a deposit $21 million in SOL on the centralized exchange Kraken, raising fears of short-term selling pressure.

The MVRV ratio analysis highlighted a potential buying opportunity. At the same time, the price traded just above a demand zone that acted as a strong resistance in mid-2024.

Solana remains bearish on the daily time frame

Source: SOL/USDT on TradingView

The market-wide slump in recent weeks following the November pump has negatively impacted SOL. With Bitcoin [BTC] When the price fell to $89.2k on Monday, January 13, it was a miracle that the Solana bulls held the $180 support.

The OBV has fallen steadily since November, despite buyers’ determined defense. This meant that sooner or later the demand zone would be flooded unless market sentiment turns bullish.

The 20 and 50 period moving averages helped highlight potential turning points. At the time of writing, they reflected bearish momentum, and the slower moving average served as short-term resistance.

The price action also told the same story. To turn the daily structure bullish, SOL needs to climb past the $218.2 lower high it formed just over a week ago.

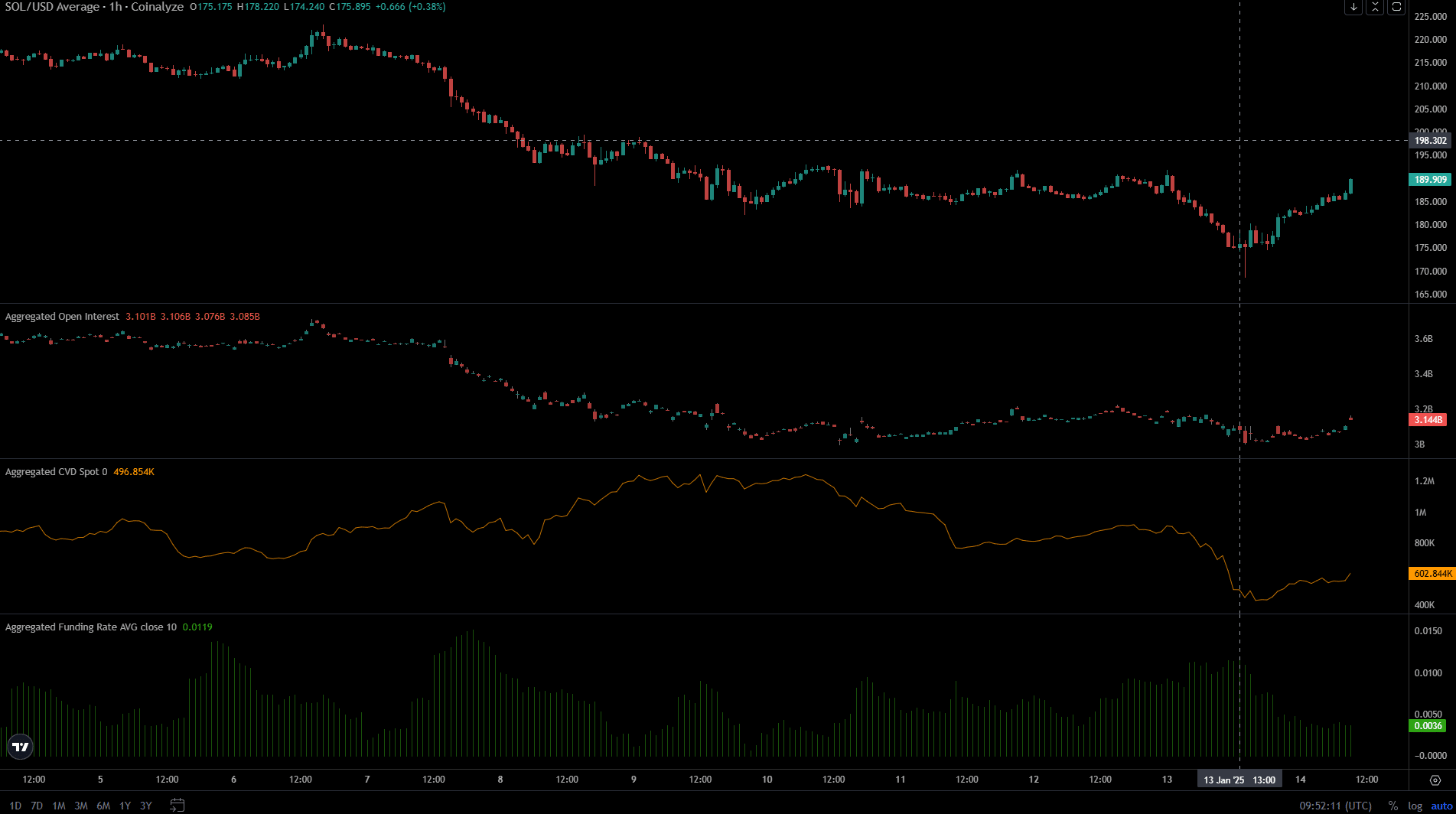

Short-term sentiment is also bearish

Coinalyze’s hourly chart also highlighted a lack of belief in Solana’s near-term bullish outlook. The price increase of $170 in the last 24 hours was accompanied by an increase in Open Interest. This increase was not enough to change the OI trend, which largely indicated neutral sentiment and speculative inactivity.

Realistic or not, here is SOL’s market cap in terms of BTC

This distant outlook was also present on the spot CVD indicator, which has reached lower highs over the past week. A change in this downtrend would signal that buyers would again be dominant.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer