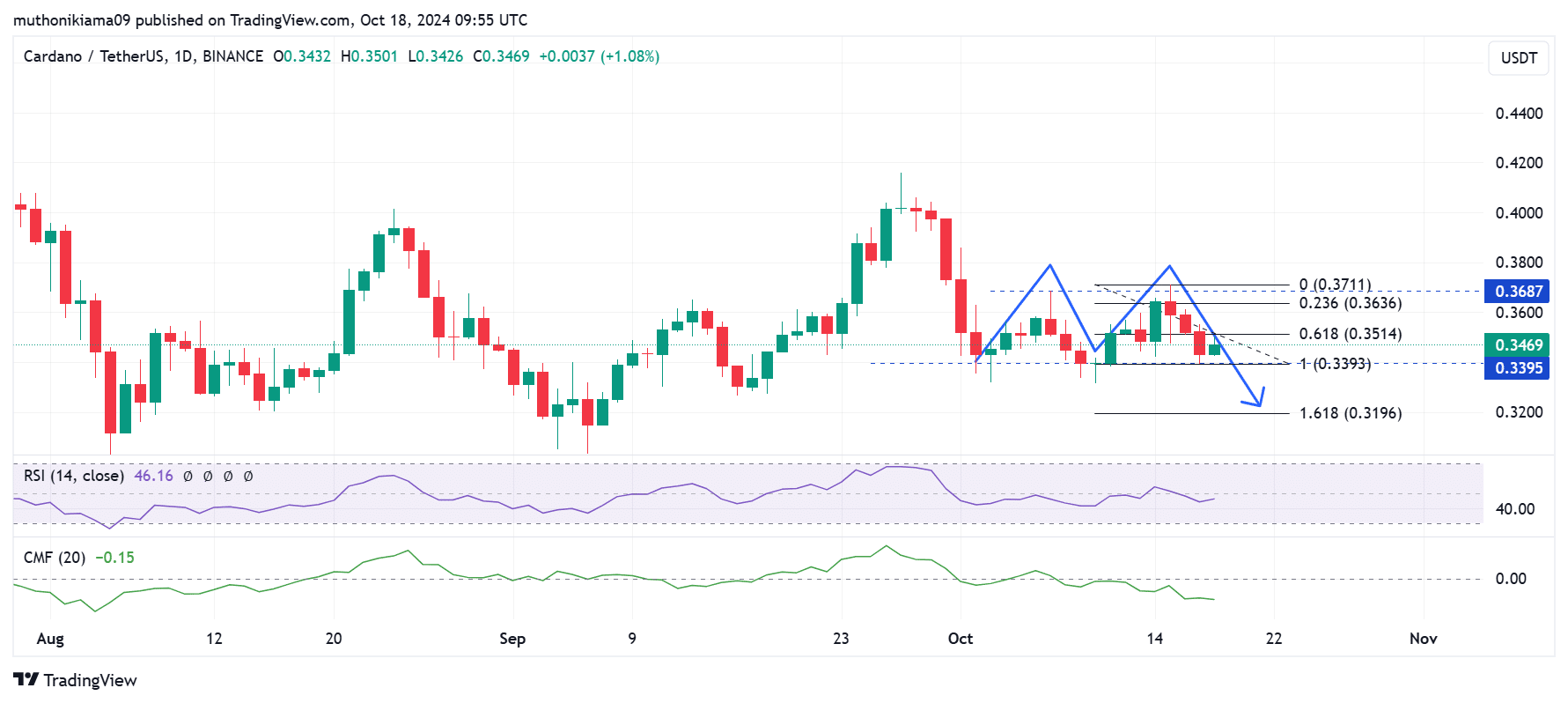

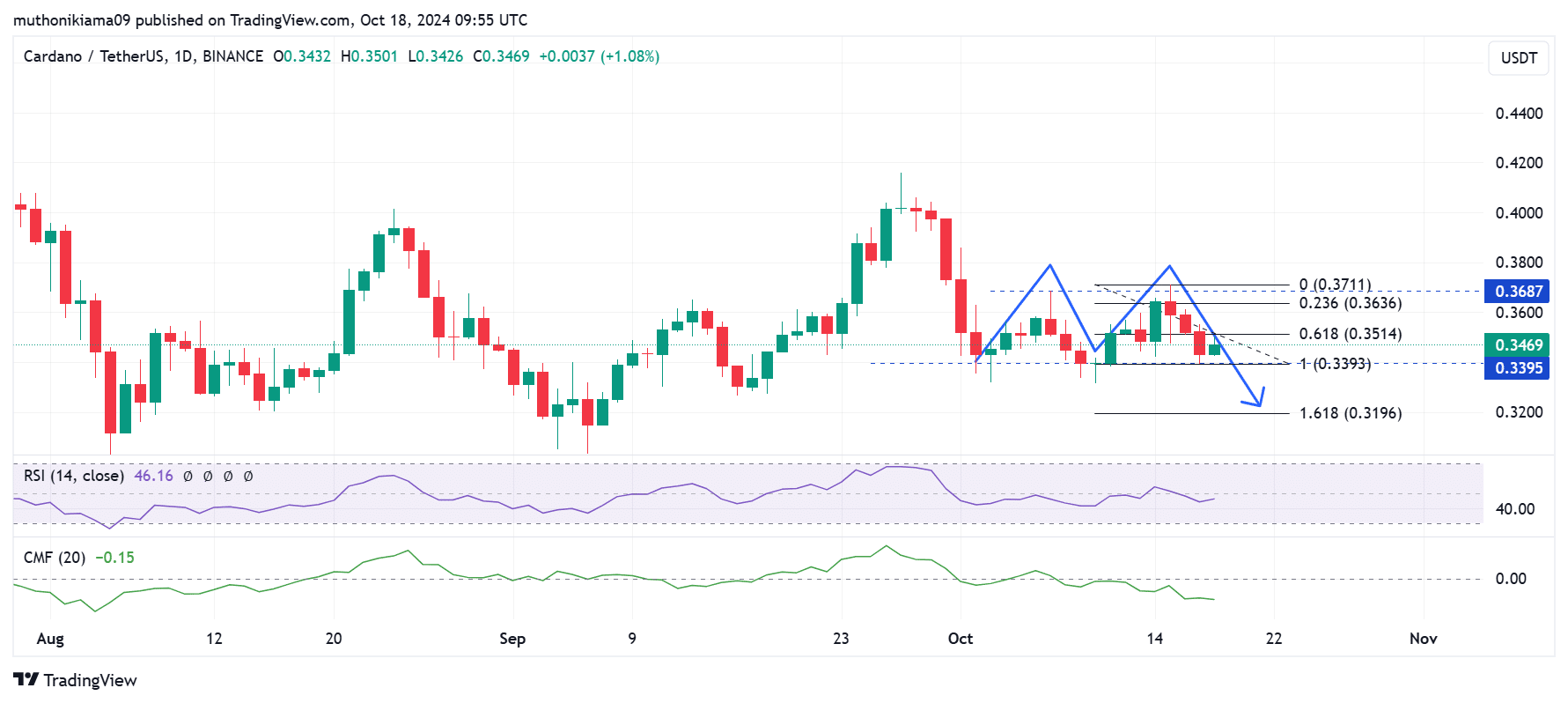

- Cardano has formed a double-top pattern on the daily chart, indicating a bearish reversal.

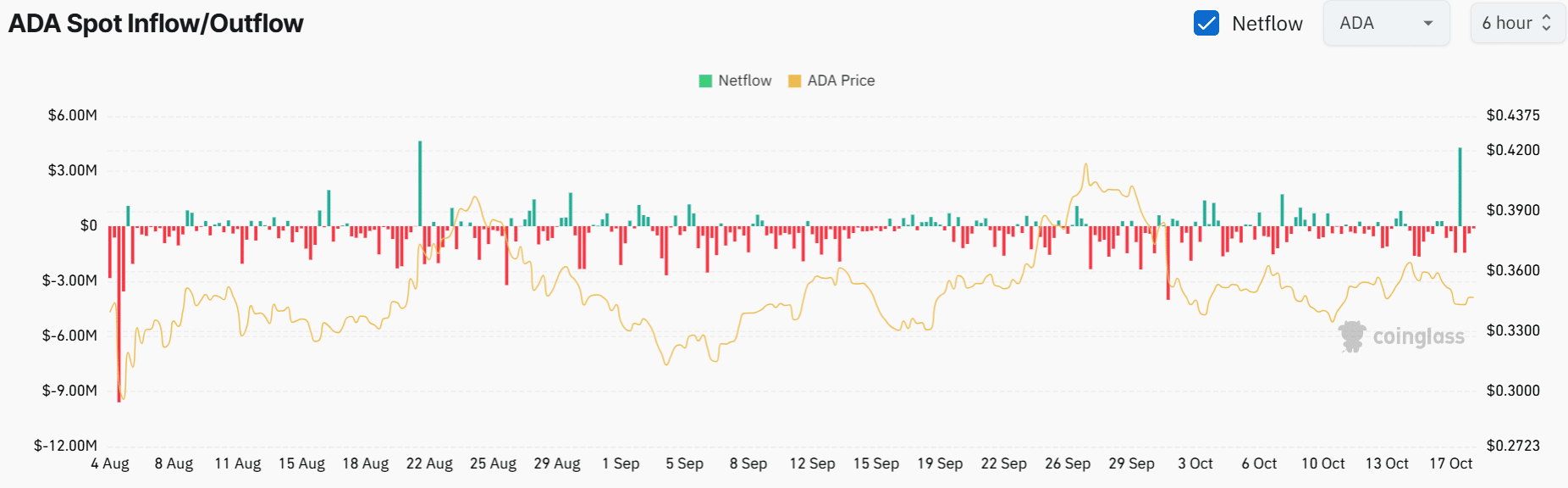

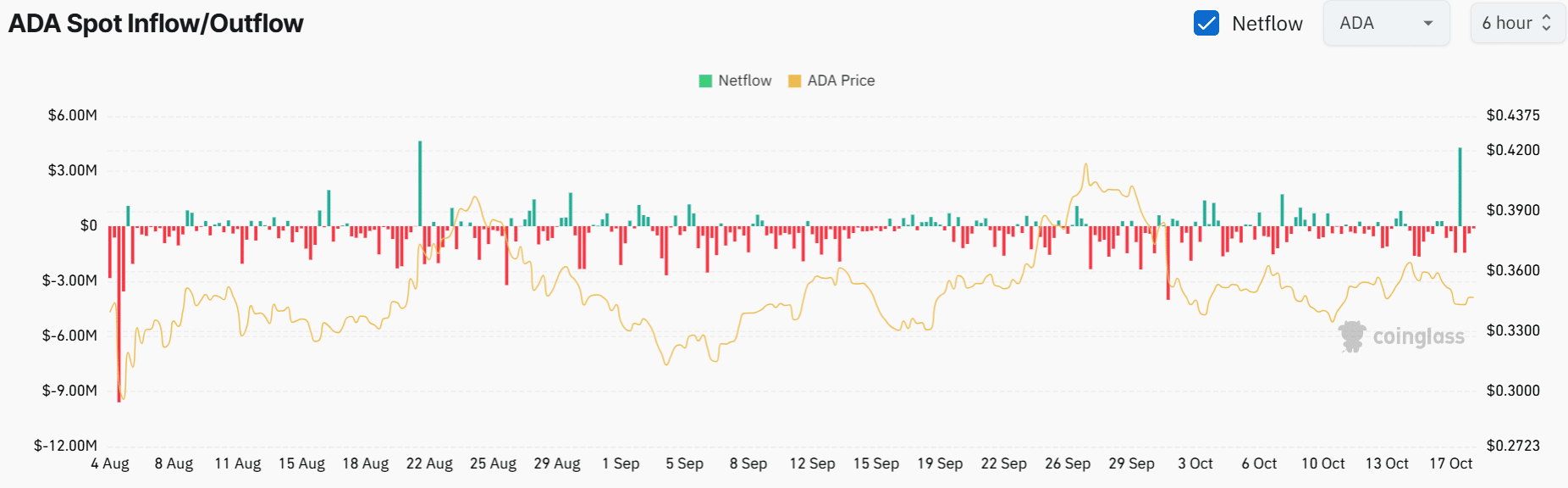

- The spike in ADA spot inflows indicates that sales pressure could increase and drive prices down.

Cardano [ADA] has underperformed against Bitcoin [BTC] considering that the altcoin is up a scant 0.4% over the past seven days to trade at $0.347 at the time of writing. ADA also showed signs of consolidation as its price fluctuated within a narrow range between $0.339 and $0.35 over the past 24 hours.

ADA’s bearish pattern emerges

The bearish trends surrounding ADA could continue as the daily chart shows the formation of a double-top pattern. This pattern typically shows a trend reversal, with ADA now poised for a downtrend if sentiment fails to turn positive.

ADA bears tested the neckline of this double-top pattern at $0.339, also the 100% Fibonacci level, before the price bounced. If ADA breaks this support and moves lower, the price is likely to drop to $0.319.

(Source: Handelsview)

For ADA to refute this bearish pattern and confirm an uptrend, the price needs to break above $0.37. However, the purchasing support necessary for such gains is lacking.

The Relative Strength Index (RSI) is at 46, indicating that sellers are in control. Moreover, the RSI line is tilting south, indicating that bearish momentum is gaining strength. The negative Chaikin Money Flow (CMF) also paints a bearish picture as selling pressure continues.

Data from Coinglass confirms that ADA traders are actively selling. Spot inflows recently rose to $4.28 million, the highest level since mid-August. This suggests that traders are moving their coins to exchanges with the intention of selling them.

Source: Coinglass

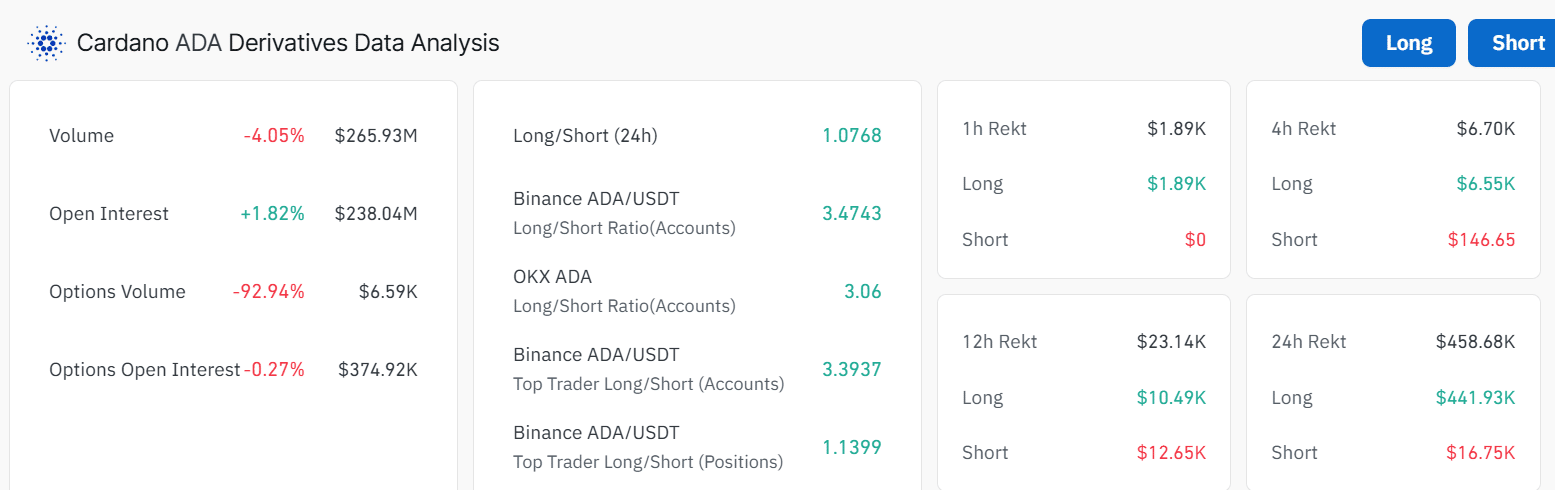

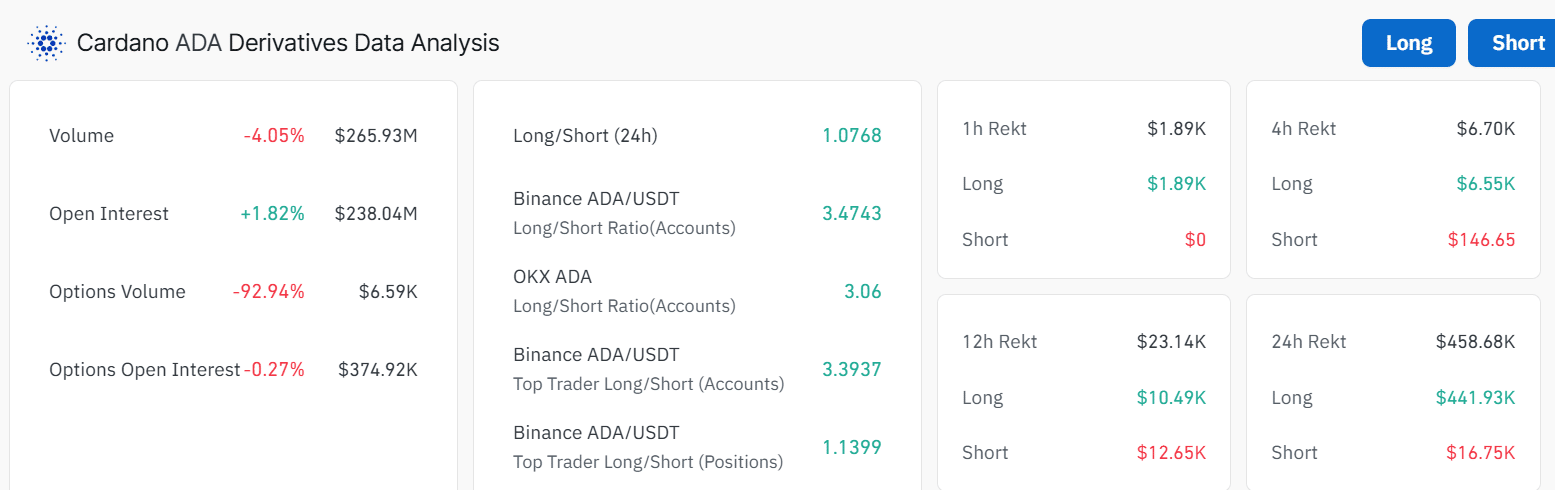

Analyzing derivatives data

The derivatives market shows that while sentiment is positive, bearish signals persist. ADA’s outstanding stake had risen to $238 million at the time of writing Mint glass. This metric is at its highest level this month, indicating that interest in the altcoin is high.

ADA’s long/short ratio was 1.07, indicating that there are slightly more long traders than short traders. On Binance, more than 90% of open positions on Cardano have long indicated market optimism.

Source: Coinglass

Read Cardanos [ADA] Price forecast 2024–2025

Despite this long bias, traders who bet on ADA profits continue to post losses. In the last 24 hours, $441,000 worth of ADA longs were liquidated, while only $16,750 of shorts were liquidated.

Nevertheless, whale activity could mean a reversal in the ADA price. Major ADA transactions recently pointed suggesting that whales could be accumulating.