According to analytics firm Santiment, deep-pocketed Bitcoin investors are snapping up billions of dollars worth of BTC.

Santiment says on social media platform

“Bitcoin whales, specifically wallets holding between 100 and 1,000 BTC, have amassed an additional 94,700 coins over the past six weeks. Now that price uncertainty has driven many traders out of crypto, key stakeholders are loading.”

Fellow analytics firm Glassnode echoes Santiment’s position that investors are accumulating Bitcoin amid market uncertainty.

Glass junction say that one on-chain metric that tracks the balance sheet size and accumulation behavior of market participants is flashing green for Bitcoin.

“The Accumulation Trend Score (ATS) indicates a market shift back towards accumulation, with the ATS reaching its maximum value of 1.0, indicating significant accumulation over the past month.”

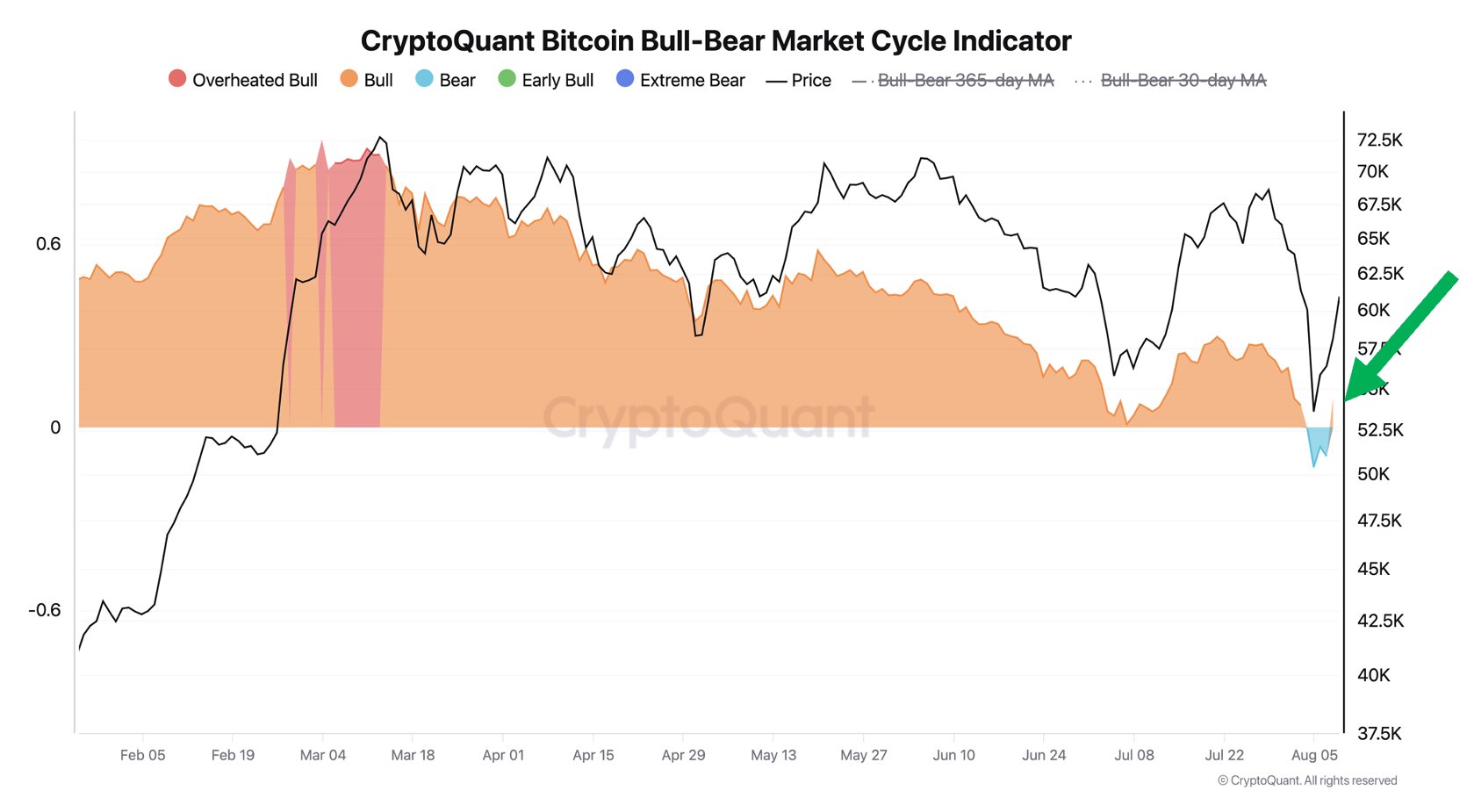

Earlier this month, the CEO of analytics firm CryptoQuant said the Bitcoin bull-bear market cycle indicator, which tracks phases of investor sentiment, was bullish again after a brief dip into bear territory.

“Most of Bitcoin’s on-chain cyclical indicators that were hovering around the line have now returned to signaling a bull market. BTC was only discounted for three days.”

At the time of writing, Bitcoin is trading at $60,516, up more than 4% on the day.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney