- Buterin’s transfer during a market downturn led to speculation about ETH’s impact on sentiment.

- ETH remained steady with moderate losses, which is in stark contrast to the declines of other cryptocurrencies.

Ethereum [ETH] co-founder Vitalik Buterine led to intense speculation within the crypto community with significant transfer.

Many investors assumed Buterin was making a strategic move or possibly selling some of his assets.

Clearing the air around Buterin’s action

But when did it become clear Wu Blockchain more details shared.

Source: Wu Blockchain/X

Interestingly, Buterin’s move coincided with a broader market downturn global cryptocurrency market capitalization reached $2.05 trillion at the time of writing, down 2.67% in the past day.

Whether Buterin’s move will shift ETH’s market sentiment from bearish to bullish remains to be seen.

As of the last update, the largest altcoin was trading at $2,946.55, reflecting a decline of 1.98% in the past 24 hours.

This decline is relatively moderate compared to Bitcoin [BTC], which fell by 2.40%. Solana [SOL] and Ripple [XRP] experienced a decline of more than 4% and 3% respectively.

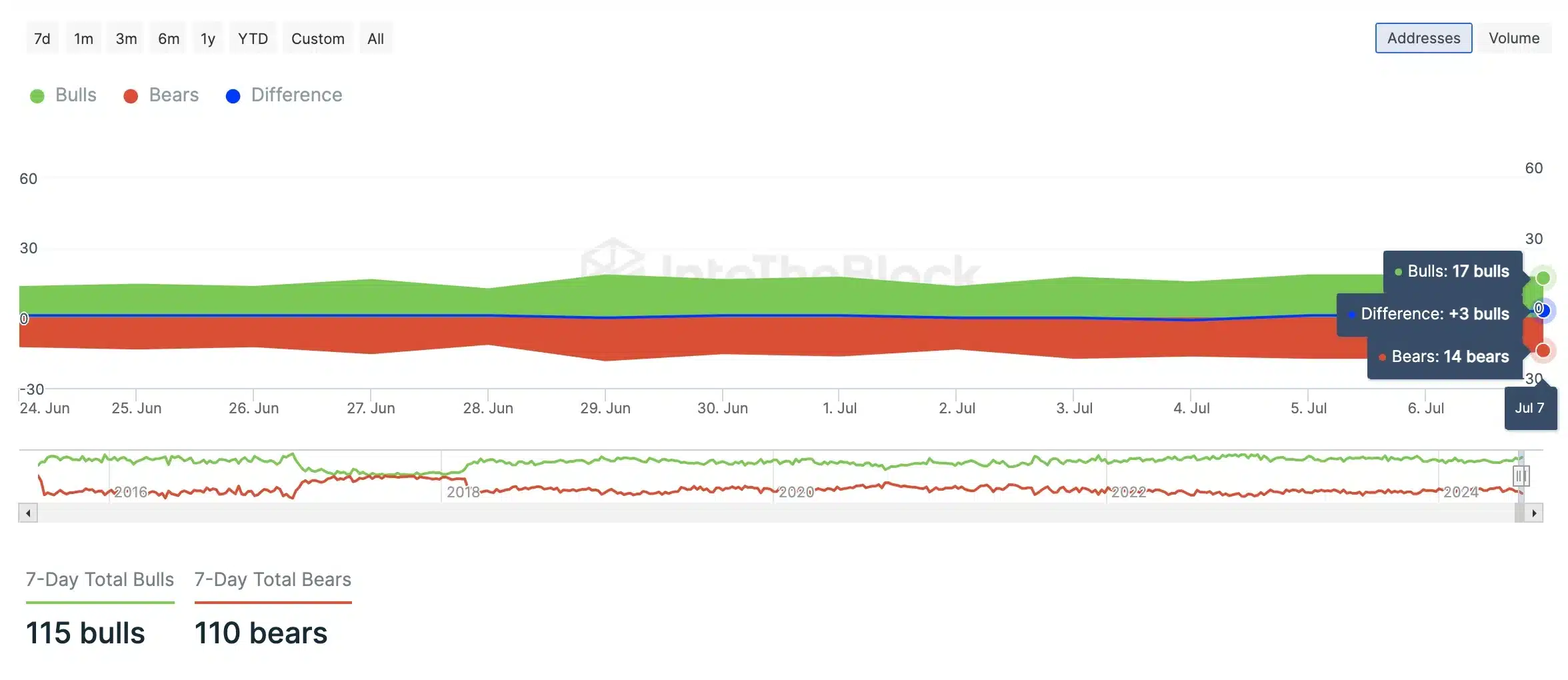

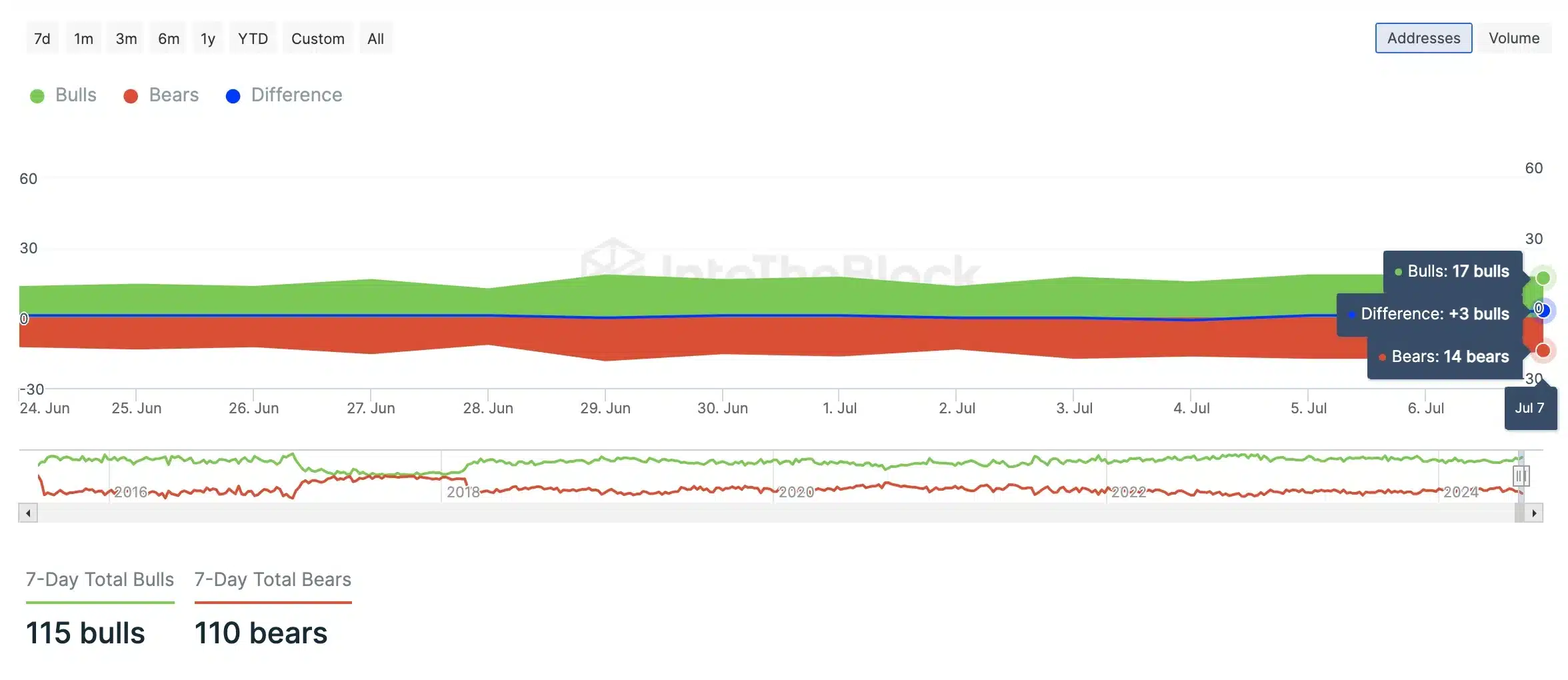

But despite the recent market decline, AMBCrypto’s analysis using IntoTheBlock data indicated that buying pressure continued to exceed selling pressure among bulls and bears.

Source: IntoTheBlock

Is cryptocurrency adoption on the rise?

Needless to say, the launch of Bitcoin ETFs has put Bitcoin in the spotlight. Lately, the king coin has attracted the attention of Wall Street, major institutions and the political sphere.

While this rise is often seen as a step forward in cryptocurrency adoption, it is very much about Bitcoin and not the broader crypto market.

Against this backdrop, Buterin’s recent actions could boost ETH adoption, especially given that investors are losing interest in ETH, fueled by the delay in the SEC’s approval of ETH ETF.

The financial influence of Vitalik Buterin

This is evident from a recent report published by an analysis company in the chain Arkham IntelligenceVitalik Buterin remains the largest individual holder of ETH.

His net worth has increased from $552.86 million in early 2024 to $834.66 million.

His holdings of approximately 245,279 ETH fluctuate with Ethereum market prices.

During the peak of the bull market in 2021, ETH’s value pushed its net worth above $2 billion, although subsequent recessions in 2022 reduced this by approximately 75%.

Despite market volatility, Buterin’s strategic investments and central role in Ethereum continue to strengthen his financial influence.