- Recent data indicated a decline in selling pressure, pointing to a potential recovery in the market.

- Positive shifts were seen in Bitcoin’s MVRV ratio and active addresses, indicating an optimistic market trend.

The global crypto market briefly surpassed a market cap of $2.35 trillion earlier on July 2 before experiencing a slight contraction, losing approximately $10 billion in market cap value.

This downturn was partially attributed to Bitcoin [BTC]which saw a decline from the 24-hour peak of $63,790 to the press time price of $62,461, marking a decline of 1.2% during this period.

Signs of a relief meeting

As the dust settles after a tumultuous June, market analysts are signaling the beginning of a “relief rally.” According to insights from crypto intelligence platform Santiment, the market could be at a turning point.

More like Santiment shared insights on X (formerly Twitter), indicating a shift in market dynamics due to reduced selling pressure on exchanges. The platform noted:

“After so much capitulation from small traders, the public’s negativity and average trader losses mean a relief rally may be starting.”

Minkyu Woo, an analyst and verified author at CryptoQuant, echoed this sentiment in a recent analysis.

He noted that seller exhaustion became evident as the average size of top Tether [USDT] outflows from the stock markets fell, after a significant increase in June.

Woo stated,

“This decline in outflows suggests that investors are more likely to hold on to their assets rather than withdraw money from the market. This could mean that investor sentiment has become more positive following the Bitcoin halving.”

Bitcoin: Are There Signs of Bullishness?

To further gauge bullish sentiment, it is essential to examine Bitcoin’s key metrics.

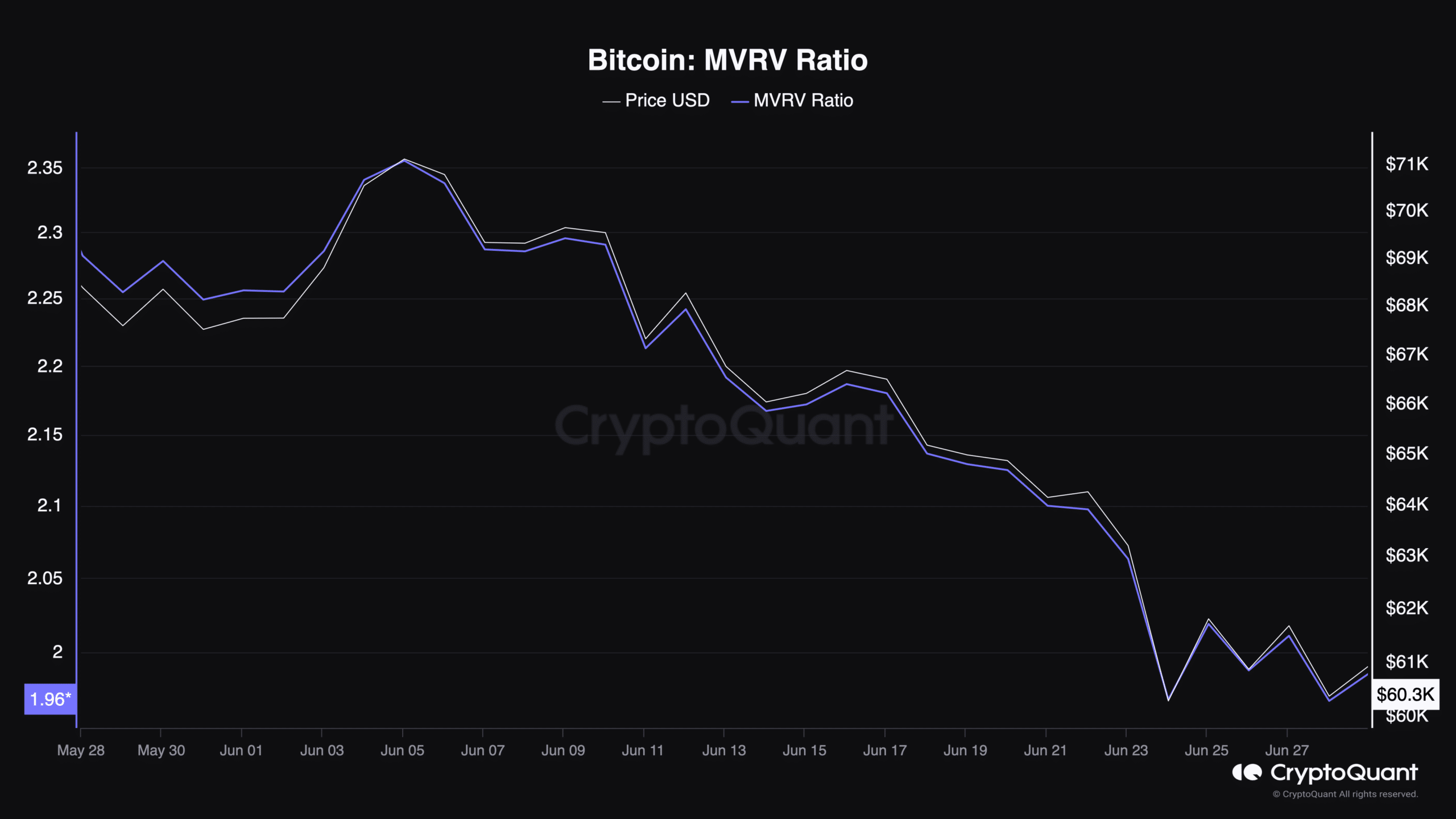

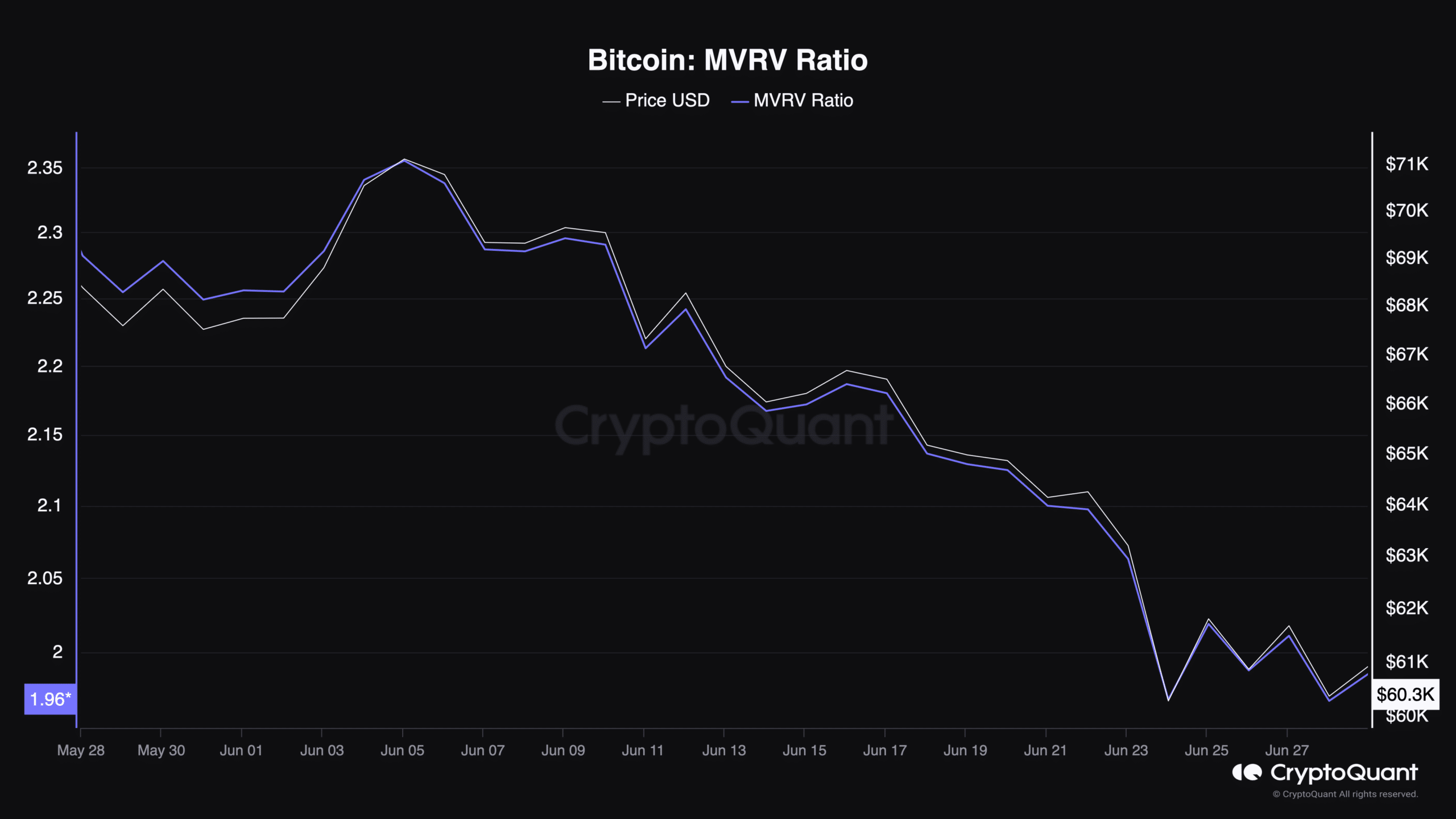

Thus, AMBCrypto noted that the market value to realized value ratio (MVRV), a key indicator of market sentiment, has recently seen a decline of almost 1%. At the time of writing, the MVRV ratio was: 1.96.

Source: CryptoQuant

This metric measures the disparity between Bitcoin’s market value and realized value, with a lower ratio often indicating undervaluation, potentially signaling a good buying opportunity or a market low.

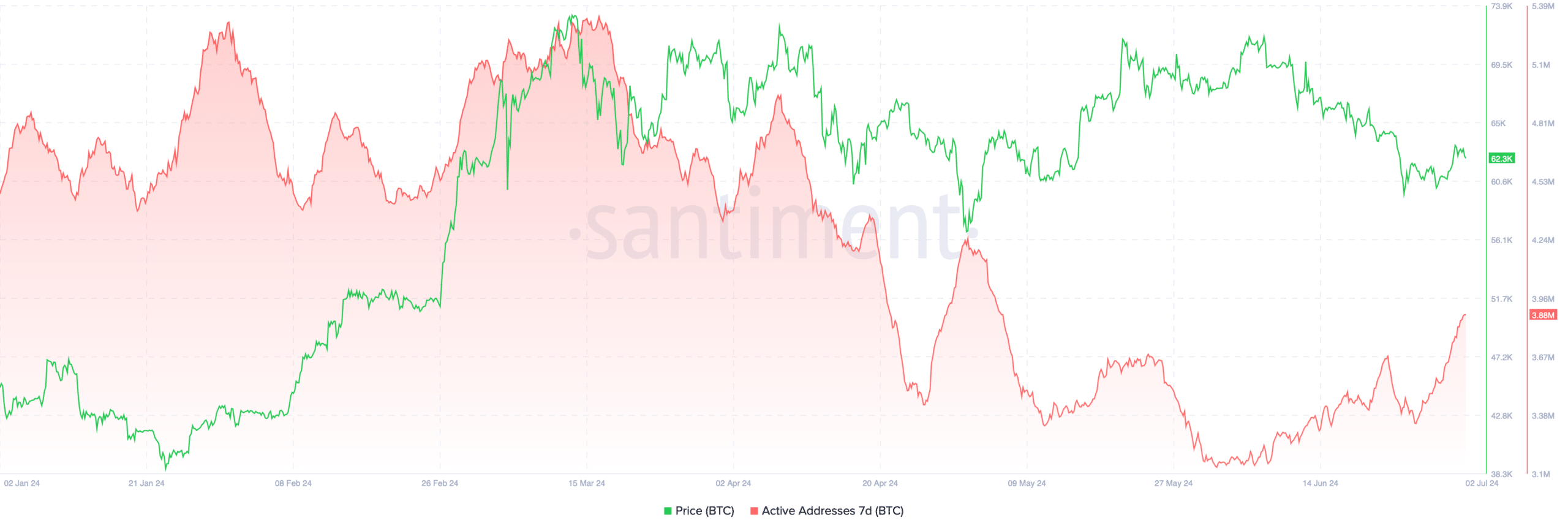

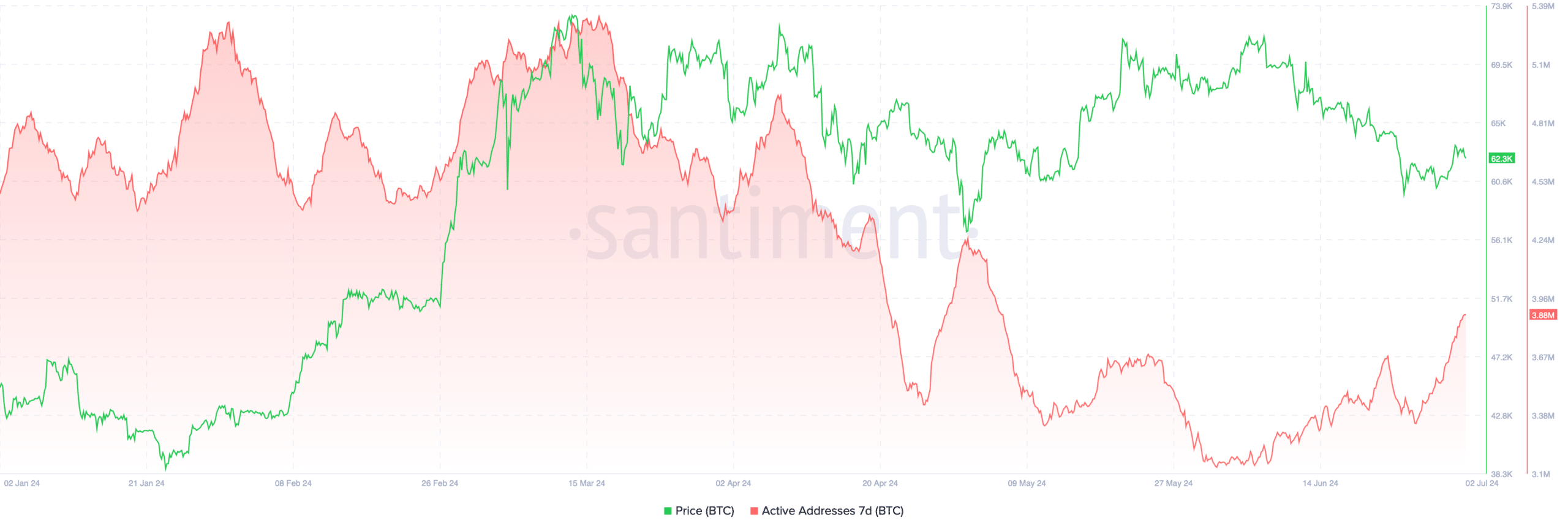

Moreover, Bitcoin network activity has seen an increase, with the number active addresses rising from 3.14 million in early June to around 3.88 million at the time of writing.

Read Bitcoin’s [BTC] Price forecast 2024-25

An increase in the number of active addresses usually indicates growing user engagement and can be a positive sign for the health and bullish potential of the market.

Source: Santiment

This bullish outlook coincided with AMBCrypto’s recent report on BTC that miner reserves of the asset have increased, which could indicate that miner sales maybe just cooling down.