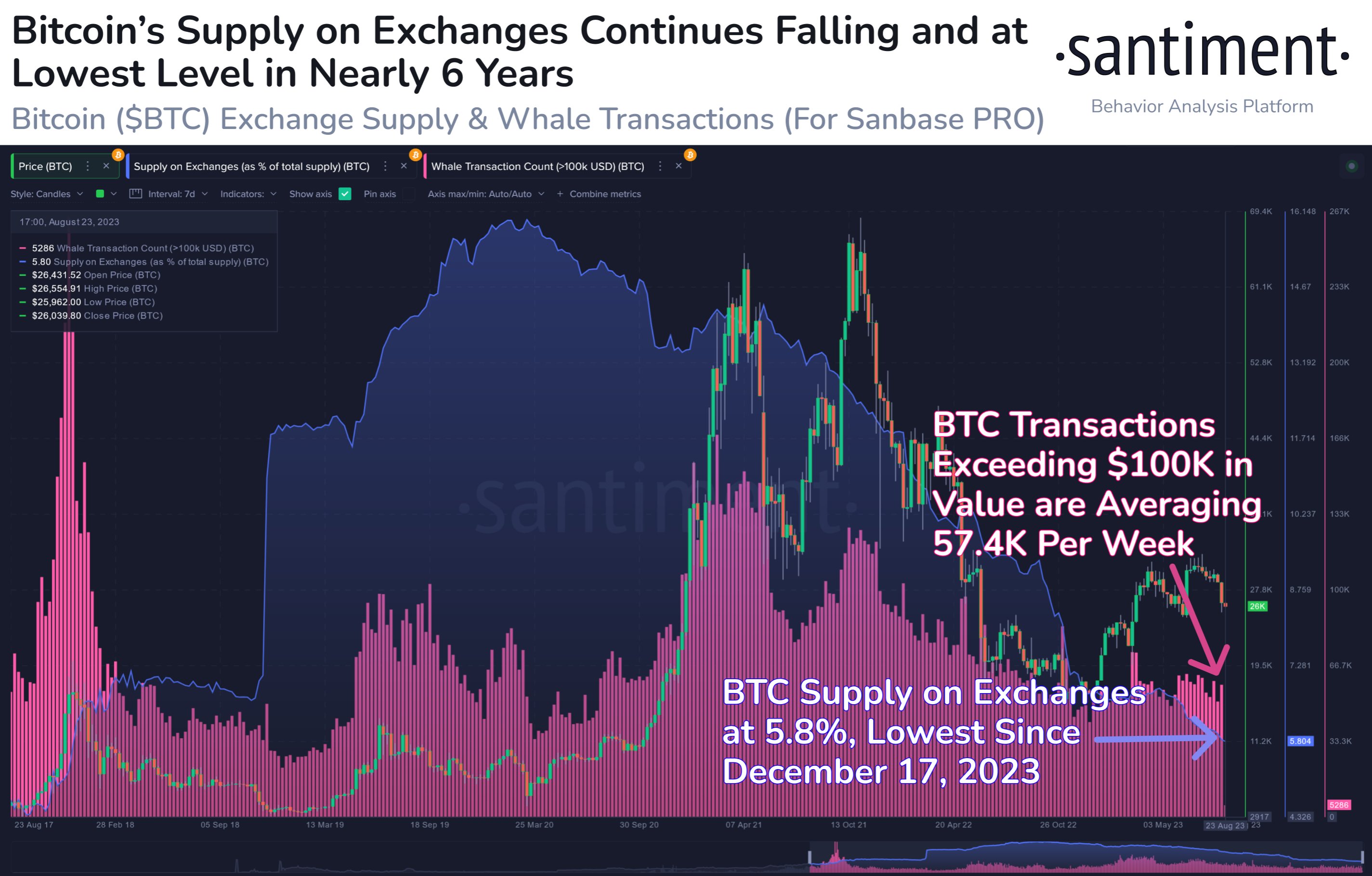

New data from crypto analytics firm Santiment shows that Bitcoin (BTC) supply on crypto exchanges is at its lowest point in more than half a decade.

According to the market information agency, this is currently only 5.8% of the crypto king’s total supply to sit on crypto exchange platforms, the lowest level since December 2017.

Santiment also notes that the major crypto assets by market capitalization are seeing decent amounts of Bitcoin whale activity.

“Only 5.8% of Bitcoin is currently on exchanges, which is officially the lowest level crypto’s highest market cap has ever been since December 17, 2017. We also continue to see reasonable amounts of BTC whale trades (57,400 per week).”

Sanitation too say that Bitcoin is currently at the forefront of being the digital asset with the highest amount of address activity.

BTC is followed by the stablecoin Tether (USDT), the smart contract platform Ethereum (ETH), layer-2 blockchain Polygon (MATIC), and the BTC alternative Litecoin (LTC), all of which have at least more than double the number of active addresses compared to other cryptocurrencies, according to Santiment.

Bitcoin is trading at $26,001 at the time of writing.

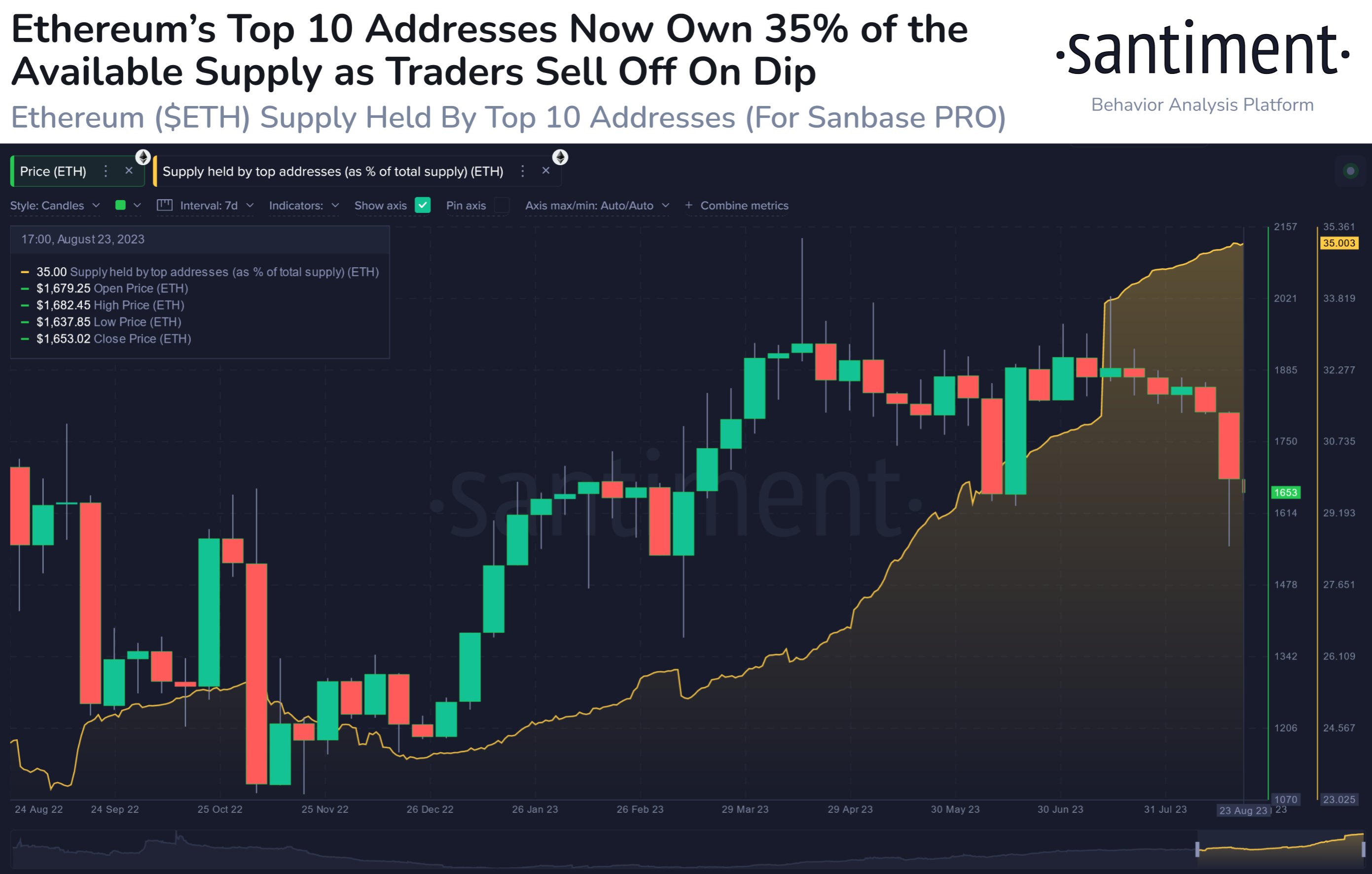

Moving on to Ethereum, the market analysis company say that the 10 largest addresses associated with the leading altcoin now hold a whopping 35% of ETH’s total supply.

According to Santiment, the increase in large address holdings is likely due to smaller investors capitulating their holdings out of fear, doubt and uncertainty (FUD) surrounding the latest dip in the crypto market.

“The ten largest addresses on the Ethereum network now control more than 35% of the available supply. This by no means means the [second-largest] assets in crypto are suddenly centralized, but it shows the capitulation of smaller traders showing FUD out of this dip.”

At the time of writing, Ethereum is worth $1,649.

Don’t miss a single beat – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Sensvector/lassedesignen