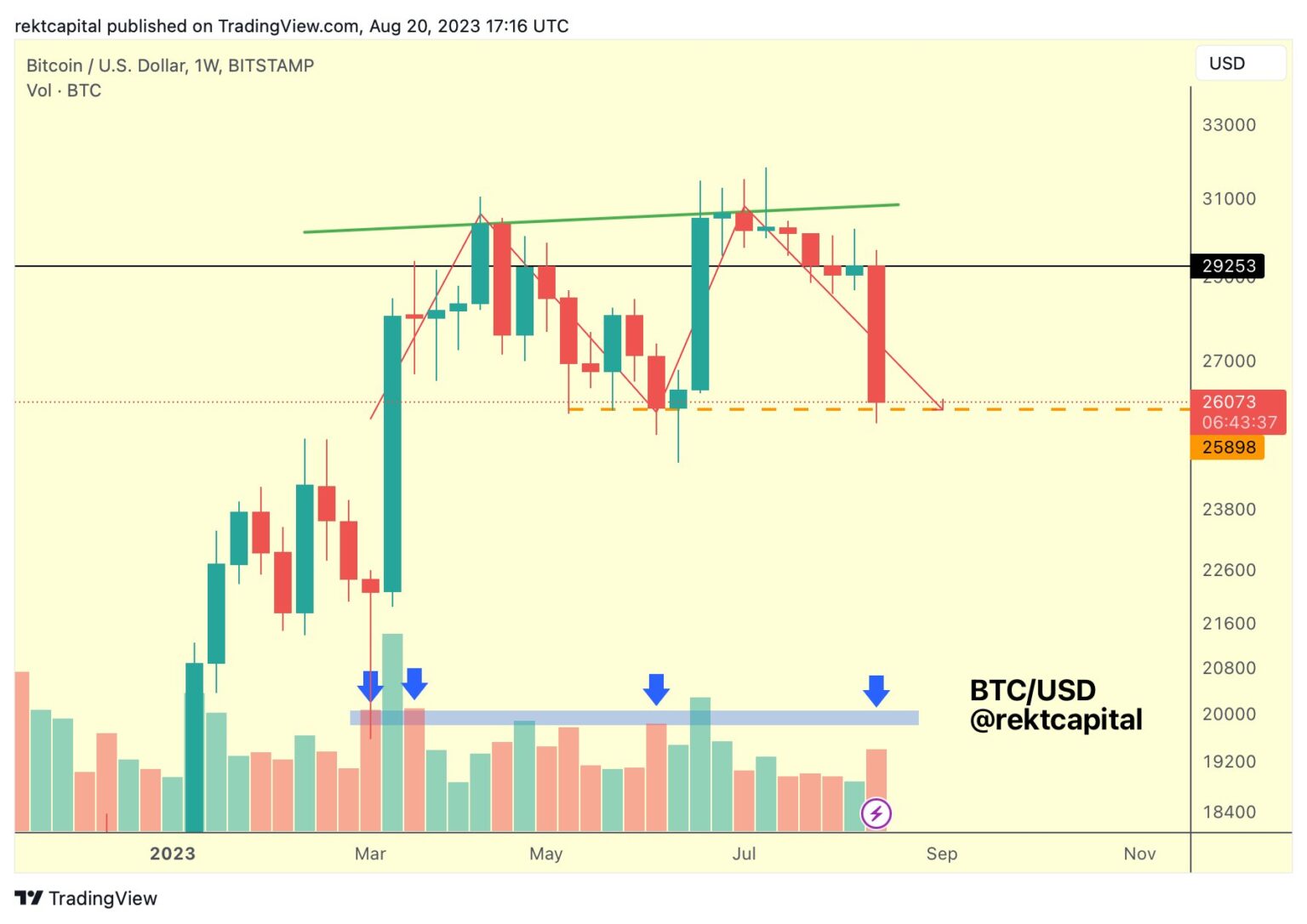

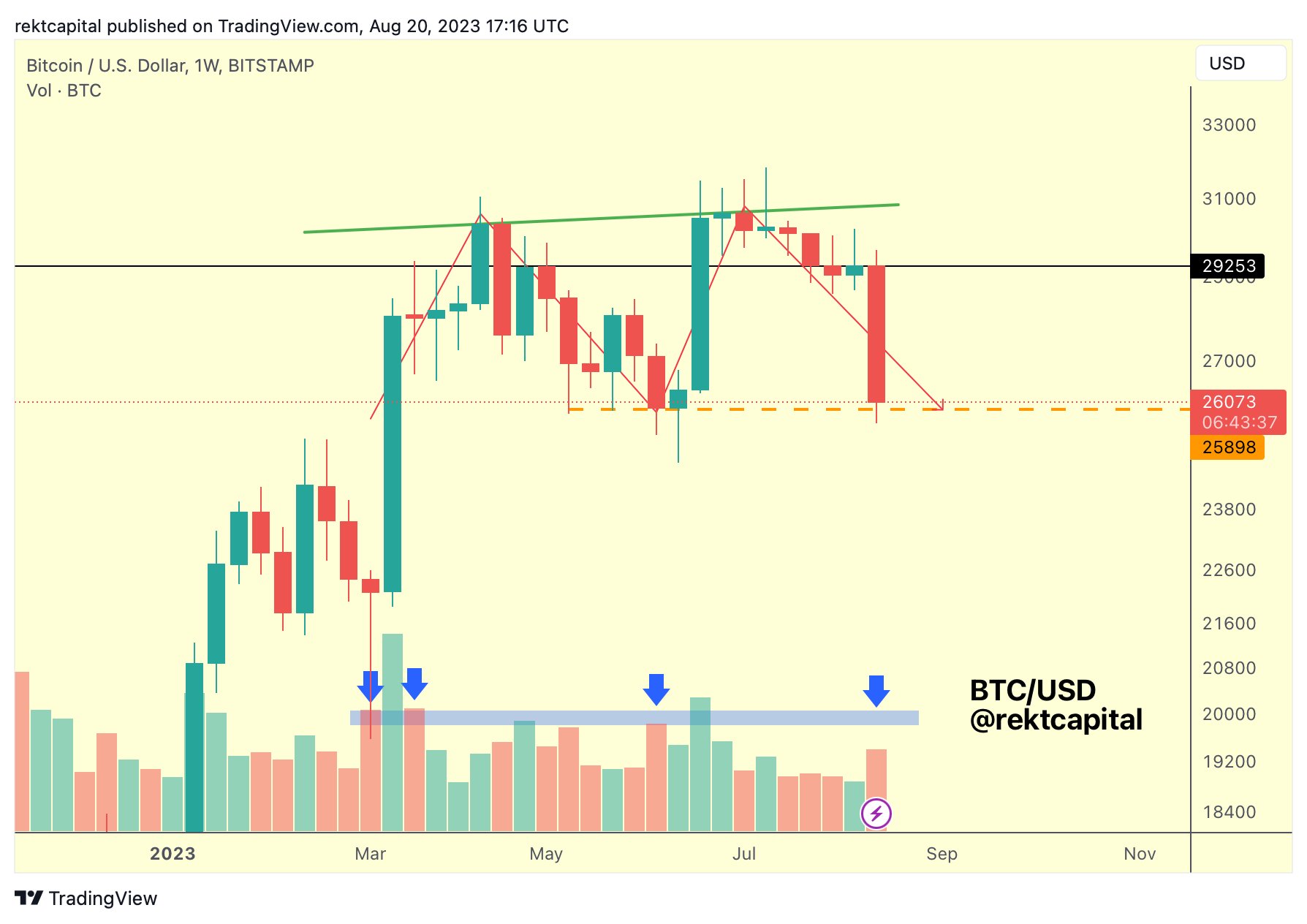

In the wake of Bitcoin’s recent price crash, analysts are brimming with speculation about the market’s next move. BTC price briefly fell to a low of $24,800 last week, and with the Bitcoin fear and greed index dropping from neutral to 38 (indicating fear), the market sentiment is palpable. Renowned analyst Rekt Capital weighed in on the situation and offered a thorough technical breakdown.

“BTC is officially at the base of the double top. The double top is complete,” says Rekt Capital. Highlighting the current fragility of the market, the analyst continues: “There will be a downward drop below ~$26,000 like mid-June. But a weekly close below ~$260.00 is what would validate the double top and begin the continuation of the outage.

While the completion of the double top has fueled bearish sentiment, there is no definitive slump yet. “BTC has completed the double top, but still no failure confirmation as BTC has ~$26,000 support,” adds Rekt Capital. The scenario becomes even more intriguing as “sales volume has increased in recent days”. The analysis shows that “selling volume should increase by about +30%” to match the selling volume Bitcoin saw during previous price reversals.

Drawing attention to Bitcoin’s volume dynamics, Rekt Capital explains, “BTC formed its higher high at ~$31,000 on rising volume. But the price formed the second half of its double top on declining volume.” While there was a spike in sales volume during the recent crash, it remains a far cry from the seller exhaustion levels seen during previous BTC reversals. analyst puts it sharply, current “selling volume should probably double” to reflect the levels that led to price reversals in March and June.

Remarkably, at yesterday’s weekly close, Bitcoin failed to maintain support above the major bull market moving averages, including the 21-week EMA, 50-week EMA, and 200-week MA. “All of these bullish momentum indicators were confirmed yesterday as lost support at the weekly close,” the analysis highlights.

How low will the price of Bitcoin fall?

In terms of future projections, Rekt Capital speculates that if the base of the double top at $26,000 is lost, it could propel a move towards $22,000. The analyst clarifies that “if we see a weekly close below $26,000 followed by a rejection of $26,000, we are likely to see a confirmed breakout of this double top.”

However, every bearish note comes with a caveat. Rekt Capital adds, “It’s very easy to get caught up in bearish euphoria… So it’s really important not to get caught up in these downside fuses (below $26,000).” And for those looking for possible bullish scenarios, the analyst has one in mind: “Even as we break out of this double top…one of the key areas is this inverted head-and-shoulders formation that we previously saw play this year.” A retest of this pattern’s neckline, roughly around USD 24,000, could signal an optimistic outlook for the major cryptocurrency.

Historical data also aids in understanding Bitcoin’s trajectory. “An 18% drawdown to $24,000 would be perfectly normal for a month in August,” the analyst shares, reminding investors that Bitcoin has often underperformed in August. Drawing parallels to 2015, Rekt Capital states that Bitcoin was also approaching a halving, losing 18% in August, suggesting history could repeat itself, especially with the next halving expected in April of next year.

At the time of writing, the BTC price stood at $26,069.

Featured image from iStock, chart from TradingView.com