NFT

Earlier this year, the new marketplace Blurred was all the rage in the NFT sector. Recent figures suggest the lending platform could create a similar buzz. However, there are real and serious risks involved in borrowing against an NFT.

Blur’s lending platform, Blend, has rapidly gained popularity since its launch just ten days ago. According to data from the Dune dashboard, users have already borrowed a staggering 51,656 ETH – equivalent to $95 million – against their digital collectibles. It is impressive that more than 3,000 individual loans have been opened on the platform to date.

Blend supports four collections

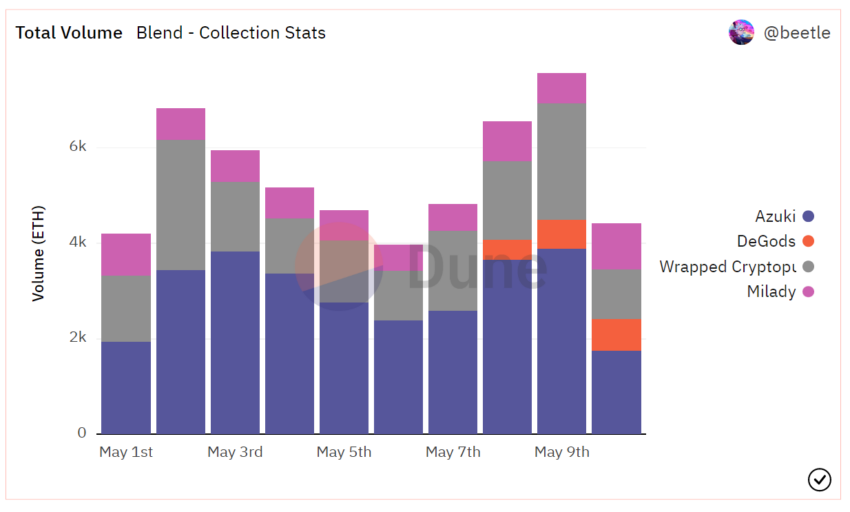

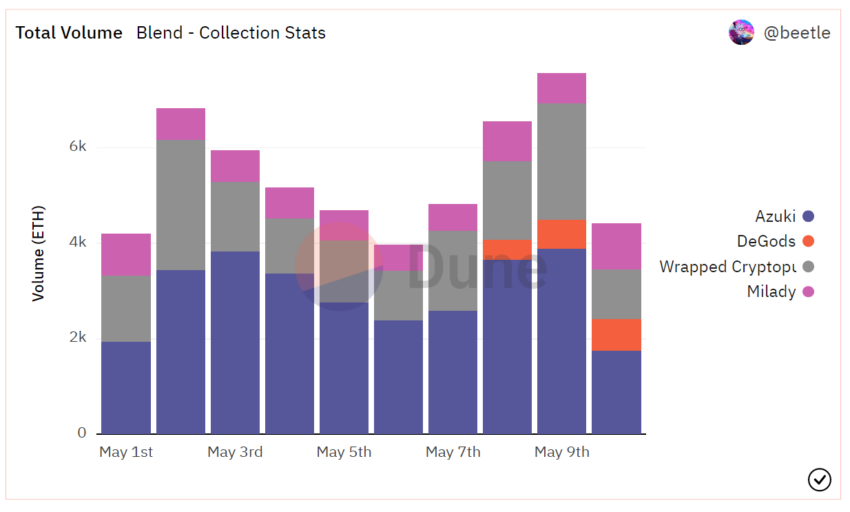

Blend currently supports loans backed by four NFT collections: Miladys, Azukis, DeGods, and wrapped versions of CryptoPunks.

Blur caused a stir earlier this year with its impact on the NFT market. Shortly after launch, it surpassed OpenSea, the king of the NFT marketplaces, with a 53% market share. Blur’s native token airdrop in Q1 2023 provided significant traction to the NFT marketplace and aggregator, resulting in a surge in Ethereum’s NFT trading volumes.

Blend, also known as Blur Lending, seems to be doing even better. Since its launch, Blur’s lending platform has rapidly outperformed competitors such as NFTfi, Arcade and BendDAO, pushing NFT lending volume to an impressive $67 million in just one week.

Blend loans alone make up a remarkable 75% of the total volume. According to Dune, the total number of loans accepted and refinanced is currently 3,045, with 922 unique lenders.

Blend is the newest player on the market. But the use of NFTs as collateral has been popular since 2021 thanks to the emergence of new platforms and the rising cost of digital assets. Prices have been more muted in more recent months. In any case, using NFTs as collateral carries serious risks for lenders.

Source: Dune

Liquidity risk

Using an NFT as collateral is similar to using other assets to finance loans. Borrowers deposit their NFT as collateral, set loan terms, and receive ETH from the lender, while the NFT remains as collateral. The borrower then repays the loan to collect the NFT. A non-repayment will result in liquidation and the lender will claim ownership of the NFT.

However, NFT lending platforms such as Blur pose a danger by allowing collectors to buy tokens without having the necessary funds. This creates liquidity risks in the future when collection floors suddenly fill up.

Liquidity risk arises when a borrower does not have enough cash to meet its financial obligations, in this case the loan.

Taking out loans on NFTs may require a margin call to avoid liquidation. A margin call occurs when the lender requests additional collateral from you to make up for the diminished value of the asset.

In 2022, traders were floored after BAYC NFT prices dropped 80% in six weeks. Many of them had overused themselves by using their Apes as collateral for taking out loans on BendDAO. Dozens of those who did faced margin calls.