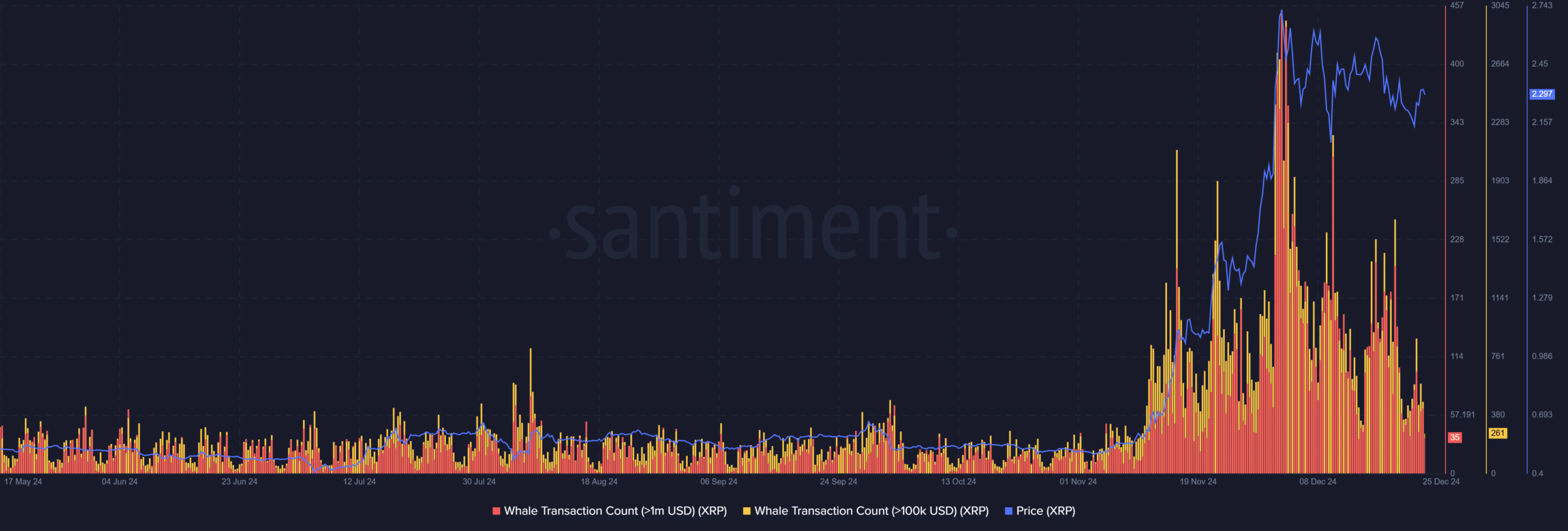

- Whale trades above $1 million indicated strategic accumulation, driving XRP’s bullish undertone.

- Price consolidated around $2.20-$2.50; a breakout could create bullish momentum

XRP recently witnessed a significant increase in whale transactions, with individual transactions exceeding $40 million.

This aggressive accumulation has coincided with a steady rise in price, indicating that institutional and high-net-worth investors are eyeing Ripple’s native token for its next big break.

As XRP moves closer to critical resistance levels, these moves are fueling speculation about whether the token is poised for a rally or merely consolidating for the next phase of market activity.

An increase in the number of transactions over $1 million

Recent data showed a notable increase in the number of XRP whale transactions, especially transactions above $1 million.

The chart highlighted two key patterns: a consistent increase in the number of large transactions and its correlation with price increases.

Transactions worth over $1 million peaked alongside a price increase, highlighting the strategic role of whales in XRP market dynamics.

Source: Santiment

Interestingly, the value of whale transactions has also soared, suggesting smaller institutional players are joining the fray.

The synchronized activity between these levels indicates a robust accumulation phase, with whales driving liquidity and stability during price increases.

Such behavior often indicates confidence in long-term price potential, as large investors rarely make impulsive trades, further reinforcing XRP’s current bullish undertone.

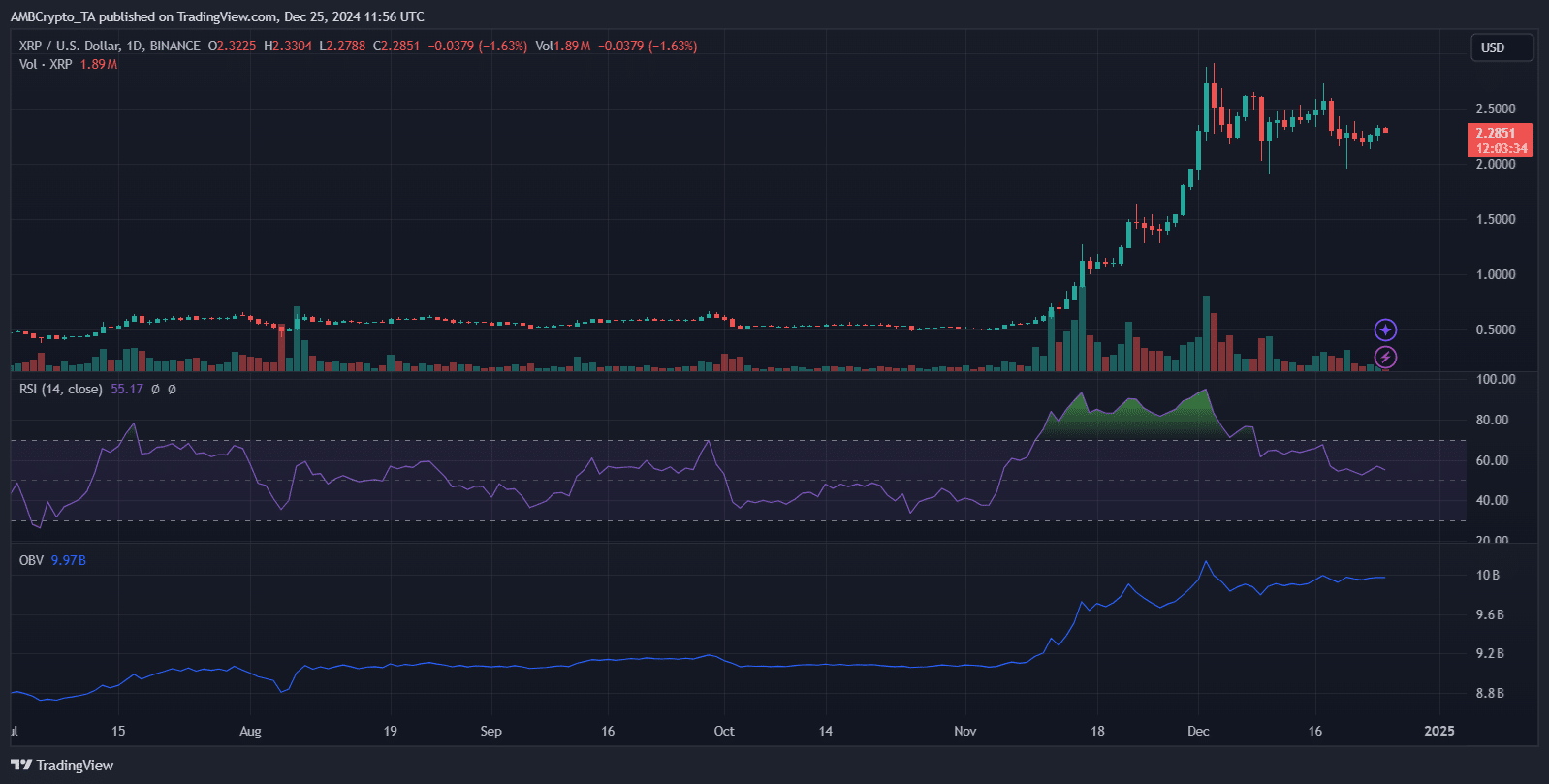

Price movement and technical overview

Source: TradingView

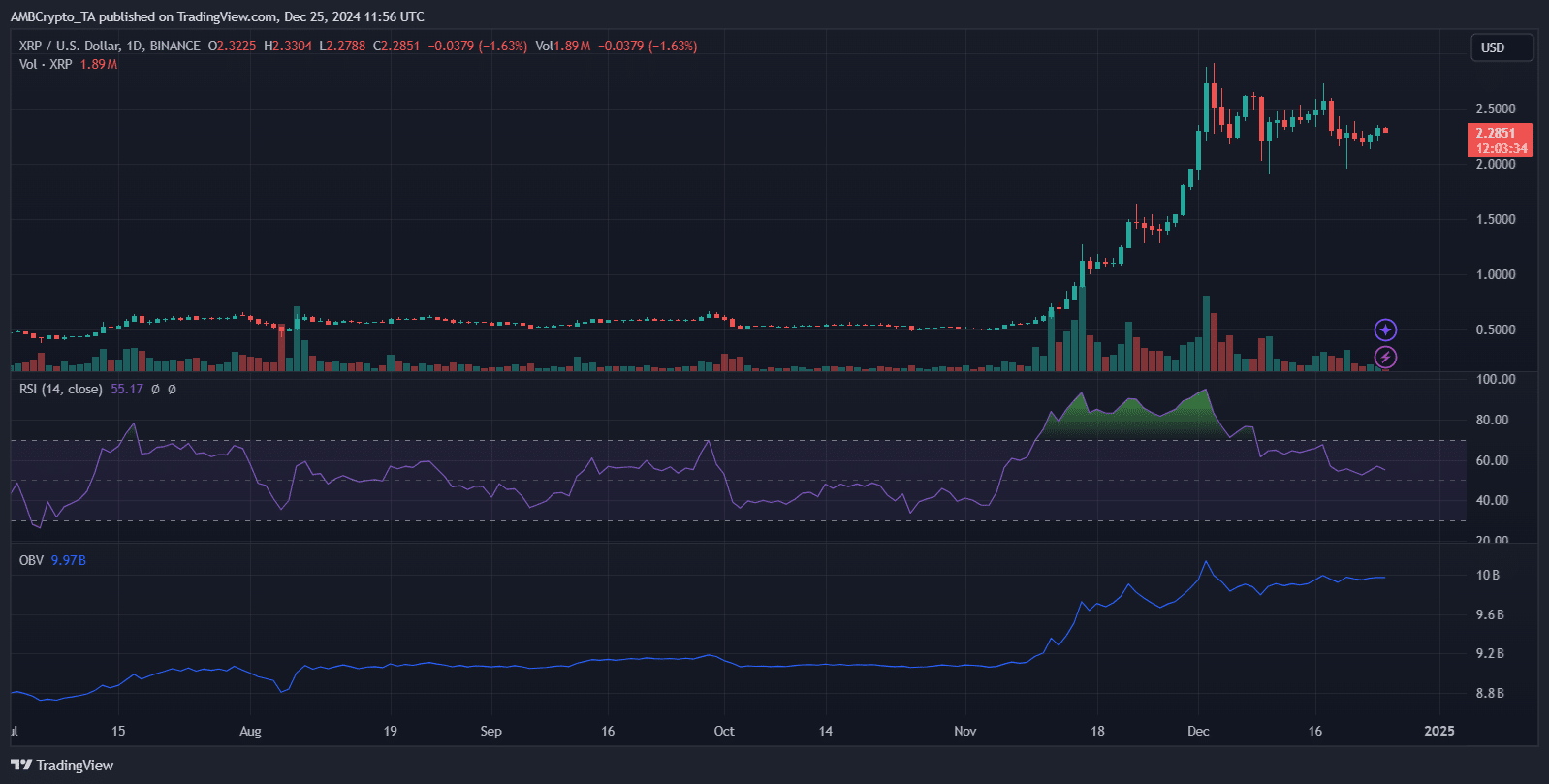

XRP was trading at $2.2851 at the time of writing, reflecting an intraday decline of 1.48%. The RSI at 55.17 indicated neutral momentum, indicating neither overbought nor oversold conditions.

The OBV was 9.97 billion, showing continued accumulation despite price consolidation. Volume trends pointed to weakening buying momentum as daily volumes decline.

The candlestick pattern indicated the potential for further consolidation below $2.50, with support near $2.20 acting as a critical zone.

The breakout resistance remained at $2.50, a level tested several times without a decisive breakout. The moving averages remained bullish, indicating a long-term upward trend.

However, the reduced volatility suggested that whales could stabilize prices, waiting for a catalyst for the next directional move.

Market drivers and potential retail implications

XRP’s price dynamics are influenced by institutional activity and recent legal clarity, especially after the victory over the SEC.

The accumulation of whales, evidenced by high OBV levels and moderate price volatility, indicates controlled supply. Macroeconomic factors, including market trends and regulatory updates, could catalyze the next step.

For retail investors, continued consolidation around $2.20-$2.50 signals cautious sentiment, which may deter short-term traders.

The RSI neutrality implies limited immediate upside potential, while lower volumes reflect lower retail participation.

Read XRP’s 2024-2025 Price Prediction

A decisive break above $2.50 could reignite bullish momentum, but failure to hold support at $2.20 could lead to a sell-off.

Retail investors should closely monitor volume spikes and news events to anticipate potential volatility and adjust their strategies accordingly.