Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

XRP has emerged as one of the strongest performing assets in recent weeks, which mounts broader market volatility and macro-economic uncertainty. After a rough start of the month, XRP has returned strongly, so that a profit of 32% was placed compared to the low point of last Monday. The resilience of the token has attracted the attention of analysts and investors because it continues to perform many of his colleagues in the Altcoin space.

Related lecture

Much of this strength is attributed to the growing optimism that macro -economic tensions – in particular around global trade policy and inflation – can alleviate. If this trend continues, XRP may be well positioned to lead the next part of the crypto recovery.

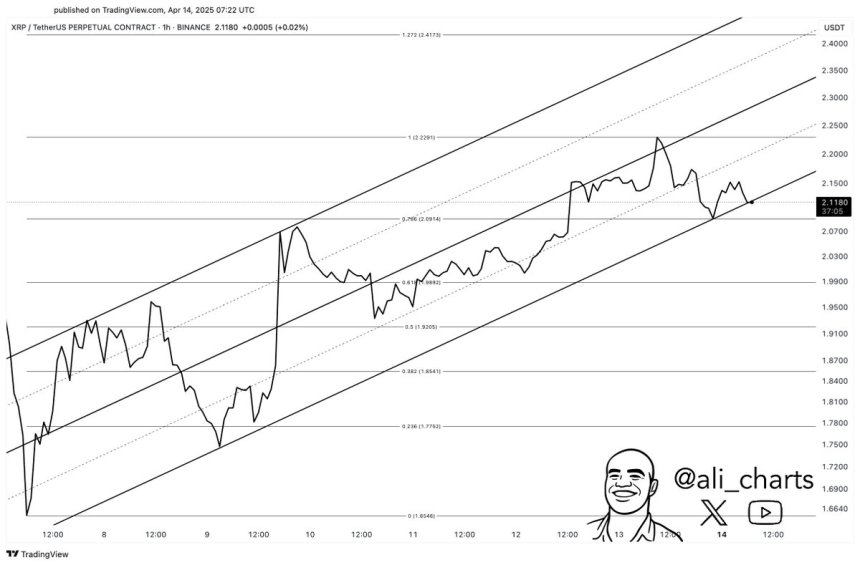

Top Crypto analyst Ali Martinez added to the bullish story and shares a technical analysis that shows that XRP is currently being traded within a rising triangle – a pattern that is usually associated with excess outbreak. Martinez identifies $ 2.22 as the critical resistance level to view. If bulls can push over that line, this can open the door to a switch to higher price levels.

With momentum structure and technical indicators that align, XRP seems to be approaching a crucial moment. The next step can determine whether this rally has more room to run – or if the resistance will block the outbreak.

XRP Bulls Eye Breakout as a market is looking for direction

XRP bulls arouse trust because the market shows signs of stabilization after weeks of volatility. With global tensions still not resolved, the wider crypto environment remains uncertain – but XRP has succeeded in keeping its land and acting consistently above the level of $ 1.80. These steady performance have analysts optimistic that token could prepare for a strong movement higher, especially if the macro -economic pressure will start to relieve in the coming weeks.

The anticipation of potential monetary policy shifts and the expectations of cooling inflation can create a more favorable environment for risk-to-assets such as XRP. Some market participants bet if clarity returns to the world economy, assets with a high conviction will lead the leadership and XRP is firmly on that list.

However, not all analysts agree that the rally will go smoothly. A more cautious picture suggests that the market may still need a correction to lay a solid foundation. This scenario would hold a dip under the current levels to set a new demand zone before the next leg starts.

In the meantime, Martinez identified An important pattern that unfolds: XRP is trading within a rising triangle – a bullish continuation setup. According to Martinez, the resistance level of $ 2.22 is the crucial threshold. A confirmed outbreak above this level could cause an increase to $ 2.40, making it possible to be the start of a wider upward trend.

While traders keep a close eye on the price promotion, the ability of XRP to keep important support and testing the top of his triangle can determine his next large move. In the coming days, it may appear to be crucial when shaping the future in the short term of this controversial Altcoin.

Related lecture

Daily price promotion leans Bullish after reclaiming important averages

XRP is currently traded at $ 2.14 after a strong movement in which token has reclaimed both the 200-day advancing average (MA) for $ 1.89 and the 200-day exponential advancing average (EMA) at $ 1.95. This bullish development indicates a possible trend shift, because XRP bulls now have a momentum benefit in the short term. Holding above these important indicators is essential for maintaining upward pressure and building trust in a broader recovery.

The next major obstacle is in the $ 2.60 daily food zone. A clean break above that level could open the door for a follow -up that focuses on higher resistance zones. For the time being, Bulls has to maintain a strong purchase interest and volume to test that level and ultimately break it.

However, disadvantaged risks continue to exist. If XRP does not have the psychological support of $ 2.00, a deeper correction can unfold. This would invalidate the recent outbreak and possibly send tooth back to the $ 1.80 zone or lower, depending on wider market conditions.

Related lecture

For the time being, all eyes are aimed at whether XRP profit above $ 2.00 can consolidate and retain sufficient momentum to challenge the next supply area. Traders must monitor the volume and broader market instructions for confirmation.

Featured image of Dall-E, graph of TradingView