Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

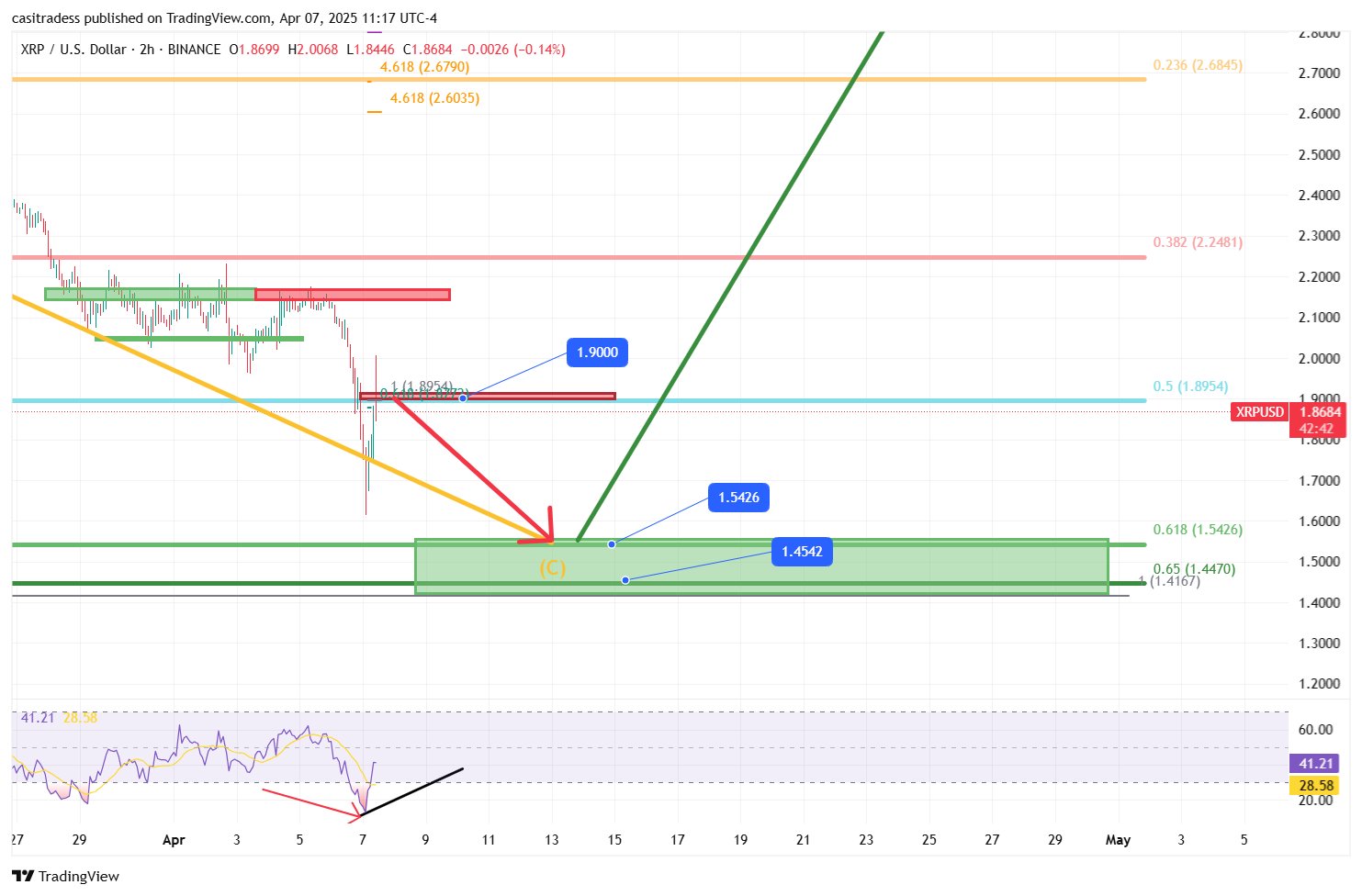

Crypto -analyst Casitrades (@Casitrades) published a new XRP analysisEmphasized the intraday dive from yesterday to around $ 1.61 after the widespread level of $ 1.90 was worked. “At night we saw $ 1.90 breaking off and price washed up to around $ 1.61,” the analyst noticed via X, and pointed out that this sudden decrease “new extremes on the RSI over the market” produced and came within a striking distance of a previously identified support zone.

XRP to reach $ 13 in April?

Since the crash on Monday, XRP has recovered considerably, but the analyst now regards $ 1.90 as “great resistance on this point” and underlines that the breakdown of the 0.5 Fibonacci racement near $ 1.90, while it is disappointing for bulls, is still consistent with a larger corrigive scenario.

Related lecture

The graph itself reveals a continuous corrective Golf 2, as CasiTrades claim: “I believed for a while that we were in a Macro Golf 2.” He emphasizes that the infringement of the support level of $ 1.90 confirms that the corrective pattern “makes more than it invalid.” Below $ 1.90 is the next crucial pivot, according to the graph, the “Golden .618 retracement”, marked at around $ 1.55.

This area is part of a wider green support band that extends from around $ 1.45 (the .65 retracement) to $ 1.55 (the .618 retracement). Casitrades suggest that the price action that arrives in this zone is perhaps the turning point that XRP puts on a path to higher soil. “It is exactly what the type of Golf 3 sets that breaks through the attreed,” she said, also noticed, “The next Golf should easily break those resistors. Be prepared that this is happening very quickly.”

The relative strength index on the CasiTrades graph shows that extremely sold -over territory reached in the midst of yesterday’s crash, which fallen below 20 before he recovered to the Low 40s. That struiting, which corresponded to the price that was returned from $ 1.61 to the $ 1.90 region, underlines the importance of the short -term retracement.

Related lecture

Nevertheless, the analyst claims that every final bullish confirmation now depends on whether XRP can stabilize around $ 1.55 if it continues to glide. “If we do a soil near $ 1.55, it reinforces the Bullish Case for that big April goals-er is still $ 8 to $ 13”, Casitrades, who repeated her conviction that a successful Golf 3 extension above earlier highlights could generate a fast climb in the multi-dollar range.

Resistance at $ 1.90 remains at the front and central for traders in the immediate term, whereby Casitrades notes that “$ 1.90 – resistance test – is now taking place.” She believes that if the price does not stop above that threshold with a retest, XRP will probably continue its descent to the $ 1.55.

From there, the graph suggests a potential golf domination that, if confirmed, could yield one of the most important pimples of this cycle. “I still believe that this could be one of the most important months XRP prints this cycle,” added Casitrades, which underlines the high bet around 0.618 FIB level Beer $ 1.55 and the possibility of a new bullish impulse that forms in the near future.

Whether XRP can regroup and the ceiling of $ 1.90 can be switched on after being immersed to the golden bag, the central question remains. At the time of the press, XRP traded at $ 1.86.

Featured image made with dall.e, graph of tradingview.com