In this market uncertainty, XLM, the native token of Stellar, Beerarish and it is ready for a huge price decrease. These Bearish front views are further supported by intraday traders, who seem to bet strongly on short positions, as reported by the on-chain analysis company Coinglass.

The strong bets of traders on short positions

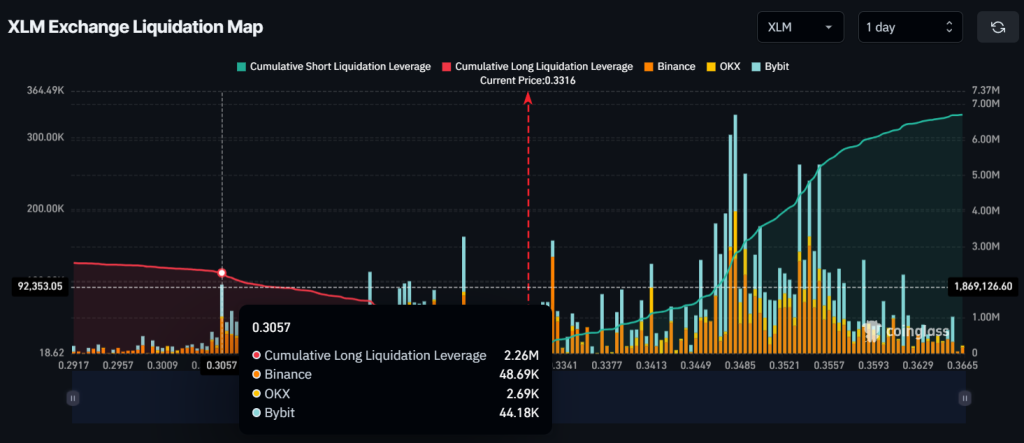

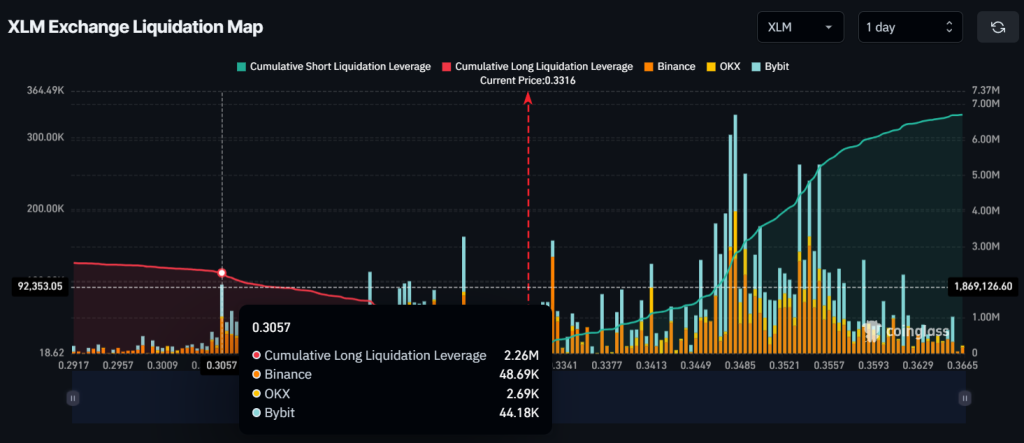

Today, February 6, 2024, the chains metric XLM Exchange Liquidation Map revealed that traders with long positions are exhausted and are currently being used too much at the level of $ 0.3057, with $ 2.26 million in long positions. In the meantime, traders with short positions dominate, because they are used too much for $ 0.355, with $ 5.25 million in short positions at this level.

However, these millions of dollars in positions will be liquidated if the market sentiment shifts and the price moves in both directions. This data on the chain clearly shows that there is no power on the side of the bull, and the bears are those who lead the XLM.

The possible reason behind this negative perception is the Beerarish price action and the current economic tensions between the United States, Mexico, Canada and China.

XLM technical analysis and the coming level

According to the technical analysis of experts, XLM has formed a bearish -reverse cup and traded the price action pattern on the daily period and is on the edge of a support or neckline drop.

Based on the recent price promotion, if XLM does not hold this level or breaks the neckline and closes a daily candle below the level of $ 0.32, there is a strong possibility that it could fall by 40% to $ 0.20 -level to reach in the future.

Despite this Bearish price action, it is still being actively traded above the 200 exponential advancing average (EMA) on the daily period, indicating that XLM is in an upward trend.

Current price momentum

XLM currently acts almost $ 0.33 and has experienced a price fall of more than 7.50% in the last 24 hours. During the same period, however, the trade volume fell by 30%, which indicates a fear of further price decreases.