- Trump-supported WLFI sold Ethereum with losses and aroused doubts about institutional confidence in ETH.

- Despite Eric Trump’s approval, the 46% drop from Ethereum indicates a potential retreat of high-profile crypto-backers.

In a striking hinge, Donald Trump-connected World Liberty Financial (WLFI) has discharged a large part of his Ethereum [ETH] Holdings – with a remarkable loss.

This dramatic shift follows the earlier claim of Eric Trump that it was a “great time” to buy ETH. His statement led shortly before institutional interest.

The sharp decline of Ethereum, however, has brought WLFI’s focus since February, calling on questions about market timing, political influence and gaining trust in prominent crypto supporters.

Ethereum’s Dia nods since Eric Trump

Source: X

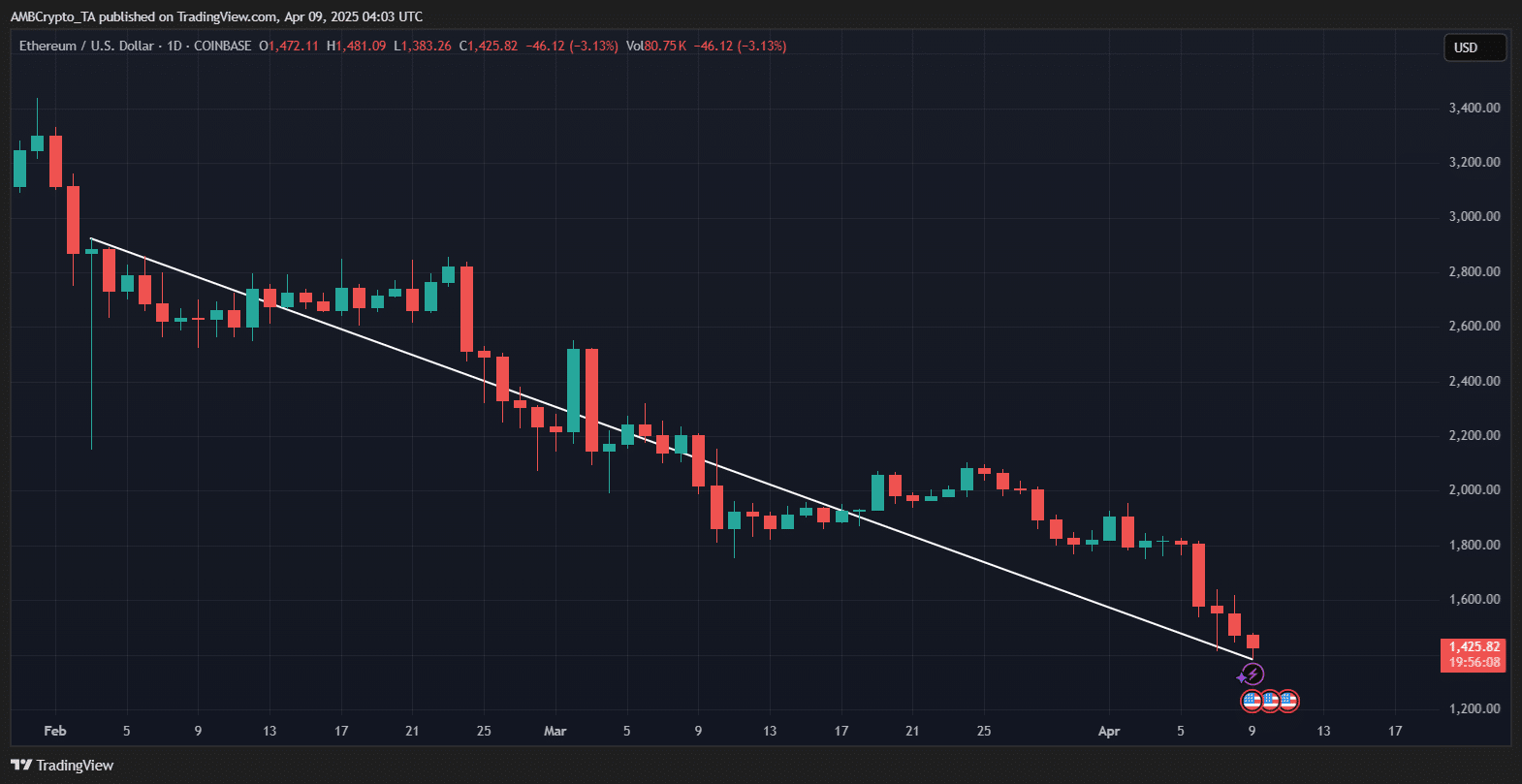

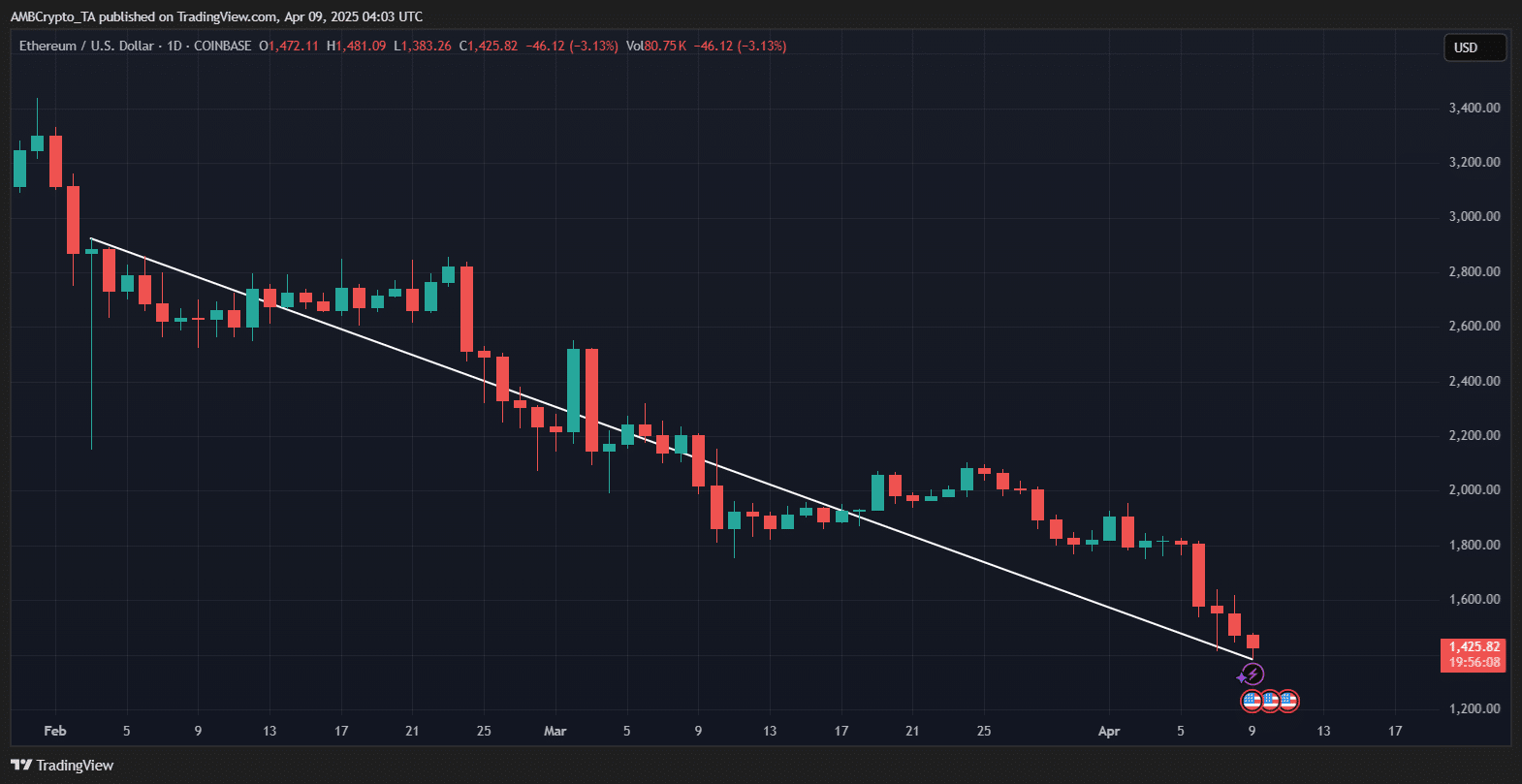

On February 4, Eric Trump approved Ethereum via a viral post then coincides with almost $ 3,000 together with ETH trade. Since then, the price has fallen around 46%and fell to around $ 1,425 at the time of the press.

Source: TradingView

As the graph shows, ETH has difficulty recovering from a consistent downward trend, which is stimulated for short optimism invalidly by the approval of Trump.

The timing of the exit of WLFI only feeds speculation that can thin institutional support faster than expected.

WLFI’s movement is in contradiction with Trump’s crypto -ethics

Despite the radiant approval of Eric Trump, Trump has since sold tens of millions of Ethereum with a steep loss.

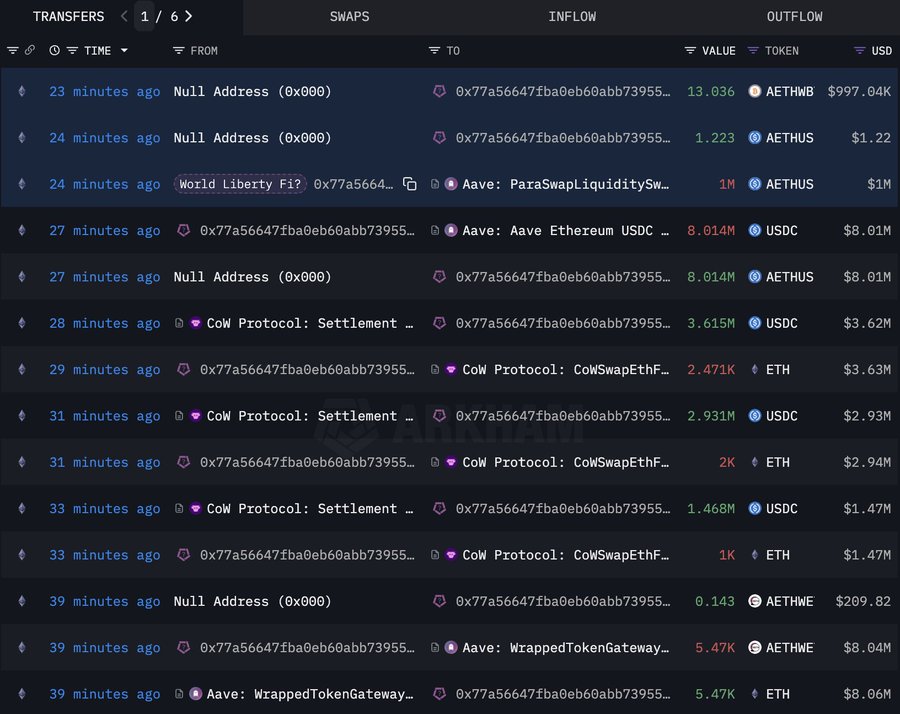

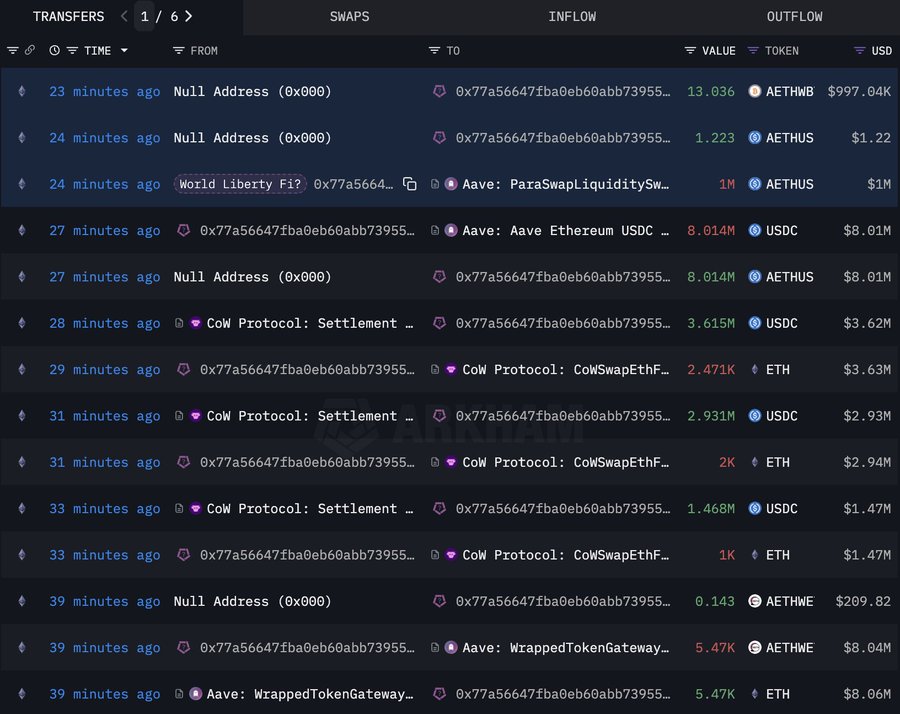

Data of Arkham Intelligence Shows WLFI has loaded 5,471 ETH for $ 1,465, only a few minutes before the time time – far below the average purchase price of $ 3,259.

Source: Arkham

The movement emphasizes a growing decoupling between public crypto-boosterism and positioning behind the scenes.

For investors who took Trump’s tweet on nominal value, the silent exit of WLFI feels less as conviction and more as capitulation.

Trump-linked wallet quietly back

The sale of WLFI reflects a wider trend of recordings of crypto-assets linked by Trump.

Only two days ago, $ 30 million in Melania tokens, bound to community funds, was mysteriously moved and is now being sold without an explanation. This situation is more than just a price problem for Ethereum – it is a reputation – challenging.

While prominent figures such as the Trump family are reducing their crypto companies, it raises critical questions. Is Institutional Interest in ETH blur, or was trust in it never fully established?