This article is available in Spanish.

Chainlink (LINK) has experienced a significant price increase, which analysts attribute to its add-on acquisition of World Liberty Financial (WLFI) and rumors of a brewery partnership with Cardano.

Related reading

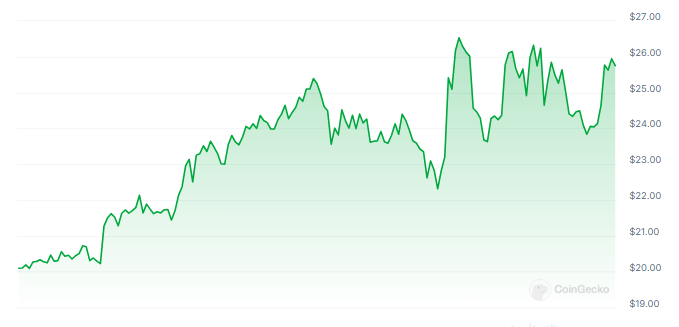

Chain link could be off to a good start as the crypto token was able to make a big run that pushed the coin from all-time lows to over $26 per coin.

Chainlink 30% price increase

Analysts said Chainlink has successfully positioned itself in the blockchain landscape after breaking out of the slump that saw the token at its lowest level this year and gaining momentum to surpass the March 2024 high of $22.87.

Data showed that the crypto token’s price skyrocketed by 40%, reaching $26.85 per coin. The come-from-behind rally also pushed the market cap to nearly $17 billion. Meanwhile, LINK was 30% up in the past seven days, Coingecko data shows.

Market observers noted that LINK’s gains to $26.87 have pushed the token past the $22.87 resistance level, which some analysts say could evolve into a very bullish state.

The cup-and-handle pattern method showed that there is a good chance that Chainlink would reach its target of $37, which one analyst explains:

“The profit target for this pattern is calculated by measuring the depth of the cup and projecting the same distance upwards from the breakout point.”

WLFI acquires more tokens

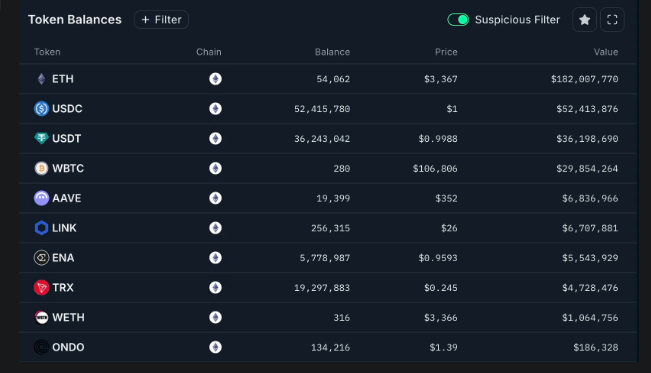

One of the reasons crypto analysts see driving Chainlink’s price in an upward direction is Trump-affiliated WLFI, which has purchased a significant number of tokens.

According to Nansenapproximately $4.6 million worth of LINK tokens was acquired by WLFI, boosting their Chainlink holdings to over $6.6 million worth of tokens.

Some analysts raised the possibility that the U.S. Securities and Exchange Commission (SEC) could approve a Chainlink ETF if an application is filed. Trump’s cryptocurrency policies could positively impact these tokens.

Additionally, data revealed that WLFI owns $179 million worth of Ethereum tokens, along with other assets such as USD Coin, Tether, Wrapped Bitcoin, AAVE, Ethena, and Tron. It is estimated that WLFI has a portfolio worth more than $322 million.

Now that the board is very much underway, I will be focusing deeply on three major themes for Cardano this year:

1) Bitcoin DeFi on Cardano (market is 4 times bigger than Ethereum and Solana combined)

2) Working on scalability 24/7, including Leios

3) From Cardano a…— Charles Hoskinson (@IOHK_Charles) January 18, 2025

Related reading

Possible Cardano partnership

Another factor that has contributed to Chainlink’s price increase is the rumor that Cardano will have a partnership agreement with the token.

None other than Cardano founder Charles Hoskinson hinted at the potential cooperation is ongoing and says they are looking to build more partnerships this year.

According to Hoskinson, one of his goals this year is to make Cardano “a peninsula, and not an island.”

“Integrations, integrations, integrations. A meeting with Chainlink is already in the books,” the Cardano founder said in a message.

Featured image from CoinFlip.tech, chart from TradingView