- The price of BTC was about to fall below the realized price-to-vibrance ratio.

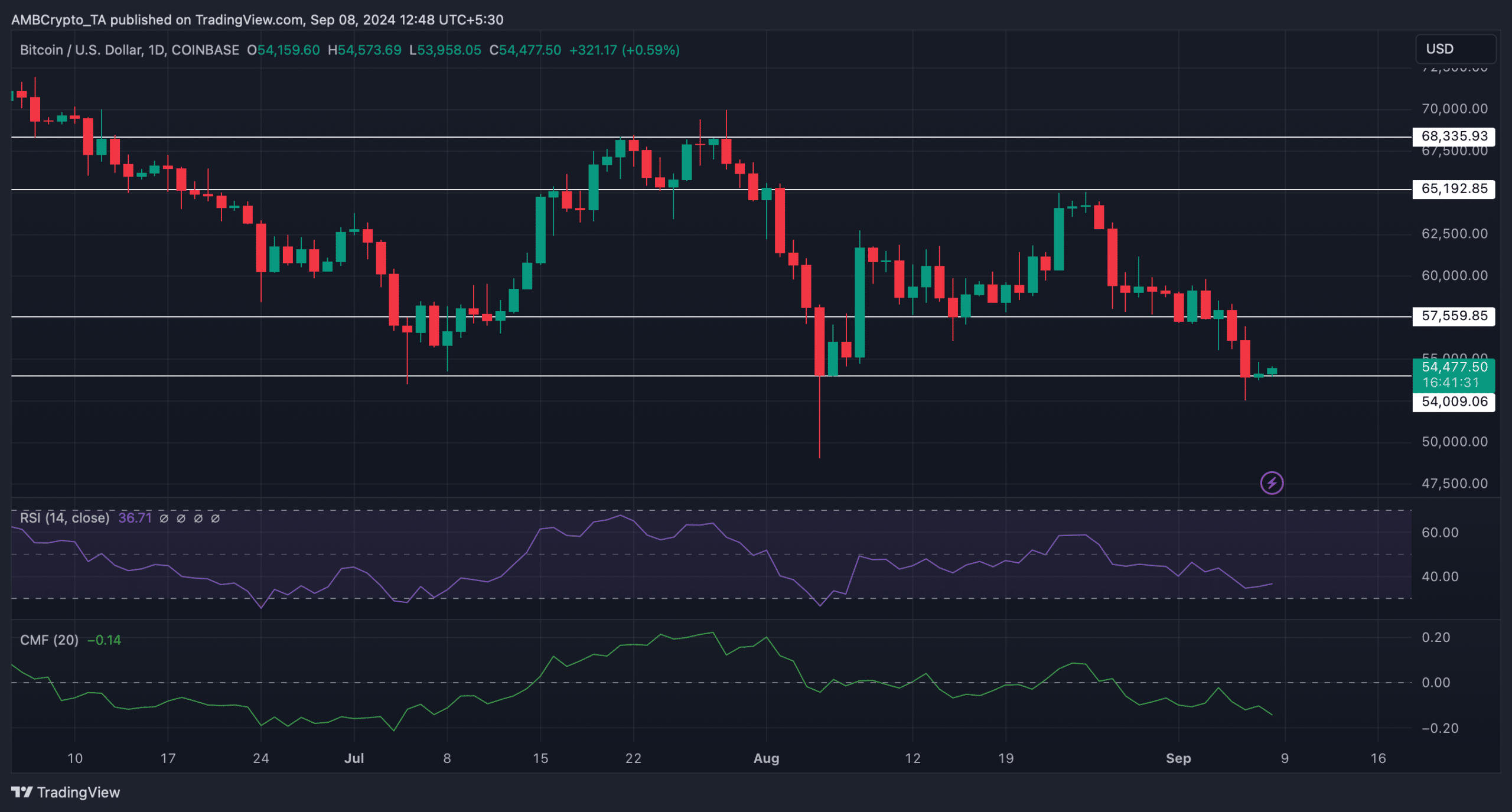

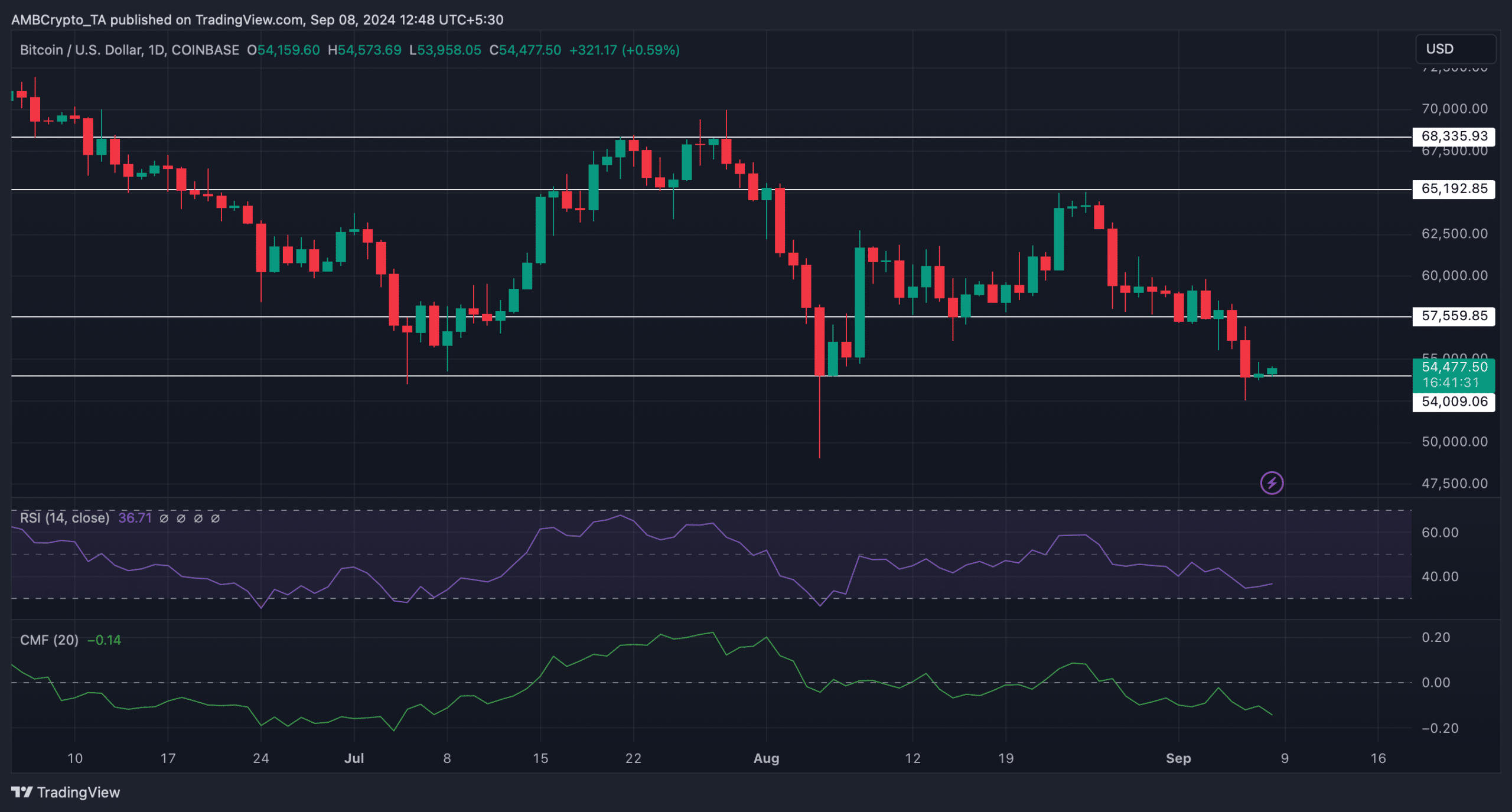

- The coin was testing a major support level at the time of writing.

Bitcoin [BTC] Investors have been struggling for quite some time as the king coin continued to lose its value. In fact, a recent analysis points to a development that pointed to a bigger price drop in the coming weeks.

Let’s take a closer look at what’s going on with Bitcoin.

Why Bitcoin Could Fall to $31,000

According to CoinMarketCap’s factsthe royal coin witnessed a price drop of almost 7% last week. The past 24 hours have also been bearish as the price of BTC declined marginally.

At the time of writing, BTC was trading at $54,306.75 with a market cap of over $1 trillion.

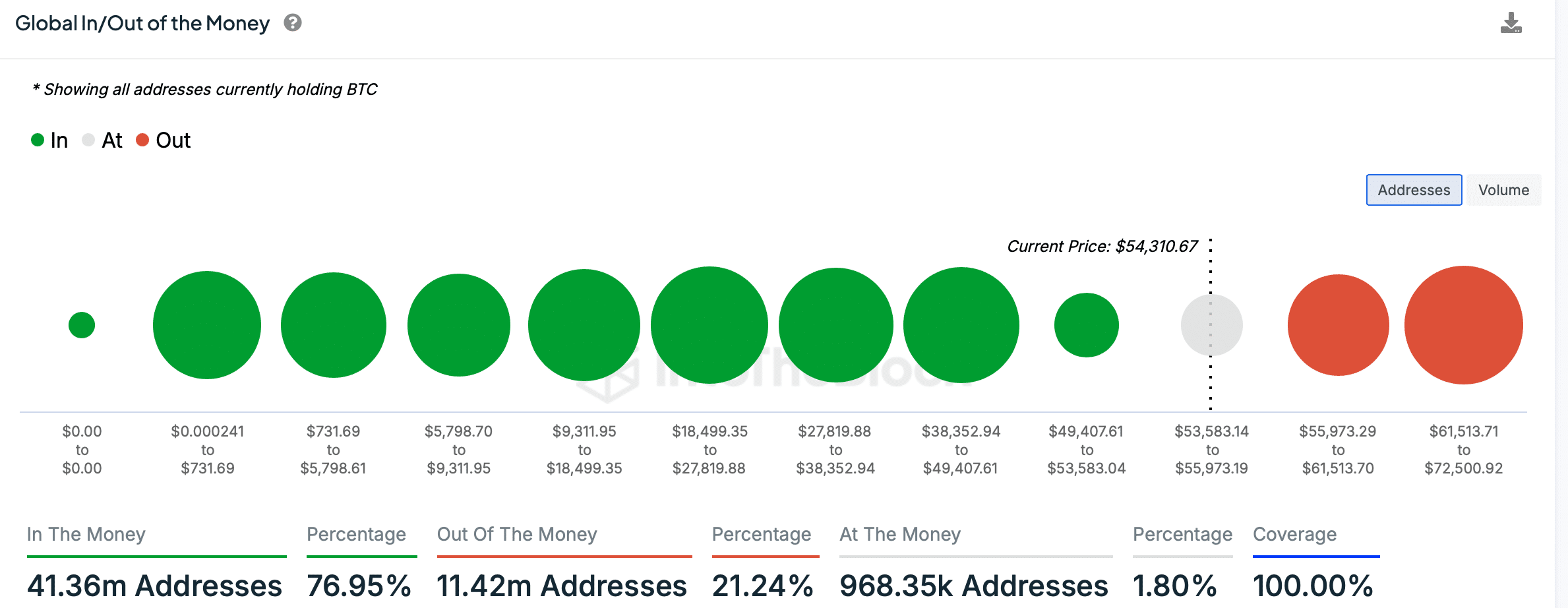

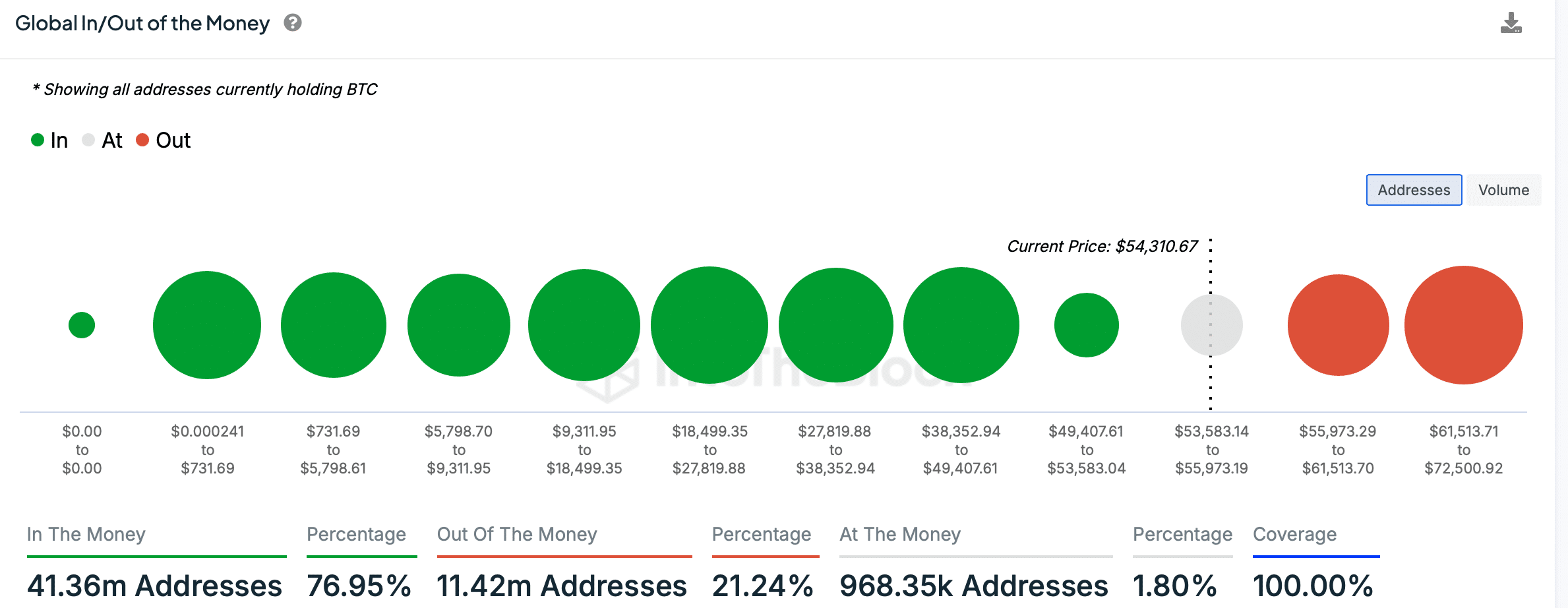

A look at IntoTheBlock’s data revealed that after the last price correction, over 41 million BTC addresses made gains, accounting for 77% of the total number of Bitcoin addresses.

Source: IntoTheBlock

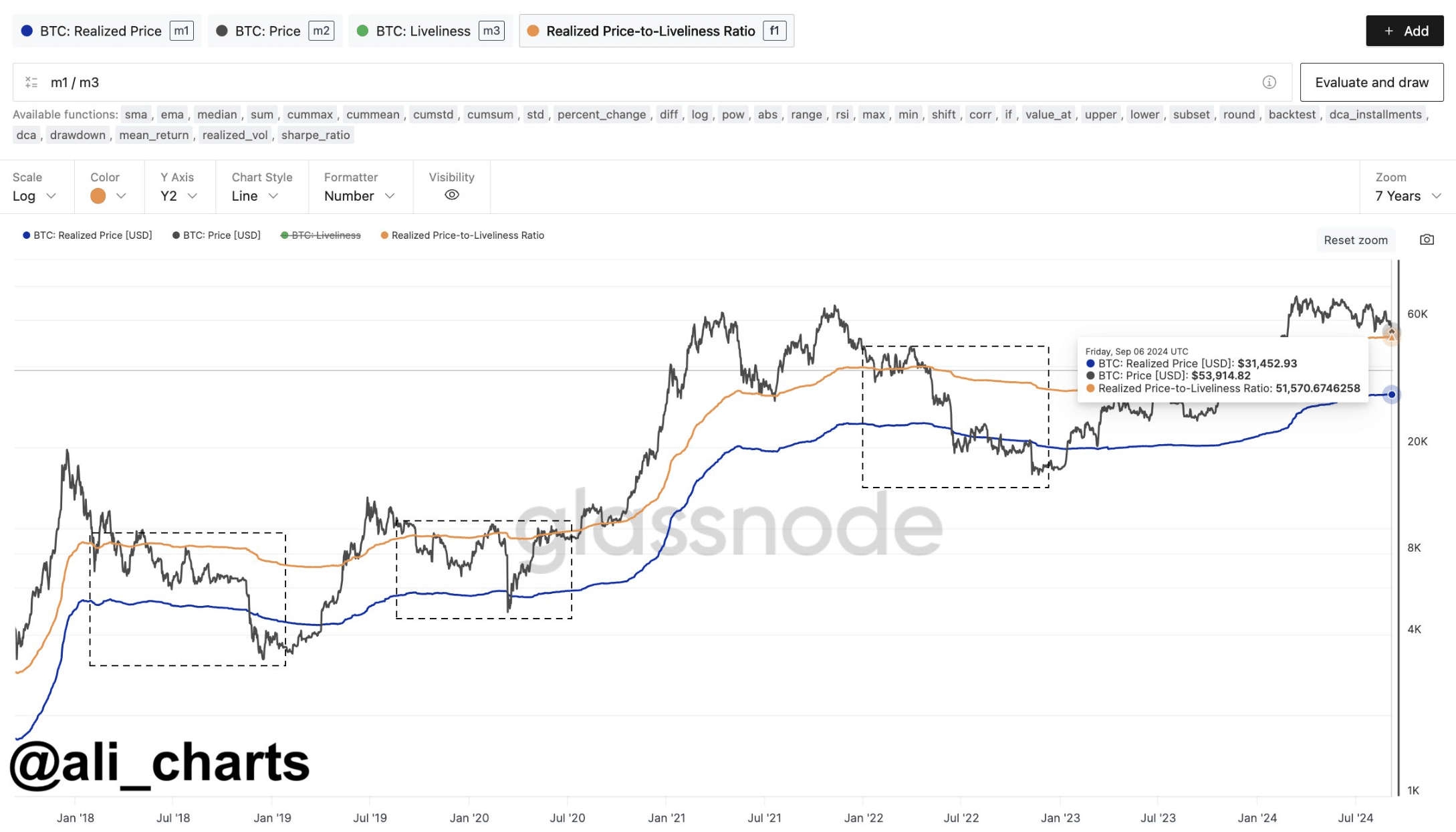

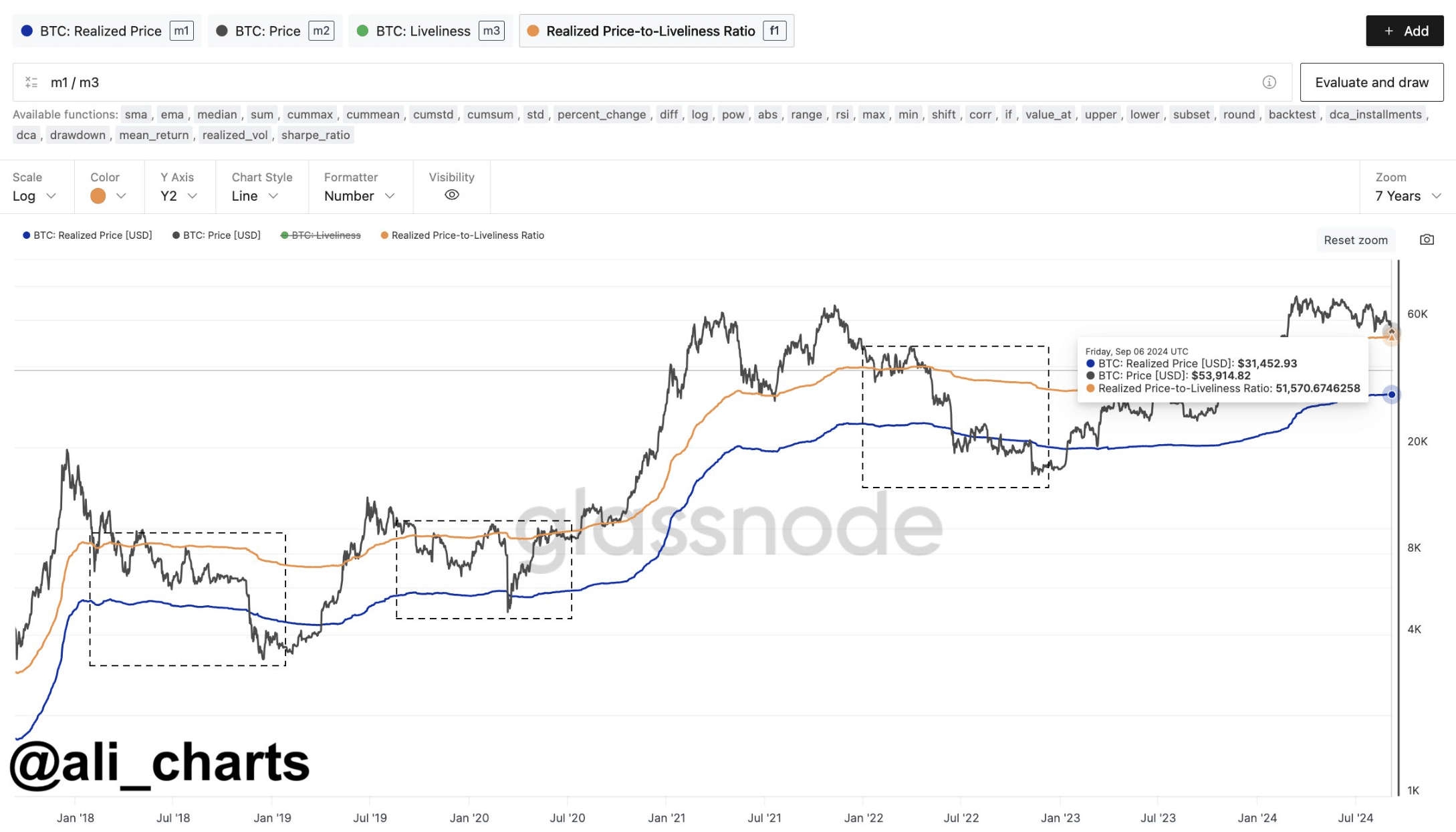

In the meantime, Ali, a popular crypto analyst, posted tweet highlighting a notable difference. The tweet talked about the relationship between the price of BTC and the realized price-to-vibrancy ratio.

Historically, every time the price of BTC falls below the realized price-to-vibrance ratio, it has led to further price declines.

To be precise, a slip below that benchmark pushes BTC down towards the realized price. Such incidents occurred in 2019, 2020 and 2022.

At the time of writing, such a bearish crossover was taking place. This suggested that traders can expect another drop in BTC to its realized price, which stood at $31.5k at the time of writing.

Source:

The likelihood of BTC remaining bearish

Since it seemed likely that BTC would fall if history repeats itself, AMBCrypto checked other data sets to find out what they suggested regarding a correction.

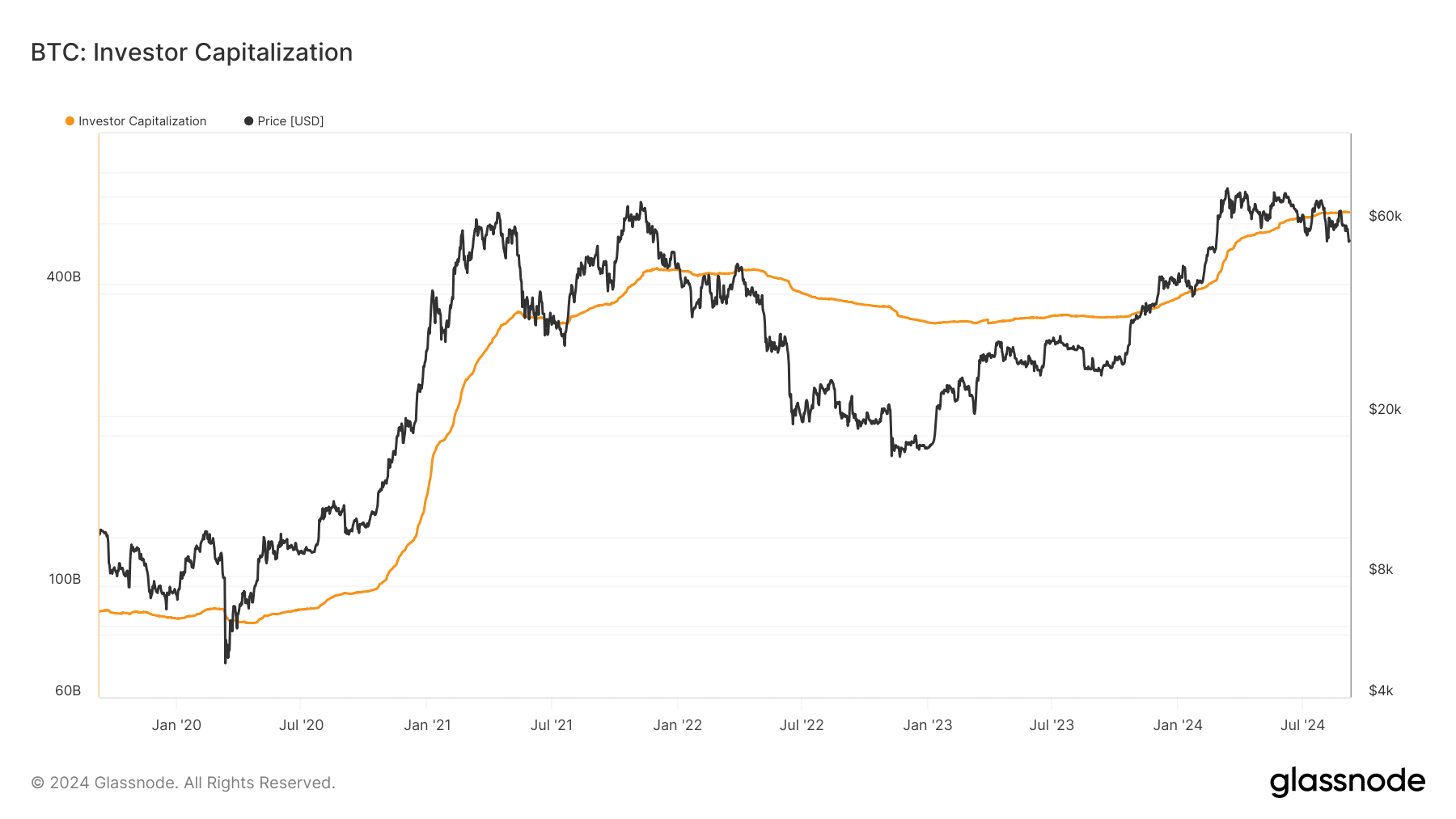

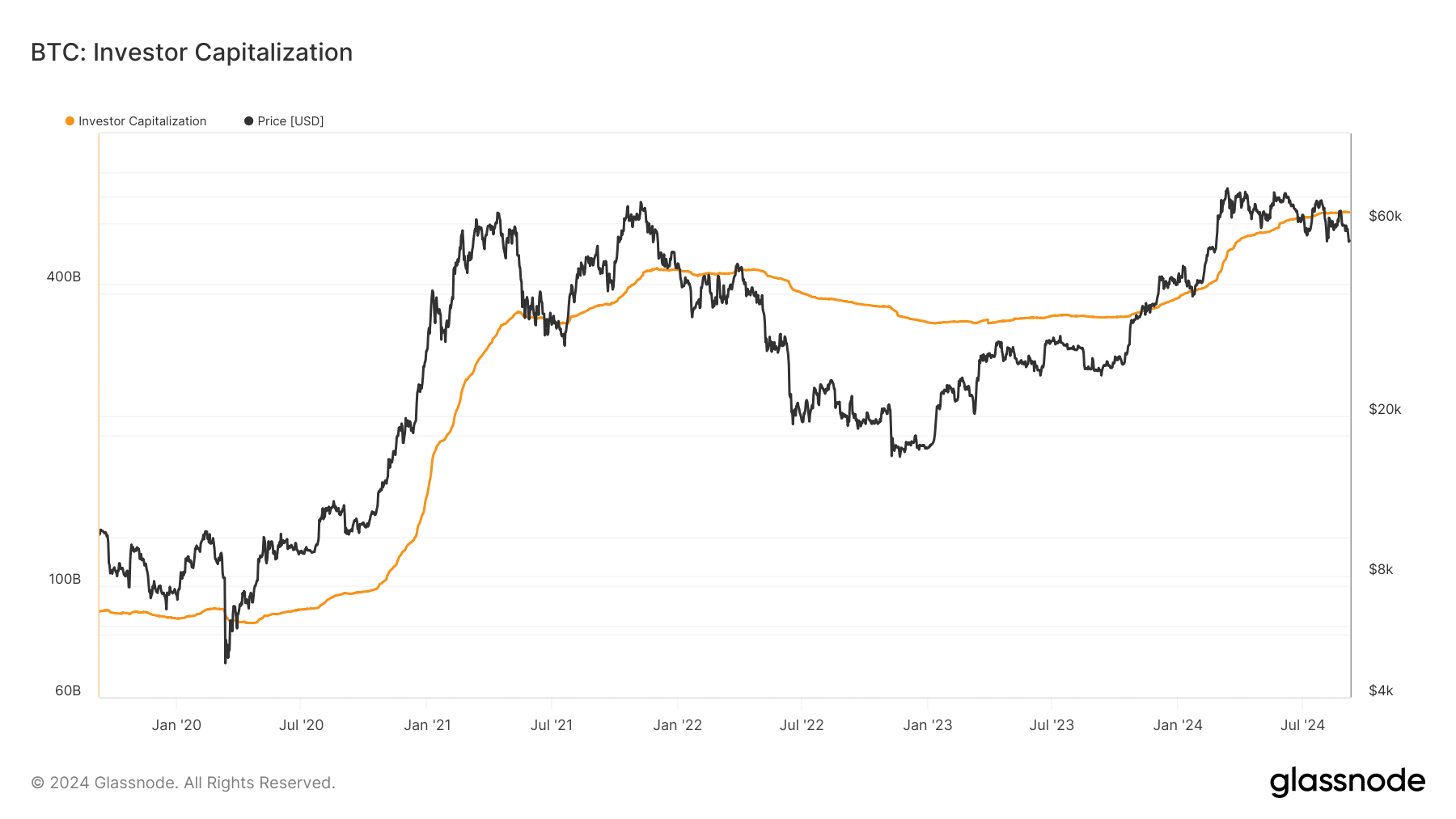

We found that BTC’s investor capitalization has increased significantly. Historically, when BTC’s investor capitalization chart exceeds its price, it is often followed by price drops.

Source: Glassnode

Next we took a look at CryptoQuant facts. We found that things were worrying in the derivatives market as Bitcoin’s funding rate fell. The coin’s taker buy sell ratio turned red, meaning selling sentiment was dominant in the futures market.

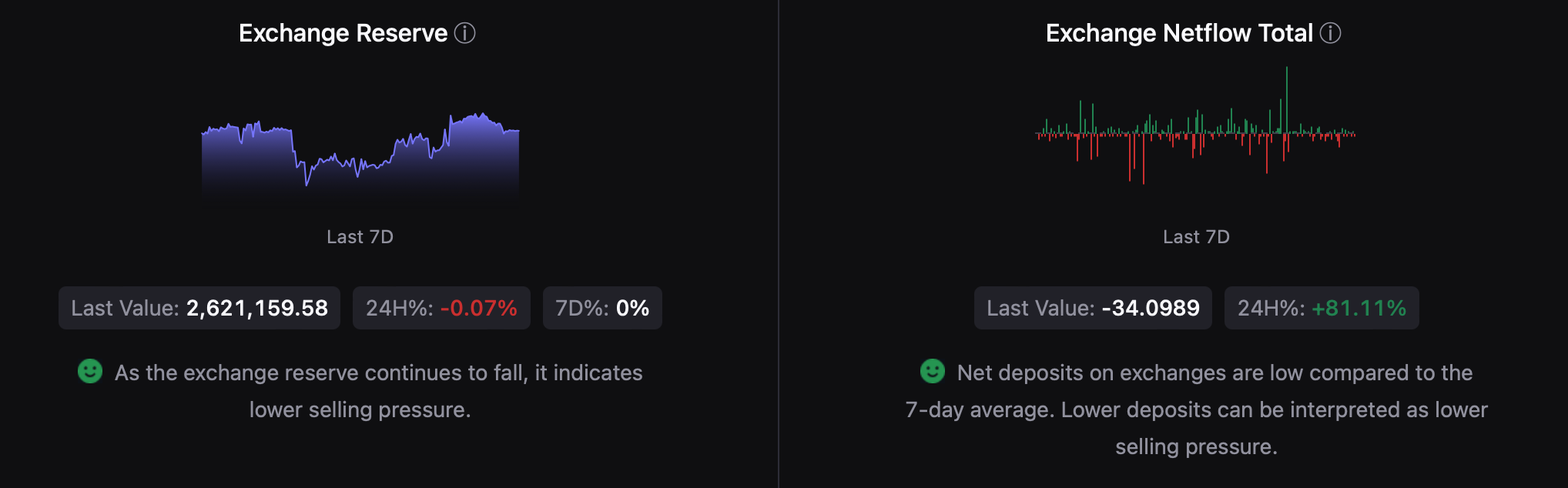

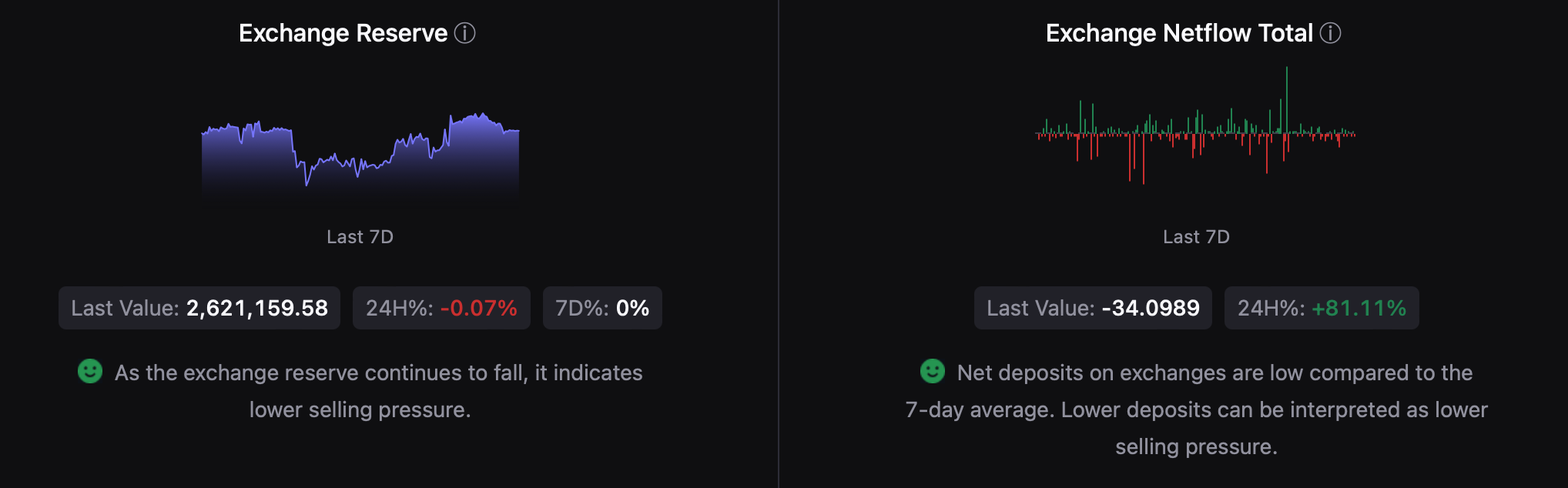

Nevertheless, investors generally bought BTC. This was reflected in the declining foreign exchange reserves and low net deposits on stock exchanges compared to the average of the past seven days.

Source: CryptoQuant

Read Bitcoins [BTC] Price prediction 2024–2025

According to our analysis, BTC was testing its crucial support. A slip below that would indicate that BTC is likely to follow past trends and move towards $31,000.

The Chaikin Money Flow (CMF) recorded a decline, indicating a failed test of BTC’s support. Nevertheless, the Relative Strength Index (RSI) remained bullish as it moved north.

Source: TradingView