- The price increase of XRP can be attributed to the growing accumulation of whales, which now own 85% of the total supply.

- Open Interest reached a three-month high, indicating increased speculative activity.

Ripple [XRP] is one of the biggest winners in recent days after the price reached $0.60. This price increase was a jump of 36.45% in the last seven days.

As surprising as this was, AMBCrypto was able to identify the reasons for the increase. According to on-chain data provider Santiment, there was a significant increase in ownership of addresses holding more than 100,000 XRP.

Go big or go home

This group of investors, known as whales and sharks, has a major influence on prices. Simply put, if this cohort’s assets fall, the price of a token will most likely plummet.

Therefore, the increase in accumulation created buying pressure for XRP and was responsible for the rise.

The increase too revealed that these sharks and whales now control 85% of the total supply. This represented an 11-month high.

Source: Santiment

Should we see a scenario where whale stocks continue to rise, the token’s value could once again reach $0.63 or possibly trade higher.

Another reason why the token could reach this price is the upcoming launch of the cryptocurrency’s reference rates and real-time indices on July 29.

However, it is important to note that these indices are not tradable futures products. Instead, they provide clear pricing data for the assets involved.

Stagnant XRP coins are now on the move

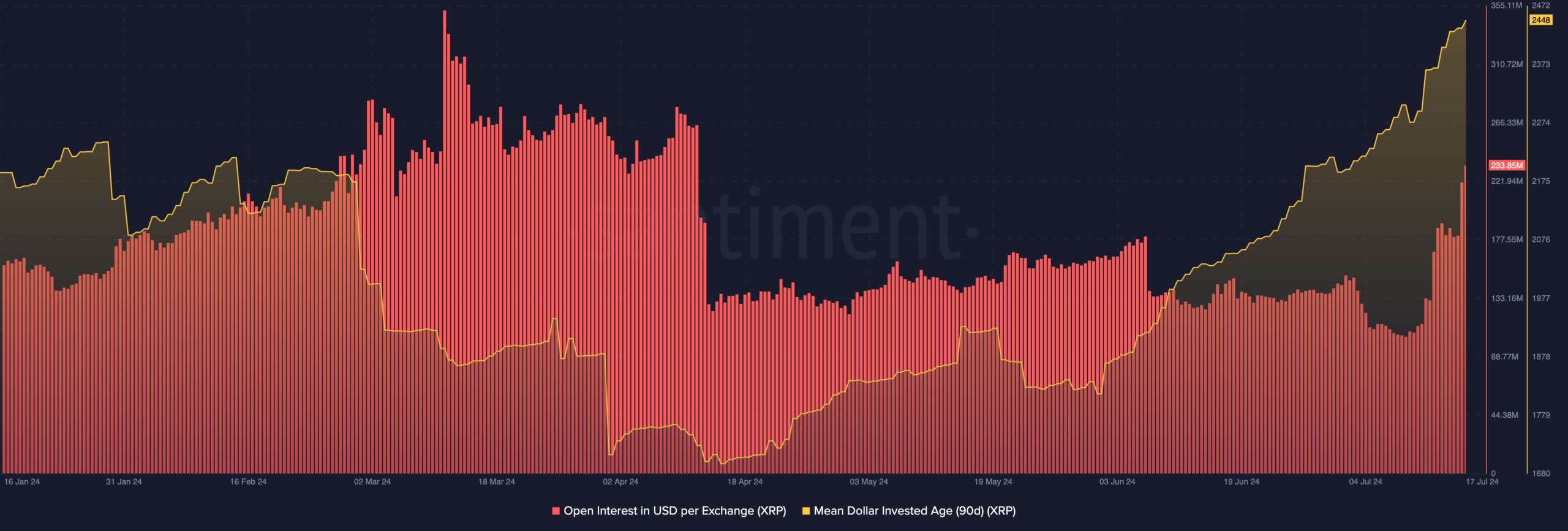

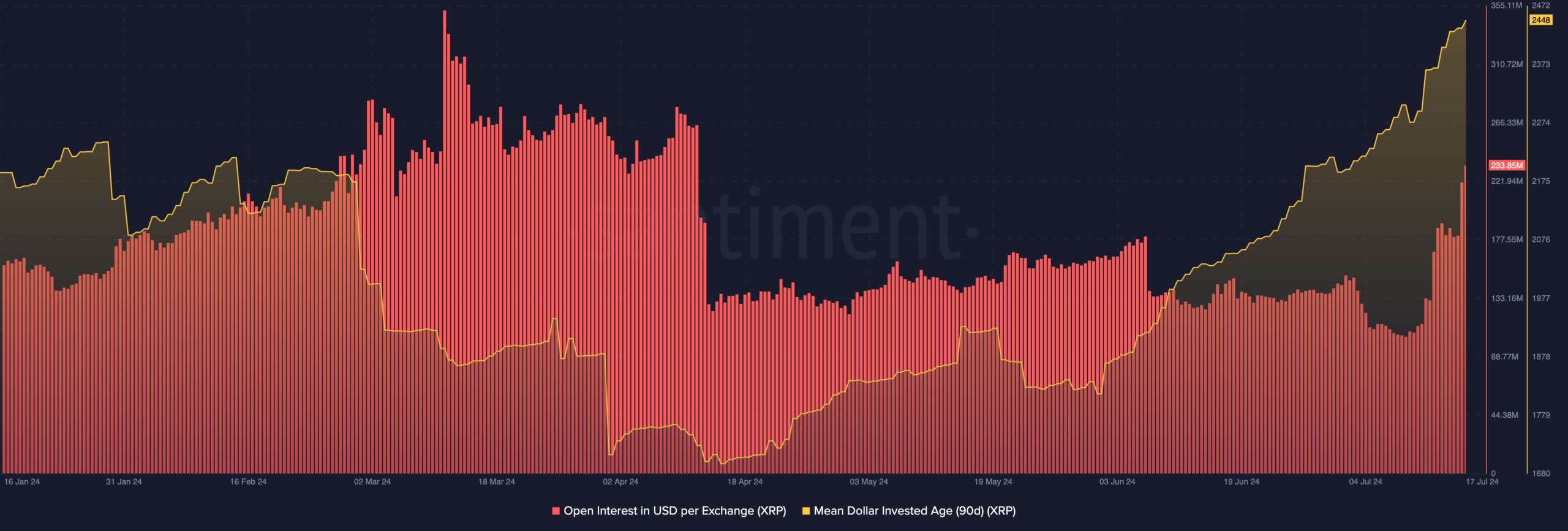

Meanwhile, in the crypto derivatives market, XRP’s Open Interest (OI) had reached $233.85 million. This was the highest value the OI has reached since April 12.

OI refers to the total value of open contracts in the market. When it rises, it means that speculative activity around a token has increased and the liquidity allocated to contracts is increasing.

But if it decreases, it means something different. From a price perspective, the rise in OI, if sustained, could further support XRP’s price appreciation. If this is the case, the value of the crypto could reach $0.63 as mentioned earlier.

In addition, there has been a notable peak in the 90-day MDIA, this acronym stands for Mean Dollar Invested Age.

As the name implies, the metric is the average dollar invested in a cryptocurrency’s market capitalization.

Source: Santiment

In previous bull markets, a rising trend in the MDIA meant whales brought inactive coins back into circulation. Should this continue, XRP’s chances of a higher price will increase.

Read Ripple’s [XRP] Price forecast 2024-2025

Going by this analysis, the token’s value could continue to extend the rally, as mentioned in AMBCrypto’s previous article.

However, beyond the potential rise to $0.63, there is a chance that XRP could attempt to reach $0.72 again – a level it last reached in March.