- According to analysts, Bitcoin needs a 3.5% rally to close above $60,600, which will help regain the crucial reaccumulation range.

- Historical patterns suggested that Bitcoin’s price could reach around $65,000, reflecting established cyclical behavior.

Bitcoin [BTC] has recently experienced varying price movements, with the price increasing $57,123.74 at the time of going to press, per Coin gecko. This marked a drop of 1.79% in the past 24 hours, but an increase of 5.31% in the past week.

Rekt Capital, a well-known analyst, declared that Bitcoin needs to rally another 3.5% to close above $60,600 for a weekly candle to close to reclaim the low.

This level is crucial for Bitcoin to reenter the reaccumulation range, which has historically led to price increases.

Trading volume for Bitcoin at the time of writing was $28,605,062,745, highlighting the intense market activity.

Analysts noted that Bitcoin’s price movements and volume trends were crucial indicators for traders in understanding potential future directions.

Historical and forecast trends

Rekt Capital’s analysis of Bitcoin’s historical performance from 2020 to 2024 indicated clear patterns following the halving events.

On May 11, 2020, Bitcoin underwent a halving, which was followed by an 11-week reaccumulation phase during which the price fell 19.56%.

Bitcoin then entered a parabolic upward phase that lasted 23 weeks and 161 days and reached a peak volume of 1.183 million.

Source:

In 2024, the chart predicted similar trends with an 11-week reaccumulation phase, with a volume of 142.103K, and a predicted parabolic uptrend over 22 weeks and 154 days, with a volume of 150.299K.

Key support levels were indicated by orange circles, which indicate points of price consolidation.

The expected peak price of around $65,000 underlined the potential for significant appreciation following established cyclical behavior.

Bitcoin, in the chain

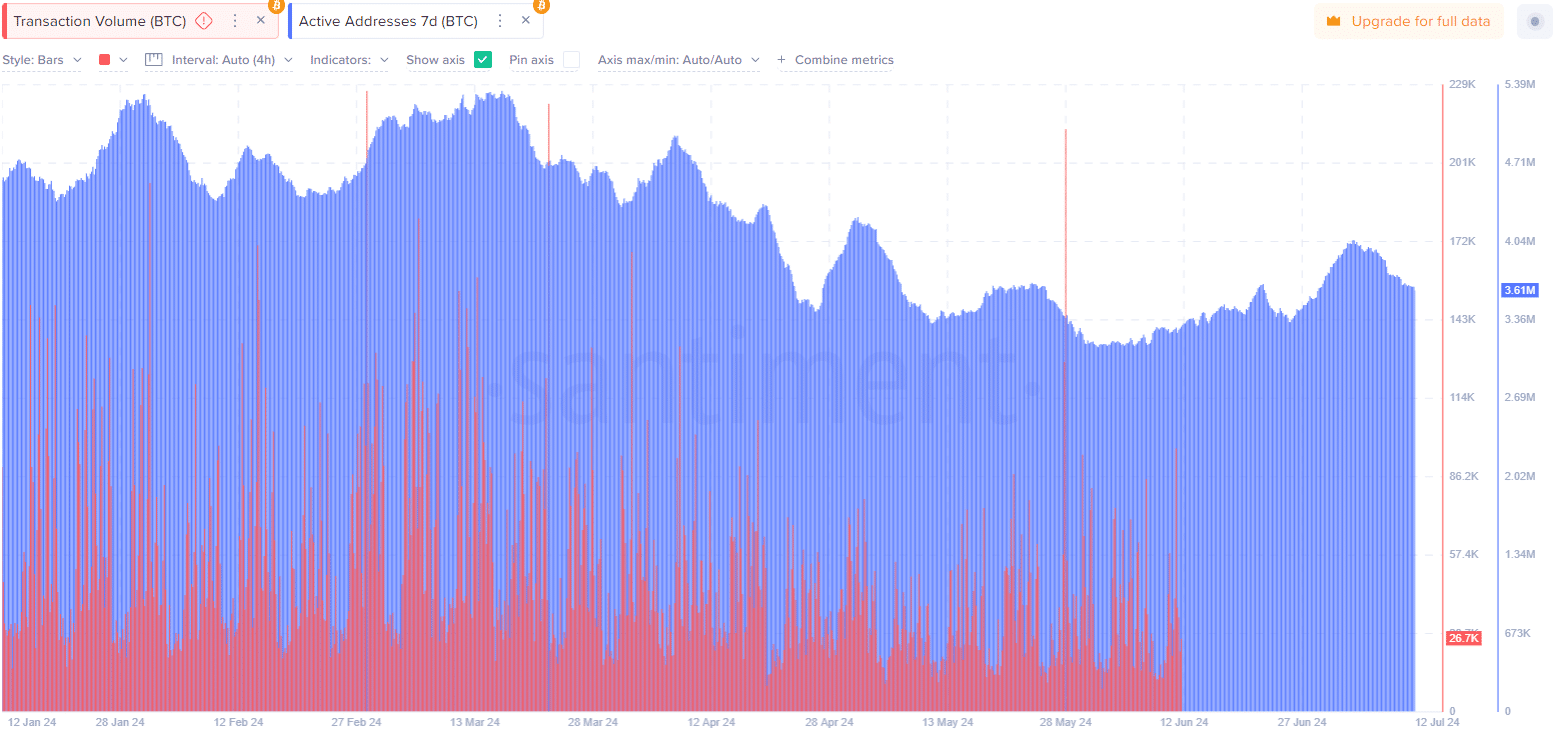

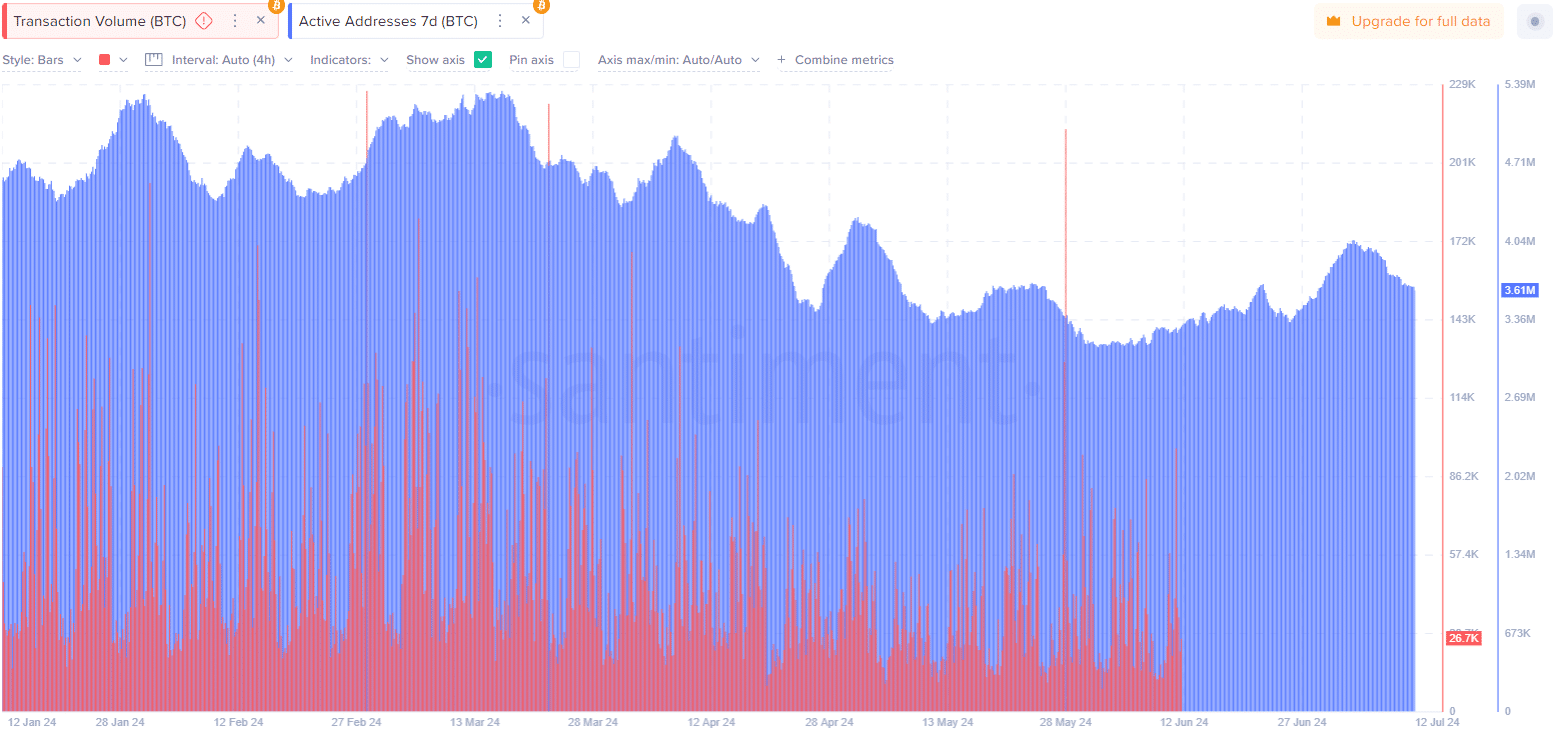

AMBCrypto’s look on Mint glass’ data showed notable spikes in Bitcoin liquidations around late February, early April, and late June.

These spikes coincided with fluctuations in Bitcoin’s price, indicating periods of high volatility and intense market activity.

Moreover, there is a general trend of increasing active addresses, peaking around the end of March and then gradually decreasing.

Transaction volume also showed significant spikes, especially in early April and mid-June, indicating periods of increased trading and network activity.

Source: Santiment

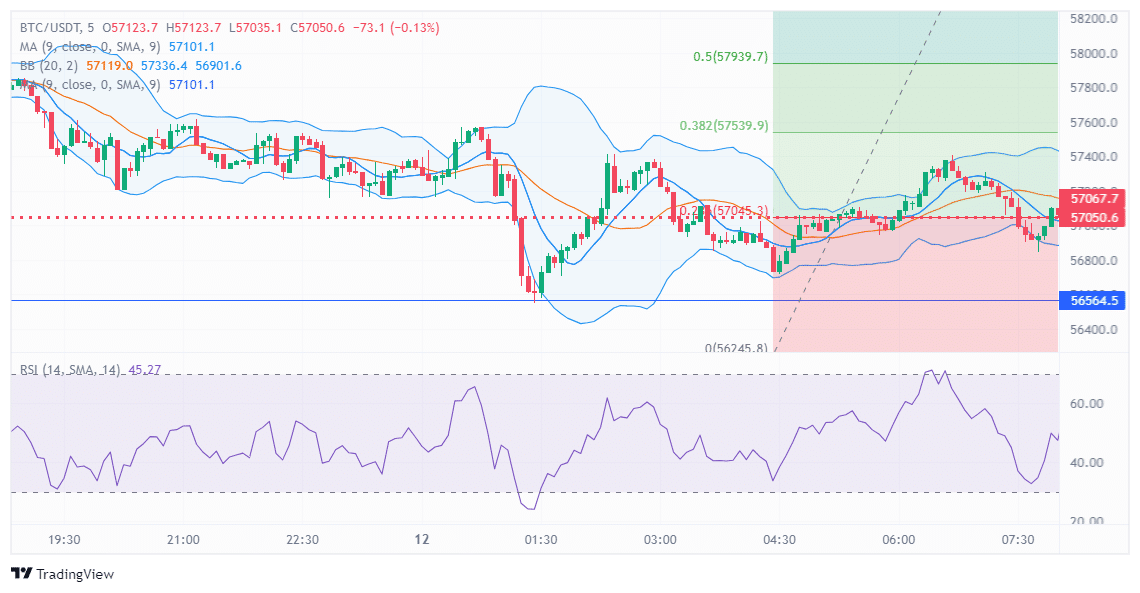

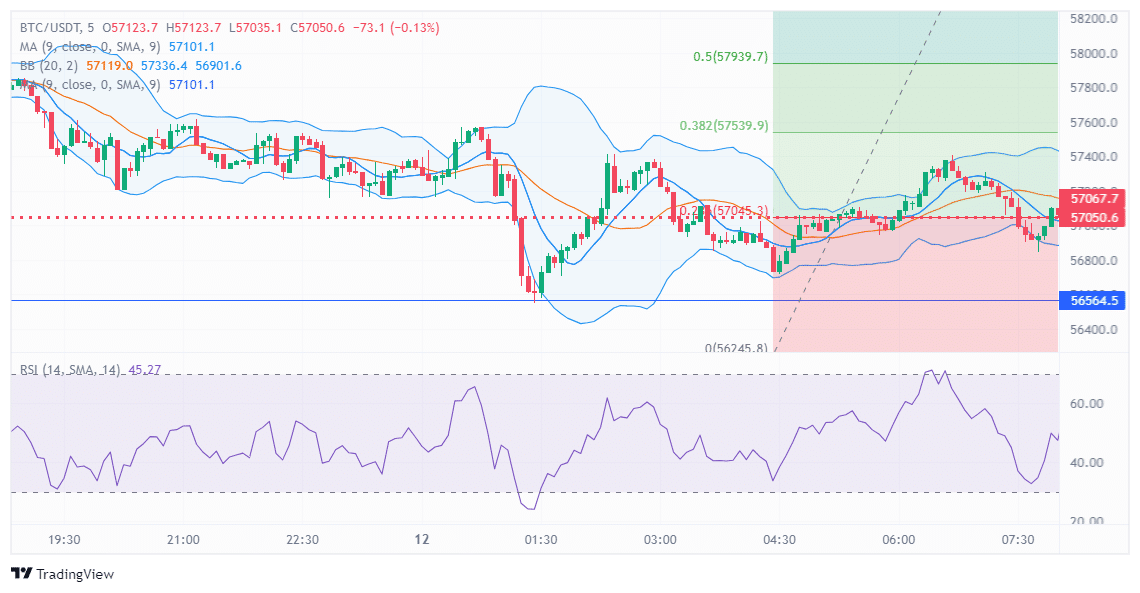

Meanwhile, the 9-period Simple Moving Average (SMA), at 57025.1, acted as a dynamic resistance or support level, with price action fluctuating around it, highlighting its relevance in short-term trading decisions.

Bollinger Bands, with 20 periods and two standard deviations, showed the price locked in, indicating periods of high and low volatility.

During a sharp decline to 56245.8, the ranges widened, indicating increased volatility, and have since contracted slightly as the price stabilizes around 57008.4. This indicated possible breakout or consolidation phases.

Source: TradingView

At the time of writing, the RSI with a 14-period setting was at 46.84, indicating neutral momentum close to the 50 level.

Read Bitcoin’s [BTC] Price forecast 2024-2025

The price had fallen significantly during the price drop, reflecting bearish momentum, but has shown some recovery, indicating a possible stabilization.

Fibonacci retracement levels from the recent high of 57939.7 to the low of 56245.8 highlighted key resistance levels during the price recovery, at 0.236 at 57045.3, 0.382 at 57539.9 and 0.5 at 57939.7.