- DOGE’s trading volume and network activity dropped significantly

- A bullish pattern also appeared on the memecoin’s daily chart

After a week of price drops, Dogecoin [DOGE] regained bullish momentum on the charts. However, the trend could change soon, especially since the memecoin seemed to follow a pattern similar to that of its previous cycles. Should investors be careful then?

Dogecoin mimics a historical pattern

The world’s largest memecoin underwent a 6% correction last week, but the bulls managed to increase its price by 3% in the past 24 hours. Here it is interesting to note that while some think that memecoins are only supported by market sentiment and hype, the reality is a little different.

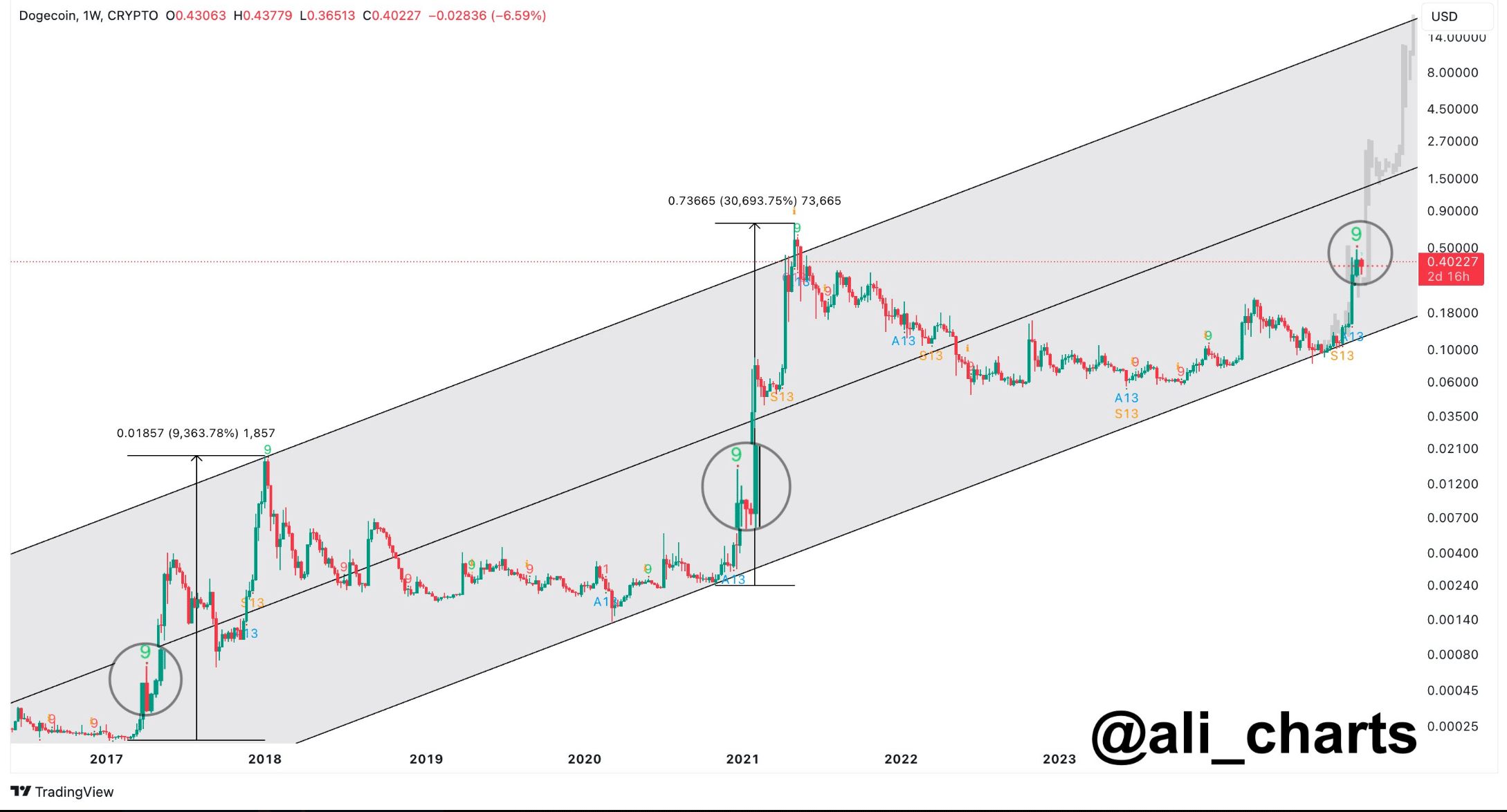

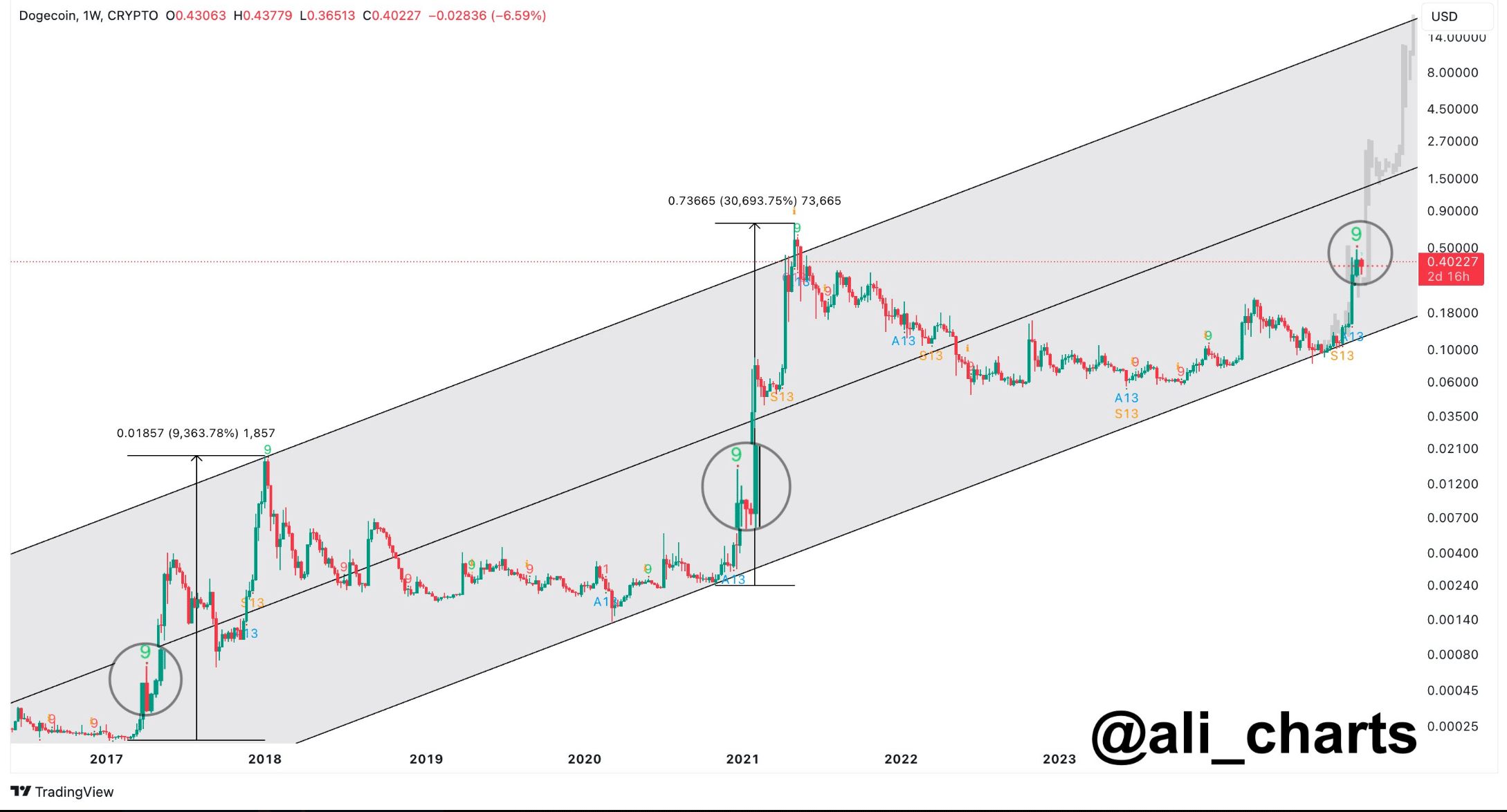

Ali Martinez, a popular crypto analyst, recently shared one tweet to draw attention to such a trend. According to the same, DOGE seems to be following the same pattern as in 2017 and 2020.

Source:

During those cycles, DOGE’s value fell after steep price spikes for a few days before resuming its rally. The pullbacks occurred as sell signals appeared on DOGE’s TD range.

Since similar events have happened twice, there is a good chance that the same episode will repeat itself in 2024. Therefore, Martinez said Dogecoin could test investors’ patience during this cycle.

Will history repeat itself?

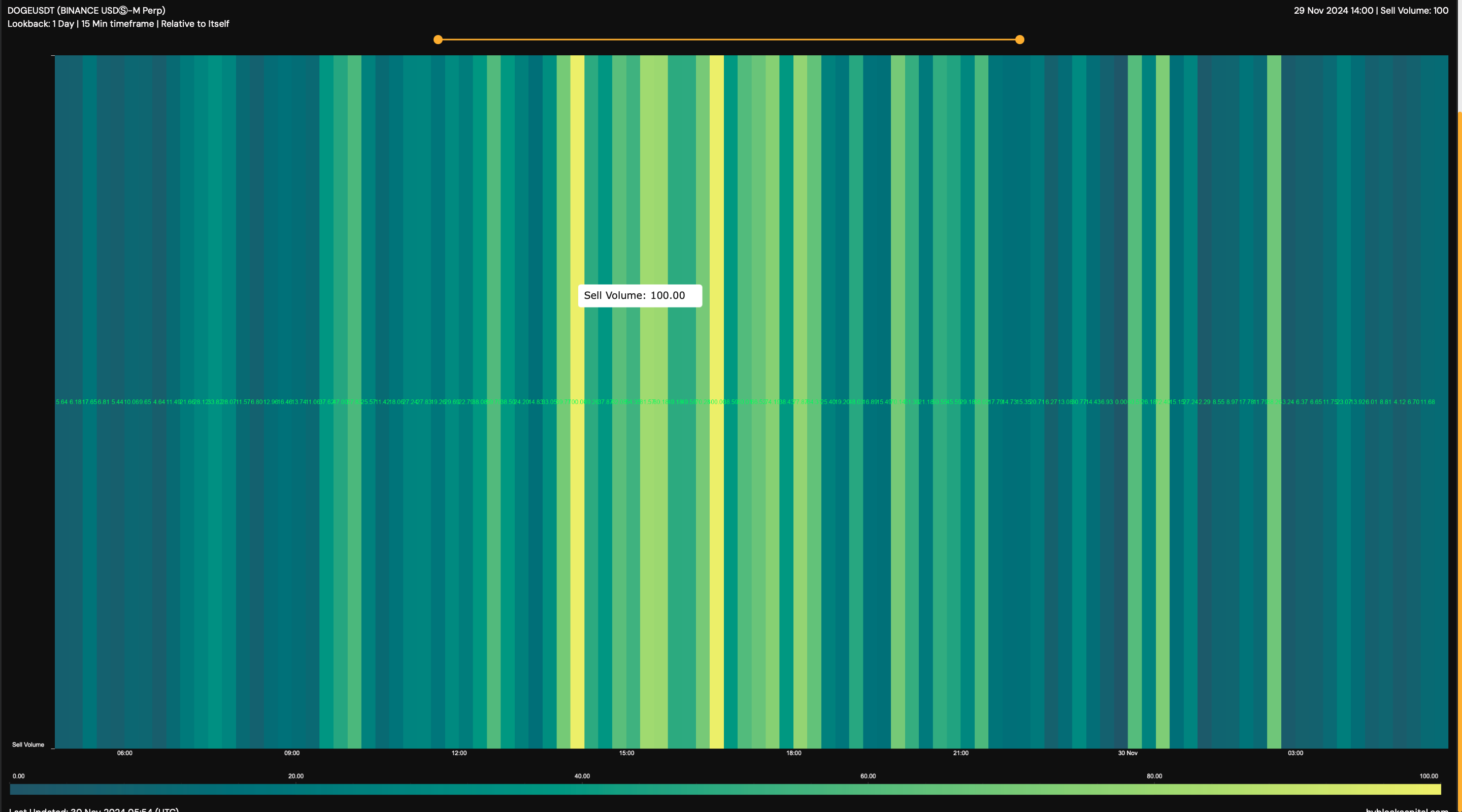

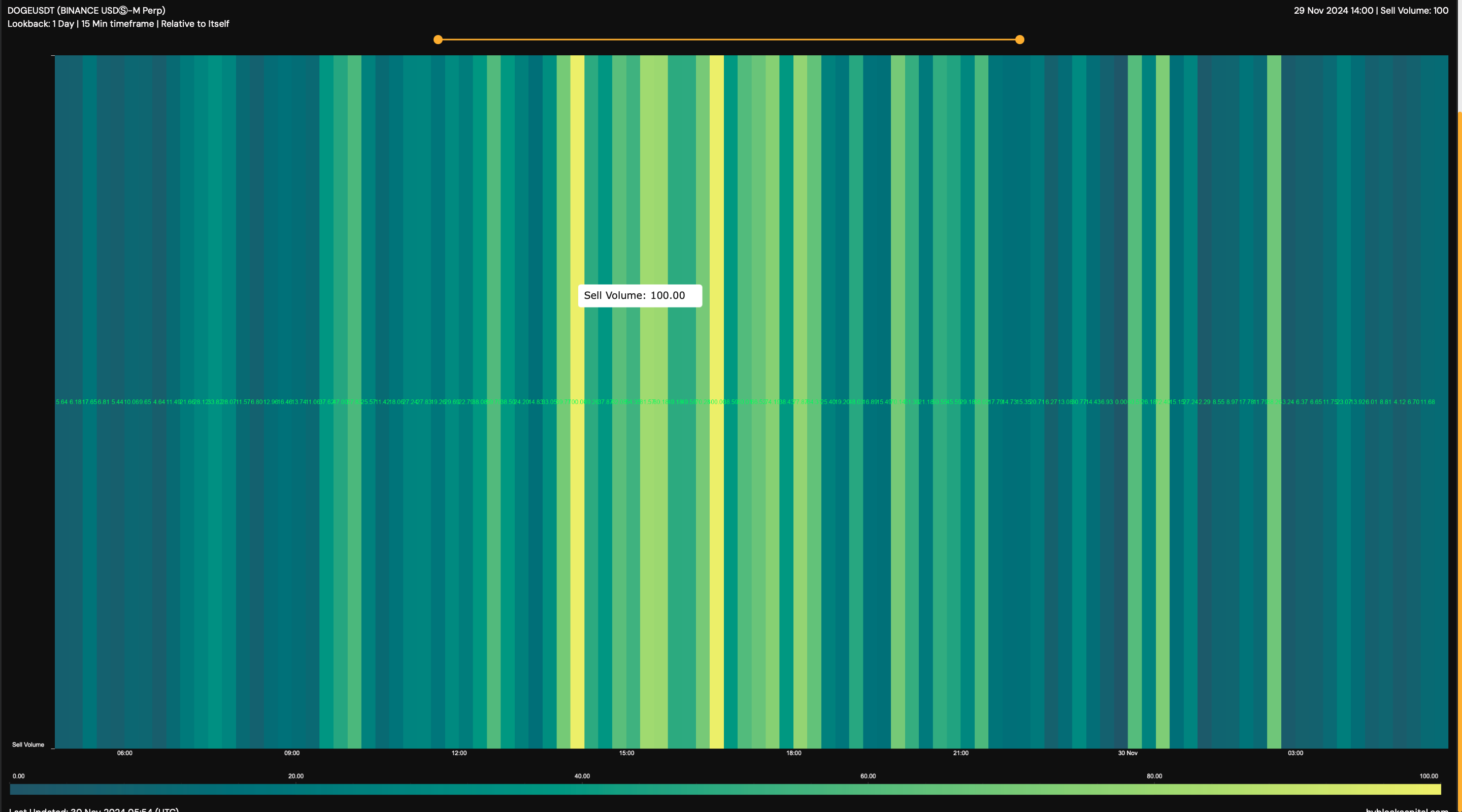

When a similar sell signal recently appeared, AMBCrypto checked whether or not investors were starting to dump their holdings. AMBCrypto found that selling pressure has indeed increased over the past 24 hours.

The sales volume of Dogecoin showed that its value reached a value of 100. For starters, a number closer to 100 means a huge increase in sales volume. However, it should also be mentioned that the selloff later cooled off when the metric dropped to 12.

Source: Hyblock Capital

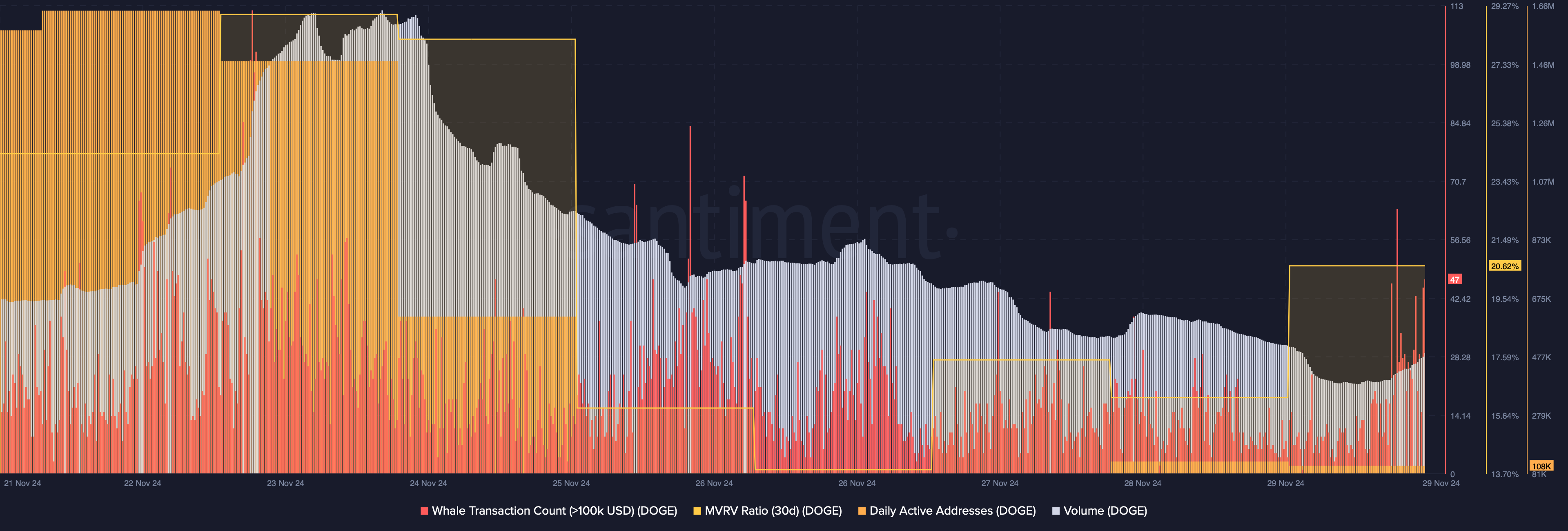

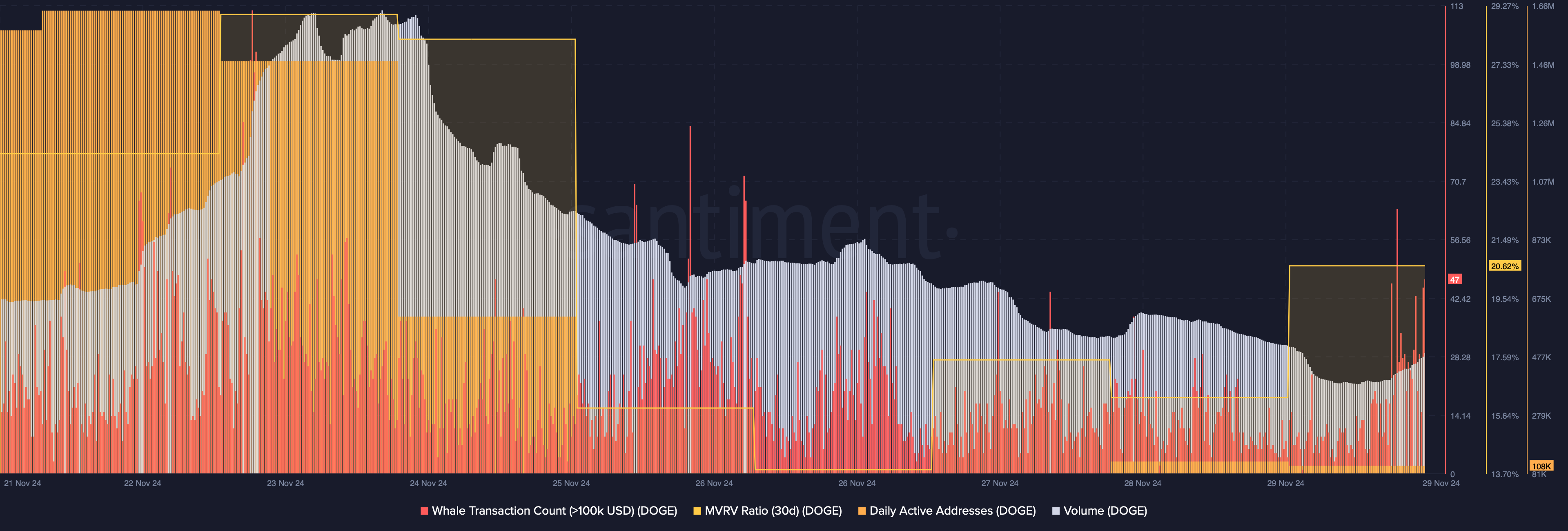

Apart from this, quite a few other metrics looked quite bearish as well. For example, DOGE trading volume fell while its price rose over the past 24 hours – indicating a bearish trend reversal.

The weekly price drop pushed the memecoin’s MVRV down – indicating that more investors have suffered losses. Whale activity around DOGE also fell last week, as evidenced by the decline in whale transactions.

Another front where DOGE witnessed a decline was in network activity. In fact, Santiment’s data showed that DOGE’s daily active addresses dropped, indicating low usage of the memecoin.

Source: Santiment

On the contrary, one look at Dogecoin’s daily chart revealed a bullish ascending triangle pattern. At the time of writing, DOGE was testing the pattern’s resistance.

Read Dogecoins [DOGE] Price prediction 2024–2025

If the bulls are successful in breaking out, DOGE could soon stage a major rally, one that could push the price towards the $1 mark.

Source: TradingView