- Solana was at the strong support level at $124 at the time of writing.

- Trading volume increased by 36%, signaling investor and trader participation.

Over the past 24 hours, the cryptocurrency market has experienced significant selling pressure, following the world’s largest digital asset, Bitcoin [BTC] fell by more than 8%.

Other cryptocurrencies, including Ethereum [ETH]Solana [SOL]and Binance Coin [BNB] have also experienced significant 24-hour losses of more than 10%, 7% and 13% respectively in the last 24 hours, per CoinMarketCap.

At the time of writing, most cryptocurrencies were showing bearish trends amid this continued selling pressure. However, Solana started to show a bullish pattern on the daily chart.

Solana: These are some important levels

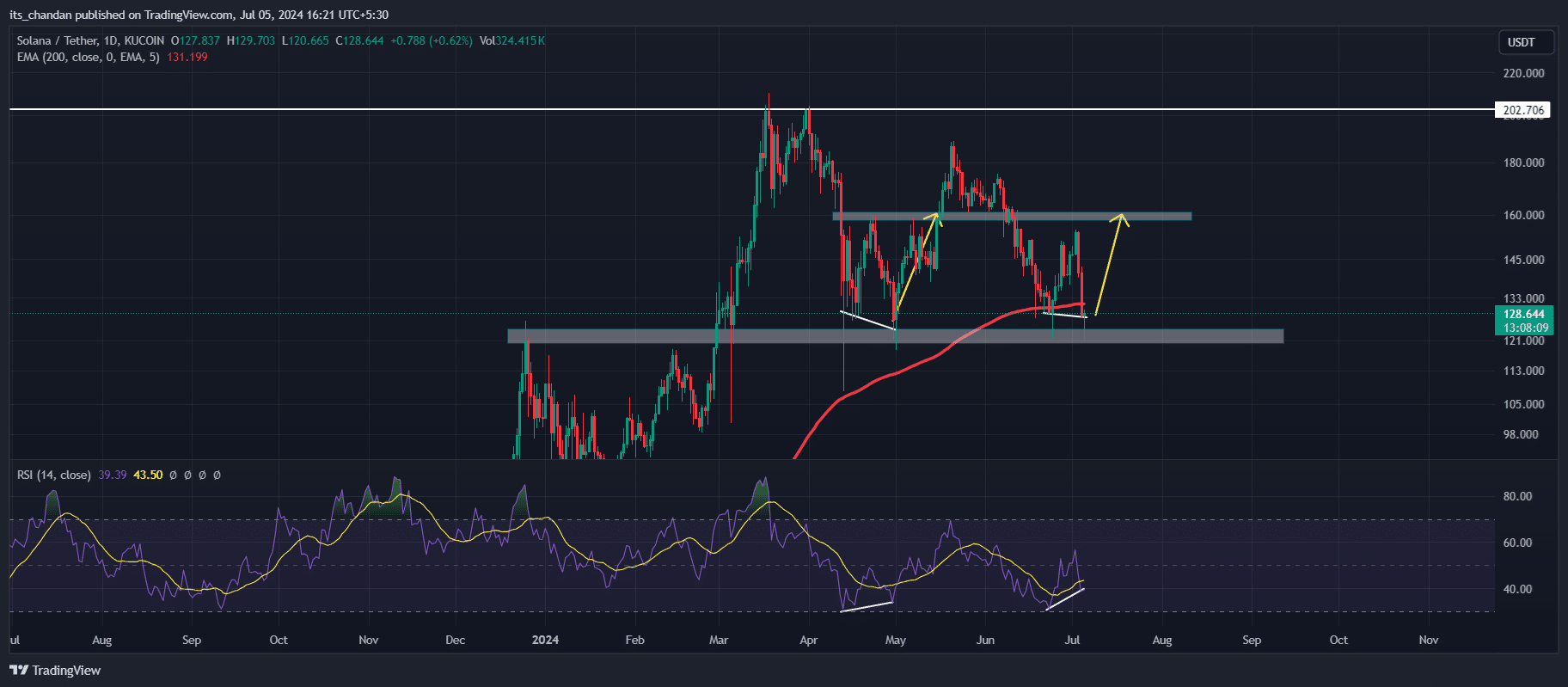

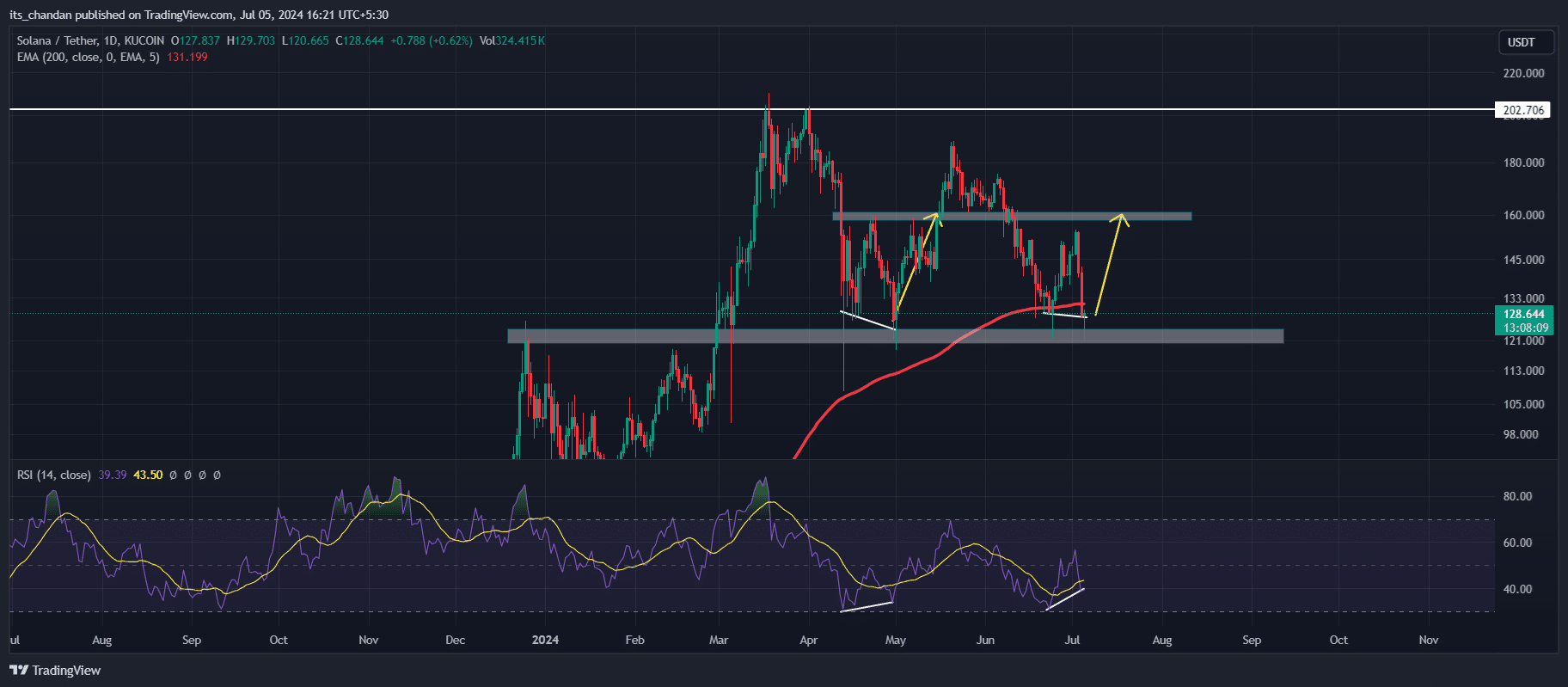

According to AMBCrypto’s analysis, SOL was at a strong support level at $124 and below the 200 EMA (Exponential Moving Average) at the time of writing.

SOL’s daily chart showed the formation of two bullish price action patterns: a bullish double-bottom pattern and a bullish divergence in the oversold region of the Relative Strength Index (RSI).

Source: TradingView

However, this was not the first time that SOL’s daily chart showed this pattern. In May 2024, a similar bullish pattern occurred at the same level around $124.

So there was a high chance that SOL would copy the May 2024 move. If history repeats itself, we could potentially witness a massive price increase of over 22%, reaching the $160 level in the coming days.

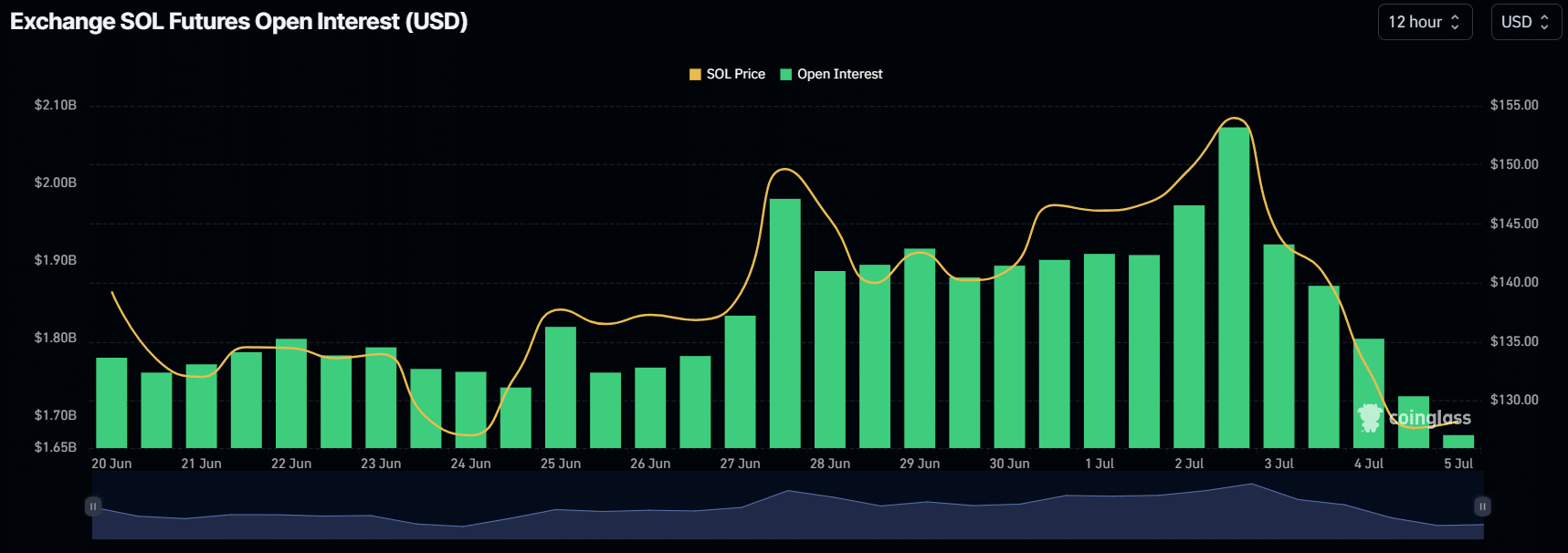

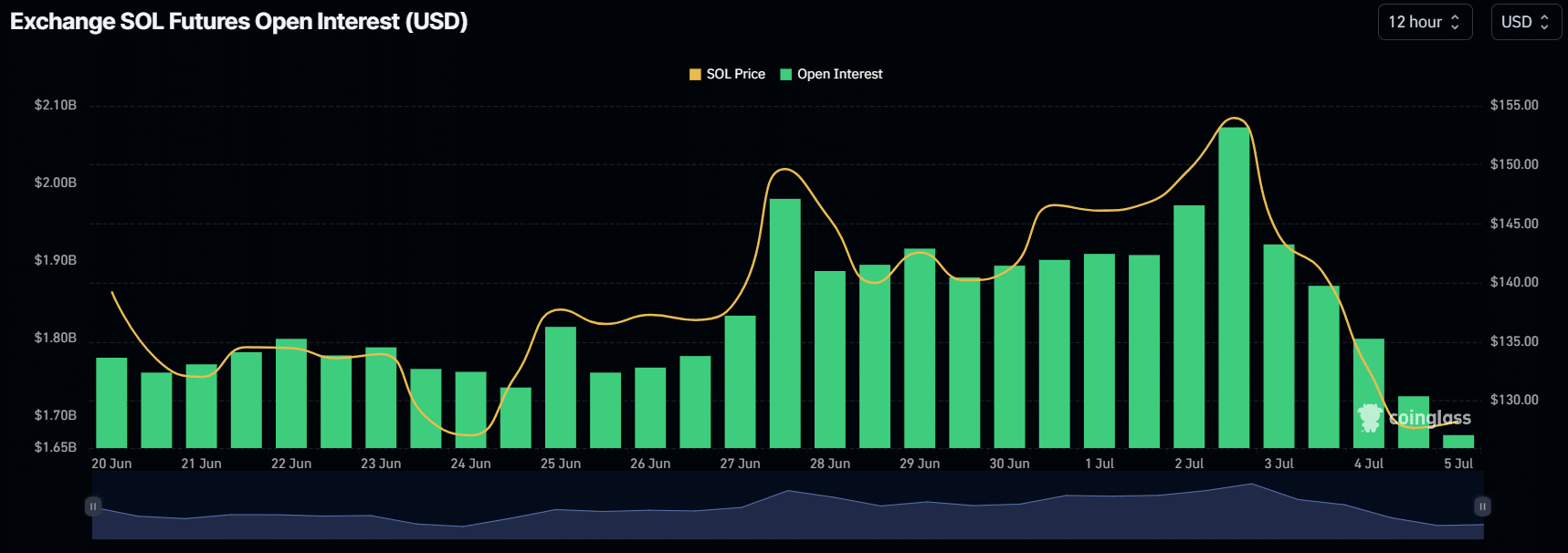

Despite this bullish outlook, the 24-hour Open Interest (OI) is down 7%, indicating lower interest from investors and traders in this challenging market, according to Coinglass.

Source: Coinglass

This drop in OI can be attributed to the liquidation of $25.5 million in trading positions, with SOL being the third highest asset to have undergone this significant liquidation.

While the highest liquidation occurred in Bitcoin and Ethereum.

Price-performance analysis

At the time of writing, SOL was trading around $126, and in the last 24 hours it has seen a price drop of 7%. Trading volume saw a remarkable increase of 36%, signaling the participation of investors and traders.

Looking at SOL’s performance over time, it has lost more than 11% of its value over the past seven days. While SOL has lost almost 26% of its gains in the last 30 days.

In addition to SOL, there are Solana-based altcoins such as Render [RNDR]Bonk [BONK]and Pyth Network [PYTH] also witnessed similar price declines.

Is your portfolio green? View the SOL Profit Calculator

According to CoinMarketCap, RDNR, BONK, and PYTH saw price drops of 9%, 12%, and 13%, respectively, over the past 24 hours.

On the other hand, the popular Solana-based meme coin dogwifhat [WIF]next to The graph [GRT] saw increases of 12% and 2% respectively in the same period.