- Historically, Bitcoin has been largely bearish in September, but this time it could be different.

- NASDAQ embracing Bitcoin and improving global liquidity conditions could deliver a bullish outcome in September.

Bitcoin [BTC] will end August in the red compared to the monthly opening price, if the price does not rise above its current weekly high in the next three days.

This means that the burden of achieving positive monthly profits will continue into September.

So should we expect a bullish month for Bitcoin in September? Historically, this has been one of the most bearish months for the cryptocurrency.

The king coin has delivered bearish performances in eight of the September 11 events since 2013.

Source:

This suggests that Bitcoin has a bearish bias in September, but will it be the same this year? There are key factors that point to the possibility that BTC could turn extremely bullish in the coming month.

Recent data has shown that global liquidity is recovering and is now at new highs. While Bitcoin has not yet received a large portion of that liquidity, the fact that liquidity is trending positively again is positive for the market.

Rising global liquidity combined with expected interest rate cuts in September could provide the boost Bitcoin needs for positive returns throughout the month.

A CryptosRus analysis suggested that a combination of rate cuts, growing liquidity, the halving, and the US election were very similar to Bitcoin in 2016 and 2020. BTC staged a robust rally in both cases.

Bitcoin is breaking through into the mainstream markets

Access to Bitcoin is now higher than ever before, especially with ETFs launching earlier this year. This growing access could soon be coming to the stock market thanks to the latest NASDAQ filing.

The latter is trying to roll out Bitcoin options tradingwhich could further boost positive sentiment among investors.

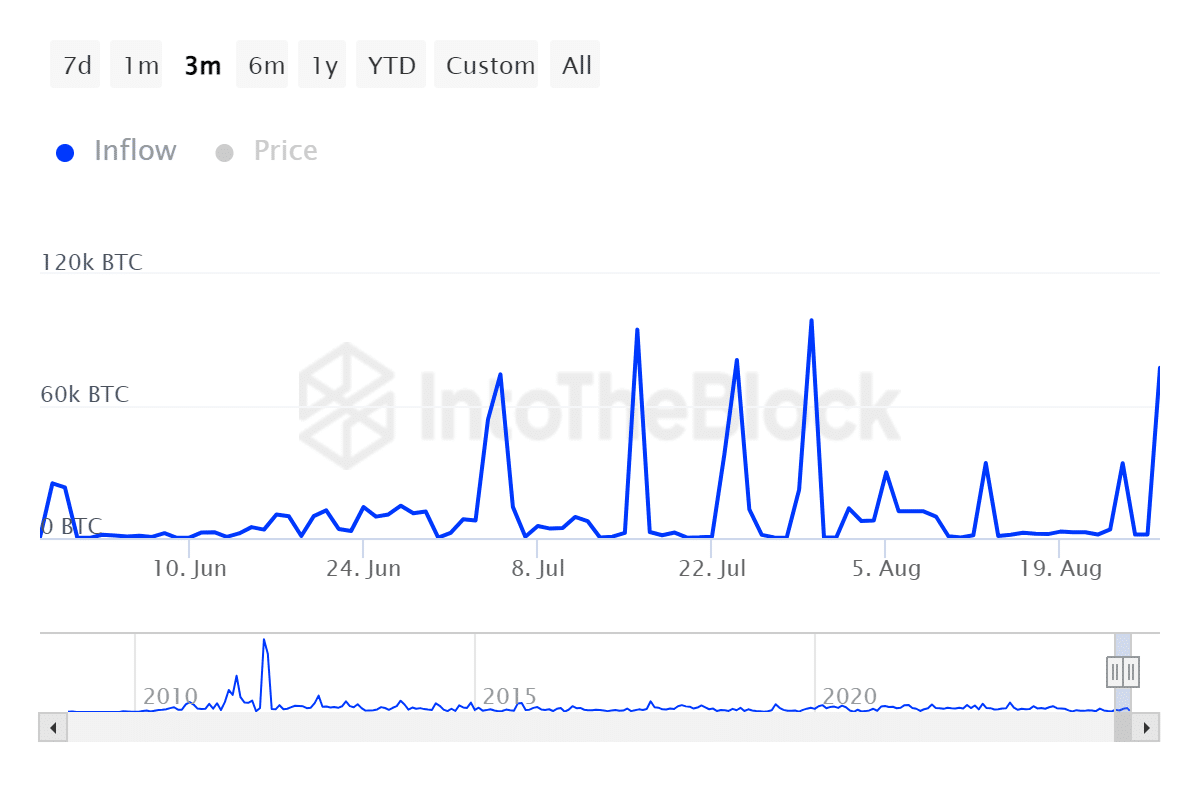

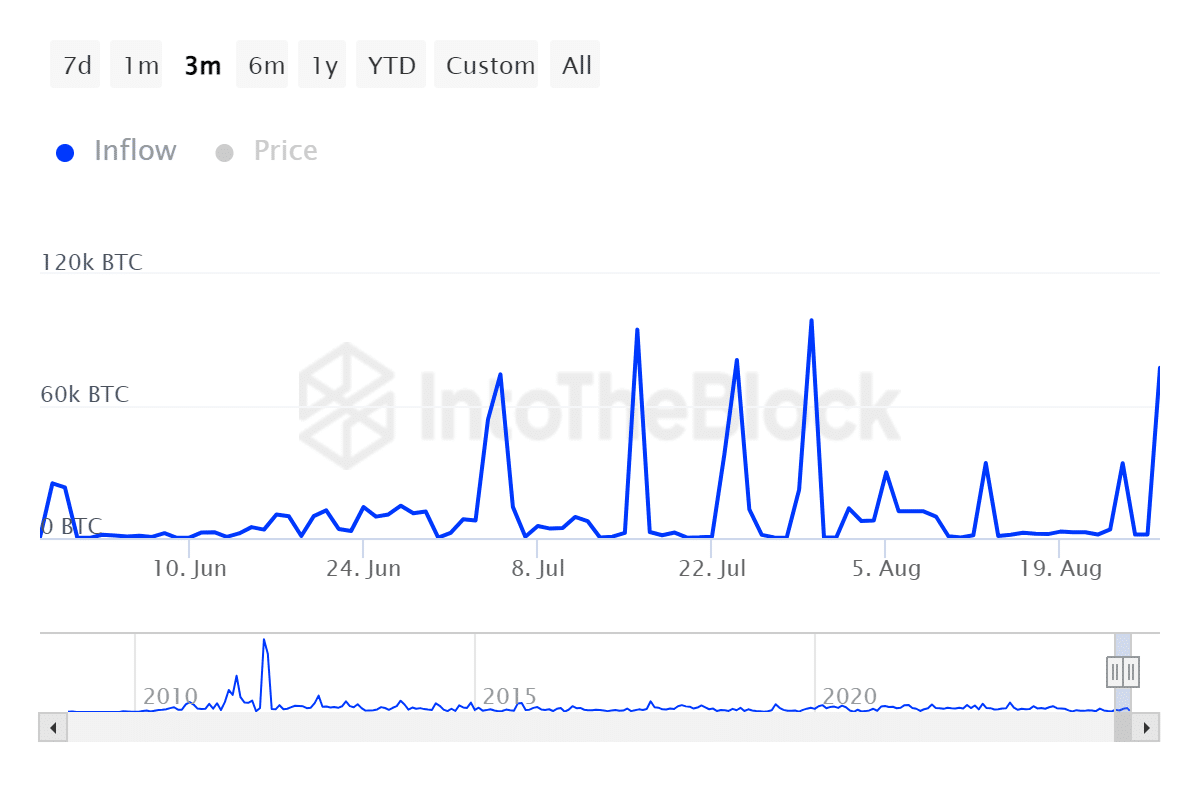

Bitcoin investors may also be preparing for a price rally in September. The inflow of large farmers rose in the past 24 hours to the fourth highest level in the past three months.

Inflows peaked at 77,400 BTC during the same period, while only 11,240 outflows were recorded during the same period.

Source: IntoTheBlock

This comes after Bitcoin fell below $60,000 again following earlier hopes that the price would head towards $70,000. So investor optimism remained high, judging by the intensity of accumulation at lower prices.

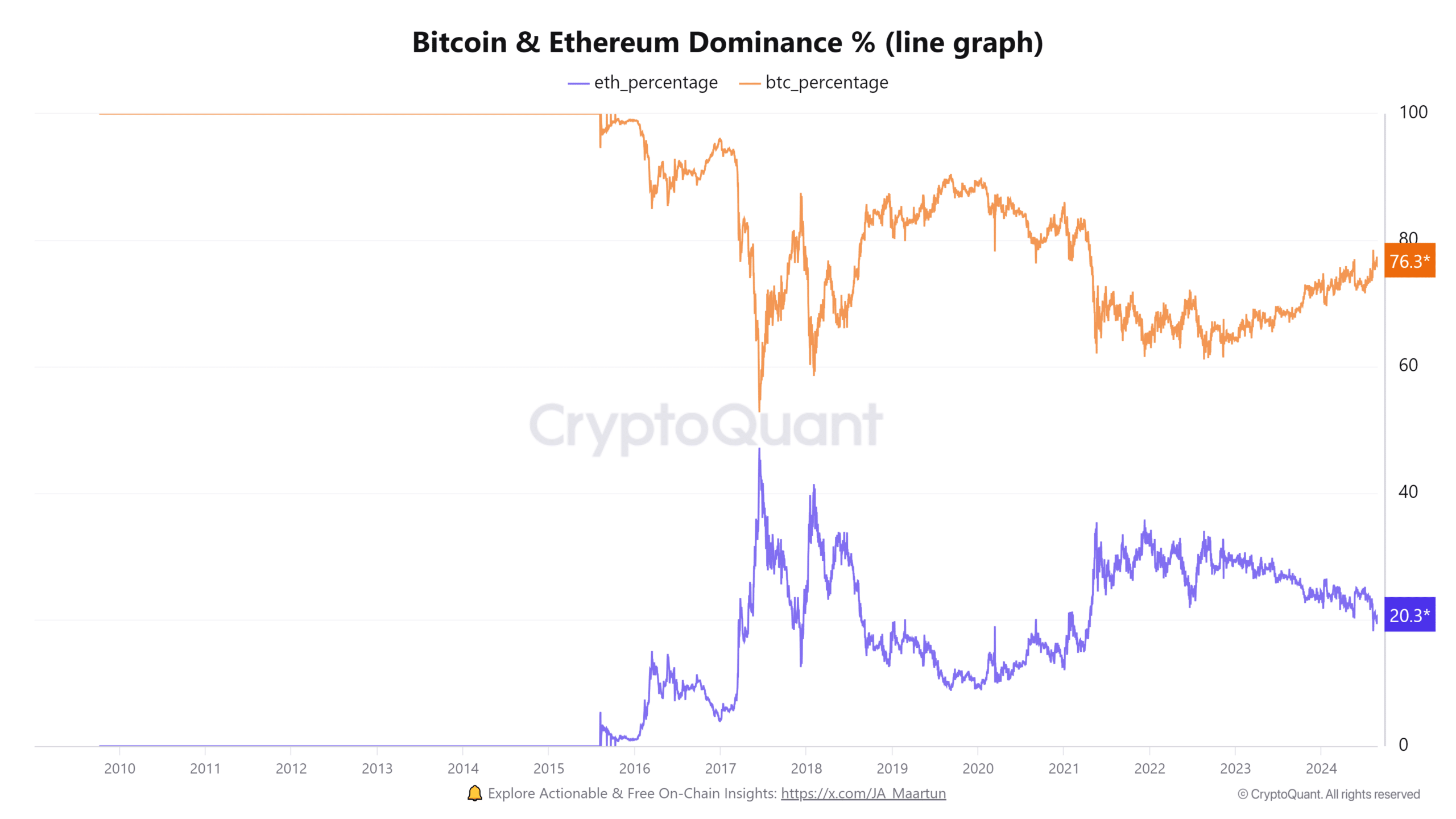

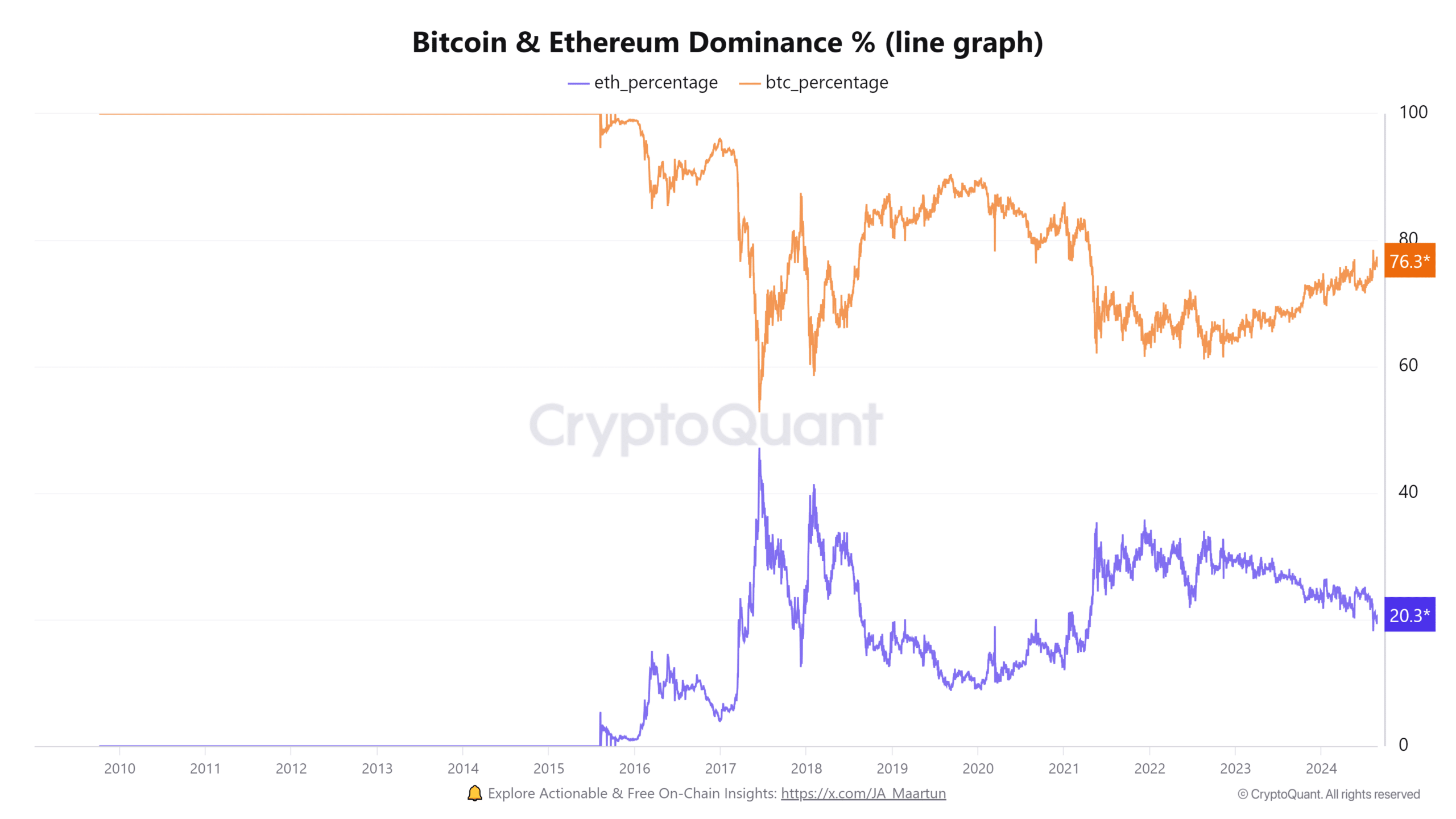

Bitcoin has also maintained significant dominance over Ethereum [ETH] and other altcoins. This means it is strategically positioned to benefit from most of the liquidity flowing into the crypto market.

Source: CryptoQuant

Bitcoin still received the most attention, despite the presence of many altcoins.

Read Bitcoin’s [BTC] Price forecast 2024–2025

In conclusion, Bitcoin is heading for a potentially bullish September if interest rates fall.

Improving global liquidity and better acceptance in mainstream markets could boost BTC’s performance before the end of the year.