Bitcoin (BTC) has been trading in a tight range for quite some time now, with bulls and bears engaged in a tug-of-war over key support and resistance levels.

The recent move above $29,500 has provided some hope for the bulls, but so far, they have been unable to gather enough momentum to push prices higher.

Bitcoin Struggles To Break Above Key Moving Average

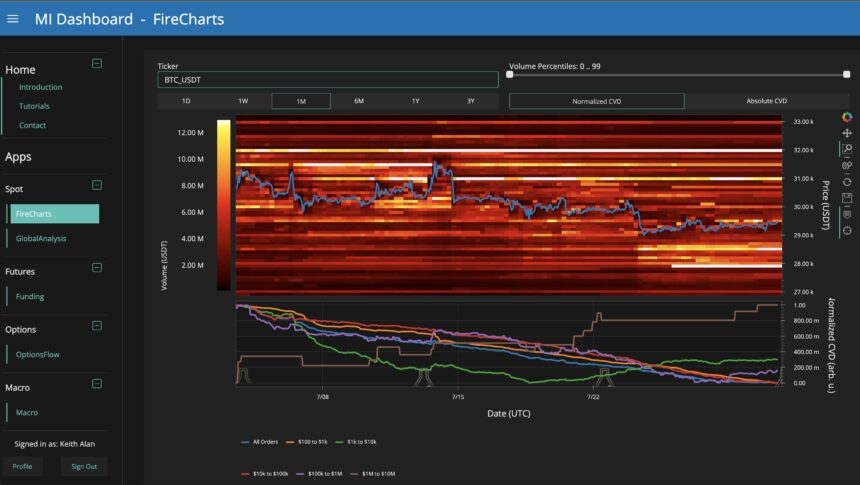

According to Material Indicators, a leading market analysis firm, the key to a bullish breakout in the BTC market is for the coin to print candles above the 100-week moving average (MA). However, BTC has yet to test this level, and bulls have struggled to maintain the current range.

The 50-day MA has been a crucial support level, with BTC testing it for today’s eighth consecutive day. While the 50-day MA has managed to hold, resistance at $29,500 has been replenishing, posing a challenge for the bulls.

If they cannot clear this level, Material Indicators expects a run at the lows with $28,300 as the last line of defense. The big question for BTC investors is whether the coin will bounce from the $28,000 zone or extend to $25,000 and beyond. All of these moves are possible, but the mystery lies in what order and timeline they will play out.

As the market approaches the monthly close, all eyes are on the potential for volatility in the BTC market. Traders and investors closely monitor the price action and indicators to prepare for potential moves.

BTC’s Store Of Value Narrative Solidified

The recent changes in the structure of Bitcoin’s trading volume have sparked a debate among cryptocurrency investors and traders. According to Crypto Quant, since January 2023, the Spot vs. Derivatives volume ratio has dropped from 35% to 6%, resulting in a new era of low volatility in the cryptocurrency market.

This decrease in spot volume means that investors are holding onto their Bitcoins instead of selling them, as Bitcoin is now considered a valuable asset, similar to digital gold.

This is seen in the BTC: Binary Coin Days Destroyed (CDD) chart, which shows that since the start of the year, there have been no active sales among the cohort of long-term holders (LTHs).

Moreover, the total Simple Moving Average (SMA)-7d weekly trading volume of Bitcoin across all exchanges has dropped from 2.5 million BTC in March to less than 600 thousand BTC in July, representing a more than 75% reduction over the specified period.

While some may see this trend as a crisis, Crypto Quant believes it is a sign of the cryptocurrency market maturing and becoming more stable and predictable.

However, this trend could lead to significant changes in the Bitcoin market. A reduction in spot volume may result in a reduction in liquidity, which could increase the demand and price of Bitcoin. The market currently lacks a new wave of optimism, and the question is, where will it come from?

The answer may lie in the growing institutional interest in Bitcoin and other cryptocurrencies. Several major financial institutions, such as Fidelity, Blackrock, and Morgan Stanley, have recently applied for Bitcoin Spot Exchange-Traded Funds (ETFs).

This institutional interest could bring a new wave of optimism to the cryptocurrency market, increasing demand and increasing prices.

Bitcoin is facing challenges in its attempt to regain its 50-day moving average (MA) as a support level instead of being another resistance line. As of the time of writing, Bitcoin is trading at $29,200, representing a slight 0.6% decline over the last 24 hours.

Featured image from iStock, chart from TradingView.com