- Bitcoin is struggling to stay above the bull market support band as the fourth quarter approaches.

- Analysis of historical trends indicates a possible rally or further decline in the fourth quarter of 2024.

Bitcoin [BTC] The price took a notable dip last week, falling to the $53,000 level for the first time since February. This downward trend continued at the beginning of this week.

However, the cryptocurrency has made a slight recovery and is currently trading above $55,000. Despite this recovery, Bitcoin remains down 2.4% over the past 24 hours, with a trading price of $55,704 and a 24-hour low of $54,320.

In the midst of this, prominent crypto analyst Benjamin Cowen recently did this taken to social media platform X to discuss the implications of Bitcoin’s current price movements and its potential trajectory through the end of the year.

According to Cowen, Bitcoin’s recent performance could be indicative of a “summer lull,” a pattern observed in previous cycles. His analysis suggests that the cryptocurrency’s future in the fourth quarter depends on its ability to regain and maintain key price levels in the coming weeks.

Bitcoin’s likely performance in the fourth quarter

Before we dive deeper into the fourth quarter projections, it is essential to understand what a Bull Market Support Band (BMSB) is.

This technical indicator combines the 20-week moving average and the 21-week exponential moving average and serves as a critical support region in bull markets.

A sustained position above this band is generally considered bullish, while a decline below it could signal bearish conditions.

Cowen points out that Bitcoin is currently testing this support band. If historical patterns hold true, Bitcoin’s behavior versus the BMSB over the summer could set the stage for its fourth-quarter performance.

For example, in 2023, after a brief dip below the BMSB, Bitcoin staged a significant rally in the fourth quarter. In 2013 and 2016, there were also significant upward movements in the periods following a dip below this bandwidth.

Looking further, Cowen draws parallels to recent years, where Bitcoin suffered similar slumps during the summer months. He notes that in years like 2019, when Bitcoin remained below the BMSB after the summer, the fourth quarter tended to be bearish.

Conversely, years that saw a recovery above the BMSB often saw robust rallies in the fourth quarter.

Current market dynamics show that Bitcoin is struggling to climb back above the BMSB. Cowen speculates that the outcome of this battle could lead to a repeat of the strong recoveries of 2013 and 2016, or mimic the quieter fourth quarter of 2019.

This uncertainty makes the coming weeks crucial in setting the tone for the rest of the year.

Current market fundamentals

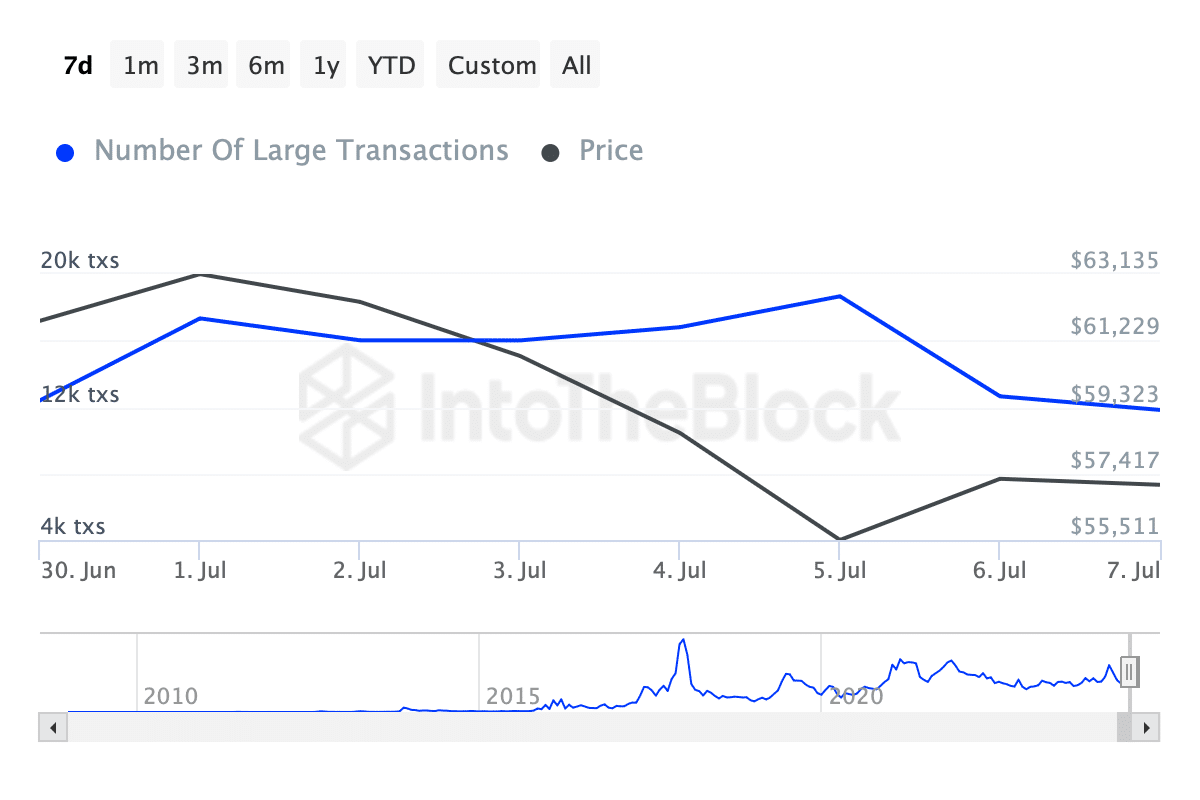

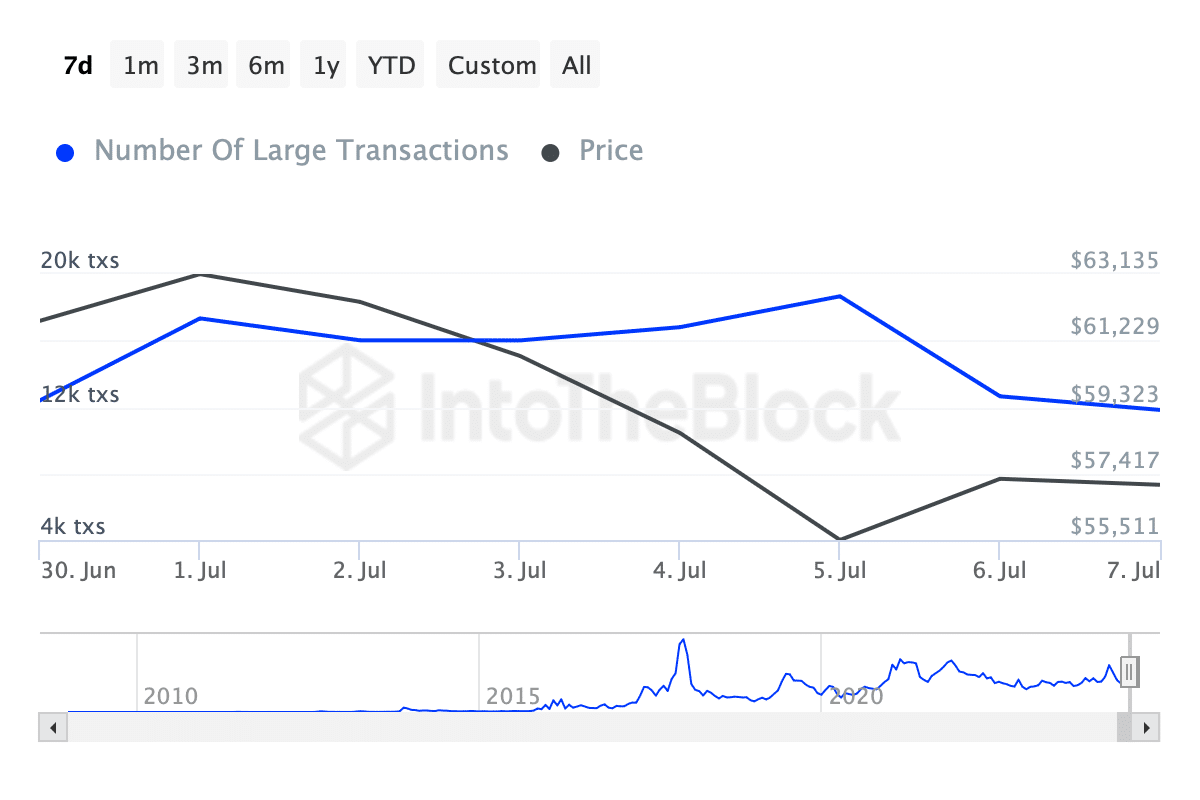

Regarding the fundamentals of Bitcoin, there has been a noticeable decline in whale transactions, with a significant decrease from 17,000 to less than 12,000 in just one week.

This decline could indicate declining interest from larger investors or a potential consolidation phase.

Source: IntoTheBlock

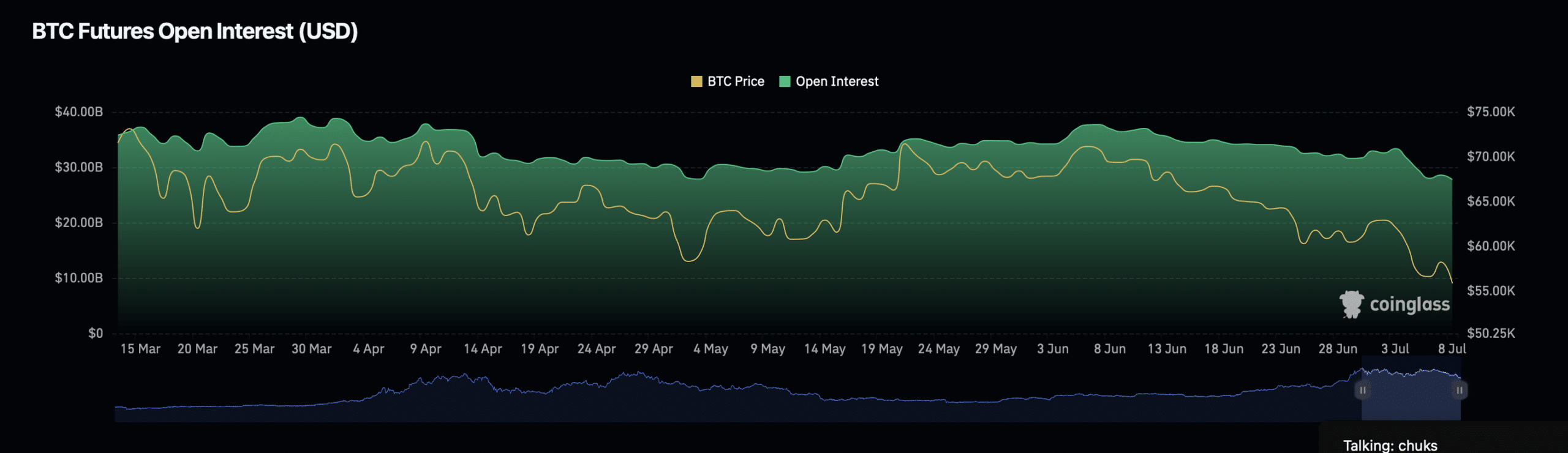

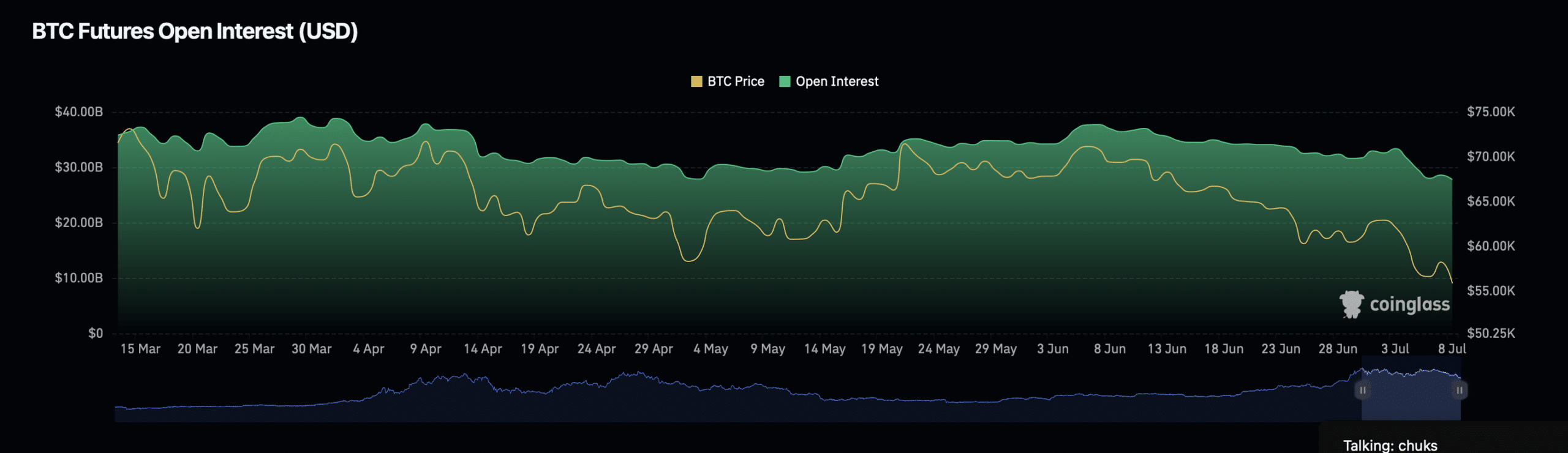

In addition, Bitcoin open interest has fallen slightly by 2% and now stands at $27.62 billion. However, there has been a sharp increase in open interest volume, which rose 32.91% to $57 billion.

This increase in trading volume amid declining open interest suggests that while there are fewer positions open, the trades taking place are more important.

Source: Coinglass

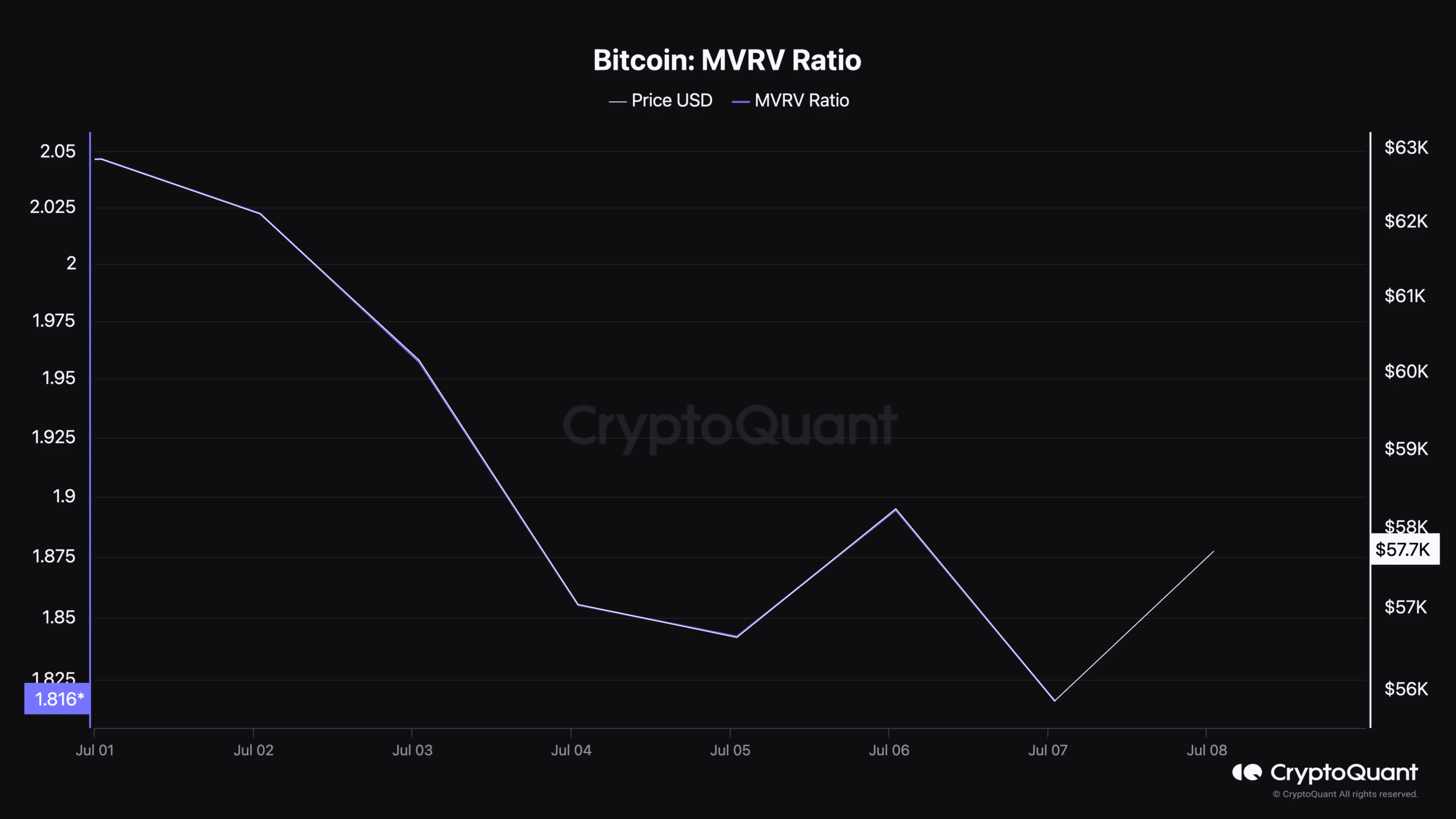

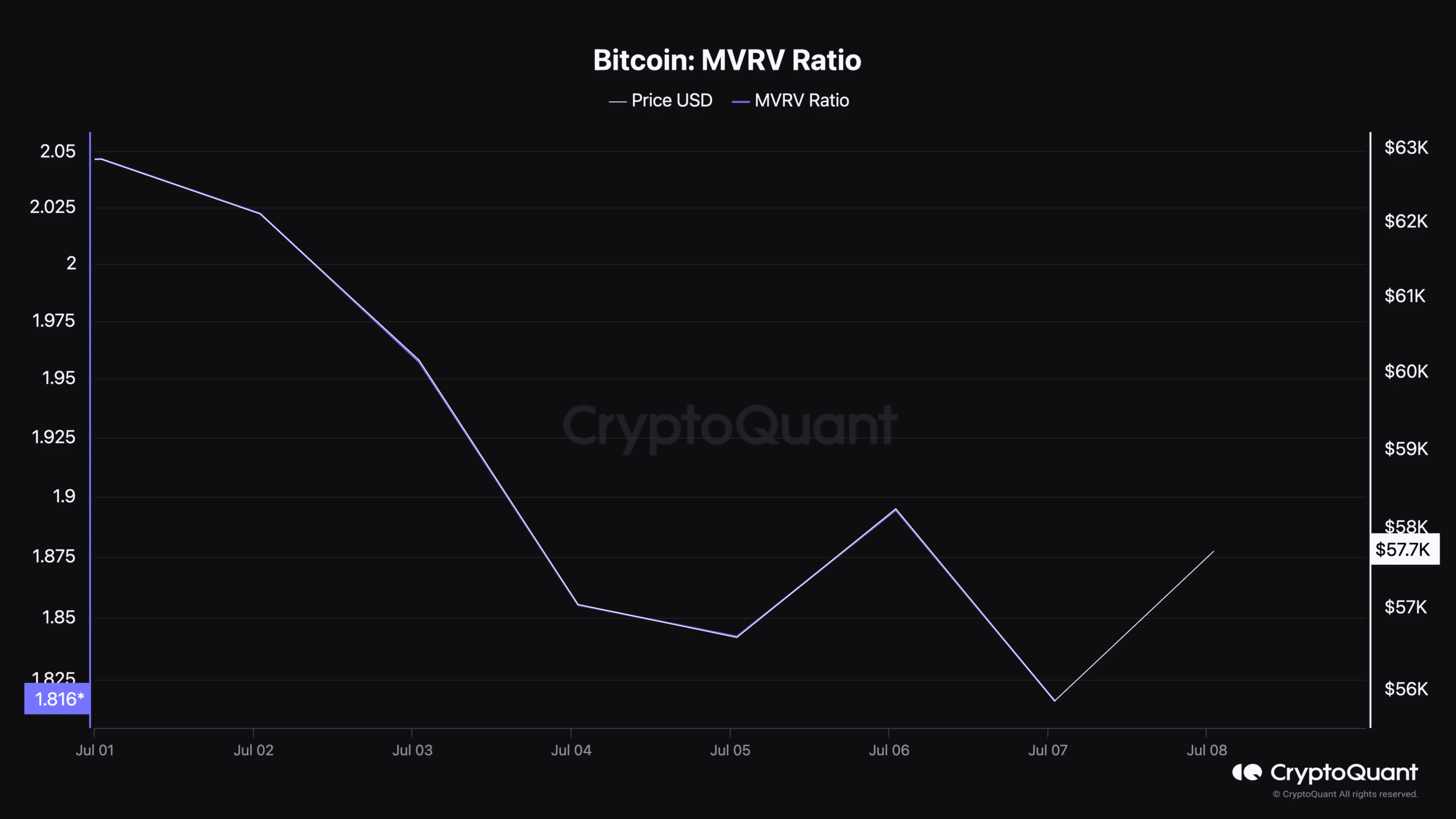

Furthermore, Bitcoin’s market value to realized value (MVRV) ratio, a measure of market profitability, stands at 1,816.

A ratio above one generally indicates that the average holder is making a profit, which could indicate that despite recent price declines, overall market sentiment remains somewhat positive.

Source: CryptoQuant

As the fourth quarter approaches, the market is still at a critical juncture.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Whether Bitcoin can recover above critical technical levels will likely determine the direction of the market in the coming months, potentially paving the way for the next big rally or an ongoing consolidation.

On the other hand, AMBCrypto recently reported that Bitcoin bottom may be inside as the increase in realized losses on-chain indicates that another BTC rally was close.