- Bitcoin NFTs are starting to outperform Ethereum NFTs in terms of 24-hour volume.

- Activity on the Ethereum network is declining and interest in staking remains high.

Since the introduction of NFTs, Ethereum-based NFTs have dominated the market. Blue chip Ethereum NFTs such as BAYC and MAYC have been in great demand since their launch and their demand has not been matched in the markets.

Realistic or not, here is the market cap of ETH in terms of BTC

However, the dominance of these NFTs could soon diminish with the rise of popular Bitcoin-based NFTs.

New kid in town

According to CryptoSlam facts, Bitcoin Frogs NFT trading volume exceeded $2.27 million in the last 24 hours. The collection managed to surpass prominent Ethereum NFTs such as HV-MTL and BAYC.

In addition, the bottom price reached 0.14 BTC. Coupled with that, the transaction volume of Bitcoin NFTs, including BRC-20, reached $7.6 million in the past 24 hours. This surpassed Solana and accounted for about 48.5% of total Ethereum NFT volume.

This spike in interest in Bitcoin NFTs could threaten many blue chip NFT collections on the Ethereum network. The floor price of many of these NFTs has already started to fall.

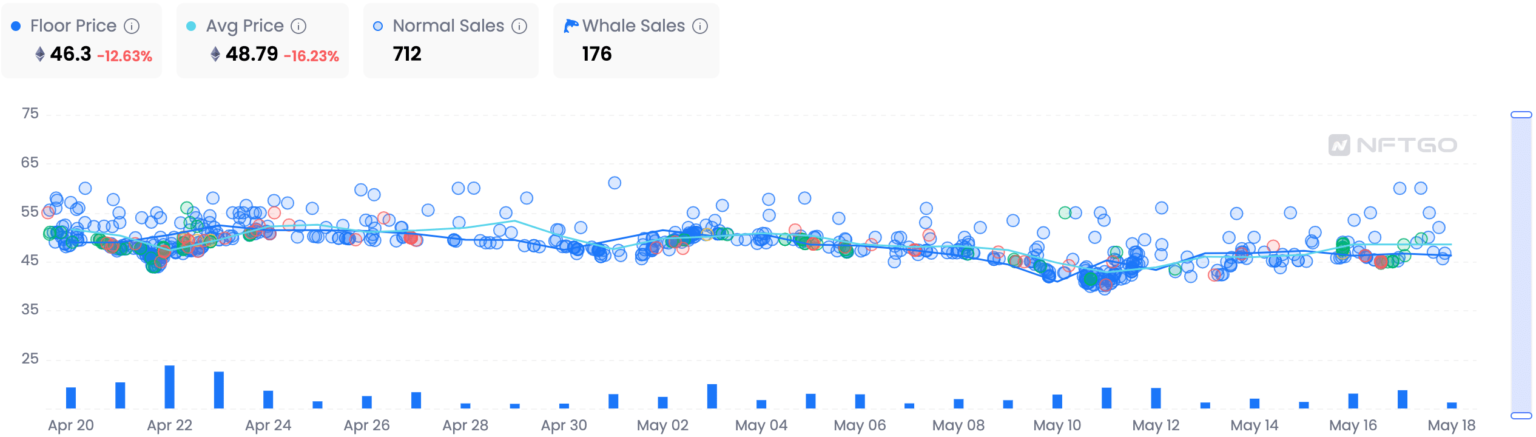

According to data from NFTGO, the bottom price of the BAYC NFT collection is down 12.83% in the past 30 days. In addition, the bottom price of the MAYC NFT collection also decreased, in combination with a decrease in the volume and sales of the NFT collection.

Source: NFTGO

The decline in interest in Blue Chip NFTs affected the overall Ethereum NFT market. According to data from Santiment, NFT transactions on the Ethereum network have dropped significantly over the past 30 days.

Subsequently, gas consumption on the Ethereum network was also affected. In recent weeks there have been huge drops in Ethereum gas usage.

Source: Sentiment

While activity on Ethereum is declining, interest in Ethereum staking has never been higher.

Strikers remain optimistic

Based on data from unlock token, the month of May witnessed a new monthly high in Ethereum 2.0 staking, with over 2.2 million ETH deposited in the ETH2 deposit contract. In addition, since the implementation of the Shanghai upgrade, the net stake of ETH has passed 1 million, which is equivalent to about 2 billion US dollars.

On the contrary, the behavior of validators was the opposite. Staking Rewards data showed that the number of stakers on the Ethereum network was down 13.3% over the past month.

Source: Staking Rewards