- Doge was at a crucial moment, with the resistance level of $ 0.20 in Focus.

- This price movement draws parallels with the Bull Cycle 2017.

With a peak of 32.25% in volume on the Memecoin market, Dogecoin [DOGE] has risen 5%, now after the most important resistance level of $ 0.20.

This price action draws strong parallels with the Bull Cycle 2017, because traders anticipate a potential outbreak. A strong push above $ 0.20 can ignite a rally, while not holding this level can cause a withdrawal.

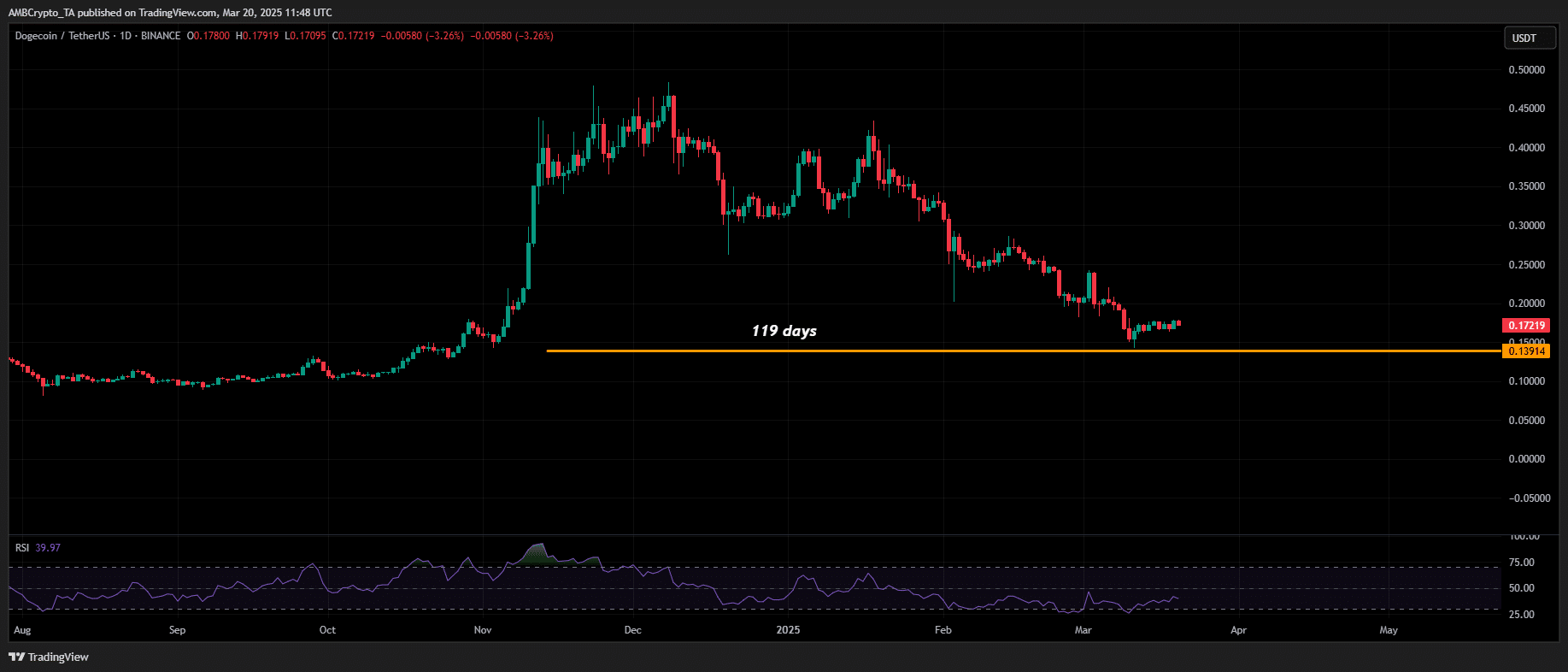

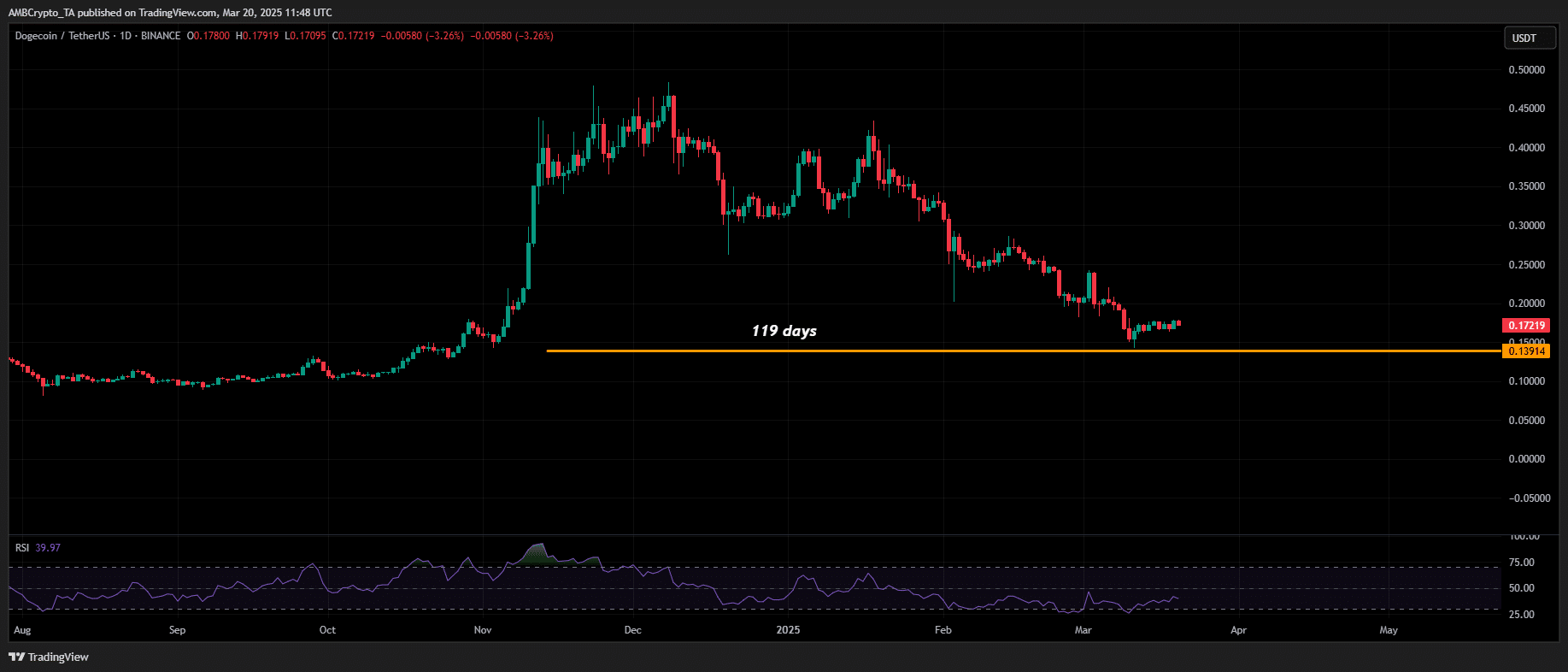

In 2017, doo experienced A break of 115 days between two explosive pumps, which ultimately rises 112% towards the end of the year.

Now, with the break that extends to 119 days, the RSI reflects the same “extremely” Oversolde state, which indicates the potential for a strong repeat rally.

Source: TradingView (Doge/USDT)

In particular, the DOGE/BTC pair has been in a slump for more than a week, but the MACD has turned Bullish. Investors probably lean in the “risky, highly salvation” attraction of memecoins, with Doge’s a 5% increase in this shift.

Of volume An increase from 65.87% to $ 1.35 billion, bulls seem to gather on the dip, indicating a possible depletion of sales pressure.

Will Doge keep this trend in the long term?

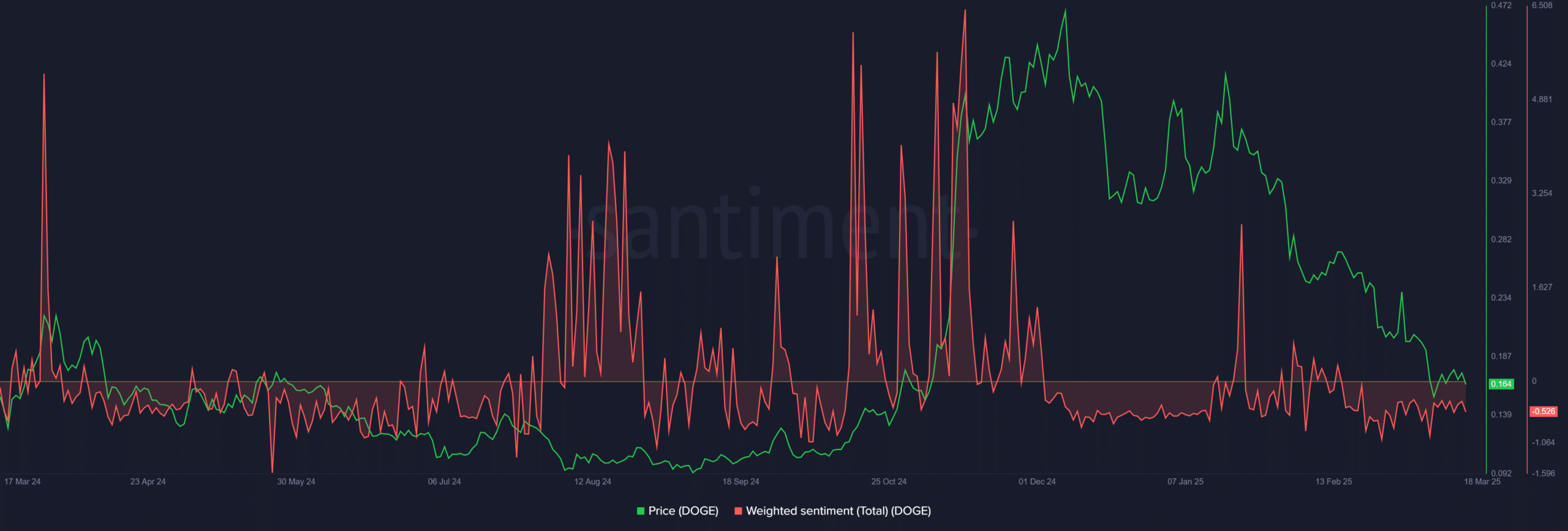

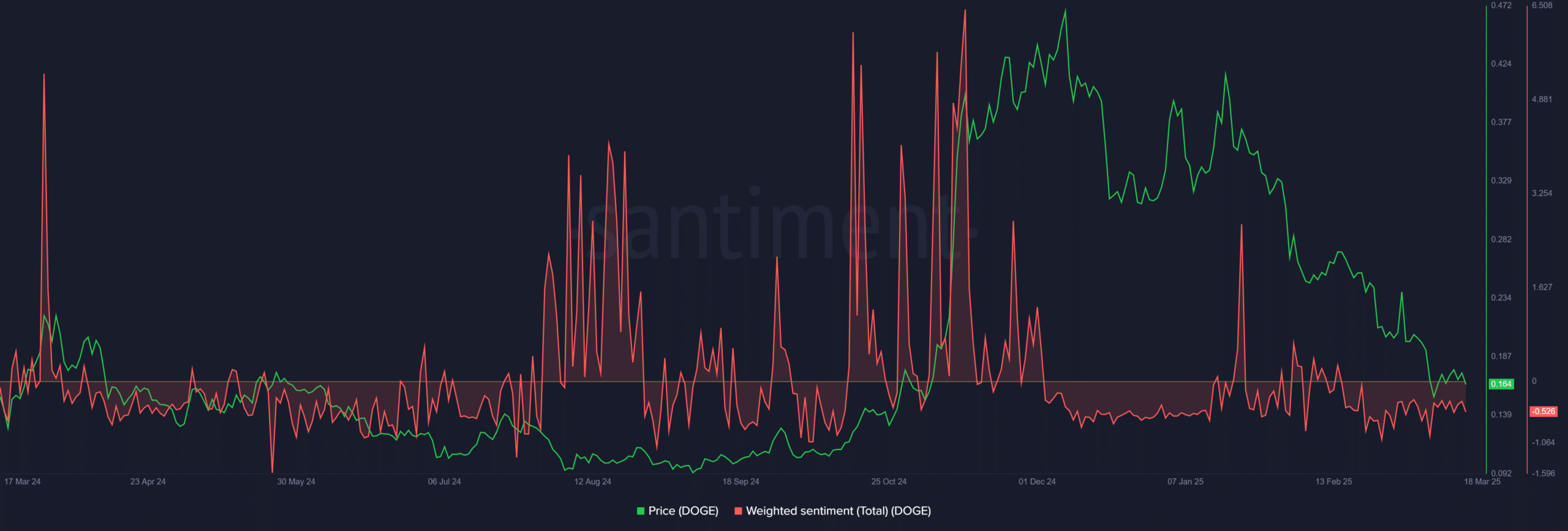

For memecoins such as Doge, Social Volume is an important driver, with price movements that are often fueled by “hype”.

However, despite the consolidation of the Memecoin, Oversold RSI and Bullish Historical Trends, the weighted sentiment has shifted negatively.

Source: Santiment

At the time of writing, the Meemcoin traded 64% below the peak after the $ 0.48 elections, with little FOMO in the market.

In the past eight years, the Memecoin space has been busy, making it more difficult for Doge to recreate the community-driven excitement that fed earlier rallies.

The lack of FOMO and minimal Whale accumulation At the current prices, doubts about the possibility of a parabolic increase in 2017 style without significant market changes.

However, the Doge/BTC couple shows bullish drawing and rising volume indicators indicate a possible price action in the short term.

DOGE seems more suitable for speculative fast profits instead of growth prospects in the long term.