Ethereum has recently seen a strong purchase interest after breaking some important resistance levels. The dominance of the market is growing, especially now that Bitcoin is reflected above $ 85,000. In addition, different indicators on the chain show positive drawing, which suggests that the growing bullish momentum goes while Ethereum is going near a falling resistance line. However, a decrease in whale interest can change the prediction.

The large transaction volume of Ethereum is falling

Ethereum has recently seen a growing purchase interest rate, with the price that almost 6% rose last week. According to CoingLass data, around $ 82.8 million were liquidated in Ethereum trading positions, whereby buyers lost around $ 43.5 million and sellers around $ 39.2 million.

Last week ETH fell to the lowest point since March 2023. A break in rates, however, helped to repair the price somewhat. Yet this recovery has not been sufficient to increase the trust of investors. Glassnode -Data shows that the number of portfolios that ECH has fallen at least $ 1 million has fallen considerably this year and has reached the lowest level since January 2023. This points to a decrease in the interest of richer investors.

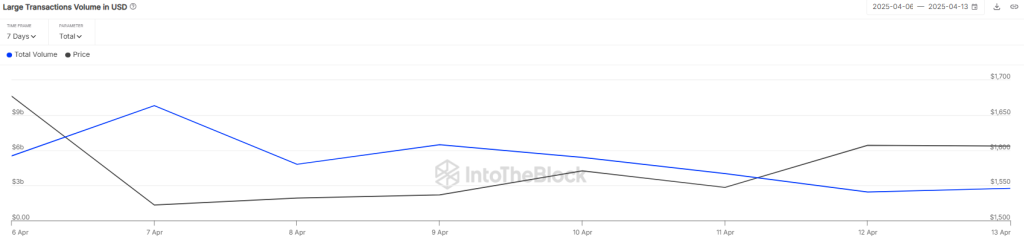

According to data from Intotheblock, the volume of large Ethereum transactions has fallen considerably. The whale activity has fallen from a peak of $ 9.81 billion to just $ 2.75 billion, which demonstrates a clear decrease in the interest of large investors. Recent activity supports this trend – on April 14, a whale moved 20,000 ETH (worth around $ 32.4 million) to the Kraken grant, probably in preparation for the sale.

Also read: Cardano Price Prediction 2025, 2026 – 2030: Will Ada Price hit $ 2?

As an addition to the pressure, an analyst on-chain reported that an early investor of Ethereum’s 2015 has consistently sold ICO. On April 13, this whale sold 632 ETH, worth around $ 1 million.

In the meantime, the market sentiment remains mixed and the open interest of Ethereum (the total value of outstanding derivative contracts) has fallen by 1.16%, now around $ 17.91 billion. This dip in open interest can delay the recovery of Ethereum and increase the chances of a recliningback in the short term.

What is the next step for ETH price?

Ether is reflected in the most important level of $ 1500, because sellers have difficulty pushing the price lower. Buyers are now aimed at retaining the price above a falling resistance line to strengthen the current bullish momentum. At the moment ETH is trading around $ 1,640, an increase of more than 2% in the last 24 hours.

The advancing averages point up and the RSI is in a positive area – both signs that buyers currently have the advantage. If they can retain the price above the falling resistance line, ETH can make a strong step in the direction of the important level of $ 2,000 in the coming hours.

On the other hand, if sellers want to regain control, they must push the price under the EMA20 trend line. If that happens, Ether can fall to $ 1,384 – an important level of support. A break below may indicate a short -term shift in Momentum in favor of the bears.