- BTC has fallen by more than 10% in the past seven days.

- Some figures suggested there were chances of a price increase.

Bitcoin [BTC] has witnessed a major price correction in the recent past, sparking fear among investors. The scenario could get worse as BTC fails to test a key support level. However, if history is to be believed, this may not be the end of BTC’s bull rally.

Bitcoin goes below $58k

According to CoinMarketCapBTC witnessed a double-digit price drop last week as its value plummeted by 10%. In the last 24 hours alone, the price of the king of cryptos fell by 4.5%.

At the time of writing, BTC was trading at $57,440.15 with a market cap of over $1.13 trillion.

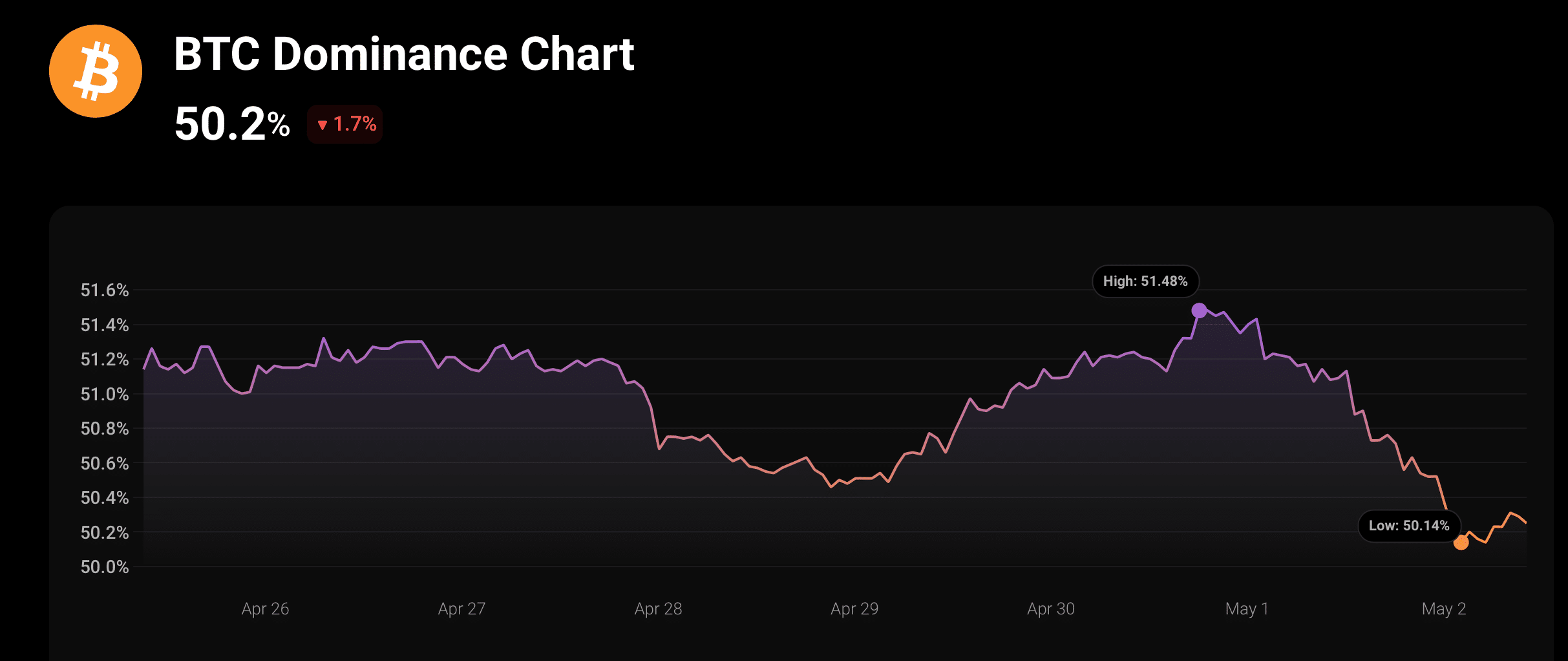

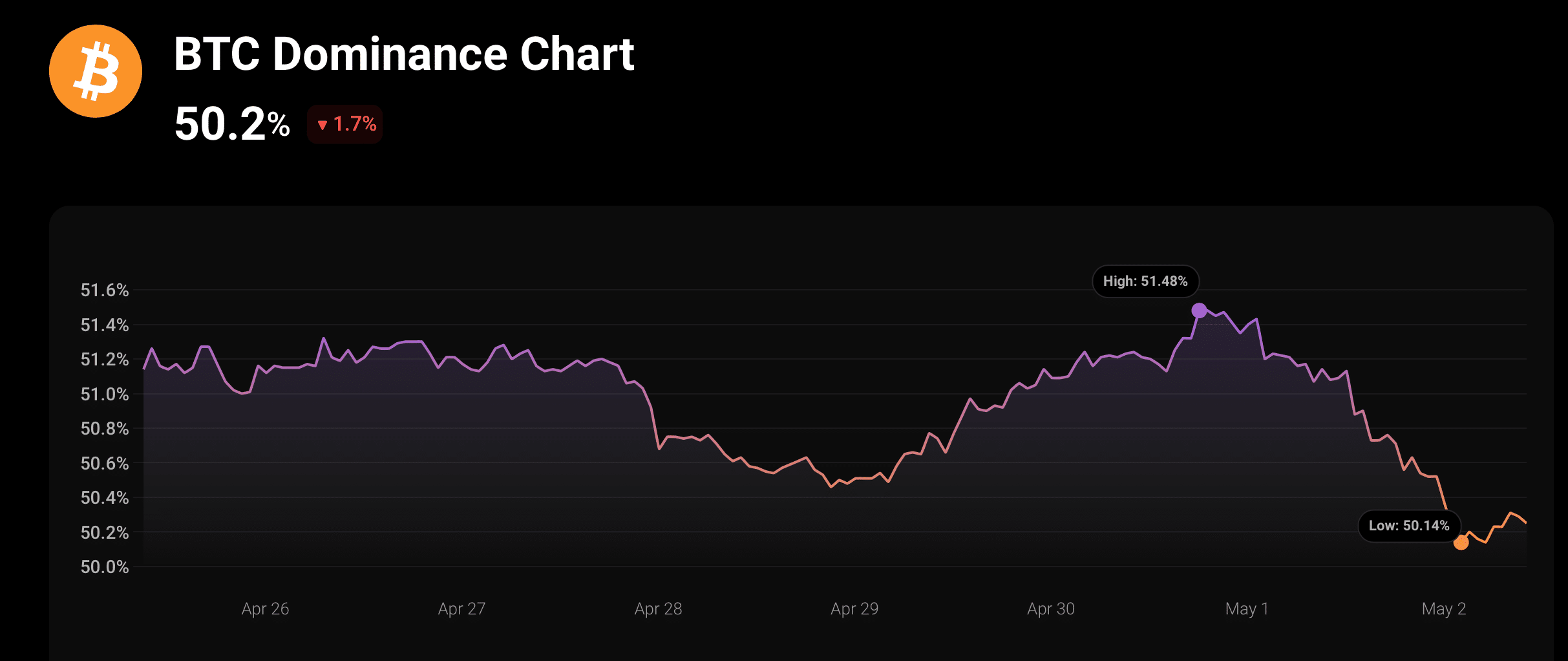

The significant price drop also had a negative effect on Bitcoin’s dominance. According to CoinStats data, BTC’s dominance has fallen by 1.7% in the past 24 hours, while it was valued at 50.2%.

Source: CoinStats

World of Charts, a popular crypto analyst, posted tweet highlighting how the price of BTC moved within a parallel channel. If the coin had tested the pattern, the price could have reached $70,000 again.

However, this was not the case as Bitcoin’s value fell below the $58,000 support.

Therefore, AMBCrypto checked Hyblock Capital’s data to look for the next level of support. We found that if the downtrend continues, BTC could find support near the $56.5,000 to $55,000 price range as liquidation would increase significantly at that level.

If it fails to test that support, investors might as well witness a drop in BTC to $51,000 in the coming days or weeks.

Conversely, if a trend reversal occurs and the coin’s price moves north, BTC could face strong resistance at $65,000.

Source: Hyblock Capital

This is better news

In the meantime, Elja, a popular crypto analyst and influencer, posted tweet stating that BTC mimicked its 2020 price action. According to the tweet, BTC followed the same pattern as the 2020 rally, indicating that BTC’s latest bull run is far from over.

In fact, AMBCrypto’s analysis is CryptoQuant’s facts revealed quite a few statistics pointing to a trend reversal. For example, BTC’s net deposits on the exchanges were low compared to the average of the past seven days.

BTC’s aSORP was green, meaning more investors were selling at a loss. In the middle of a bear market, this could indicate a market bottom.

Read Bitcoins [BTC] Price prediction 2024-2025

Moreover, the binary CDD also suggested that long-term holders’ moves were lower than average over the past seven days, indicating their motive to hold.

If these indicators are to be believed, Bitcoin could be setting the stage for a price increase.

Source: CryptoQuant